Leverage ratio and the new normal

01 March 2022

With the CRR2 Leverage Ratio requirements now live, Frank Odendall, head of securities financing product and business development at Eurex, weighs up whether the European repo market will trend towards a new orthodoxy

Image: stock.adobe.com/Jackie Niam

Image: stock.adobe.com/Jackie Niam

The Leverage Ratio continues to be one of the most widely debated prudential measures implemented since the Great Financial Crisis of 2007 and 2008. Supporters of the Leverage Ratio laud the measure as a critical prudential backstop in benign economic environments and a defence against creative quantitative modellers, weak model governance, and under-resourced supervisors. The Leverage Ratio is considered to be the perfect tool for an imperfect prudential framework. Its detractors condemn the measure for its dependence on accounting standards, arbitrary calibration, the lack of risk-sensitivity, and the perverse incentives towards risky behaviour that it creates. There is now a growing chorus calling for its outright removal, arguing that many of the objectives of the Leverage Ratio measure are now met with the Standardized Output Floor introduced as part of the Basel III final rules, which employs more credible standardised approaches.

Repurchase agreements (repo) are probably the product most unduly penalised by the Leverage Ratio regime, aside from perhaps prime residential mortgages. Some would argue that this is an unintended consequence of the application of accounting measures in the Leverage Ratio calculation which reports repos on a gross basis, while the collateral received is given no recognition. Others would argue that this is exactly what was intended, given the use of repo to create significant, even infinite, leverage in the financial system. Regardless of which side of the fence you are on, it is difficult to argue about the importance of the repo market and the critical role it plays in the smooth functioning of the global financial system.

End to window dressing

In June 2021, the second iteration of the Capital Requirements Regulation (CRR II) for the European Union went live. The revisions included a change which reflected a recommendation from the Basel Committee that the Leverage Ratio should be calculated using average measures, rather than spot measures, for those inputs that can exhibit volatility during reporting periods. This was a polite way of saying that the regulators needed to take steps to stop institutions from “window dressing”, a practice where firms adjust their trading activity in the lead up to key regulatory or external reporting dates to make their prudential and statutory performance measures look better than would be the case in the normal course of trading. While markets should be a simple function of supply and demand, these nuances around the regulation can have profound effects on market structure and dynamics. The European repo market dysfunction of year-end 2016 and the collateral scarcity effects during the fourth quarter of 2021 are just two of many examples of the complex interaction of regulation and the markets.

