South Africa: finding a place in the global financial arena

17 October 2023

Carmella Haswell explores South Africa’s transition from its first securities finance transaction in 1988 to its current status as Africa’s largest securities lending market

Image: stock.adobe.com/malajscy

Image: stock.adobe.com/malajscy

Despite the emergence of new pockets of securities lending activity across the continent, such as in Kenya and Nigeria, South Africa continues to be the largest securities lending market across Africa. This is a well established activity in the South African market that brings key benefits of liquidity, fails coverage and greater market efficiency in this location.

Known for its cultural diversity, topography and natural beauty, South Africa is situated on the southernmost tip of the African continent and is host to three capitals — Cape Town, Pretoria and Bloemfontein.

The South African Securities Lending Association, otherwise known as SASLA, is an industry body that represents the common interests of South Africa’s securities finance market. Chaired by Michael Wright, senior manager of securities lending at Nedbank, the Association assists in the orderly, efficient and competitive development of this market and works closely with regulators to provide for industry participants.

With an average lendable value of ZAR 1.3 trillion (US$68.3 billion) and lender-to-broker loan values reaching ZAR 137.6 billion (US$7.2 billion), SASLA says the South African securities lending market can no longer be ignored in the global arena.

Positioning for success

In the past, this market has primarily served domestic needs, due to the influence of the regulatory environment, market infrastructure and the overall economic landscape. However, market participants have witnessed an increase in demand domestically and abroad for securities financing activities in South Africa.

Hitesh Harduth, head of securities lending at Standard Bank, notes that to further the development of the market, participants would need to consider the eligibility of foreign currency as collateral, as well as foreign equities, classic repos and equity repos.

South Africa’s first securities lending transaction took place in 1988, with the local industry only starting in 1992. South Africa’s return to the international financial arena in 1994 provided the opportunity for several domestic companies to raise capital offshore — achieved through the issuance of offshore convertible bonds.

SASLA chairperson Wright explains that this movement gave rise to arbitrage opportunities between the two instruments — the convertible bond and the underlying equities — with additional opportunities arising due to the introduction of the ALSI 40 and other indices, as well as through the increased use of futures-based hedging by pension funds.

“The steady growth of the South African securities lending industry can be attributed to a number of measures that effectively reduced the transaction costs associated with securities lending and borrowing,” says Wright. These measures include the Securities Transfer Tax (STT) relief for securities lending transactions in 1996, SASLA’s development of the first South African market standard schedule in 2008, and VAT exemption on securities lending transactions in 2022.

Today, securities lending has been rebranded as ‘equity finance’ at a number of South African agent lenders, reflecting the broader diversity of services that agents can offer to provide holistic solutions to clients. According to Wright, several agents provide a full suite of financing products alongside traditional securities lending. “There is a move to utilise assets as efficiently as possible, whether in securities lending, as collateral, to lend or raise cash, or to provide additional leverage,” he adds.

