Centralised collateral connectivity

13 June 2017

With the help of Pirum, collateral and exposure management are fast becoming straight-through, exception-based processes, says James Cherry

Image: Shutterstock

Image: Shutterstock

Regulation continues to move through it’s inevitable cycle, from legislation to implementation, and market behaviour continues to shift in tandem. Repo markets continue to be stifled by the leverage ratio, which limits the practice of netting, reducing the number of repos that currently offset each other or which lie off-balance sheet, which now must be independently haircutted or collateralised. Regulations such as the European Market Infrastructure Regulation (EMIR) and US Dodd-Frank Act impose stringent clearing and margining requirements on over-the-counter (OTC) derivatives products.

In an ever-convergent world, liquidity and capital in the securities finance markets are simultaneously affected. Collateral management activities, associated with the derivatives markets, are massive consumers of high quality liquid assets (HQLA). The International Swaps and Derivatives Association estimates that encumbered collateral will reach approximately $800 billion by 2020, while other estimates go to $1.7 trillion.

The continuing impact of compliance with various regulatory regimes such as Basel III and the liquidity coverage ratio (LCR), the Securities Financing Transactions Regulation (SFTR)—the list goes on--could cause some institutions engaged in the lending of securities to reconsider their involvement rather than face compliance with this ever-mounting stack of regulation.

The industry is increasingly turning to vendors such as Pirum, with its pedigree in post-trade automation and ever-growing role as a connectivity hub, to help ease this continuing burden.

Disincentivising lenders obviously has counter-productive repercussions in terms of the loss of market liquidity, making it harder and costlier for the institutional investor to access equity markets and for government institutions to issue and manage existing government bond programmes. The availability of HQLA in financing markets also, arguably, continues to be undermined by the European Central Bank’s public sector purchase programme (PSPP), which saps away supply. Evidence for this can been seen in volatility spikes, most notably 2015’s ‘bund tantrum’ where yields on long-term bonds surged 21 basis points intra-day, peaking at 80 basis points only to return by the end of day to the previous day’s close.

Levels of non-cash collateral continue to rise in response to regulation as dealers continue to reposition and deleverage their balance sheets. Current estimates place the split at roughly 60/40, up from 45/55 only a year ago.

A shift in trading inventory can also be observed with many institutions replacing equity collateral (high capital charges associated with equities) in favour of government bonds. The International Securities Lending Association 2016 market survey noted government bonds as a proportion of total non-cash collateral increasing from 38 percent at 31 December 2015 to 48 percent as at 30 June 2016.

A counter narrative could, however, become true in the US with the proposed changes to rule Rule 15c3-3. This would allow collateral providers to more directly finance their equity inventories. Capital constraints stemming from the leverage ratio could be mitigated through equity-for-equity trading. With the US market historically so focused on cash collateral, Pirum’s suite of automation services are perfectly placed to enable our customers make the transition to non-cash.

Managing resources effectively

Consequently, cost and resource management are now a factor at every juncture of the trade lifecycle, hence the blurring of lines between front office and back office and pre-and post-trade. With an overwhelming focus on more efficient collateral management across the industry, unsurprisingly there is a continuing trend for firms seeking to ‘do more with less’. Our customers are increasingly looking to automate, reducing manual intervention at every possible point in the trade lifecycle. In days gone by, an institution may have had the resources and inclination to build to this effect, but increasingly, regulatory drag, flatlining revenue, squeezed margins, shrinking financial resources and the increased costs of supporting legacy infrastructure means the market is looking to service providers to resolve non-differentiating problems via technology.

With such a heavy focus on optimising the use of balance sheet and collateral, and ensuring inventory is deployed in a manner that is both capital-efficient and cost-effective, post-trade visibility and efficiency are now front and centre.

The increasing cost of balance sheet provision due in part to complying with liquidity regulation (LCR and the net stable funding ratio) also forces some banks to shy away from providing short-term deposits and repo to a segment of their traditional customer franchise. The historical pressures of month-, quarter- and year-end have become exacerbated, and again signs of a liquidity drought can be observed.

