The winning equation: Scale + experience + technology = SFCM FastStart

10 November 2020

Broadridge sets out its stall on why SFCM FastStart has something of offer securities finance market participants of all sizes and regardless of the scale or complexity of existing infrastructures

Image: monsitj/stock.adobe.com

Image: monsitj/stock.adobe.com

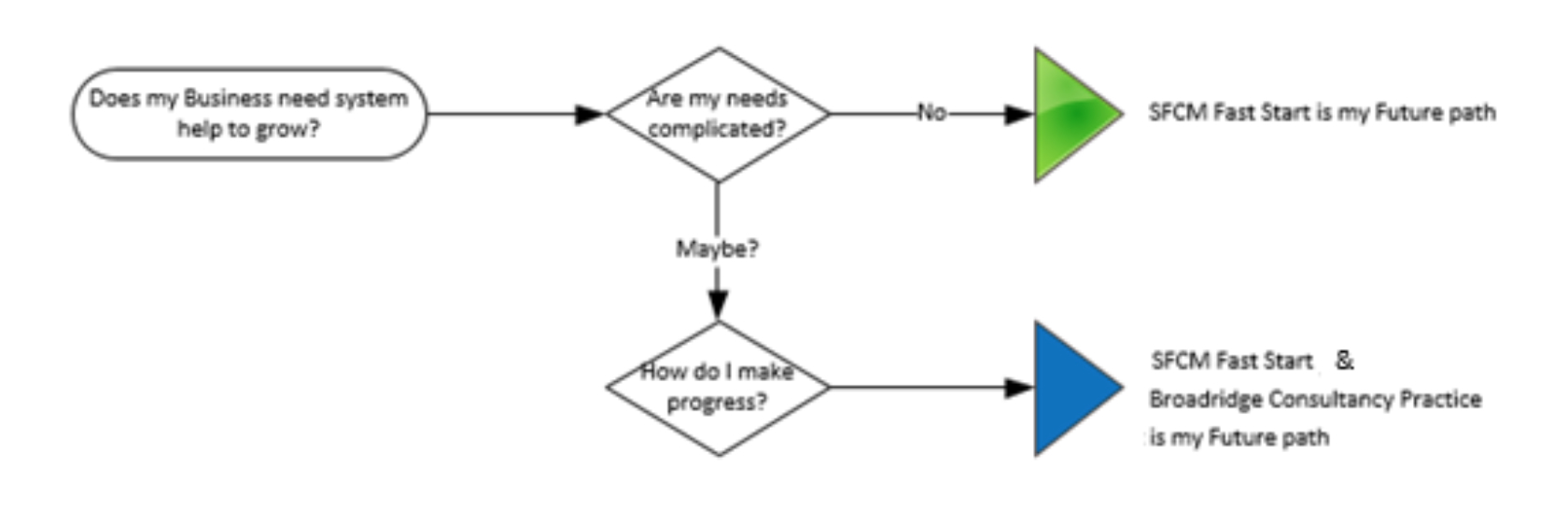

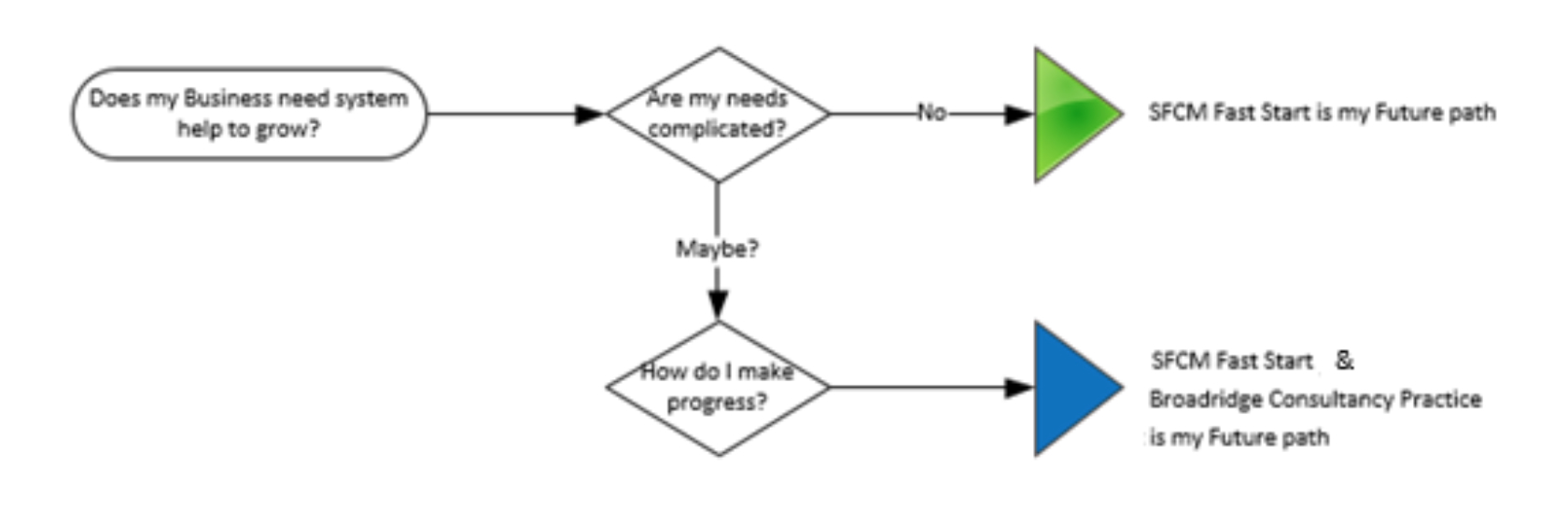

Are my needs complex?