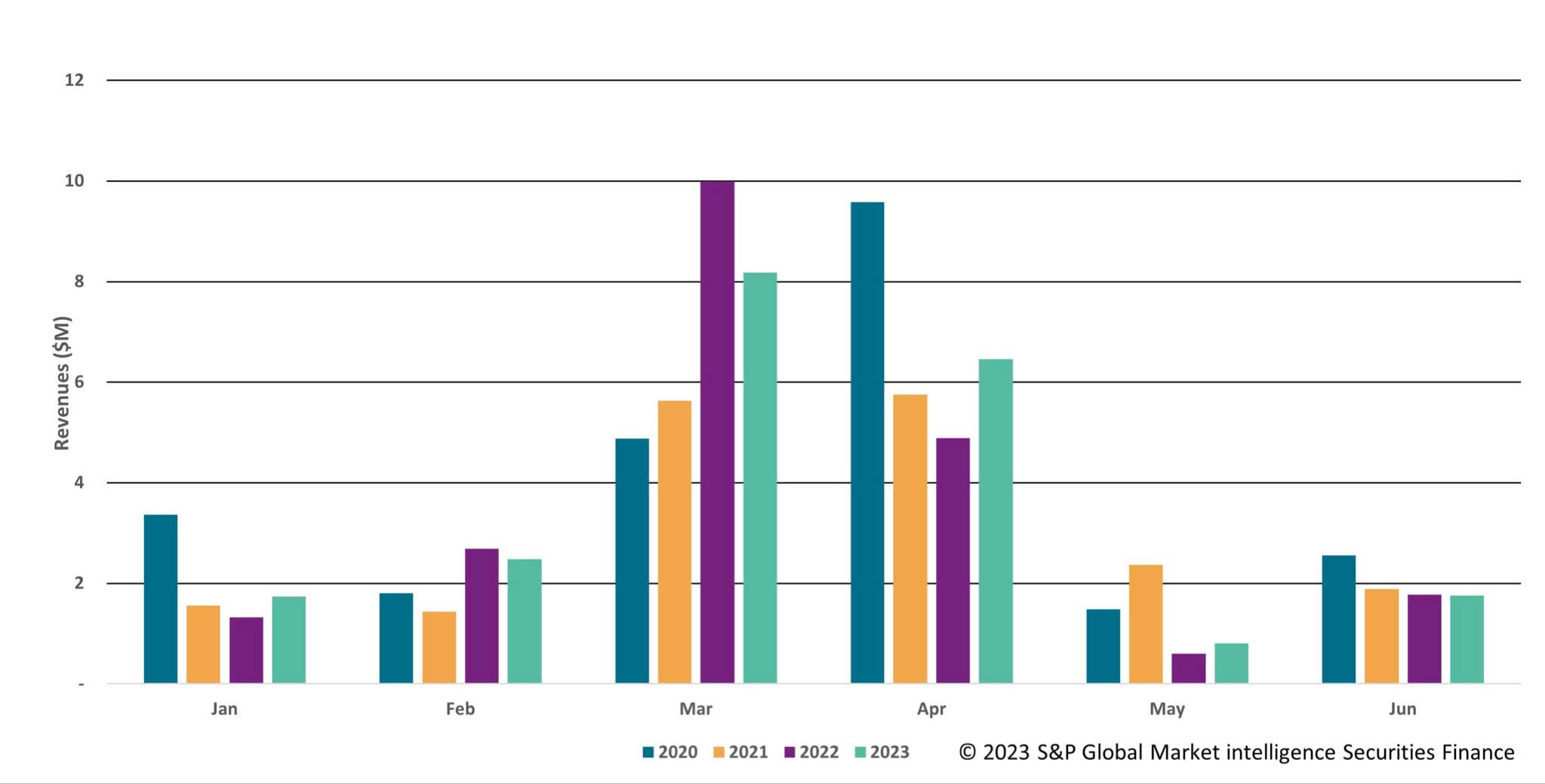

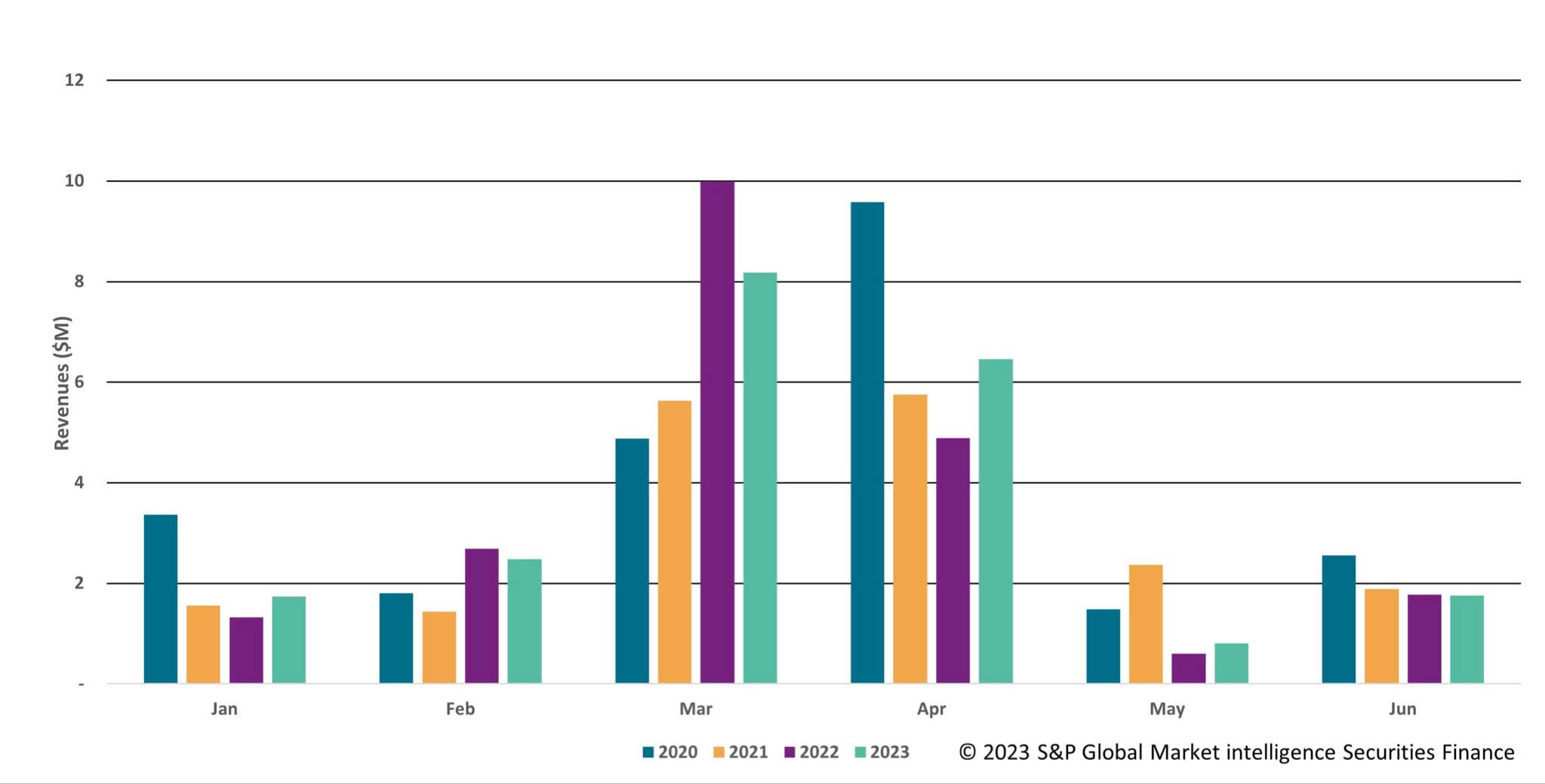

According to data collected by S&P Global Market Intelligence Securities Finance, securities lending activity in South African equities generated revenues of US$21.27 million during H1 2023 — a slight dip from the previous year’s revenue figure of US$21.4 million (fig 1). Over the course of 2022, securities lending revenues in the region generated US$44.5 million following a standout year in 2021, which delivered US$91.5 million in revenue generation.

The bumper revenues experienced during 2021 were largely due to one stock, Naspers Ltd (NPN). Chessum indicates that this trade was very popular among securities lenders and borrowers as it allowed owners of Naspers stock to tender their shares for 2.27 shares in Prosus (PRX). “Subsequently, this led to an arbitrage opportunity between the two stocks, pushing both securities lending fees and revenues higher. This one stock generated more than US$50 million of securities lending revenues during 2021 with US$49 million being generated during the month of August alone,” says Chessum.

Fig 1: South Africa equity monthly revenues for H1, 2020-2023

“The positioning of the region’s securities lending market within the global securities finance arena has been characterised by specific challenges and opportunities,” comments Natasha Williams, equity finance, Absa CIB. Speaking to SFT, Williams highlights that the adoption of a global triparty system has the potential to address some of these challenges and contribute to the evolution of the market.

According to Williams, the adoption of a global triparty system could bring the South African market further into line with global standards and practices in securities lending, potentially elevating its position in the global arena. Through this alignment with best practices, the market could attract a broader spectrum of international participants, increasing its global reach and relevance to the global financial arena.