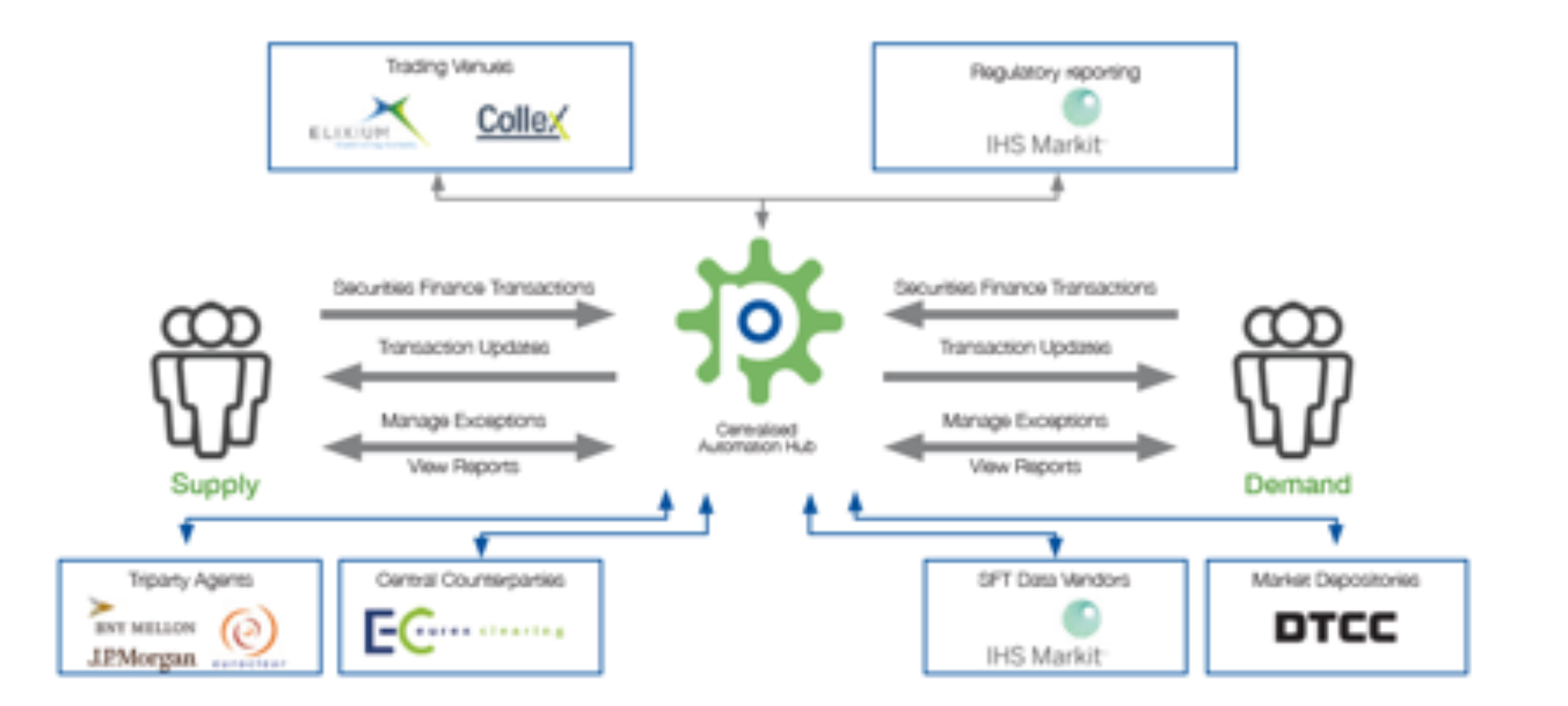

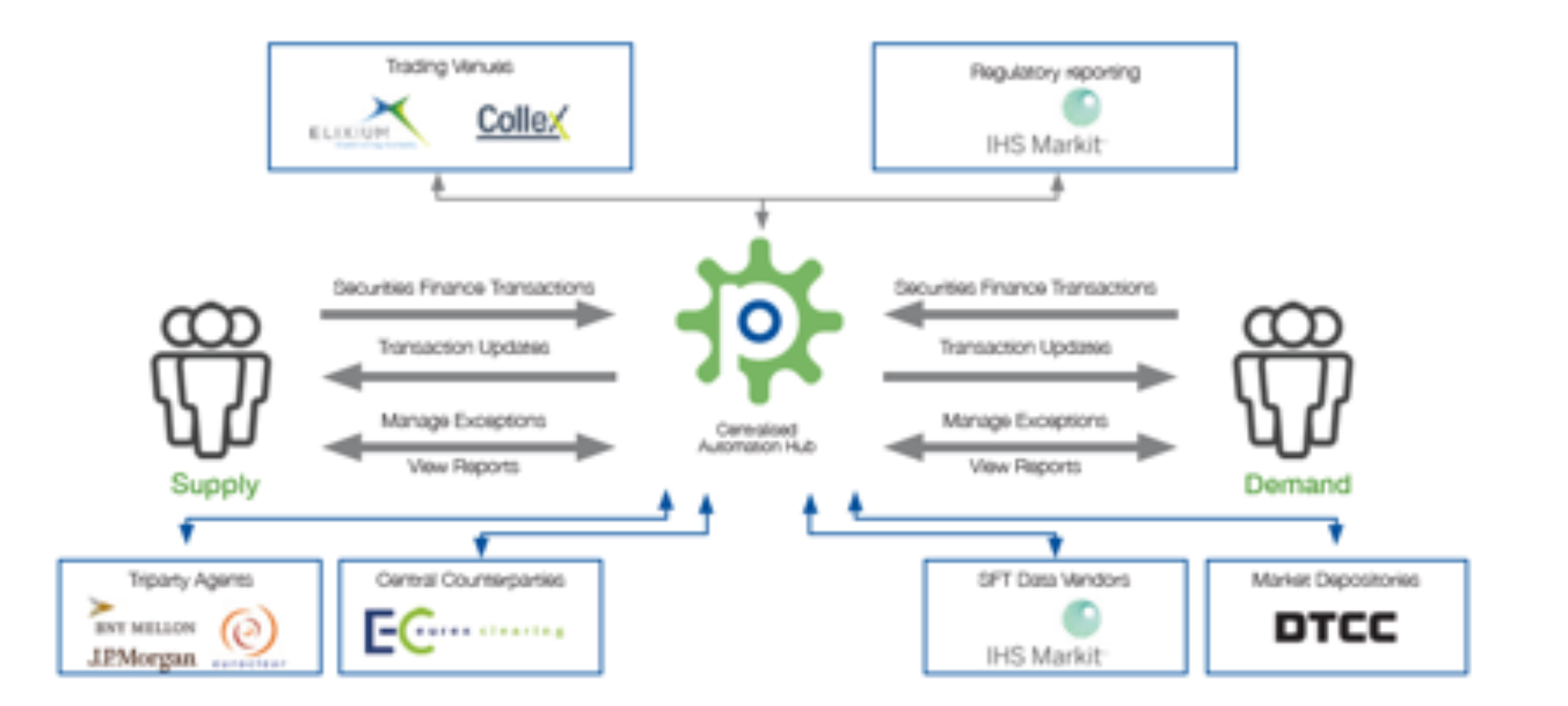

This creates an interesting dynamic in the market, in which the role of the traditional intermediary repo dealer is supplemented by additional non-traditional institution types (for example, corporate treasurers, asset managers and clearinghouses). A number of execution venues are evolving in this space, seeking to connect the traditional with the new entrants. Pirum has established connections to multiple trading venues, providing full post-trade lifecycle management such as automated collateral management in conjunction with triparty providers and regulatory reporting. This seamless straight-through processing connectivity will help to bring liquidity to the platforms and allow participants that have less developed back-office infrastructures to lower the implementation burden and realise the benefits of the trading platform. Similarly, Pirum’s CCP Gateway enables bilaterally-traded business to be sent to a central counterparty (CCP) for novation by leveraging post-trade automation connectivity to access central clearing platforms. This allows customers to gain the efficiencies in capital costs that a CCP offers without the additional heavy build.

