South Korea's FSC to increase illegal short selling fines

24 October 2019 Seoul

Image: Shutterstock

Image: Shutterstock

South Korea’s Financial Services Commission (FSC) is set to ratchet up penalties for violating short-selling rules and introduce a revised measure to strengthen market regulation.

The proposed revision to the operational rules on capital market investigation establishes a new standard to impose significantly higher penalties for illegal short-selling activities.

Currently, illegal short sellers in South Korea are fined KRW 60 million (US$51,000), multiplied by differential penalty ratio depending on the gravity of the consequence and the perceived intent of the violations.

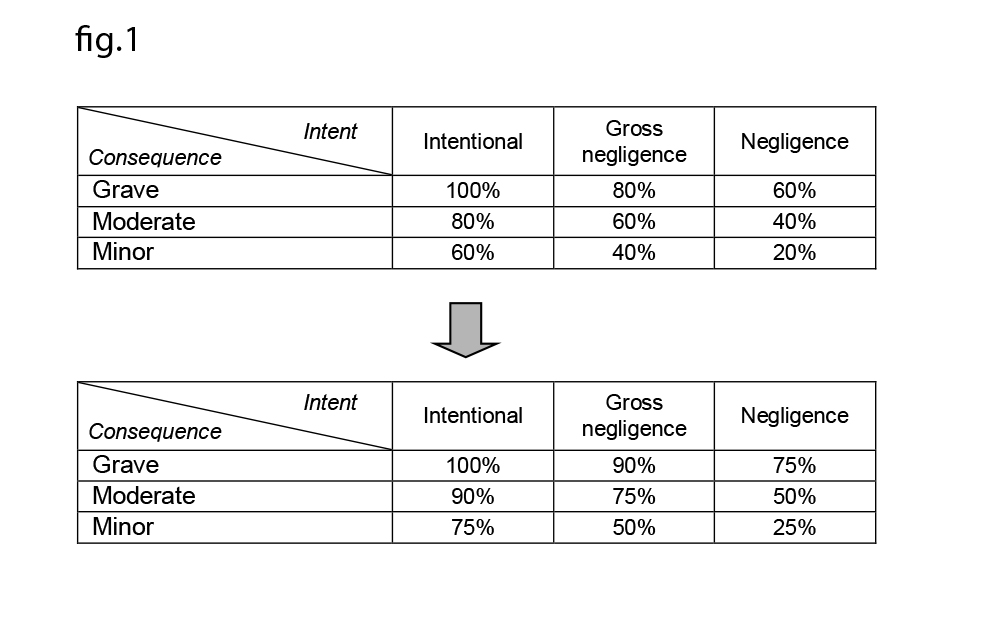

Violations are currently ranked (see figure one) on intent between ‘negligence’, ‘gross negligence’ and ‘intentional’, and on consequence between ‘minor’, ‘moderate’ and ‘grave’, with each stage bringing an increasing significant penalty.

The ratio ranges from 100 percent for violation rates as ‘international’ and ‘grave’ down to 20 percent for a ‘minor’ and ‘negligent’ illegal transaction.

The FSC’s proposed revision, which was published on 18 October, will raise the current imposition ratio by 5-15 percent, depending on the severity of the misdemeanour.

Moreover, the country’s government has established a regulatory basis to impose an additional penalty of up to 50 percent if the entity in question is found to be involved in unfair transactions.

The revision will take effect in the first quarter of 2020 following the notice period between 17 October and 26 November.

South Korea’s FSC has been prolific in its enforcement of short selling rules in recent years and has found several domestic and international players guilty of misstepping in its markets.

In April, the

SFC fined a Goldman Sachs affiliate KRW 72 million ($63,000) for naked short selling, which marked the third case of the US-based investment bank’s affiliates facing financial sanctions in Seoul.

Last week’s proposed penalty increase marks the latest move by South Korea’s FSC on-going efforts to clamp down on misconduct in the country’s securities finance and short selling markets. The previous revamp of short selling rules came in 2017, when FSC handed the Korean Stock Exchange increased powers to withdraw "overheated" stocks that receive “extraordinary increases in short selling and sharp falls in prices” during a single day for a 24-hour cooling-off period.

The proposed revision to the operational rules on capital market investigation establishes a new standard to impose significantly higher penalties for illegal short-selling activities.

Currently, illegal short sellers in South Korea are fined KRW 60 million (US$51,000), multiplied by differential penalty ratio depending on the gravity of the consequence and the perceived intent of the violations.

Violations are currently ranked (see figure one) on intent between ‘negligence’, ‘gross negligence’ and ‘intentional’, and on consequence between ‘minor’, ‘moderate’ and ‘grave’, with each stage bringing an increasing significant penalty.

The ratio ranges from 100 percent for violation rates as ‘international’ and ‘grave’ down to 20 percent for a ‘minor’ and ‘negligent’ illegal transaction.

The FSC’s proposed revision, which was published on 18 October, will raise the current imposition ratio by 5-15 percent, depending on the severity of the misdemeanour.

Moreover, the country’s government has established a regulatory basis to impose an additional penalty of up to 50 percent if the entity in question is found to be involved in unfair transactions.

The revision will take effect in the first quarter of 2020 following the notice period between 17 October and 26 November.

South Korea’s FSC has been prolific in its enforcement of short selling rules in recent years and has found several domestic and international players guilty of misstepping in its markets.

In April, the

SFC fined a Goldman Sachs affiliate KRW 72 million ($63,000) for naked short selling, which marked the third case of the US-based investment bank’s affiliates facing financial sanctions in Seoul.

Last week’s proposed penalty increase marks the latest move by South Korea’s FSC on-going efforts to clamp down on misconduct in the country’s securities finance and short selling markets. The previous revamp of short selling rules came in 2017, when FSC handed the Korean Stock Exchange increased powers to withdraw "overheated" stocks that receive “extraordinary increases in short selling and sharp falls in prices” during a single day for a 24-hour cooling-off period.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times