“Triparty services can enhance market transparency, risk management and operational efficiency, making the South African market more appealing to both domestic and foreign investors,” Williams comments. “In essence, the integration of a global triparty system represents a potential step forward in the market’s development, helping it to bridge the gap with global securities finance businesses and positioning it for enhanced competitiveness and growth on the global stage.”

On a similar note, Wright believes technology innovation and process standardisation will drive greater efficiency within the securities finance industry. The streamlining of operating models has been accelerated by the remote working environment that was created by the Covid pandemic. Wright explains: “South African financial institutions are rethinking the old practices of collateral management and breaking existing silos. Market participants are seeking more sophisticated and comprehensive collateral solutions.”

Key regulatory developments

A number of key regulatory movements in the South African securities lending market have made their mark on participants with respect to collateral, securities lending and short selling. For instance, the region’s Taxation Laws Amendment Act No.21 of 2021 (TLAA) — which came into effect on 1 January 2023 — redefines ‘collateral arrangement’ parameters by limiting the ways a collateral taker can re-use non-cash collateral assets within the STT and Capital Gains Tax (CGT) exemption.

Previous tax legislation provided a 24-month-long exemption to the charging of STT and CGT, where non-cash assets as collateral were re-used in line with the ‘collateral arrangement’ parameters. With regards to the new regulation, Melissa van der Merwe, director of DeriviDoc CC, says: “Should non-cash collateral be used in ways other than those permitted, then STT and CGT will be applied to the poster of those non-cash collateral assets.”