Furthermore, the market is increasingly looking for one macro and consistent solution to its multi-regional issues, with transparency and connectivity becoming paramount in decision-making processes. Pirum already provides a secure, centralised automation and connectivity hub that seamlessly connects market participants, allowing them to electronically verify key transaction details and automate the post-trade lifecycle. Our platform provides connectivity to a plethora of partner infrastructure and complementary service providers. Our position, at the heart of securities finance markets, allows our clients to leverage the connectivity that we continue to build, to access CCPs, triparty agents, data vendors and regulatory reporting platforms, with more connections being added all the time.

A holistic view of collateral

Proliferation of non-cash collateral has helped triparty agents to become the boilerplate method for collateral management in the securities finance markets. The regulatory and operational requirements for the management of initial margin with respect to non-cleared derivatives (for example, segregation at a non-affiliated third party, T+1 settlement and complicated rules around the management of concentration limits) dictate that triparty agents also form the basis of collateral models here, too.

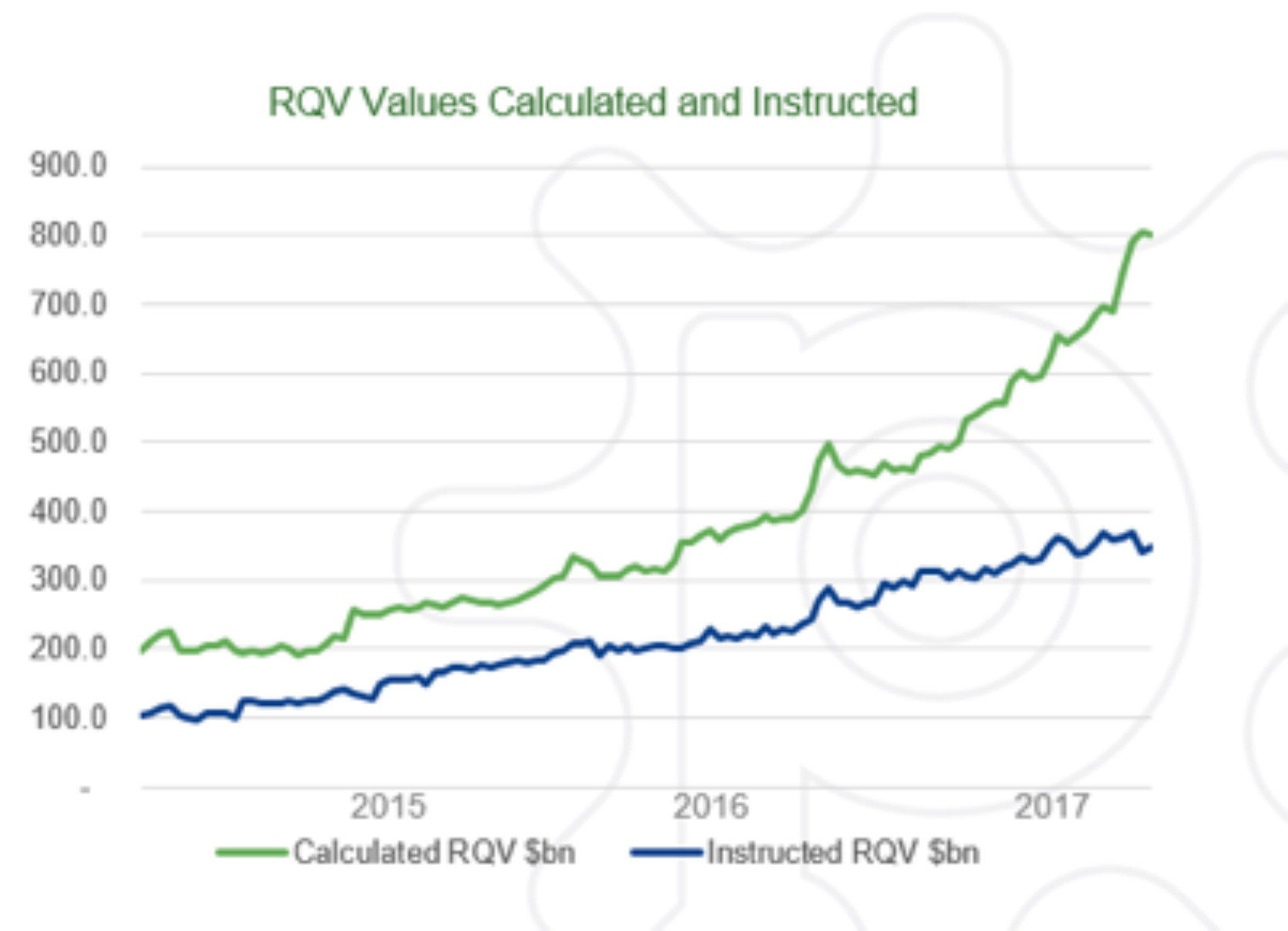

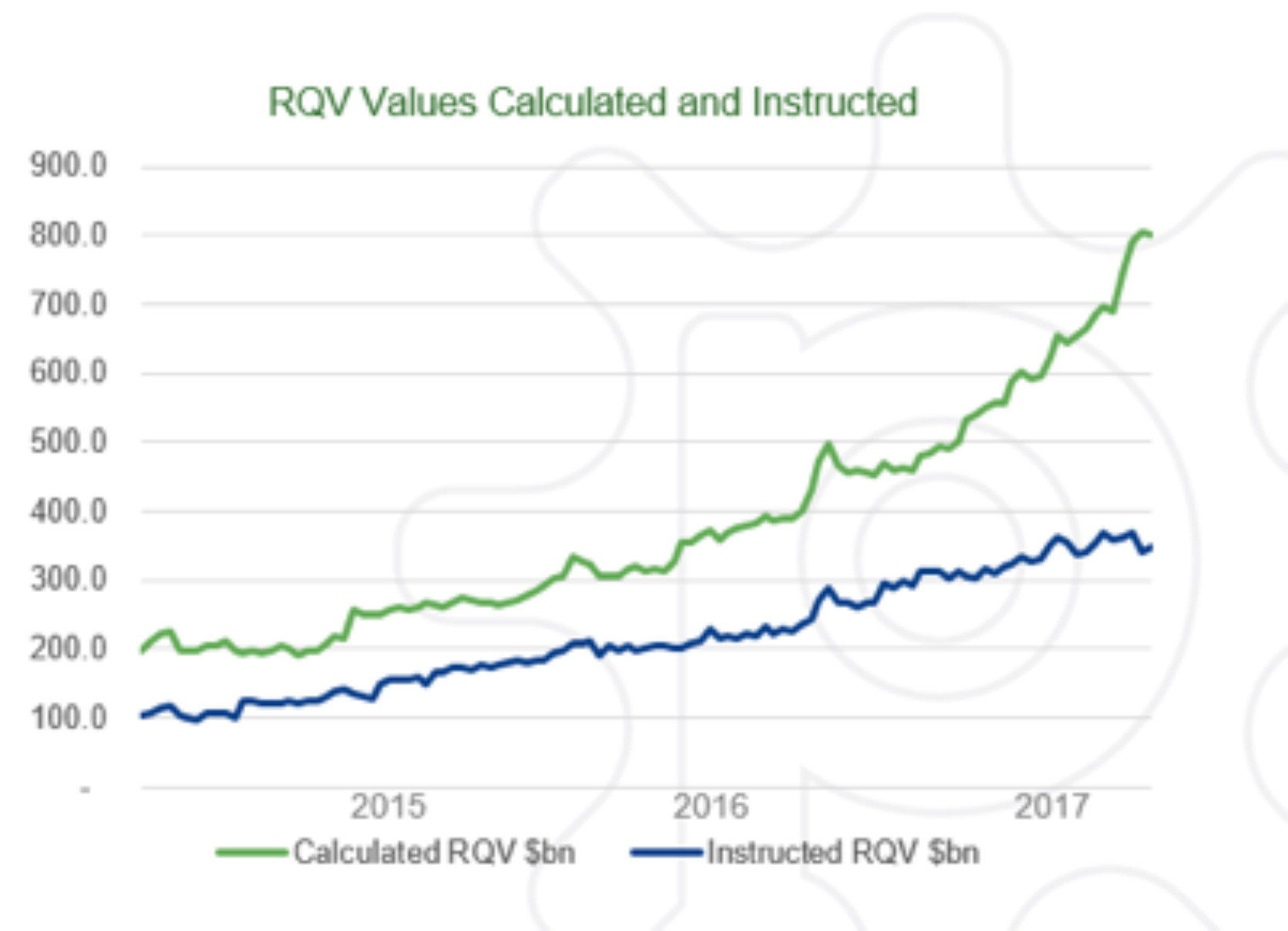

Pirum, through partnerships with BNY Mellon, J.P. Morgan and Euroclear (with Clearstream soon to be added), allows mutual clients to seamlessly interact with each of the providers. Pirum’s service gives users a holistic view of their collateral management activities across both triparty agent and bilateral obligations. Users have access to fully automated intra-day position updates, close of business market prices and foreign exchange rates electronically via near real-time feeds. Using this information, Pirum can for triparty relationships calculate the required collateral value (RQV) at the triparty account level for each side of the exposure, displaying the results on its secure, intuitive web portal. Pirum’s proven reconciliation platform then analyses any differences and determines the root cause of any dispute leading to a rapid resolution.

