Global PSSL and prominent short sellers unveil new ESG standard on short activism

31 March 2021 UK

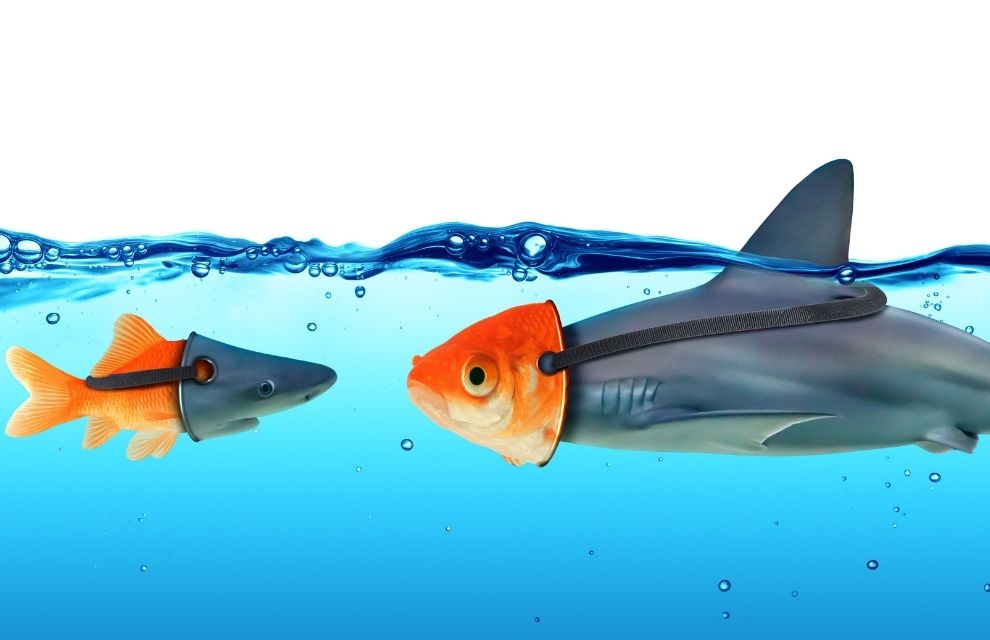

Image: Romolo_Tavani/adobe.stock.com

Image: Romolo_Tavani/adobe.stock.com

The Global Principles for Sustainable Securities Lending (Global PSSL) brought together a panel of renowned short sellers as part of unveiling a first-of-its-kind voluntary ESG standard on short activism.

The environmental, social and governance (ESG) standard was launched by Radek Stech, founder and CEO of Global PSSL and a senior academic at University of Exeter Law School, during Global PSSL’s first public impact roundtable, held virtually yesterday.

The standard has been produced over the past six months in collaboration with prominent short activists such as Carson Block of Muddy Waters Capital, Gabriel Grego of Quintessential Capital Management, and Anne Stevenson-Yang of J Capital Research, which are among the most active shorts in the business and were connected to several major fraud cases in recent years, such as Wirecard.

The event also included a personal keynote address from Davide Salvatore Mare from The World Bank, who offered an insight into how ESG criteria may be implemented into the banking sectors of developing markets.

Global PSSL, as a voluntary high-level code, comprises nine principles that align securities lending participants with their ESG ambitions.

Principle five is dedicated to short selling and was developed by the short activist representatives — also including Bronte Capital’s John Hempton — and Stech.

A key phrase from this principle, Stech says, is “[this principle provides an opportunity for] market participants to discover poor governance and environmental and social mismanagement” which has been welcomed by pension funds, institutional investors, sovereign wealth funds and banks.”

Of the launch, Stech says: “This initiative will advance a socially-responsible and environmentally beneficial application of short activism.”

Stevenson-Yang emphasised that “high-quality research and due diligence play crucial roles in successful short activism. I am delighted to be teaming up with Global PSSL to work on an initiative that balances outstanding research with practical application.”

Grego adds: “It is very encouraging to see a young initiative, such as Global PSSL, tackle the big issues with such focus and maturity. I look forward to working with Dr Stech to advance sustainable finance and help Global PSSL become a gold standard for securities lending and borrowing.”

Finally, Block states: “Short selling is a venture involving high risk to the individual. But, by its very nature, short activism exposes bad governance, scams, and fraud.

“It’s reassuring to see someone like Radek co-create a voluntary framework for short activists to prove their ESG credentials.”

As part of the virtual roundtable on the role activist short sellers can play in the advancement of ESG, it was noted that short sellers are already adept at highlighting where firms may be failing on governance and the addition of a social and environmental lens to their research will be a natural progression.

However, it was emphasised that short sellers will ultimately continue to primarily expose instances of outright fraud, rather than ESG infringements which may be distasteful but are not currently illegal.

Answering a question from SFT, the panellists were unanimous that the post-COVID bull market combined with the mad rush to allocate money to the ESG space is likely to create a breeding ground for instances of greenwashing and outright fraud.

Multiple panellists indicated they had several companies on their radar that may be guilty of using ESG as a smokescreen to hide their malfeasance.

The environmental, social and governance (ESG) standard was launched by Radek Stech, founder and CEO of Global PSSL and a senior academic at University of Exeter Law School, during Global PSSL’s first public impact roundtable, held virtually yesterday.

The standard has been produced over the past six months in collaboration with prominent short activists such as Carson Block of Muddy Waters Capital, Gabriel Grego of Quintessential Capital Management, and Anne Stevenson-Yang of J Capital Research, which are among the most active shorts in the business and were connected to several major fraud cases in recent years, such as Wirecard.

The event also included a personal keynote address from Davide Salvatore Mare from The World Bank, who offered an insight into how ESG criteria may be implemented into the banking sectors of developing markets.

Global PSSL, as a voluntary high-level code, comprises nine principles that align securities lending participants with their ESG ambitions.

Principle five is dedicated to short selling and was developed by the short activist representatives — also including Bronte Capital’s John Hempton — and Stech.

A key phrase from this principle, Stech says, is “[this principle provides an opportunity for] market participants to discover poor governance and environmental and social mismanagement” which has been welcomed by pension funds, institutional investors, sovereign wealth funds and banks.”

Of the launch, Stech says: “This initiative will advance a socially-responsible and environmentally beneficial application of short activism.”

Stevenson-Yang emphasised that “high-quality research and due diligence play crucial roles in successful short activism. I am delighted to be teaming up with Global PSSL to work on an initiative that balances outstanding research with practical application.”

Grego adds: “It is very encouraging to see a young initiative, such as Global PSSL, tackle the big issues with such focus and maturity. I look forward to working with Dr Stech to advance sustainable finance and help Global PSSL become a gold standard for securities lending and borrowing.”

Finally, Block states: “Short selling is a venture involving high risk to the individual. But, by its very nature, short activism exposes bad governance, scams, and fraud.

“It’s reassuring to see someone like Radek co-create a voluntary framework for short activists to prove their ESG credentials.”

As part of the virtual roundtable on the role activist short sellers can play in the advancement of ESG, it was noted that short sellers are already adept at highlighting where firms may be failing on governance and the addition of a social and environmental lens to their research will be a natural progression.

However, it was emphasised that short sellers will ultimately continue to primarily expose instances of outright fraud, rather than ESG infringements which may be distasteful but are not currently illegal.

Answering a question from SFT, the panellists were unanimous that the post-COVID bull market combined with the mad rush to allocate money to the ESG space is likely to create a breeding ground for instances of greenwashing and outright fraud.

Multiple panellists indicated they had several companies on their radar that may be guilty of using ESG as a smokescreen to hide their malfeasance.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times