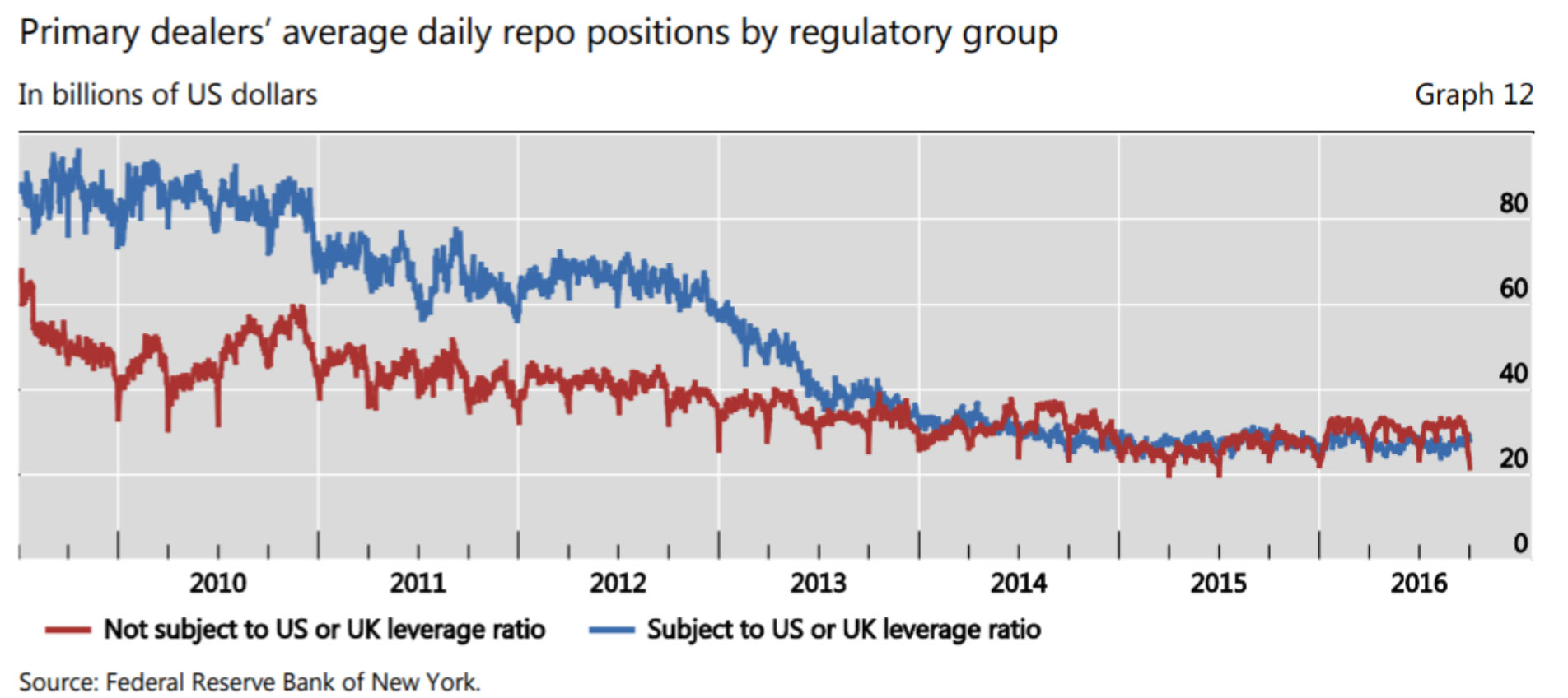

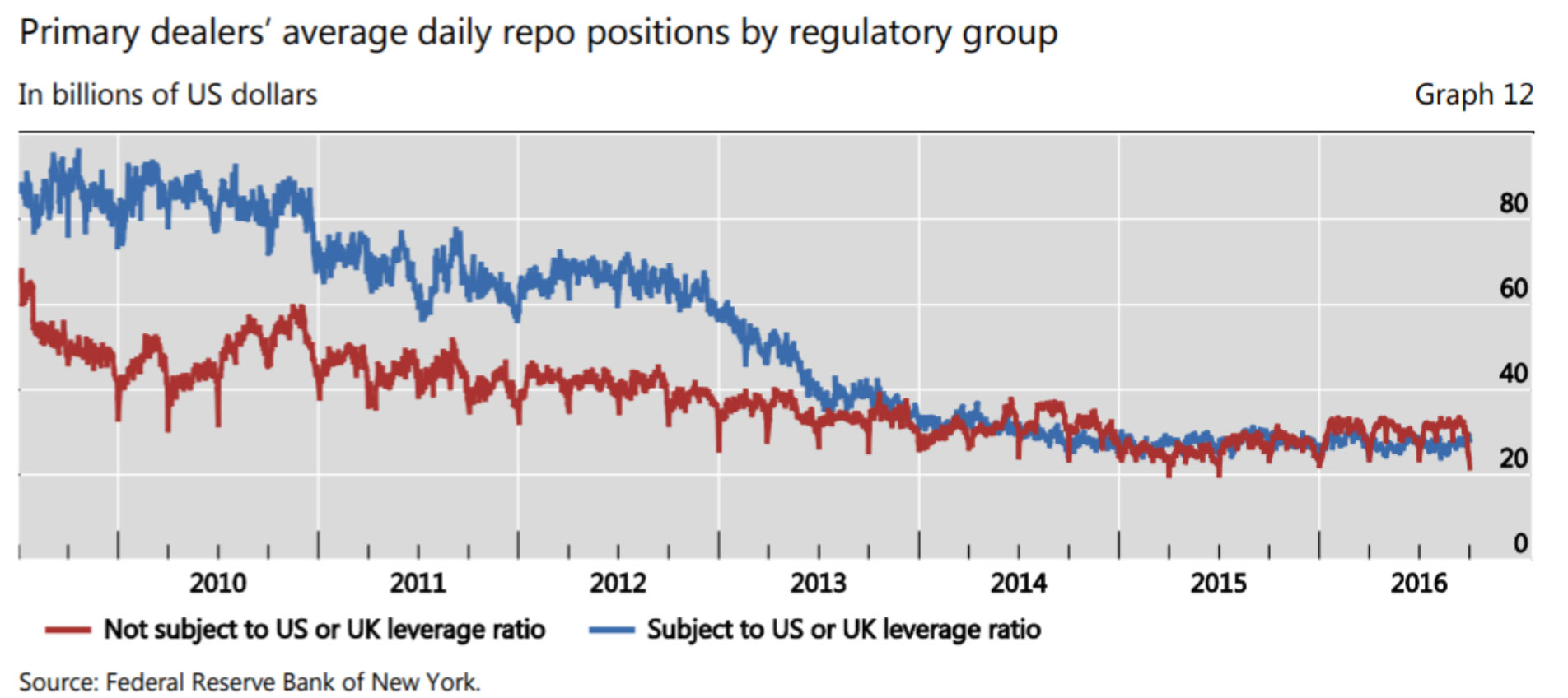

Figure 1

Under CRR II, the Leverage Ratio measure must now also be calculated and disclosed based on a daily average of exposures for securities financing transactions (SFTs), rather than the period-end measures. European regulators have lagged behind their US and UK peers in implementing daily averaging, which may go some way to explain why such an important change has largely gone unreported. The landmark 2017 report on repo market functioning by the Committee on the Global Financial System — J Cunliffe, “Repo market functioning”, CGFS Paper No. 59 — gave an illustration of the market impact of average versus spot reporting and disclosure requirements. The report includes charts, reproduced below, showing primary dealers’ average daily repo positions for firms subject to US and UK leverage ratio rules alongside firms not subject to US and UK leverage ratio rules.

Prior to 2012, both charts showed pronounced dips in trading volumes at times coinciding with quarter-end and year-ends. For firms subject to US and UK leverage ratio rules, these periodic dips begin to subside from 2013, which broadly aligns with the time when US banks started to report on a daily basis and began to manage under the Leverage Ratio regime. For firms not subject to US and UK leverage ratio rules, where calculation and disclosure of the Leverage Ratio was still based on spot period-end measures, the dips remained. What is more sobering about the chart is the downward trend of the use of repo, as measured through trading volumes. A Leverage Ratio regime based on averaging, rather than spot, resulted in a “new normal” for repo trading, the impacts of which still reverberate today.

With Leverage Ratio measures based on daily averaging of SFTs now live in Europe, the question then becomes what the new normal will look like for the Euro repo market, and for the European repo market more generally. While it is too early to tell, it raises several other questions about how firms should respond to these coming changes. At Eurex, we are working with our sell-side and buy-side client institutions to shape this new normal.

Cleared repo

While repo is reported on a gross basis under the Leverage Ratio, the netting of cash payables with cash receivables is permitted under the regulation, but subject to a range of stringent criteria. The criterion that payables and receivables must be with the same counterparty is quite challenging in the repo market because buy-side clients tend to be segmented into natural cash takers and natural cash providers.

Clearing houses are well positioned to solve this problem. By inserting the clearing house between the buy-side cash takers and cash providers, the repo dealer is well placed to apply balance sheet netting because the dealer is facing the clearing house on both the long and short positions. Eurex, in partnership with Clearstream, offers integrated trading, clearing and settlement for repo. This maximises balance sheet netting opportunities, opening the door to capital efficient trading strategies such as funding specials trading with Eurex GC Pooling. For further information, refer to our whitepaper, “Innovations with balance sheet netting solutions for repo trading,” available at www.eurex.com.