We live in fast paced times and technological innovation continues to reshape the world in which our industry operates. However, in many respects, exposure and collateral management practices remain archaic. With manual, operationally intensive practices de rigueur at many firms, many are stuck in third gear. Regulatory change, though, is unforgiving, and leaves little room for inefficiency in operational practice. An obvious example of this can be found in securities finance collateral management, where processes largely operate in static time slices, often reviewed only once per day. Counterparties still pick a fixed schedule to perform and reconcile their calculations, and subsequently instruct settlement based on this one point in time. Thus, collateral movements occur after the fact and, by the time they settle, no longer accurately represent the real state of exposure. ‘After the fact’ collateralisation leaves one party with a residual exposure that digs directly into their capital reserve.

Pirum’s services, however, allow our customers to shift up into sixth gear, allowing for intra-day, real-time collateral management via triparty agents. This is a service that, unsurprisingly, is gaining rapid traction (currently, Pirum manages $800 billion of non-cash collateral and instructs more than $350 billion of RQVs). Our new, all-encompassing exposure management system extends the service to cover all collateralisation methods, including bilateral non-cash, cash pool, cash rebate and inter-company collateral exposure across securities lending and repo trades. The offering works in harmony with the existing triparty RQV service and offers additional features, including:

• Full counterparty to counterparty exposure agreement workflow

• Full audit and retrospective details of exposure agreements

