Collateral innovation with HQLAX

19 November 2020

Nick Short explains how HQLAX provide solutions for the collateral management challenges of today and tomorrow

Image: Nick Short

Image: Nick Short

It’s been said before that innovation can be achieved by putting existing things together in a different way to create something new. This is something that could also be said of HQLA?. We’re coupling the benefits of distributed ledger technology (DLT) with existing triparty and custody infrastructure, to improve collateral ownership mobility for our clients.

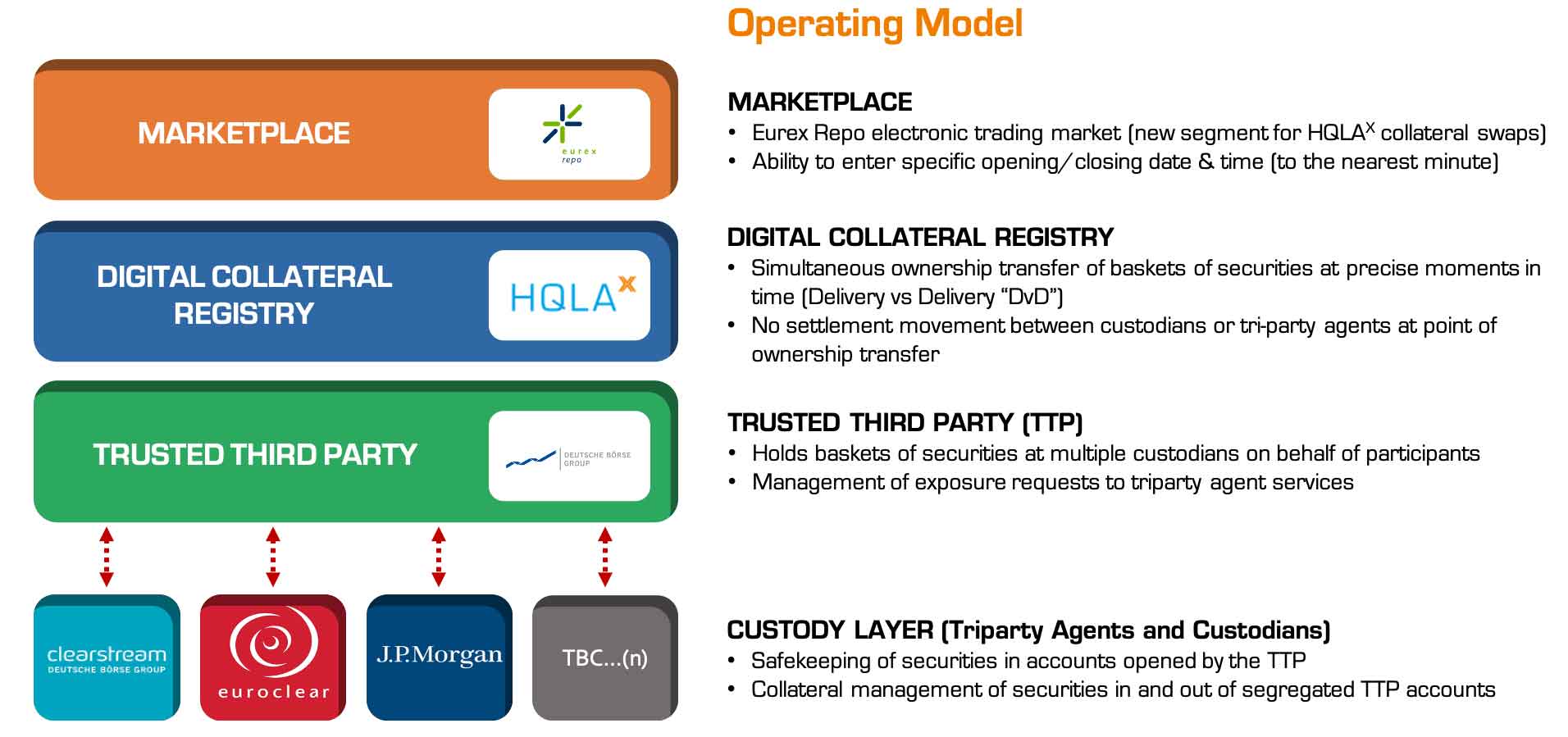

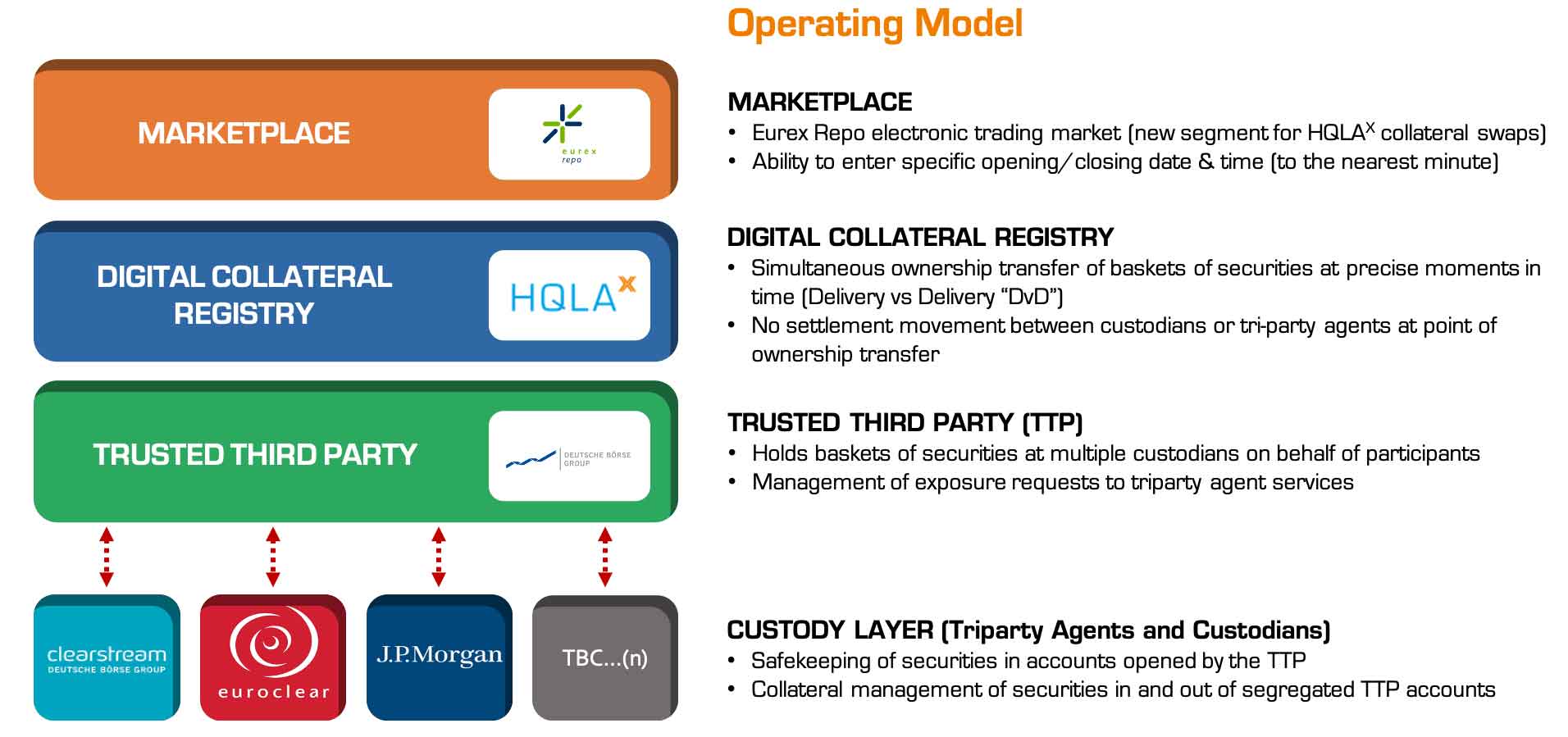

To begin with we’re improving collateral ownership mobility between market-leading triparty agents and custodians to help our clients more efficiently manage their collateral portfolios in order to satisfy key regulatory ratios such as capital ratio, leverage ratio, net stable funding ratio (NSFR), liquidity coverage ratio (LCR). Initially, we’re doing this to help financial institutions who are active in securities lending and collateral management in Europe. The HQLA? post trade processing solution which we’ve developed with our strategic partner Deutsche Boerse Group, achieves this for securities lending collateral swap transactions by enabling ownership exchange of baskets of securities: one: without settlement movement between custodians or triparty agents; two: simultaneously (we call this DvD – delivery vs. delivery; three: at precise moments in time.