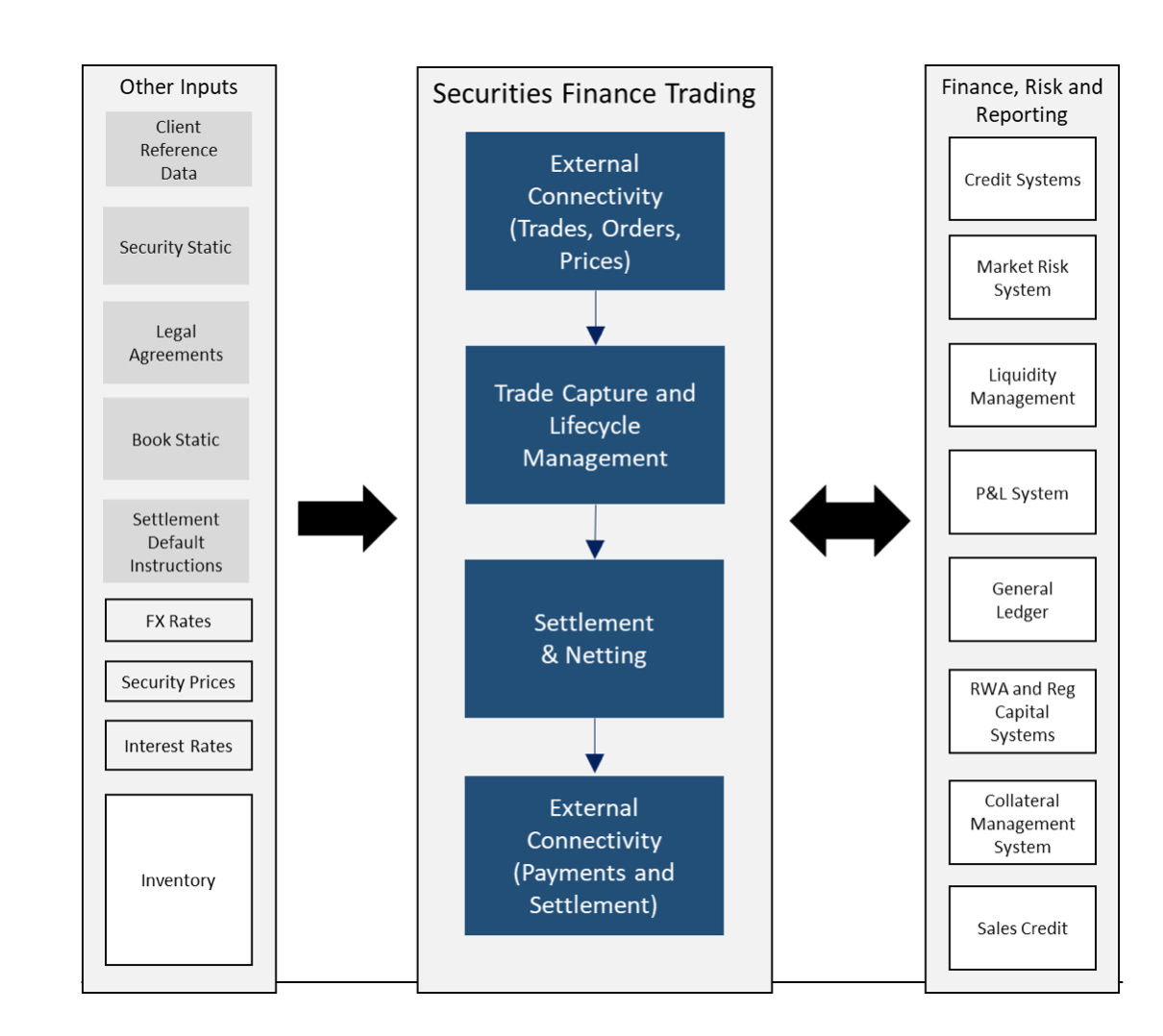

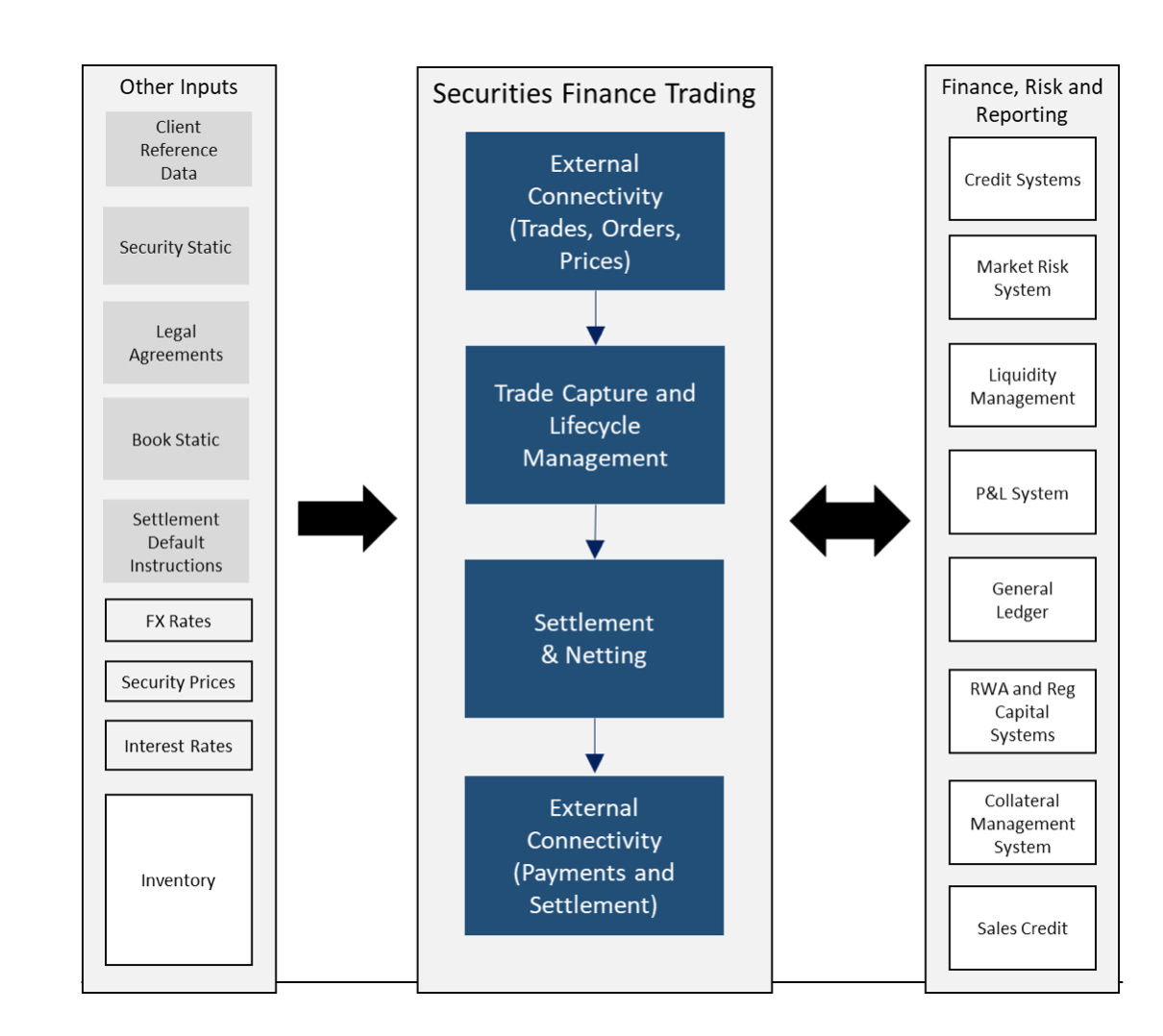

Senior management in most firms understand that a holistic view across all business lines is intrinsically important, not simply for the operation of securities finance, but for the overall optimisation of the balance sheet firm wide. Securities and cash often live in separate silos with their risk profiling existing elsewhere. These silos include treasury, liquidity, fixed income and equities securities finance, repo desks, prime brokerage, credit trading and collateral management.

The crux of installing an integrated system for securities and cash-based collateralised businesses is, therefore, the sheer number of systems that need integrated. It’s a challenge, especially when attempted around a ‘sticky’ legacy platform core, which is why it’s rarely achieved fully.

Figure 1