• A centralised platform to calculate, communicate, agree and record exposures for all counterparties across all collateral venues (bilateral, triparty and CCP)

• Live updates from client systems, counterparties, triparty agents, trading venues and CCPs

• A management dashboard to identify key risks and alert users to significant exposure change

• Filters to allow you to focus on and update the status of individual exposure groups (for example, pending, agreed and disputed) with current and projected exposure values visible

• Reporting options that allow the capture and recording of exposures at key points in time for internal or audit purposes

Additionally, and to return to the gloomy picture of regulatory drag, flatlining revenue, squeezed margins and shrinking financial resources, clients can further benefit from Pirum’s loan release and pre-pay automation services, which work in harmony with the exposure management product. For firms looking to balance their activities within the context of constrained financial resources, it simply does not make sense to tie up capital in a non-productive manner (one-day pre-pay and the associated capital charge for overnight overcollateralisation), especially when technology and automation now exists to prevent the occurrence.

With the help of Pirum, exposure management is fast becoming a straight-through process and exception-based model. Again, to place post-trade back within the regulatory context, the reporting obligations of SFTR are looming large and being able to manage exposures and reconcile differences in near real-time has never been more important.

In an ever-convergent world, liquidity and capital in the securities finance markets are simultaneously affected. Collateral management activities, associated with the derivatives markets, are massive consumers of high quality liquid assets (HQLA). The International Swaps and Derivatives Association estimates that encumbered collateral will reach approximately $800 billion by 2020, while other estimates go to $1.7 trillion.