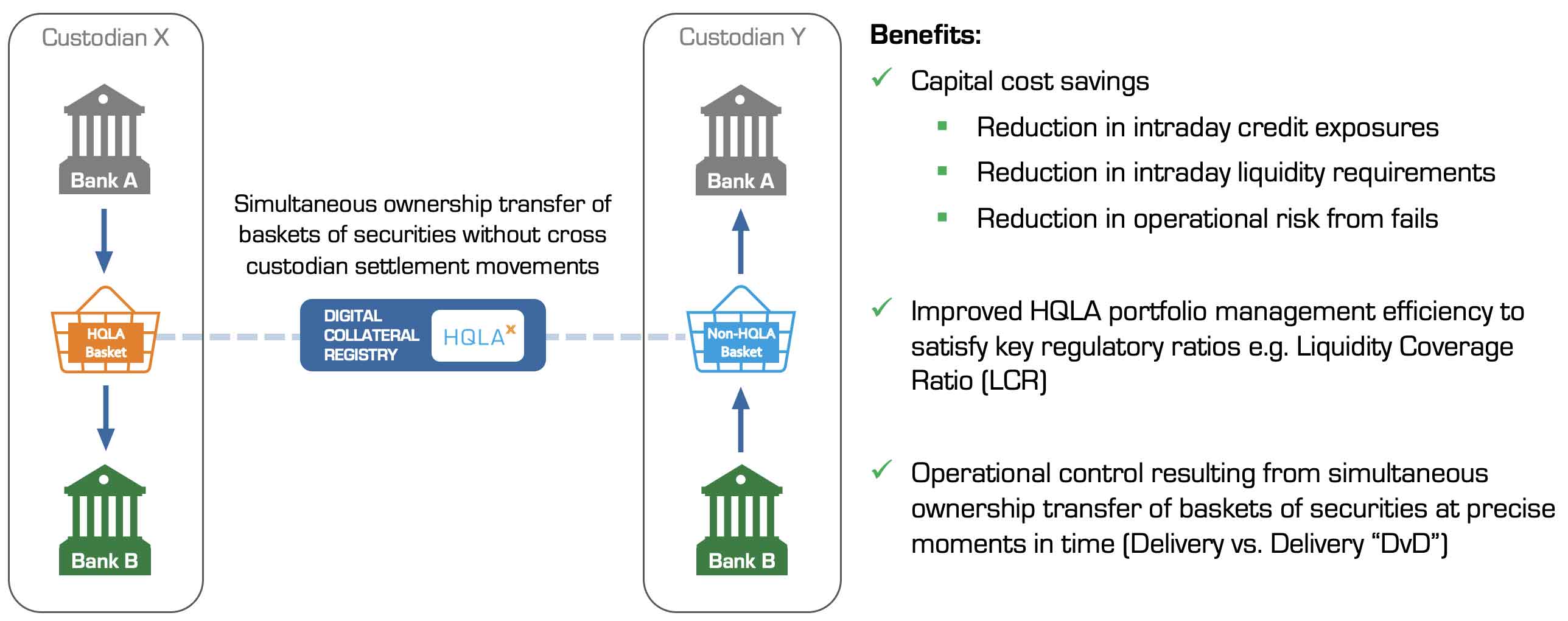

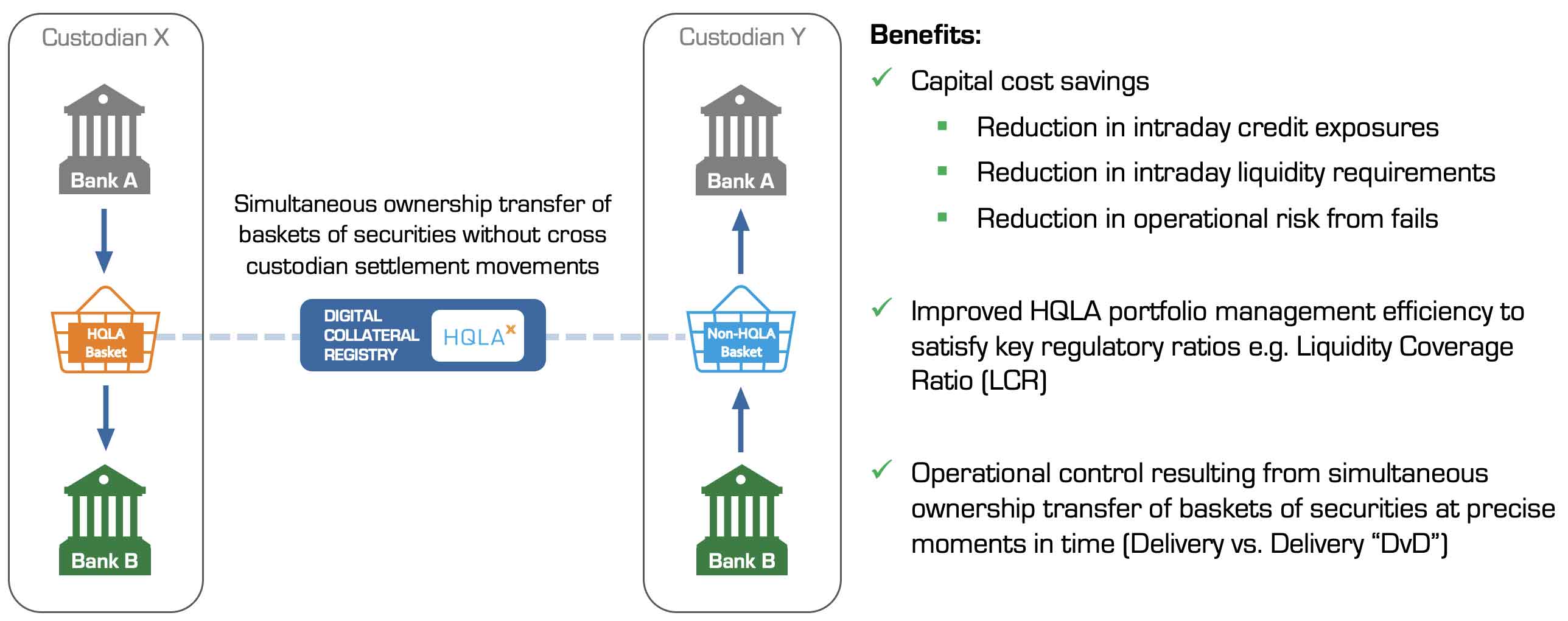

The benefits of the HQLA? model are captured in the diagram below.

All of this is achieved across multiple collateral pools involving assets held for safekeeping at three leading European triparty agents, Clearstream, Euroclear and J.P. Morgan, all of which are all already connected to the HQLA? platform. Additional triparty agents and custodians will connect in the future. Our digital collateral registry uses R3’s Enterprise Corda DLT solution coupled with a Luxembourg legal framework to enable ownership exchanges of assets to take place simultaneously and at precise moments in time.

Despite all that’s happened this year with the pandemic, we’ve continued to make great progress to address what we call ‘specific pain points’ for our clients and for the broader benefit of the securities lending and collateral management market. We’re incredibly grateful to our clients and partners for the time they’ve invested to do this, and for the enthusiasm they’ve shown for the benefits of using the HQLA? platform.

We’ve done this by innovating on top of our base-line product described above. This has been a very satisfying experience, involving focusing on detail, connecting the dots, challenging existing ideas, and a sprinkle of creativity to ensure that we arrive at solutions that benefit not only one client but the broader market. The reality is that there are many things we as a company could focus on, so we’re careful about developing the ideas that will provide the most benefit to our clients. For the solutions that reach the top of the priority list, we run regular client roundtable meetings to help focus everyone on designing the solution, validating it, and to then get the solution up and running on the HQLA? platform.

We call this ‘agile innovation’ where we iterate and improve via baby steps which don’t attempt to change the collateral ecosystem in one go but instead move things forward pragmatically towards our vision of frictionless ownership transfers of assets. Throughout this process, the importance of connectivity - be it to counterparts, trading platforms, exposure management platforms, or market infrastructure providers - has remained key. Connectivity can mean a couple of different things. One: people connectivity, and two: technical connectivity.