SASLA has worked alongside market participants to amend the Schedule to the Global Master Securities Lending Agreement (GMSLA) to ensure that the collateral poster is indemnified in cases where STT and CGT is applied when the collateral taker uses non-cash collateral assets outside the remit of the exemptions in the TLAA. van der Merwe says this has provided a market standard way in which tax risk mitigation for the collateral poster can be achieved.

Another key regulatory development in the South African market is the draft bill on the Conduct of Financial Institutions (CoFI). Once published, van der Merwe says this act will provide various different conduct standards to regulate the products and market participants in the financial markets, aligning them to international standards. Conduct standards pertaining to short selling, securities lending and collateral are a few of the areas which will be governed by new conduct standards.

With the advent of electronic settlement in South Africa in 2000, the exchange and clearing house JSE produced rules and directives which prohibited naked short selling, says Brett Kotze, head post trade services at A2X Markets. Should this practice be used, participants will be subject to penalties.

SASLA and a number of industry groups have worked with regulators over the last year to ensure that the regime for resolution of financial institutions would treat securities finance transactions in a manner similar to offshore regimes.

According to Kelle Gagné, counsel at Allen & Overy, that experience reinforced the view that the regulators seek to maintain a level regulatory playing field for the South African securities lending market where possible. “Consistent and clear regulation, including with finalisation and promulgation of the long-anticipated CoFI Act, will enhance South Africa’s position in the global markets,” Gagné notes.

Taking control of collateral

Lenders and borrowers are actively involved in managing their collateral — with lenders demanding a liquid basket with less concentration risk, and borrowers focusing on the cheapest to deliver with optimisation top of mind. From a risk perspective, and given the STT exemption granted on the outright transfer of collateral, Harduth notes a shift to outright transfer versus pledge in the region, as lenders look to have further control of their collateral.

For Gagné, South African lenders have been gaining further control over non-cash collateral by moving towards title transfer, “given the restrictive nature of the South African law of pledge where securities must remain in the borrower’s custody account and any reuse results in a loss of security for the lender”.

She continues: “The manual flagging of pledges within custody accounts contributes to the inefficiency of pledge in a modern financial market. However, recent restrictive tax changes affecting title transfer, automation and international trends may send market participants back to pledges of non-cash collateral.”