Leverage Ratio constraints can also be managed using Eurex’s ISA Direct clearing models, which provide the buy-side with direct access to cleared repo markets, facilitated by a dealer (clearing agent) which covers the default fund and default management obligations. Buy-side clients can maintain, or even enhance, their access to repo liquidity, while leaving the option for the clearing agent to act as the liquidity provider or step out of the trade flow to control their leverage exposure. In addition, the buy-side would, of course, also benefit from other typical benefits associated with CCPs (e.g. risk mitigation, operational efficiency and price transparency). There are immediate risk-weighted asset (RWA) benefits with this model, along with potential Leverage Ratio benefits from balance sheet netting for banks if the financing to the buy-side via ISA Direct is also funded via the clearing house. Further details are available in the whitepaper, “Capital efficiencies through direct access repo clearing models for the buy-side,” published on the Eurex website.

Perhaps it is not a coincidence that buy-side entities started to take central clearing of US treasury repos through the DTCC Fixed Income Clearing Corporation’s (FICC`s) sponsored programme more seriously when US banks were not only required to report, but to fulfil, minimum supplementary leverage ratio requirements on a daily basis from January 2018. Buy-side US repo central clearing volumes increased from US$20 billion in 2017 to more than US$400 billion at the end 2021, according to data from the US Federal Reserve. Eurex recently launched an extension of ISA Direct which is specifically targeted to those buy-side clients which would not otherwise qualify for clearing membership (e.g. hedge funds). Under the ISA Direct Indemnified model, buy-side clients can directly access cleared repo, with the assistance of a clearing agent that provides an indemnity to the clearing house.

In summary, the change in basis of calculation of the Leverage Ratio from spot measures to daily averaging for SFTs under CRR 2 will have an enduring impact on the Euro and European repo market if the experiences of the US and UK markets are any indication. On the one hand, the change may help stabilise the volatility in liquidity levels at period ends. On the other hand, market liquidity may trend to a new normal based on new average capital costs which may push overall trading costs higher. Eurex’s cleared repo market has a number of solutions to help firms optimise their trading and navigate the new normal.

Repurchase agreements (repo) are probably the product most unduly penalised by the Leverage Ratio regime, aside from perhaps prime residential mortgages. Some would argue that this is an unintended consequence of the application of accounting measures in the Leverage Ratio calculation which reports repos on a gross basis, while the collateral received is given no recognition. Others would argue that this is exactly what was intended, given the use of repo to create significant, even infinite, leverage in the financial system. Regardless of which side of the fence you are on, it is difficult to argue about the importance of the repo market and the critical role it plays in the smooth functioning of the global financial system.

End to window dressing

In June 2021, the second iteration of the Capital Requirements Regulation (CRR II) for the European Union went live. The revisions included a change which reflected a recommendation from the Basel Committee that the Leverage Ratio should be calculated using average measures, rather than spot measures, for those inputs that can exhibit volatility during reporting periods. This was a polite way of saying that the regulators needed to take steps to stop institutions from “window dressing”, a practice where firms adjust their trading activity in the lead up to key regulatory or external reporting dates to make their prudential and statutory performance measures look better than would be the case in the normal course of trading. While markets should be a simple function of supply and demand, these nuances around the regulation can have profound effects on market structure and dynamics. The European repo market dysfunction of year-end 2016 and the collateral scarcity effects during the fourth quarter of 2021 are just two of many examples of the complex interaction of regulation and the markets.

Figure 1

Under CRR II, the Leverage Ratio measure must now also be calculated and disclosed based on a daily average of exposures for securities financing transactions (SFTs), rather than the period-end measures. European regulators have lagged behind their US and UK peers in implementing daily averaging, which may go some way to explain why such an important change has largely gone unreported. The landmark 2017 report on repo market functioning by the Committee on the Global Financial System — J Cunliffe, “Repo market functioning”, CGFS Paper No. 59 — gave an illustration of the market impact of average versus spot reporting and disclosure requirements. The report includes charts, reproduced below, showing primary dealers’ average daily repo positions for firms subject to US and UK leverage ratio rules alongside firms not subject to US and UK leverage ratio rules.