This year many existing client and partner relationships have been enhanced, whilst many new client and partner relationships have been forged – all achieved this year mostly via remote conference calls rather than in person. It’s been inspirational to see how everyone’s adapted to the new way of working to the point where we’ve even run successful ‘whiteboarding’ sessions remotely. If anything, working remotely puts more emphasis on improved documentation so that everyone’s clear on what’s been agreed. In terms of technical connectivity, we’ve put considerable effort into defining flows in order to plug into existing infrastructure providers, and we’ve continued to streamline our technical connectivity to clients to facilitate their onboarding to HQLA?. For example, we’ve worked with the Deutsche Boerse Trusted Third Party (TTP) to deliver a solution to make the Securities Financing Transactions Regulation (SFTR) reporting of HQLA? collateral swap transactions as easy as possible for our clients.

One example of innovating on top of our initial product, is that we’re working with a leading agency securities lender to enable their bank borrowers and beneficial owners to benefit from exchanging ownership of collateral and principal legs simultaneously via the HQLA? platform. For borrowers, this will help avoid the capital costs that exist today because of intraday credit exposures and operational risk caused by the collateral and principal legs moving at different times. Beneficial owners will also benefit from a potential reduction in ‘fails’ risk.

Another example of where we’re innovating on top of our base-line product, is in helping clients finance securities in local custody locations which for various reasons are not easily financed today and are usually fairly static in nature. Many of our clients have expressed interest in financing local custody positions via HQLA? collateral swaps.

We’re also focused on ensuring that the ownership exchange of baskets of securities on the HQLA? platform can be seamlessly repeated many times between participants (while the underlying securities remain in the same place). We call this ‘DCR Reuse’. DCR (Digital Collateral Record) is the name given to the digital representation on the HQLA? distributed ledger of the record of ownership of the basket of securities. There’s more than one way of achieving DCR Reuse so we’re working with clients and partners to arrive at the most optimum solution for all, and in the end, we may implement more than one solution. This is another exciting area of innovation for us, because it amplifies the benefit of effecting collateral ownership transfers without settlement movements.

Additional future variations on the DCR theme include collateralisation of an obligation using multiple DCRs which represent securities in different locations (custodians or triparty agents), or single DCRs which themselves represent securities in different locations. Both of these solutions will achieve greater collateral ownership flexibility for our clients.

We also plan to implement an intra-day solution to enable a collateral swap to start at, say, 10:15am, and to then mature later that same day at, say, 4:30pm. This is another advantage of using DLT to effect more flexible ownership exchange of collateral.

We’re also hearing increasing client interest in collateral ownership mobility of non-European assets. One example of this that we’re exploring is how the HQLA? platform could help improve the financing efficiency of collateral swaps of US treasuries versus Japanese government bonds via the HQLA? platform, by minimising some of the global timing issues which this trade faces today using existing settlement rails. More generally, we want to expand the HQLA? operating model into other jurisdictions like North America and Asia to further increase the collateral pools connected to the HQLA? platform.

The HQLA? platform has also been built to accommodate new types of assets. One example of this are assets which are themselves natively represented on the digital ledger, and this is something which we’ve also looked at this year in response to client interest.

With the help of some of our clients, we’ve also been exploring creative ways to use the HQLA? platform to help clients satisfy pledge requirements. These could be to offset counterparty credit exposures to a central counterparty or a bilateral counterparty for OTC derivatives, or to help source intraday cash liquidity with a clearing bank or central bank. We’ve accelerated our thinking in this space primarily for two reasons: first: clients have told us that HQLA? could have helped them more efficiently satisfy collateral requirements during the market volatility earlier this year; second: clients are increasingly focused on getting ready for upcoming Uncleared Margin Rules phases.

These are just some of the areas of innovation which are achievable from representing baskets of securities on a distributed ledger via HQLA?. Another key area of future innovation for us will be delivery versus payment (DvP). For the ‘D’ (i.e. securities) we’ve already connected multiple custodians and triparty agents to the HQLA? platform. For the ‘P’ we’re excited about the prospect of connecting various representations of cash on ledger (e.g. cash ‘coins’) which in turn will help us apply the benefits of the HQLA? platform to repos.

We initially chose R3’s Enterprise Corda DLT solution to help us achieve instantaneous and simultaneous exchange of ownership of baskets of securities for our clients as described above. We make onboarding as easy as possible for clients by providing clients with the option to have their DLT node hosted entirely by HQLA? to start with. This is another example of us taking pragmatic ‘baby steps’.