The continuing impact of compliance with various regulatory regimes such as Basel III and the liquidity coverage ratio (LCR), the Securities Financing Transactions Regulation (SFTR)—the list goes on--could cause some institutions engaged in the lending of securities to reconsider their involvement rather than face compliance with this ever-mounting stack of regulation.

The industry is increasingly turning to vendors such as Pirum, with its pedigree in post-trade automation and ever-growing role as a connectivity hub, to help ease this continuing burden.

Disincentivising lenders obviously has counter-productive repercussions in terms of the loss of market liquidity, making it harder and costlier for the institutional investor to access equity markets and for government institutions to issue and manage existing government bond programmes. The availability of HQLA in financing markets also, arguably, continues to be undermined by the European Central Bank’s public sector purchase programme (PSPP), which saps away supply. Evidence for this can been seen in volatility spikes, most notably 2015’s ‘bund tantrum’ where yields on long-term bonds surged 21 basis points intra-day, peaking at 80 basis points only to return by the end of day to the previous day’s close.

Levels of non-cash collateral continue to rise in response to regulation as dealers continue to reposition and deleverage their balance sheets. Current estimates place the split at roughly 60/40, up from 45/55 only a year ago.

A shift in trading inventory can also be observed with many institutions replacing equity collateral (high capital charges associated with equities) in favour of government bonds. The International Securities Lending Association 2016 market survey noted government bonds as a proportion of total non-cash collateral increasing from 38 percent at 31 December 2015 to 48 percent as at 30 June 2016.

A counter narrative could, however, become true in the US with the proposed changes to rule Rule 15c3-3. This would allow collateral providers to more directly finance their equity inventories. Capital constraints stemming from the leverage ratio could be mitigated through equity-for-equity trading. With the US market historically so focused on cash collateral, Pirum’s suite of automation services are perfectly placed to enable our customers make the transition to non-cash.

Managing resources effectively

Consequently, cost and resource management are now a factor at every juncture of the trade lifecycle, hence the blurring of lines between front office and back office and pre-and post-trade. With an overwhelming focus on more efficient collateral management across the industry, unsurprisingly there is a continuing trend for firms seeking to ‘do more with less’. Our customers are increasingly looking to automate, reducing manual intervention at every possible point in the trade lifecycle. In days gone by, an institution may have had the resources and inclination to build to this effect, but increasingly, regulatory drag, flatlining revenue, squeezed margins, shrinking financial resources and the increased costs of supporting legacy infrastructure means the market is looking to service providers to resolve non-differentiating problems via technology.

With such a heavy focus on optimising the use of balance sheet and collateral, and ensuring inventory is deployed in a manner that is both capital-efficient and cost-effective, post-trade visibility and efficiency are now front and centre.

The increasing cost of balance sheet provision due in part to complying with liquidity regulation (LCR and the net stable funding ratio) also forces some banks to shy away from providing short-term deposits and repo to a segment of their traditional customer franchise. The historical pressures of month-, quarter- and year-end have become exacerbated, and again signs of a liquidity drought can be observed.

This creates an interesting dynamic in the market, in which the role of the traditional intermediary repo dealer is supplemented by additional non-traditional institution types (for example, corporate treasurers, asset managers and clearinghouses). A number of execution venues are evolving in this space, seeking to connect the traditional with the new entrants. Pirum has established connections to multiple trading venues, providing full post-trade lifecycle management such as automated collateral management in conjunction with triparty providers and regulatory reporting. This seamless straight-through processing connectivity will help to bring liquidity to the platforms and allow participants that have less developed back-office infrastructures to lower the implementation burden and realise the benefits of the trading platform. Similarly, Pirum’s CCP Gateway enables bilaterally-traded business to be sent to a central counterparty (CCP) for novation by leveraging post-trade automation connectivity to access central clearing platforms. This allows customers to gain the efficiencies in capital costs that a CCP offers without the additional heavy build.