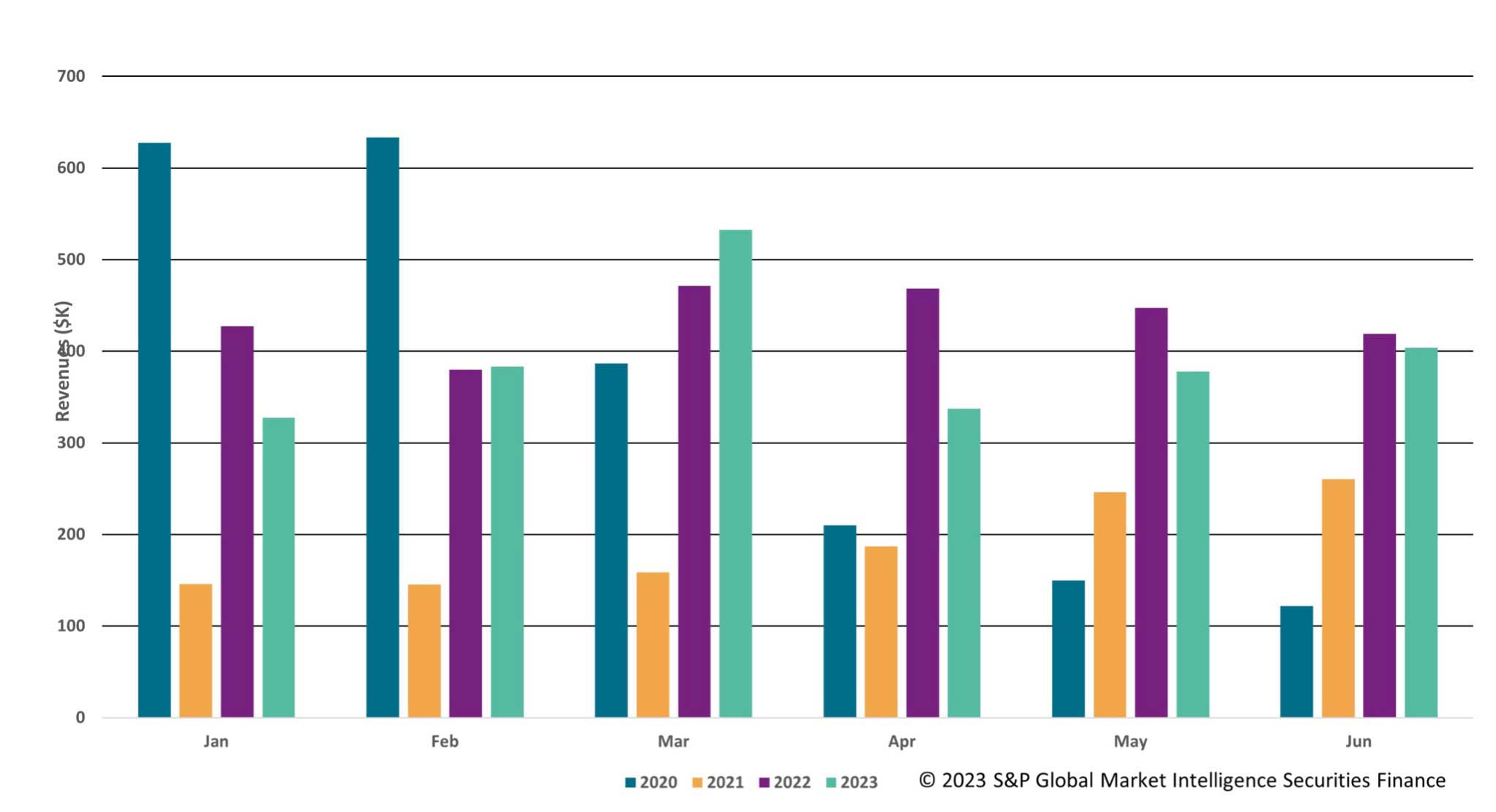

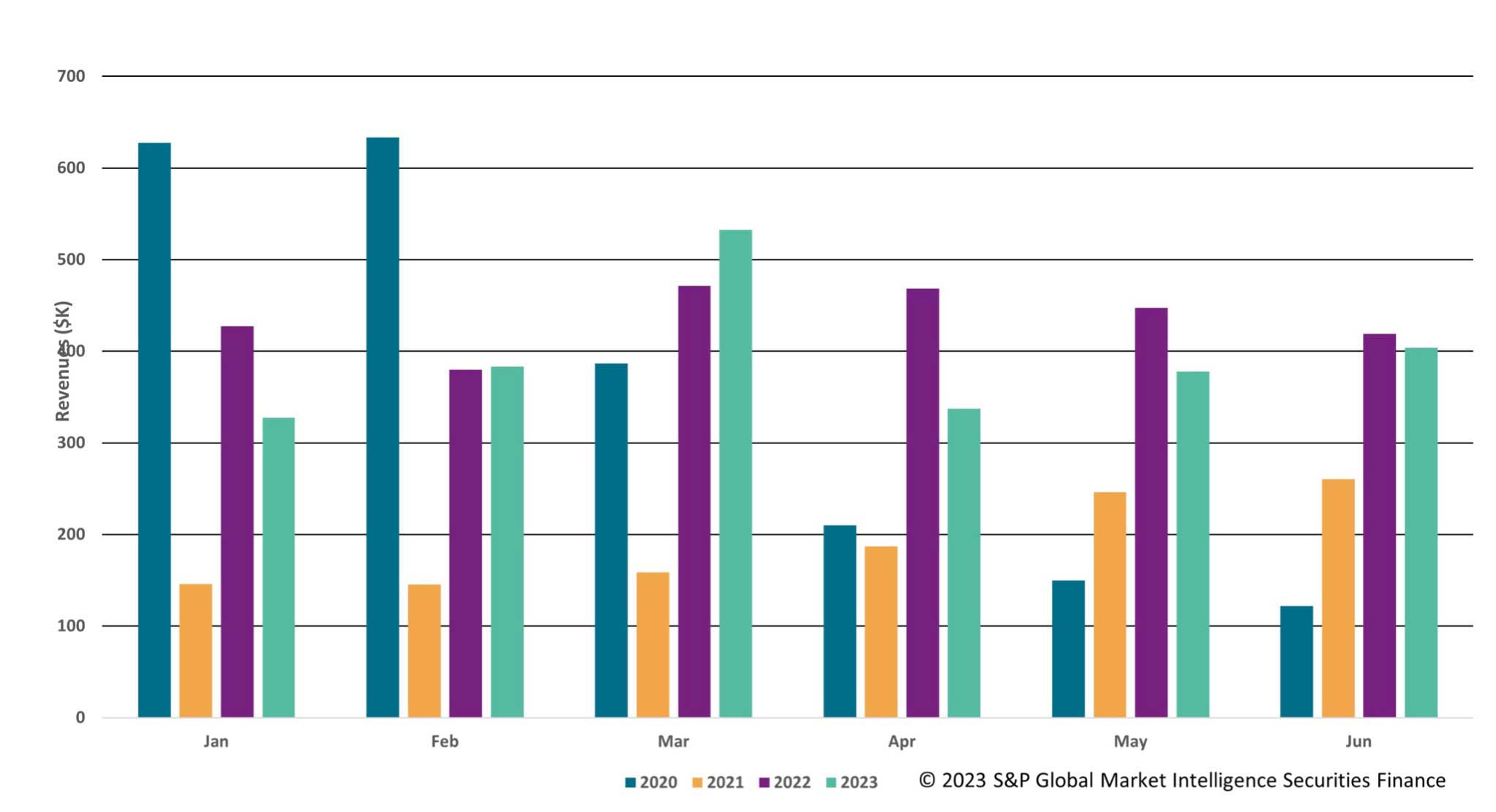

In the fixed income markets, loan balances of South African government bonds averaged just over US$2 billion during H1 2023, says Chessum, which represents a 16 per cent increase YoY. Information from S&P Global Market Intelligence reveals that the average fees across South African government bonds have been in decline over 2023, standing at an average of 24bps during the first six months of the year.

Fig 2: South African government bonds: monthly lending revenues H1, 2020-2023

Chessum indicates that utilisation has been 6 per cent higher on average throughout the period, as the lendable value has declined and balances have increased. Utilisation has been fairly consistent over the last 12 months, according to Umesh Vaga, director at Zarclear Securities Lending. However, the local market has seen new asset managers entering the securities lending space, leading to an increased supply of lendable assets.

With a number of large international banks exiting the country over the last three to five years, this has led to reduced demand and oversupply. As a result of this, the market has seen a down-turn in the general collateral (GC) lending fee, adds Michael Terry-Lloyd, head of Sygnia Securities at Sygnia Asset Management.

For Williams, the GC market “typically exhibits an abundance of readily available securities for lending or borrowing, making it an area with lower competition and, potentially, lower fee rates compared to the high-demand stock lending segment”. This pattern can be influenced by various factors including market sentiment, investor strategies, and the prevailing economic and regulatory conditions within the South African securities finance landscape.

Pursuing future initiatives

Looking ahead to 2024, the South African market continues to watch closely as the US, Canada and Mexico move to a T+1 settlement, which is set to take effect in the first half of next year. Of further regulatory importance, the draft bill on CoFI will provide “various conduct standards to regulate the products and market participants in the financial markets, aligning them to international standards”, according to van der Merwe. This regulation will be under the watchful eye of the region’s market participants.