However, there are many additional benefits that DLT will bring to our clients in the future. These include the ability for counterparties to both see the same representation of the trade and record of basket ownership, thus reducing the need for time consuming reconciliations throughout the life of the trade. DLT also provides the prospect of instant communication between counterparties, custodians and triparty agents, and provides the possibility for regulators to have an improved real-time transparent view of collateral ownership. Many clients have expressed interest in running their own Corda nodes, so we know that they share this vision of the additional future benefits that DLT will bring for HQLA? transactions.

At HQLA? we strive to strike a happy balance between agility and obtaining sufficient client feedback upfront to ensure we’re all focusing on the things which provide the greatest value to our clients.

I’m excited for what the future holds for HQLA? and I’m proud of the progress we’ve made towards achieving our vision to accelerate the financial ecosystem’s transition towards frictionless ownership transfers of assets.

We relish the opportunity to implement these new ideas for the benefit of our clients.

To begin with we’re improving collateral ownership mobility between market-leading triparty agents and custodians to help our clients more efficiently manage their collateral portfolios in order to satisfy key regulatory ratios such as capital ratio, leverage ratio, net stable funding ratio (NSFR), liquidity coverage ratio (LCR). Initially, we’re doing this to help financial institutions who are active in securities lending and collateral management in Europe. The HQLA? post trade processing solution which we’ve developed with our strategic partner Deutsche Boerse Group, achieves this for securities lending collateral swap transactions by enabling ownership exchange of baskets of securities: one: without settlement movement between custodians or triparty agents; two: simultaneously (we call this DvD – delivery vs. delivery; three: at precise moments in time.

The benefits of the HQLA? model are captured in the diagram below.

All of this is achieved across multiple collateral pools involving assets held for safekeeping at three leading European triparty agents, Clearstream, Euroclear and J.P. Morgan, all of which are all already connected to the HQLA? platform. Additional triparty agents and custodians will connect in the future. Our digital collateral registry uses R3’s Enterprise Corda DLT solution coupled with a Luxembourg legal framework to enable ownership exchanges of assets to take place simultaneously and at precise moments in time.

Despite all that’s happened this year with the pandemic, we’ve continued to make great progress to address what we call ‘specific pain points’ for our clients and for the broader benefit of the securities lending and collateral management market. We’re incredibly grateful to our clients and partners for the time they’ve invested to do this, and for the enthusiasm they’ve shown for the benefits of using the HQLA? platform.

We’ve done this by innovating on top of our base-line product described above. This has been a very satisfying experience, involving focusing on detail, connecting the dots, challenging existing ideas, and a sprinkle of creativity to ensure that we arrive at solutions that benefit not only one client but the broader market. The reality is that there are many things we as a company could focus on, so we’re careful about developing the ideas that will provide the most benefit to our clients. For the solutions that reach the top of the priority list, we run regular client roundtable meetings to help focus everyone on designing the solution, validating it, and to then get the solution up and running on the HQLA? platform.

We call this ‘agile innovation’ where we iterate and improve via baby steps which don’t attempt to change the collateral ecosystem in one go but instead move things forward pragmatically towards our vision of frictionless ownership transfers of assets. Throughout this process, the importance of connectivity - be it to counterparts, trading platforms, exposure management platforms, or market infrastructure providers - has remained key. Connectivity can mean a couple of different things. One: people connectivity, and two: technical connectivity.

This year many existing client and partner relationships have been enhanced, whilst many new client and partner relationships have been forged – all achieved this year mostly via remote conference calls rather than in person. It’s been inspirational to see how everyone’s adapted to the new way of working to the point where we’ve even run successful ‘whiteboarding’ sessions remotely. If anything, working remotely puts more emphasis on improved documentation so that everyone’s clear on what’s been agreed. In terms of technical connectivity, we’ve put considerable effort into defining flows in order to plug into existing infrastructure providers, and we’ve continued to streamline our technical connectivity to clients to facilitate their onboarding to HQLA?. For example, we’ve worked with the Deutsche Boerse Trusted Third Party (TTP) to deliver a solution to make the Securities Financing Transactions Regulation (SFTR) reporting of HQLA? collateral swap transactions as easy as possible for our clients.

One example of innovating on top of our initial product, is that we’re working with a leading agency securities lender to enable their bank borrowers and beneficial owners to benefit from exchanging ownership of collateral and principal legs simultaneously via the HQLA? platform. For borrowers, this will help avoid the capital costs that exist today because of intraday credit exposures and operational risk caused by the collateral and principal legs moving at different times. Beneficial owners will also benefit from a potential reduction in ‘fails’ risk.