Furthermore, the market is increasingly looking for one macro and consistent solution to its multi-regional issues, with transparency and connectivity becoming paramount in decision-making processes. Pirum already provides a secure, centralised automation and connectivity hub that seamlessly connects market participants, allowing them to electronically verify key transaction details and automate the post-trade lifecycle. Our platform provides connectivity to a plethora of partner infrastructure and complementary service providers. Our position, at the heart of securities finance markets, allows our clients to leverage the connectivity that we continue to build, to access CCPs, triparty agents, data vendors and regulatory reporting platforms, with more connections being added all the time.

A holistic view of collateral

Proliferation of non-cash collateral has helped triparty agents to become the boilerplate method for collateral management in the securities finance markets. The regulatory and operational requirements for the management of initial margin with respect to non-cleared derivatives (for example, segregation at a non-affiliated third party, T+1 settlement and complicated rules around the management of concentration limits) dictate that triparty agents also form the basis of collateral models here, too.

Pirum, through partnerships with BNY Mellon, J.P. Morgan and Euroclear (with Clearstream soon to be added), allows mutual clients to seamlessly interact with each of the providers. Pirum’s service gives users a holistic view of their collateral management activities across both triparty agent and bilateral obligations. Users have access to fully automated intra-day position updates, close of business market prices and foreign exchange rates electronically via near real-time feeds. Using this information, Pirum can for triparty relationships calculate the required collateral value (RQV) at the triparty account level for each side of the exposure, displaying the results on its secure, intuitive web portal. Pirum’s proven reconciliation platform then analyses any differences and determines the root cause of any dispute leading to a rapid resolution.

We live in fast paced times and technological innovation continues to reshape the world in which our industry operates. However, in many respects, exposure and collateral management practices remain archaic. With manual, operationally intensive practices de rigueur at many firms, many are stuck in third gear. Regulatory change, though, is unforgiving, and leaves little room for inefficiency in operational practice. An obvious example of this can be found in securities finance collateral management, where processes largely operate in static time slices, often reviewed only once per day. Counterparties still pick a fixed schedule to perform and reconcile their calculations, and subsequently instruct settlement based on this one point in time. Thus, collateral movements occur after the fact and, by the time they settle, no longer accurately represent the real state of exposure. ‘After the fact’ collateralisation leaves one party with a residual exposure that digs directly into their capital reserve.

Pirum’s services, however, allow our customers to shift up into sixth gear, allowing for intra-day, real-time collateral management via triparty agents. This is a service that, unsurprisingly, is gaining rapid traction (currently, Pirum manages $800 billion of non-cash collateral and instructs more than $350 billion of RQVs). Our new, all-encompassing exposure management system extends the service to cover all collateralisation methods, including bilateral non-cash, cash pool, cash rebate and inter-company collateral exposure across securities lending and repo trades. The offering works in harmony with the existing triparty RQV service and offers additional features, including:

• Full counterparty to counterparty exposure agreement workflow

• Full audit and retrospective details of exposure agreements

• A centralised platform to calculate, communicate, agree and record exposures for all counterparties across all collateral venues (bilateral, triparty and CCP)

• Live updates from client systems, counterparties, triparty agents, trading venues and CCPs

• A management dashboard to identify key risks and alert users to significant exposure change

• Filters to allow you to focus on and update the status of individual exposure groups (for example, pending, agreed and disputed) with current and projected exposure values visible

• Reporting options that allow the capture and recording of exposures at key points in time for internal or audit purposes

Additionally, and to return to the gloomy picture of regulatory drag, flatlining revenue, squeezed margins and shrinking financial resources, clients can further benefit from Pirum’s loan release and pre-pay automation services, which work in harmony with the exposure management product. For firms looking to balance their activities within the context of constrained financial resources, it simply does not make sense to tie up capital in a non-productive manner (one-day pre-pay and the associated capital charge for overnight overcollateralisation), especially when technology and automation now exists to prevent the occurrence.

With the help of Pirum, exposure management is fast becoming a straight-through process and exception-based model. Again, to place post-trade back within the regulatory context, the reporting obligations of SFTR are looming large and being able to manage exposures and reconcile differences in near real-time has never been more important.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times