Market closures for US national day of mourning

04 December 2018 Washington DC

Image: Shutterstock

Image: Shutterstock

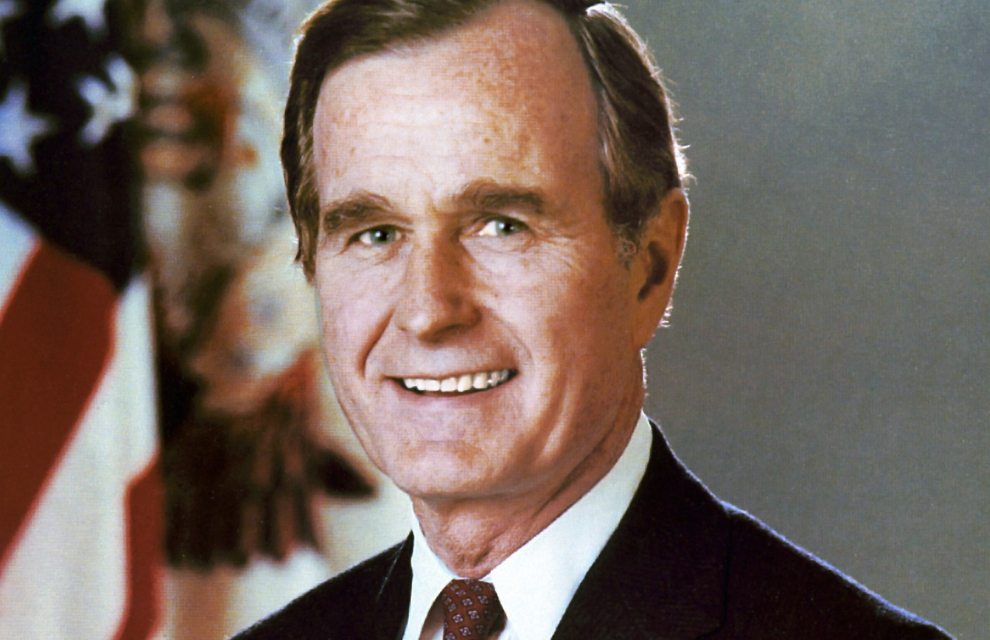

US President Donald Trump has signed an order to close the federal government on Wednesday 5 December, in a day of mourning for former President George H W Bush, who died on Friday 30 November at the age of 94.

Nasdaq stated it will observe the passing of the former president by closing all Nasdaq US equities and options markets.

The Financial Industry Regulatory Authority (FINRA) will also be closed in observance of the national day of mourning.

FINRA said its trade reporting and compliance engine, exchange trade reporting facilities, as well as its over the counter (OTC) reporting facility, will not be in use on the 5 December.

FINRA added, in relation to its OTC reporting facility, “member firms are advised that any OTC equity securities that normally would have had an ex-dividend date of Wednesday 5 December have been adjusted to Thursday 6 December”.

The Depository Trust & Clearing Corporation (DTCC) has announced it plans to remain open to clear and settle securities trades and conduct all other normal business activities.

It added: “DTCC recognises that situations such as this can be unique and our objective is to minimise disruption to the securities industry.”

“DTCC would also like to remind members that Wednesday 5 December will be considered a valid settlement date for purposes of calculating when trades will settle at The Depository Trust Company (DTC).”

The corporation said, in addition, standard rapid-application development (RAD) processing will be in effect for 5 December and transactions will not be forced to RAD.

The DTC Rights and Warrant platforms will be open and investors voluntary redemption and sales will be disabled for the day.

DTCC said additional updates will be communicated as needed.

DTCC said: “As announced, the equity markets are closed on 5 December and certain other securities markets in the US may close or conduct limited activity.”

It added: “DTCC will also process maturing money market instruments and follow normal allocation procedures for any periodic principal, dividend and interest payments due that day.”

It also said the Fixed Income Clearing Corporation, as well as those DTCC subsidiaries supporting global corporate action announcement services and matching and other activities for over-the-counter derivative transactions, will also operate as normal.

Nasdaq stated it will observe the passing of the former president by closing all Nasdaq US equities and options markets.

The Financial Industry Regulatory Authority (FINRA) will also be closed in observance of the national day of mourning.

FINRA said its trade reporting and compliance engine, exchange trade reporting facilities, as well as its over the counter (OTC) reporting facility, will not be in use on the 5 December.

FINRA added, in relation to its OTC reporting facility, “member firms are advised that any OTC equity securities that normally would have had an ex-dividend date of Wednesday 5 December have been adjusted to Thursday 6 December”.

The Depository Trust & Clearing Corporation (DTCC) has announced it plans to remain open to clear and settle securities trades and conduct all other normal business activities.

It added: “DTCC recognises that situations such as this can be unique and our objective is to minimise disruption to the securities industry.”

“DTCC would also like to remind members that Wednesday 5 December will be considered a valid settlement date for purposes of calculating when trades will settle at The Depository Trust Company (DTC).”

The corporation said, in addition, standard rapid-application development (RAD) processing will be in effect for 5 December and transactions will not be forced to RAD.

The DTC Rights and Warrant platforms will be open and investors voluntary redemption and sales will be disabled for the day.

DTCC said additional updates will be communicated as needed.

DTCC said: “As announced, the equity markets are closed on 5 December and certain other securities markets in the US may close or conduct limited activity.”

It added: “DTCC will also process maturing money market instruments and follow normal allocation procedures for any periodic principal, dividend and interest payments due that day.”

It also said the Fixed Income Clearing Corporation, as well as those DTCC subsidiaries supporting global corporate action announcement services and matching and other activities for over-the-counter derivative transactions, will also operate as normal.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times