Another example of where we’re innovating on top of our base-line product, is in helping clients finance securities in local custody locations which for various reasons are not easily financed today and are usually fairly static in nature. Many of our clients have expressed interest in financing local custody positions via HQLA? collateral swaps.

We’re also focused on ensuring that the ownership exchange of baskets of securities on the HQLA? platform can be seamlessly repeated many times between participants (while the underlying securities remain in the same place). We call this ‘DCR Reuse’. DCR (Digital Collateral Record) is the name given to the digital representation on the HQLA? distributed ledger of the record of ownership of the basket of securities. There’s more than one way of achieving DCR Reuse so we’re working with clients and partners to arrive at the most optimum solution for all, and in the end, we may implement more than one solution. This is another exciting area of innovation for us, because it amplifies the benefit of effecting collateral ownership transfers without settlement movements.

Additional future variations on the DCR theme include collateralisation of an obligation using multiple DCRs which represent securities in different locations (custodians or triparty agents), or single DCRs which themselves represent securities in different locations. Both of these solutions will achieve greater collateral ownership flexibility for our clients.

We also plan to implement an intra-day solution to enable a collateral swap to start at, say, 10:15am, and to then mature later that same day at, say, 4:30pm. This is another advantage of using DLT to effect more flexible ownership exchange of collateral.

We’re also hearing increasing client interest in collateral ownership mobility of non-European assets. One example of this that we’re exploring is how the HQLA? platform could help improve the financing efficiency of collateral swaps of US treasuries versus Japanese government bonds via the HQLA? platform, by minimising some of the global timing issues which this trade faces today using existing settlement rails. More generally, we want to expand the HQLA? operating model into other jurisdictions like North America and Asia to further increase the collateral pools connected to the HQLA? platform.

The HQLA? platform has also been built to accommodate new types of assets. One example of this are assets which are themselves natively represented on the digital ledger, and this is something which we’ve also looked at this year in response to client interest.

With the help of some of our clients, we’ve also been exploring creative ways to use the HQLA? platform to help clients satisfy pledge requirements. These could be to offset counterparty credit exposures to a central counterparty or a bilateral counterparty for OTC derivatives, or to help source intraday cash liquidity with a clearing bank or central bank. We’ve accelerated our thinking in this space primarily for two reasons: first: clients have told us that HQLA? could have helped them more efficiently satisfy collateral requirements during the market volatility earlier this year; second: clients are increasingly focused on getting ready for upcoming Uncleared Margin Rules phases.

These are just some of the areas of innovation which are achievable from representing baskets of securities on a distributed ledger via HQLA?. Another key area of future innovation for us will be delivery versus payment (DvP). For the ‘D’ (i.e. securities) we’ve already connected multiple custodians and triparty agents to the HQLA? platform. For the ‘P’ we’re excited about the prospect of connecting various representations of cash on ledger (e.g. cash ‘coins’) which in turn will help us apply the benefits of the HQLA? platform to repos.

We initially chose R3’s Enterprise Corda DLT solution to help us achieve instantaneous and simultaneous exchange of ownership of baskets of securities for our clients as described above. We make onboarding as easy as possible for clients by providing clients with the option to have their DLT node hosted entirely by HQLA? to start with. This is another example of us taking pragmatic ‘baby steps’.

However, there are many additional benefits that DLT will bring to our clients in the future. These include the ability for counterparties to both see the same representation of the trade and record of basket ownership, thus reducing the need for time consuming reconciliations throughout the life of the trade. DLT also provides the prospect of instant communication between counterparties, custodians and triparty agents, and provides the possibility for regulators to have an improved real-time transparent view of collateral ownership. Many clients have expressed interest in running their own Corda nodes, so we know that they share this vision of the additional future benefits that DLT will bring for HQLA? transactions.

At HQLA? we strive to strike a happy balance between agility and obtaining sufficient client feedback upfront to ensure we’re all focusing on the things which provide the greatest value to our clients.

I’m excited for what the future holds for HQLA? and I’m proud of the progress we’ve made towards achieving our vision to accelerate the financial ecosystem’s transition towards frictionless ownership transfers of assets.

We relish the opportunity to implement these new ideas for the benefit of our clients.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times