South Africa continues to provide meaningful revenues for market participants through its role as the regional hub for the securities lending markets, indicates Chessum.

Wright says that the market is identifying interest from African countries, both as lenders of SA stock and lenders of local equities. He adds: “The growth is limited in the short term, but there will be opportunities to scale the business in the future.”

As more African jurisdictions adopt netting laws, opportunities for trading with African neighbours is expected to increase, according to Gagné.

In his concluding remarks, Chessum says that the work of SASLA continues to support the market to the benefit of both onshore and offshore investors. “Through its representation in the Global Alliance of Securities Lending Associations (GASLA), SASLA provides an important voice for the African continent which remains critical in the pursuit of global initiatives.”

Known for its cultural diversity, topography and natural beauty, South Africa is situated on the southernmost tip of the African continent and is host to three capitals — Cape Town, Pretoria and Bloemfontein.

The South African Securities Lending Association, otherwise known as SASLA, is an industry body that represents the common interests of South Africa’s securities finance market. Chaired by Michael Wright, senior manager of securities lending at Nedbank, the Association assists in the orderly, efficient and competitive development of this market and works closely with regulators to provide for industry participants.

With an average lendable value of ZAR 1.3 trillion (US$68.3 billion) and lender-to-broker loan values reaching ZAR 137.6 billion (US$7.2 billion), SASLA says the South African securities lending market can no longer be ignored in the global arena.

Positioning for success

In the past, this market has primarily served domestic needs, due to the influence of the regulatory environment, market infrastructure and the overall economic landscape. However, market participants have witnessed an increase in demand domestically and abroad for securities financing activities in South Africa.

