Many market participants are now subject to the initial margin rules for non-cleared derivative transactions. David Beatrix, head of OTC and collateral services at BNP Paribas’ Securities Services, provides an update on the latest evolutions of this regulation

From 1 September 2016 until September 2022, the initial margin (IM) rules for non–cleared derivative transactions have been phased in, and an increasing number of market participants have been subject to the requirements every year.

However, many firms are still not affected by the IM rules for non-cleared derivative transactions, does this mean that those firms are done with IM concerns?

IM rules reminder

Before the enforcement of the initial margin rules, exchanging “Independent Amounts” on non-cleared derivatives was not a common practice. It was mainly a means for risk departments to mitigate the low creditworthiness of a counterparty, or the risk implied by the synthetic leverage of their clients (in the hedge funds space for example), via a one-way delivery of collateral (usually from the buy side client to the sell side bank), either outright or with segregation arrangements.

Exchanging initial margin (IM) on non-cleared derivative trades has become an established practice since the implementation of the IM rules (ie the Uncleared Margin Rules (UMR)). Today, all firms with an aggregate average notional amount (AANA) of non-centrally cleared derivatives at consolidated group level above €8 billion are subject to these rules. All OTC derivative positions (even those exempted from IM requirements such as physically settled forex forward and forex swap transactions) count for the purpose of calculating the AANA.

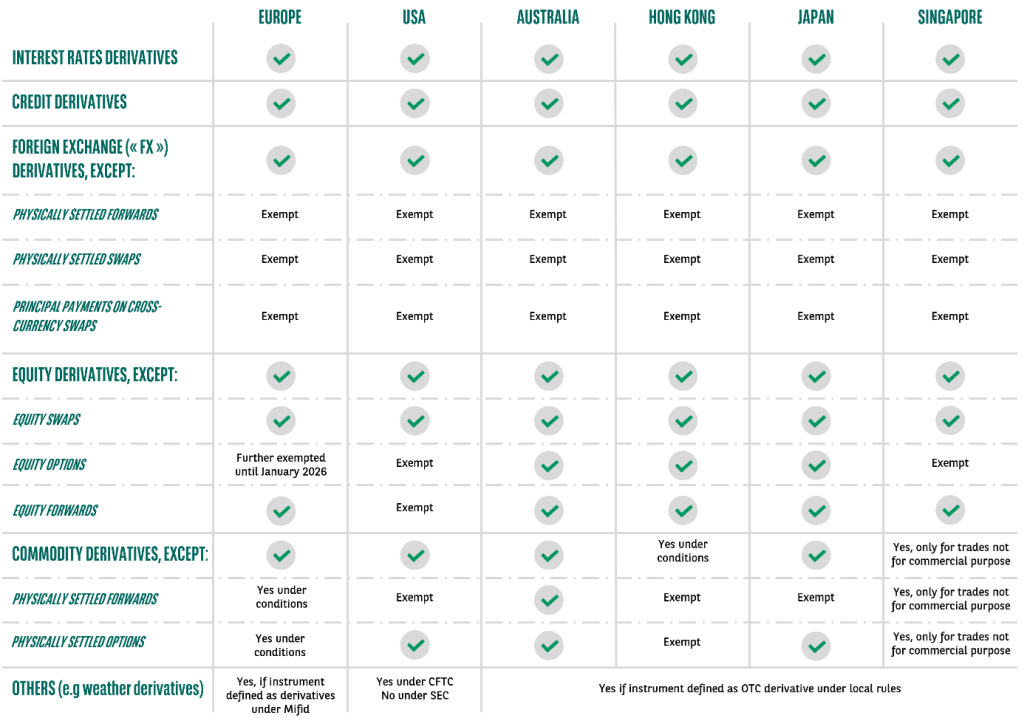

Most financial counterparties trading non-cleared derivatives are in-scope of the rules and exemptions are very limited. As of today, the rules have been transposed in a number of jurisdictions — the EU, USA, Japan, Australia, Hong Kong and Singapore — and they embed a significant extraterritorial effect. Therefore, most cross-border transactions involving third-country entities have been brought in-scope of the IM obligations.

The scope of non-cleared derivative instruments subject to the rules is generally consistent across the main jurisdictions in Europe, Asia-Pacific, and in the USA. Physically settled forex forwards and swaps are excluded across all jurisdictions, as well as the exchange of principal on cross-currency swaps. However, some jurisdictions may have specific exemptions, either on a permanent basis — for example, equity options and forwards are out of scope in the USA — or on a temporary basis — such as equity options for which the exemption in the EU is extended for two years to January 2026, as proposed by the European Supervisory Authorities.

IM can be calculated either by using a table-based model, also called ‘Grid’, or a regulator-approved internal model, such as the Standard Initial Margin Model (SIMM) developed by the International Securities and Derivatives Association (ISDA).

These two methods coexist, however, industry participants are encouraging the adoption of a unique calculation framework to facilitate regulatory approval and minimise margin disputes between participants. They are subject to a two-ways exchange principle, where each party posts and receives at the same time, a bankruptcy-remote obligation from a safekeeping perspective (implying custodial segregation), and among other things, a possible relief if margins stay under a €50 million threshold.

The compliance process is complex, involves many parties and resources (eg trading, risk, legal, middle and back offices, IT, custodians and market platforms) and can take from six to nine months on average. To face these requirements, firms have different options to comply, such as implementing the rules by their own means, or appointing a service provider, like BNP Paribas, who can propose an end-to-end solution.

Staying alert

Although the final phase has passed, vigilance must endure.

For firms already live, solid controls must be maintained to ensure the process runs properly as the volume of IM exchanges is growing.