Fortunately, Broadridge Securities Finance and Collateral Management (SFCM) business has years of experience and our flexible exact transform and load (ETL) application programming interfaces for system integration, meaning that no client’s infrastructure is too intimidating, regardless of how complex it might appear. Now with our new FastStart program, we can deliver a clean, SFCM platform ‘blank canvas’, deployable in just two weeks. It’s a core securities finance foundation, to simplify and streamline at a low pricing point.

Now, ask yourself the question again: Are my needs really complex?

It’s worth thinking deeply about this because the actual root level of complexity may be due to legacy issues, tech limitations, or a need to strip back and rebuild static data. Reviewing true complexity with a clean SFCM platform may be the way to see the wood for the trees.

Does it need to be complex? Sometimes yes.

Where the answer really is ‘maybe’ or ‘yes’, a cost-effective and rapid shift to a more efficient software-as-a-service (SaaS) platform, combined with our consultancy practice knowledge and the ability to apply it to your problem areas is the right solution. We help cut through complexity to its core — the difference between fast and efficient versus slow and painful progress. Which one would you prefer?

Being able to think front-to-back and having a holistic view of capital markets from both a business and technology perspective means the work we are called upon goes far beyond system integration. A better description of much of the work we are called on to do is ‘solution design’.

We work with clients to create new infrastructure, new business processes; sometimes completely new businesses, allowing us to attract talent with the skills to continue this practice. SFCM is fully front-to-back in functionality, for buy and sell side alike, and so are our staff. Having completed more than 50 client rollouts we can see the big picture and tame complexity.