Hitesh Harduth, head of securities lending at Standard Bank, notes that to further the development of the market, participants would need to consider the eligibility of foreign currency as collateral, as well as foreign equities, classic repos and equity repos.

South Africa’s first securities lending transaction took place in 1988, with the local industry only starting in 1992. South Africa’s return to the international financial arena in 1994 provided the opportunity for several domestic companies to raise capital offshore — achieved through the issuance of offshore convertible bonds.

SASLA chairperson Wright explains that this movement gave rise to arbitrage opportunities between the two instruments — the convertible bond and the underlying equities — with additional opportunities arising due to the introduction of the ALSI 40 and other indices, as well as through the increased use of futures-based hedging by pension funds.

“The steady growth of the South African securities lending industry can be attributed to a number of measures that effectively reduced the transaction costs associated with securities lending and borrowing,” says Wright. These measures include the Securities Transfer Tax (STT) relief for securities lending transactions in 1996, SASLA’s development of the first South African market standard schedule in 2008, and VAT exemption on securities lending transactions in 2022.

Today, securities lending has been rebranded as ‘equity finance’ at a number of South African agent lenders, reflecting the broader diversity of services that agents can offer to provide holistic solutions to clients. According to Wright, several agents provide a full suite of financing products alongside traditional securities lending. “There is a move to utilise assets as efficiently as possible, whether in securities lending, as collateral, to lend or raise cash, or to provide additional leverage,” he adds.

According to data collected by S&P Global Market Intelligence Securities Finance, securities lending activity in South African equities generated revenues of US$21.27 million during H1 2023 — a slight dip from the previous year’s revenue figure of US$21.4 million (fig 1). Over the course of 2022, securities lending revenues in the region generated US$44.5 million following a standout year in 2021, which delivered US$91.5 million in revenue generation.

The bumper revenues experienced during 2021 were largely due to one stock, Naspers Ltd (NPN). Chessum indicates that this trade was very popular among securities lenders and borrowers as it allowed owners of Naspers stock to tender their shares for 2.27 shares in Prosus (PRX). “Subsequently, this led to an arbitrage opportunity between the two stocks, pushing both securities lending fees and revenues higher. This one stock generated more than US$50 million of securities lending revenues during 2021 with US$49 million being generated during the month of August alone,” says Chessum.

Fig 1: South Africa equity monthly revenues for H1, 2020-2023

“The positioning of the region’s securities lending market within the global securities finance arena has been characterised by specific challenges and opportunities,” comments Natasha Williams, equity finance, Absa CIB. Speaking to SFT, Williams highlights that the adoption of a global triparty system has the potential to address some of these challenges and contribute to the evolution of the market.

According to Williams, the adoption of a global triparty system could bring the South African market further into line with global standards and practices in securities lending, potentially elevating its position in the global arena. Through this alignment with best practices, the market could attract a broader spectrum of international participants, increasing its global reach and relevance to the global financial arena.

“Triparty services can enhance market transparency, risk management and operational efficiency, making the South African market more appealing to both domestic and foreign investors,” Williams comments. “In essence, the integration of a global triparty system represents a potential step forward in the market’s development, helping it to bridge the gap with global securities finance businesses and positioning it for enhanced competitiveness and growth on the global stage.”

On a similar note, Wright believes technology innovation and process standardisation will drive greater efficiency within the securities finance industry. The streamlining of operating models has been accelerated by the remote working environment that was created by the Covid pandemic. Wright explains: “South African financial institutions are rethinking the old practices of collateral management and breaking existing silos. Market participants are seeking more sophisticated and comprehensive collateral solutions.”

Key regulatory developments

A number of key regulatory movements in the South African securities lending market have made their mark on participants with respect to collateral, securities lending and short selling. For instance, the region’s Taxation Laws Amendment Act No.21 of 2021 (TLAA) — which came into effect on 1 January 2023 — redefines ‘collateral arrangement’ parameters by limiting the ways a collateral taker can re-use non-cash collateral assets within the STT and Capital Gains Tax (CGT) exemption.

Previous tax legislation provided a 24-month-long exemption to the charging of STT and CGT, where non-cash assets as collateral were re-used in line with the ‘collateral arrangement’ parameters. With regards to the new regulation, Melissa van der Merwe, director of DeriviDoc CC, says: “Should non-cash collateral be used in ways other than those permitted, then STT and CGT will be applied to the poster of those non-cash collateral assets.”