Meanwhile, some firms have not yet been impacted but could be in the future, and they must monitor their AANA. For the EU, the next AANA calculation period is between March and May 2024, with a compliance date of 1 January 2025 and with the application of several calculation methods, depending on the regulation. Getting close to the €8 billion AANA should instantly trigger an implementation project to avoid a compliance breach.

Grid vs SIMM

The Grid method has the beauty of simplicity, but does not consider the netting of risks inside a portfolio.

Meanwhile, SIMM is more complex to implement, maintain, and produces more complex analysis when disputes arise. However, it allows netting of market risks for positions executed with the same counterparty — for example, payer versus receiver swap — and reflects a better picture for risk-neutral portfolios.

Despite a massive adoption of SIMM, the Grid method remains an option in some relationships between banks and buy side firms, with some agreements combining the two methodologies (SIMM and Grid) depending on instrument types.

There are multiple reasons for this:

• Implementing SIMM can take more time for certain types of instruments, Grid can be an alternative to comply quickly with the rules.

• The regulator may prescribe to use the Grid method for certain instruments where they estimate that a specific risk is not sufficiently considered by SIMM.

• Grid can lead to lower IM amounts in specific cases, and as the costs of financing posted collateral come into play, especially when collateral received cannot be reused — this is an important criterion.

For example, for a six-month bond forward with an underlying bond maturity above 10 years, the difference between Grid and SIMM can be significant — such as for a 40-years underlying bond maturity, where the difference is about 13 per cent of the notional. Under SIMM, a longer time-to-maturity implies higher rate sensitivities, therefore a higher SIMM amount, whereas Grid is capped after a certain time-to-maturity.

As a result, directional rate portfolios with long maturities — typical of insurance or pension portfolios — may in some cases exhibit lower IM amounts with Grid compared to SIMM.

Figure 1: Initial margin (In scope instruments by jurisdiction)

When the regulation does not prescribe the use of a method, a firm can opt for the different methods listed in the Credit Support Annex (CSA) signed with its counterparty.

Buying more time

A relief mechanism has been put in place to take into consideration the complexity of implementation for firms with a low trading activity.

In April 2020, the Basel Committee on Banking Supervision (BCBS) stated: “The requirements could impose some unnecessary operational costs on smaller entities that pose no significant systemic risk to the system and would not be expected to be bound by the initial margin requirements, in particular, in light of the provided threshold amount of €50 million.”

As always, the devil is in the details. This €50 million threshold is the maximum a firm can set with another trading relationship — both firms should consider this amount at a consolidated group level. Therefore, for institutions with multiple entities, themselves in trading relationships with several branches or subsidiaries of a bank, a significant part of the preparatory work (and maintenance thereafter) is to map and allocate the appropriate threshold amount to each relationship, function of the expected trading activity post-compliance date, and the risk profile of the transactions. Finally, for a same relationship, it could also happen that these thresholds are set in an asymmetric way between the pledger and pledgee directions.

In light of that, if, for a given trading relationship, the uncleared OTC derivatives portfolio in-scope — ie having all of its trades executed after compliance date — has its IM amounts under the threshold, it is then exempt of IM postings until it reaches this threshold. Firms under the threshold are not expected to have the specific documentation in place, custodial or operational processes related to IM.

However, this is only supposed to grant more time for firms and custodians to prepare for full IM compliance. Once this threshold is exceeded, firms are expected to start posting and collecting, and so firms should have all required documentation and processes in place and running. Consequently, a precise monitoring of the thresholds is crucial.

Latest evolutions

Since its introduction, most industry participants have adopted the SIMM model. However, there remain areas for strengthening IM models. Regulators, such as the Prudential Regulation Authority (PRA), have highlighted some concerns regarding the proper implementation and use of the SIMM model, and therefore the ability to identify and correct model malfunctions in a stressed market.

In 2023, significant changes were published with the revision of the Governance Framework in early March, including the modification of the recalibration frequency from annual to biannual, to adjust the SIMM model shortfalls more dynamically.

On top of that, the ISDA SIMM Remediation defined a €25 million threshold, where back testing and reporting must be in place, regardless of whether the portfolio exposure is above or below the €50 million margin exchange threshold. This means, even if they do not exchange margin, certain entities will be subject to the back-testing obligation for the first time, and will have to monitor where they stand against this €25 million threshold.

On 3 July 2023, the European Banking Authority (EBA) published the final draft of the Regulatory Technical Standard on the Initial Margin Model Validation as an answer to the risk mitigation for non-cleared OTC derivatives, in accordance with Article 11(15) of the European Market Infrastructure Regulation (EMIR 648/2012). It defines obligations for market participants around their internal compliance policies on the IM framework (governance and back testing methodology), and harmonises the supervisory review for validation of the internal model.

Those requirements of IM validation will be phased-in and will apply to the largest firms first, as per the AANA calculation criteria.

In the first phase (date not yet published at the time of writing), the firms above €750 billion gross notional of uncleared OTC derivatives will follow the ‘standard’ approach as defined in the Regulatory Technical Standard (RTS), which includes several procedure and documentation requirements compared to the current framework of internal model approval.

To simplify the validation for firms below €750 billion, these will be subject to the ‘simplified’ approach, two years after the first phase.

However, in parallel to the final draft of the RTS, the EBA published an opinion letter in which they recommend facilitating the coordination with the industry by centralising the validation exercise. The EBA also proposes to review the scope of firms impacted by the RTS requirements, by restricting the submission only to the largest one.

The rules may still evolve over time. As we observe reviews for other major regulations, some consultations have happened recently in Europe, the latest one being issued by the BCBS and the International Organization of Securities Commissions on the IM model validation framework.

At BNP Paribas, we remain committed to accompany our clients in the complex regulatory and market evolutions surrounding IM, in an integrated manner within our wider set of OTC and collateral services, and develop new solutions to facilitate their compliance processes.