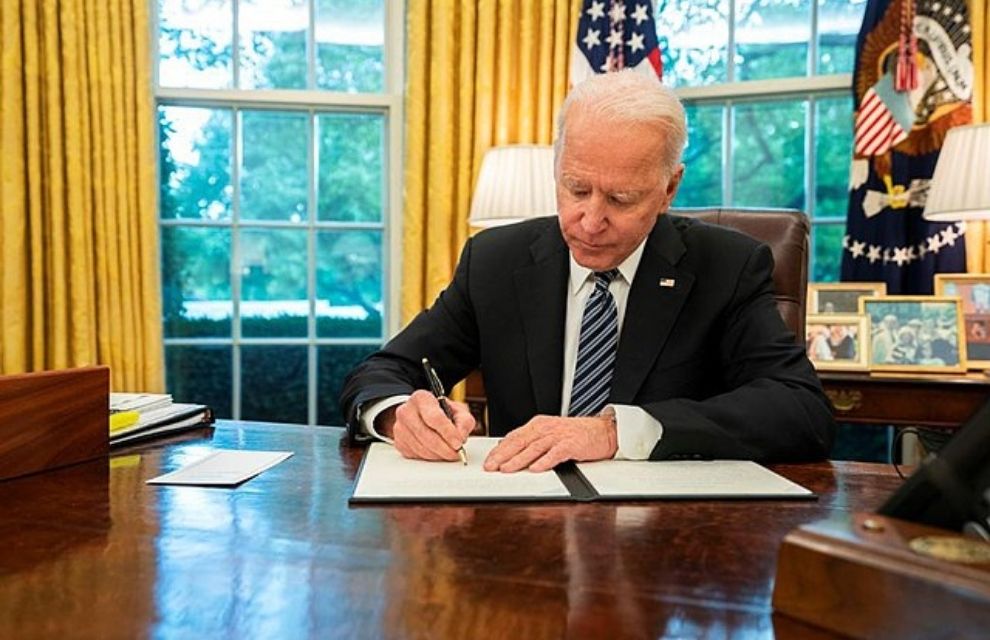

Biden signs executive order for regulation on digital assets

10 March 2022 United Kingdom

Image: US Government

Image: US Government

President Joe Biden has signed an executive order that highlights the US government's commitment to ensuring that virtual assets and cryptocurrencies will be subject to further compliance measures with appropriate regulations and supervision.

Cryptocurrencies have seen "explosive growth" over the past five years climbing from a US$14 billion to $3 trillion market cap, Biden said in the executive order.

Biden affirmed: “The US has an interest in responsible financial innovation, expanding access to safe and affordable financial services, and reducing the cost of domestic and cross-border funds transfers and payments, including through the continued modernisation of public payment systems.

“We must take strong steps to reduce the risks that digital assets could pose to consumers, investors, and business protections; financial stability and financial system integrity. Some digital asset trading platforms and service providers have grown rapidly in size and complexity and may not be subject to or in compliance with appropriate regulations or supervision.

“Digital asset issuers, exchanges and trading platforms, and intermediaries whose activities may increase risks to financial stability, should, as appropriate, be subject to and in compliance with regulatory and supervisory standards that govern traditional market infrastructures and financial firms, in line with the general principle of ‘same business, same risks, same rules’”.

The 46th US president added: “We must mitigate the illicit finance and national security risks posed by misuse of digital assets. We must reinforce US leadership in the global financial system and in technological and economic competitiveness, including through the responsible development of payment innovations and digital assets. We must promote access to safe and affordable financial services.”

Commenting on the order, Ganesh Iyer, chief marketing and strategy officer at IPC Systems, says: “Is Biden beckoning the beginning of the end for ‘wild west’ crypto markets? More regulation of digital assets has implications for how institutions engage with the burgeoning asset class.

He adds: “Whatever happens with crypto regulation, these fund managers need to squeeze out every opportunity by utilising networks that provide fast and unrestricted access to the major crypto exchanges. Only time will tell how and when this market will mature. Until that point there is an opportunity now for hedge funds to utilise ultra-low latency networks to make the most of volatile, compliance-light and liquid crypto markets.”

The executive order was signed on the same day that The US Securities and Exchange Commission (SEC) proposed amendments to its rules to enhance and standardise disclosures regarding cybersecurity risk management, strategy, governance, and incident reporting by public companies.

The proposed amendments are intended to better inform investors about a registrant's risk management, strategy, and governance and to provide timely notification to investors of material cybersecurity incidents.

Commenting on the proposed rule, Gary Gensler, SEC chair says: "Investors want to know more about how issuers are managing those growing risks. A lot of issuers already provide cybersecurity disclosure to investors.

“I think companies and investors alike would benefit if this information were required in a consistent, comparable, and decision-useful manner. I am pleased to support this proposal because, if adopted, it would strengthen investors’ ability to evaluate public companies' cybersecurity practices and incident reporting."

Cryptocurrencies have seen "explosive growth" over the past five years climbing from a US$14 billion to $3 trillion market cap, Biden said in the executive order.

Biden affirmed: “The US has an interest in responsible financial innovation, expanding access to safe and affordable financial services, and reducing the cost of domestic and cross-border funds transfers and payments, including through the continued modernisation of public payment systems.

“We must take strong steps to reduce the risks that digital assets could pose to consumers, investors, and business protections; financial stability and financial system integrity. Some digital asset trading platforms and service providers have grown rapidly in size and complexity and may not be subject to or in compliance with appropriate regulations or supervision.

“Digital asset issuers, exchanges and trading platforms, and intermediaries whose activities may increase risks to financial stability, should, as appropriate, be subject to and in compliance with regulatory and supervisory standards that govern traditional market infrastructures and financial firms, in line with the general principle of ‘same business, same risks, same rules’”.

The 46th US president added: “We must mitigate the illicit finance and national security risks posed by misuse of digital assets. We must reinforce US leadership in the global financial system and in technological and economic competitiveness, including through the responsible development of payment innovations and digital assets. We must promote access to safe and affordable financial services.”

Commenting on the order, Ganesh Iyer, chief marketing and strategy officer at IPC Systems, says: “Is Biden beckoning the beginning of the end for ‘wild west’ crypto markets? More regulation of digital assets has implications for how institutions engage with the burgeoning asset class.

He adds: “Whatever happens with crypto regulation, these fund managers need to squeeze out every opportunity by utilising networks that provide fast and unrestricted access to the major crypto exchanges. Only time will tell how and when this market will mature. Until that point there is an opportunity now for hedge funds to utilise ultra-low latency networks to make the most of volatile, compliance-light and liquid crypto markets.”

The executive order was signed on the same day that The US Securities and Exchange Commission (SEC) proposed amendments to its rules to enhance and standardise disclosures regarding cybersecurity risk management, strategy, governance, and incident reporting by public companies.

The proposed amendments are intended to better inform investors about a registrant's risk management, strategy, and governance and to provide timely notification to investors of material cybersecurity incidents.

Commenting on the proposed rule, Gary Gensler, SEC chair says: "Investors want to know more about how issuers are managing those growing risks. A lot of issuers already provide cybersecurity disclosure to investors.

“I think companies and investors alike would benefit if this information were required in a consistent, comparable, and decision-useful manner. I am pleased to support this proposal because, if adopted, it would strengthen investors’ ability to evaluate public companies' cybersecurity practices and incident reporting."

Next industry article →

Global on-loan securities hit record €2.7tn in December, says ISLA market report

Global on-loan securities hit record €2.7tn in December, says ISLA market report

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times