SASLA has worked alongside market participants to amend the Schedule to the Global Master Securities Lending Agreement (GMSLA) to ensure that the collateral poster is indemnified in cases where STT and CGT is applied when the collateral taker uses non-cash collateral assets outside the remit of the exemptions in the TLAA. van der Merwe says this has provided a market standard way in which tax risk mitigation for the collateral poster can be achieved.

Another key regulatory development in the South African market is the draft bill on the Conduct of Financial Institutions (CoFI). Once published, van der Merwe says this act will provide various different conduct standards to regulate the products and market participants in the financial markets, aligning them to international standards. Conduct standards pertaining to short selling, securities lending and collateral are a few of the areas which will be governed by new conduct standards.

With the advent of electronic settlement in South Africa in 2000, the exchange and clearing house JSE produced rules and directives which prohibited naked short selling, says Brett Kotze, head post trade services at A2X Markets. Should this practice be used, participants will be subject to penalties.

SASLA and a number of industry groups have worked with regulators over the last year to ensure that the regime for resolution of financial institutions would treat securities finance transactions in a manner similar to offshore regimes.

According to Kelle Gagné, counsel at Allen & Overy, that experience reinforced the view that the regulators seek to maintain a level regulatory playing field for the South African securities lending market where possible. “Consistent and clear regulation, including with finalisation and promulgation of the long-anticipated CoFI Act, will enhance South Africa’s position in the global markets,” Gagné notes.

Taking control of collateral

Lenders and borrowers are actively involved in managing their collateral — with lenders demanding a liquid basket with less concentration risk, and borrowers focusing on the cheapest to deliver with optimisation top of mind. From a risk perspective, and given the STT exemption granted on the outright transfer of collateral, Harduth notes a shift to outright transfer versus pledge in the region, as lenders look to have further control of their collateral.

For Gagné, South African lenders have been gaining further control over non-cash collateral by moving towards title transfer, “given the restrictive nature of the South African law of pledge where securities must remain in the borrower’s custody account and any reuse results in a loss of security for the lender”.

She continues: “The manual flagging of pledges within custody accounts contributes to the inefficiency of pledge in a modern financial market. However, recent restrictive tax changes affecting title transfer, automation and international trends may send market participants back to pledges of non-cash collateral.”

In the fixed income markets, loan balances of South African government bonds averaged just over US$2 billion during H1 2023, says Chessum, which represents a 16 per cent increase YoY. Information from S&P Global Market Intelligence reveals that the average fees across South African government bonds have been in decline over 2023, standing at an average of 24bps during the first six months of the year.

Fig 2: South African government bonds: monthly lending revenues H1, 2020-2023

Chessum indicates that utilisation has been 6 per cent higher on average throughout the period, as the lendable value has declined and balances have increased. Utilisation has been fairly consistent over the last 12 months, according to Umesh Vaga, director at Zarclear Securities Lending. However, the local market has seen new asset managers entering the securities lending space, leading to an increased supply of lendable assets.

With a number of large international banks exiting the country over the last three to five years, this has led to reduced demand and oversupply. As a result of this, the market has seen a down-turn in the general collateral (GC) lending fee, adds Michael Terry-Lloyd, head of Sygnia Securities at Sygnia Asset Management.

For Williams, the GC market “typically exhibits an abundance of readily available securities for lending or borrowing, making it an area with lower competition and, potentially, lower fee rates compared to the high-demand stock lending segment”. This pattern can be influenced by various factors including market sentiment, investor strategies, and the prevailing economic and regulatory conditions within the South African securities finance landscape.

Pursuing future initiatives

Looking ahead to 2024, the South African market continues to watch closely as the US, Canada and Mexico move to a T+1 settlement, which is set to take effect in the first half of next year. Of further regulatory importance, the draft bill on CoFI will provide “various conduct standards to regulate the products and market participants in the financial markets, aligning them to international standards”, according to van der Merwe. This regulation will be under the watchful eye of the region’s market participants.

South Africa continues to provide meaningful revenues for market participants through its role as the regional hub for the securities lending markets, indicates Chessum.

Wright says that the market is identifying interest from African countries, both as lenders of SA stock and lenders of local equities. He adds: “The growth is limited in the short term, but there will be opportunities to scale the business in the future.”

As more African jurisdictions adopt netting laws, opportunities for trading with African neighbours is expected to increase, according to Gagné.

In his concluding remarks, Chessum says that the work of SASLA continues to support the market to the benefit of both onshore and offshore investors. “Through its representation in the Global Alliance of Securities Lending Associations (GASLA), SASLA provides an important voice for the African continent which remains critical in the pursuit of global initiatives.”

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times