Prior to 2012, both charts showed pronounced dips in trading volumes at times coinciding with quarter-end and year-ends. For firms subject to US and UK leverage ratio rules, these periodic dips begin to subside from 2013, which broadly aligns with the time when US banks started to report on a daily basis and began to manage under the Leverage Ratio regime. For firms not subject to US and UK leverage ratio rules, where calculation and disclosure of the Leverage Ratio was still based on spot period-end measures, the dips remained. What is more sobering about the chart is the downward trend of the use of repo, as measured through trading volumes. A Leverage Ratio regime based on averaging, rather than spot, resulted in a “new normal” for repo trading, the impacts of which still reverberate today.

With Leverage Ratio measures based on daily averaging of SFTs now live in Europe, the question then becomes what the new normal will look like for the Euro repo market, and for the European repo market more generally. While it is too early to tell, it raises several other questions about how firms should respond to these coming changes. At Eurex, we are working with our sell-side and buy-side client institutions to shape this new normal.

Cleared repo

While repo is reported on a gross basis under the Leverage Ratio, the netting of cash payables with cash receivables is permitted under the regulation, but subject to a range of stringent criteria. The criterion that payables and receivables must be with the same counterparty is quite challenging in the repo market because buy-side clients tend to be segmented into natural cash takers and natural cash providers.

Clearing houses are well positioned to solve this problem. By inserting the clearing house between the buy-side cash takers and cash providers, the repo dealer is well placed to apply balance sheet netting because the dealer is facing the clearing house on both the long and short positions. Eurex, in partnership with Clearstream, offers integrated trading, clearing and settlement for repo. This maximises balance sheet netting opportunities, opening the door to capital efficient trading strategies such as funding specials trading with Eurex GC Pooling. For further information, refer to our whitepaper, “Innovations with balance sheet netting solutions for repo trading,” available at www.eurex.com.

Leverage Ratio constraints can also be managed using Eurex’s ISA Direct clearing models, which provide the buy-side with direct access to cleared repo markets, facilitated by a dealer (clearing agent) which covers the default fund and default management obligations. Buy-side clients can maintain, or even enhance, their access to repo liquidity, while leaving the option for the clearing agent to act as the liquidity provider or step out of the trade flow to control their leverage exposure. In addition, the buy-side would, of course, also benefit from other typical benefits associated with CCPs (e.g. risk mitigation, operational efficiency and price transparency). There are immediate risk-weighted asset (RWA) benefits with this model, along with potential Leverage Ratio benefits from balance sheet netting for banks if the financing to the buy-side via ISA Direct is also funded via the clearing house. Further details are available in the whitepaper, “Capital efficiencies through direct access repo clearing models for the buy-side,” published on the Eurex website.

Perhaps it is not a coincidence that buy-side entities started to take central clearing of US treasury repos through the DTCC Fixed Income Clearing Corporation’s (FICC`s) sponsored programme more seriously when US banks were not only required to report, but to fulfil, minimum supplementary leverage ratio requirements on a daily basis from January 2018. Buy-side US repo central clearing volumes increased from US$20 billion in 2017 to more than US$400 billion at the end 2021, according to data from the US Federal Reserve. Eurex recently launched an extension of ISA Direct which is specifically targeted to those buy-side clients which would not otherwise qualify for clearing membership (e.g. hedge funds). Under the ISA Direct Indemnified model, buy-side clients can directly access cleared repo, with the assistance of a clearing agent that provides an indemnity to the clearing house.

In summary, the change in basis of calculation of the Leverage Ratio from spot measures to daily averaging for SFTs under CRR 2 will have an enduring impact on the Euro and European repo market if the experiences of the US and UK markets are any indication. On the one hand, the change may help stabilise the volatility in liquidity levels at period ends. On the other hand, market liquidity may trend to a new normal based on new average capital costs which may push overall trading costs higher. Eurex’s cleared repo market has a number of solutions to help firms optimise their trading and navigate the new normal.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times