As a result, Broadridge has an established global consulting practice which provides a range of expert professionals to serve as designers, project managers, business analysts, project management office developers and testers. In the current climate, this is proving an essential service, with Broadridge providing project augmentation and testing-as-a-Service, bringing our clients the ability to rapidly deliver on their business plans and meet their financial objectives.

This consultancy expertise, combined with a FastStart platform creates a clean, cost-effective live evaluation testbed with no legacy baggage. A clean starting point to build a new business or a way for smaller players to access a state-of-the-art platform previously out of reach due to high price point and get the help needed to scale it where and when you want and to your budget and return on investment expectations.

Does it need to be this complex? no.

When the answer is ‘no’, a cost-effective, rapid shift to an efficient SaaS platform like SFCM FastStart could very well be the solution. This is simplification and streamlining in action.

When you are at the smaller end of the market or starting a new securities finance business line from scratch there is a tendency to assume you may need to compromise on a solution; they’re too expensive and costly to spin up. One thing is true. There is a core securities finance competency needed whether you’re running a book of 10 trades on one site or a global book of 100,000, or if you’re evaluating change in your business model. We’re here to tell you that this does not need to be expensive, and it doesn’t need to be complex.

Having run a start-up myself, I know how important it is to put in the right system in the right way on the right architecture. Budgets don’t allow for costly refactoring of the consequences of bad choices, and levels of integration can be kept low without increasing full-time equivalent headcount.

The point of SFCM FastStart is to provide this core competency, get the foundations right but on a lighter footprint, provide a solid basis of training, then build on it and scale both with additional modules, integration and automation when needs and budgets allow.

Figure 2

Figure 3: This is SFCM FastStart: a rapid, extensible, Spin-up Operating Model

What does SFCM FastStart Provide?

FastStart is exactly what it says on the tin. You can start fast, with a new SFCM platform. Use it to begin your Securities finance business, or to replace macros/excel where they limit growth. Build a new business line with a clean platform or use it to find the effective route to a legacy lift-out.

What are the Fast Start Benefits?

• Price: low entry point, attractive monthly cost

• Terms: accessible month-to-month contract in the initial period

• Speed: FastStart can be spun up in two weeks for up to six users

Simplicity: UI-based, on-demand ETL and data management toolkit

• Core: trading, inventory and coll management, billing, reporting, profit-and-loss for repo and

securities lending

• Infrastructure: ‘all in’ Broadridge AWS SaaS, DR, BCP, Support and managed service

• Scale: expand to full-service SFCM in four key areas:

• Cost – pay for expansion points only when requirements and budgets allow

• Integration – hook into where you need, for what you need, when you need it

• Modular growth – use only the parts of SFCM you need, when you need them

• Knowledge – Combine FastStart with Broadridge’s consultancy practice experts

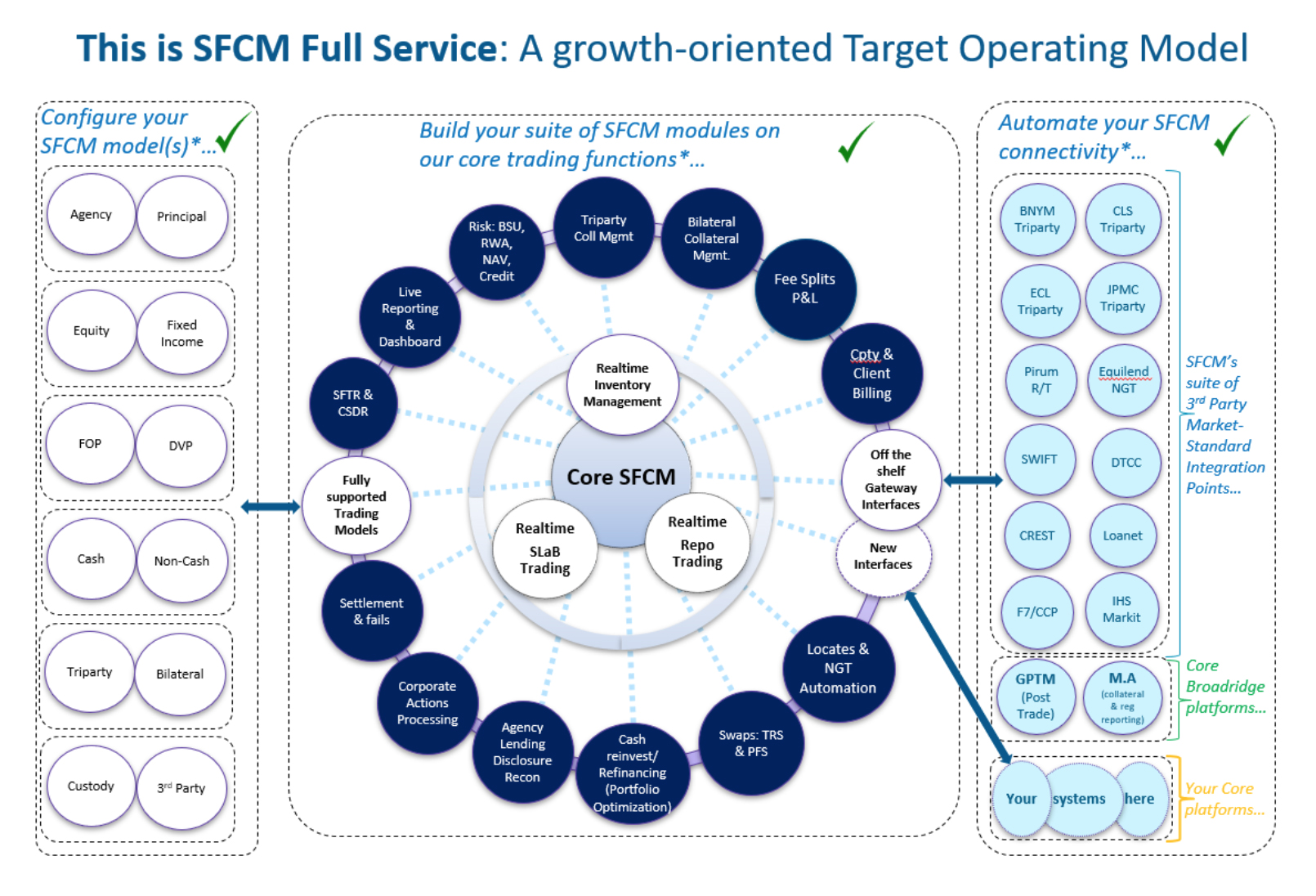

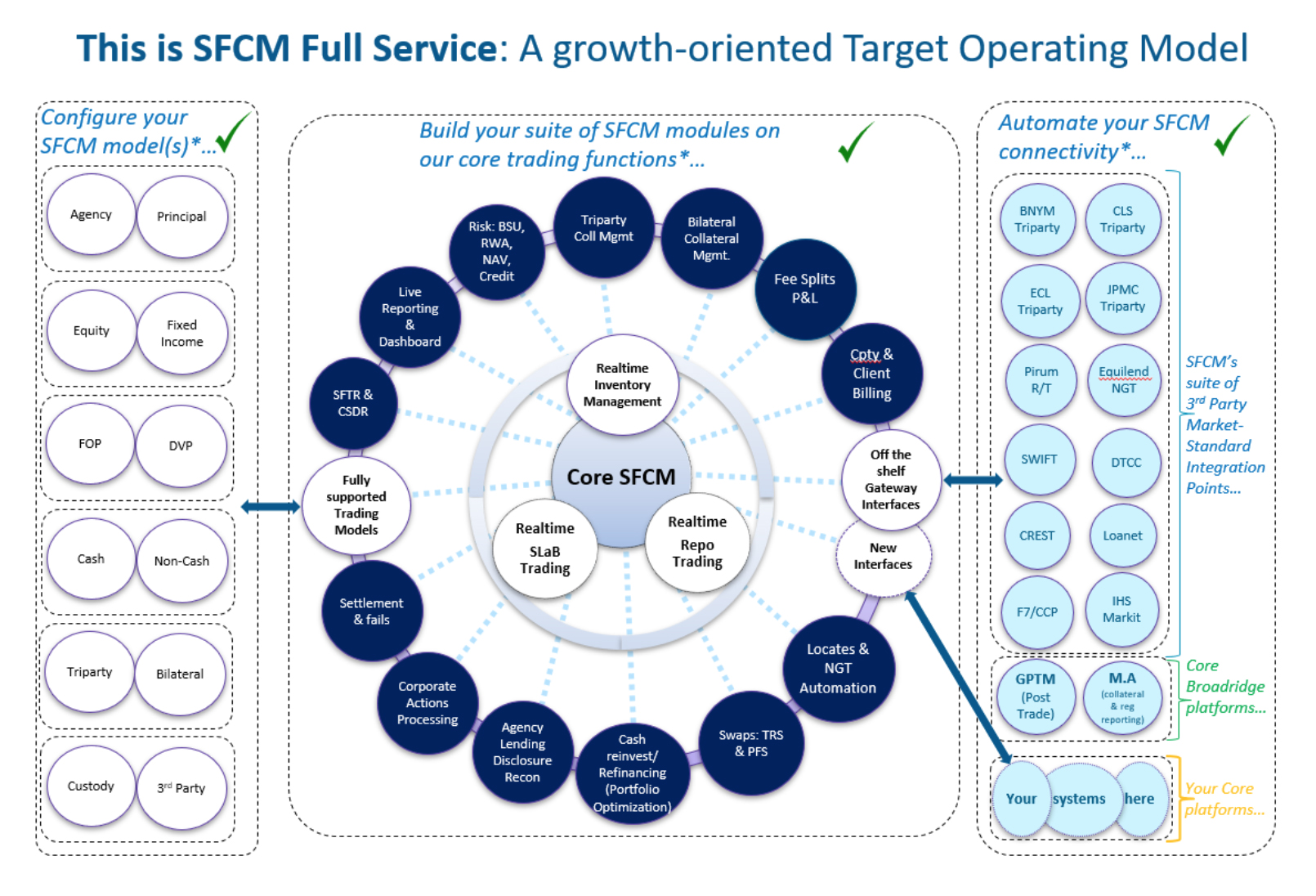

Figure 4: This is SFCM Full Service: A growth-oriented Target Operating Model

Senior management in most firms understand that a holistic view across all business lines is intrinsically important, not simply for the operation of securities finance, but for the overall optimisation of the balance sheet firm wide. Securities and cash often live in separate silos with their risk profiling existing elsewhere. These silos include treasury, liquidity, fixed income and equities securities finance, repo desks, prime brokerage, credit trading and collateral management.

The crux of installing an integrated system for securities and cash-based collateralised businesses is, therefore, the sheer number of systems that need integrated. It’s a challenge, especially when attempted around a ‘sticky’ legacy platform core, which is why it’s rarely achieved fully.

Figure 1

Fortunately, Broadridge Securities Finance and Collateral Management (SFCM) business has years of experience and our flexible exact transform and load (ETL) application programming interfaces for system integration, meaning that no client’s infrastructure is too intimidating, regardless of how complex it might appear. Now with our new FastStart program, we can deliver a clean, SFCM platform ‘blank canvas’, deployable in just two weeks. It’s a core securities finance foundation, to simplify and streamline at a low pricing point.

Now, ask yourself the question again: Are my needs really complex?

It’s worth thinking deeply about this because the actual root level of complexity may be due to legacy issues, tech limitations, or a need to strip back and rebuild static data. Reviewing true complexity with a clean SFCM platform may be the way to see the wood for the trees.

Does it need to be complex? Sometimes yes.

Where the answer really is ‘maybe’ or ‘yes’, a cost-effective and rapid shift to a more efficient software-as-a-service (SaaS) platform, combined with our consultancy practice knowledge and the ability to apply it to your problem areas is the right solution. We help cut through complexity to its core — the difference between fast and efficient versus slow and painful progress. Which one would you prefer?

Being able to think front-to-back and having a holistic view of capital markets from both a business and technology perspective means the work we are called upon goes far beyond system integration. A better description of much of the work we are called on to do is ‘solution design’.

We work with clients to create new infrastructure, new business processes; sometimes completely new businesses, allowing us to attract talent with the skills to continue this practice. SFCM is fully front-to-back in functionality, for buy and sell side alike, and so are our staff. Having completed more than 50 client rollouts we can see the big picture and tame complexity.

As a result, Broadridge has an established global consulting practice which provides a range of expert professionals to serve as designers, project managers, business analysts, project management office developers and testers. In the current climate, this is proving an essential service, with Broadridge providing project augmentation and testing-as-a-Service, bringing our clients the ability to rapidly deliver on their business plans and meet their financial objectives.

This consultancy expertise, combined with a FastStart platform creates a clean, cost-effective live evaluation testbed with no legacy baggage. A clean starting point to build a new business or a way for smaller players to access a state-of-the-art platform previously out of reach due to high price point and get the help needed to scale it where and when you want and to your budget and return on investment expectations.

Does it need to be this complex? no.

When the answer is ‘no’, a cost-effective, rapid shift to an efficient SaaS platform like SFCM FastStart could very well be the solution. This is simplification and streamlining in action.

When you are at the smaller end of the market or starting a new securities finance business line from scratch there is a tendency to assume you may need to compromise on a solution; they’re too expensive and costly to spin up. One thing is true. There is a core securities finance competency needed whether you’re running a book of 10 trades on one site or a global book of 100,000, or if you’re evaluating change in your business model. We’re here to tell you that this does not need to be expensive, and it doesn’t need to be complex.

Having run a start-up myself, I know how important it is to put in the right system in the right way on the right architecture. Budgets don’t allow for costly refactoring of the consequences of bad choices, and levels of integration can be kept low without increasing full-time equivalent headcount.

The point of SFCM FastStart is to provide this core competency, get the foundations right but on a lighter footprint, provide a solid basis of training, then build on it and scale both with additional modules, integration and automation when needs and budgets allow.

Figure 2

Figure 3: This is SFCM FastStart: a rapid, extensible, Spin-up Operating Model

What does SFCM FastStart Provide?

FastStart is exactly what it says on the tin. You can start fast, with a new SFCM platform. Use it to begin your Securities finance business, or to replace macros/excel where they limit growth. Build a new business line with a clean platform or use it to find the effective route to a legacy lift-out.

What are the Fast Start Benefits?

• Price: low entry point, attractive monthly cost

• Terms: accessible month-to-month contract in the initial period

• Speed: FastStart can be spun up in two weeks for up to six users

Simplicity: UI-based, on-demand ETL and data management toolkit

• Core: trading, inventory and coll management, billing, reporting, profit-and-loss for repo and

securities lending

• Infrastructure: ‘all in’ Broadridge AWS SaaS, DR, BCP, Support and managed service

• Scale: expand to full-service SFCM in four key areas:

• Cost – pay for expansion points only when requirements and budgets allow

• Integration – hook into where you need, for what you need, when you need it

• Modular growth – use only the parts of SFCM you need, when you need them

• Knowledge – Combine FastStart with Broadridge’s consultancy practice experts

Figure 4: This is SFCM Full Service: A growth-oriented Target Operating Model

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times