Bridging the value chain

16 August 2022

Comyno’s Markus Büttner and Frank Becker discuss the advantages of a single hybrid platform that covers the full securities finance value chain and has an established track record in the execution of blockchain-based trades

Image: Shutterstock

Image: Shutterstock

The securities financing market is known to be undergoing structural change, with a wide range of optimisation needs. At the macro level these include ever increasing regulatory requirements, a lack of automation and process standardisation and, consequently, a big human error factor and high costs. But problems are also omnipresent at the micro-level in day-to-day business practices. These include operational inefficiencies due to multiple manual and error-prone work steps or processes resulting from siloed, fragmented legacy systems. The causal chain related to this dilemma is well known everywhere and can be found in figures, data, and facts — reflected in monetary terms or in increasing dissatisfaction from the people involved.

But how can this hassle be stopped? It is worth taking a closer look at Comyno.

Founded almost two decades ago, Comyno pivoted from a specialised consulting firm into a software development boutique for the securities finance industry. Its unique combination of strategy, business and IT expertise found its purpose in the creation of Comyno’s modular trading software, C-ONE.

Leading private and public financial institutions, asset managers, clearing houses and triparty agents trust Comyno’s services and products. Further development and expansion are managed by its founder Markus Büttner, Admir Spahic and Frank Becker.

A particular focus lies on trend identification and innovation, as well as value-added enhancements of its hybrid platform. The solution not only covers the entire value chain of current securities finance business processes, but already has a proven track record in the execution of blockchain-based trades.

Supporting the world´s first DvD transaction in real-time

Comyno supported two German banks to conduct a securities lending transaction without prior collateralisation. The trade was processed on a blockchain-based digital securities platform using Comyno’s securities finance software C-ONE.

The trading parties point out that the delivery-versus-delivery (DvD) transaction makes the established collateral requirements unnecessary. Transfers occur directly between custodian banks without moving securities between accounts at the CSD. This does not involve tokenisation and can eliminate the chains of custody that have traditionally supported securities lending activity. Trade and settlement can now take place almost simultaneously for such securities transactions. This reduces counterparty risk, as well as delivering a range of other resource-saving benefits.

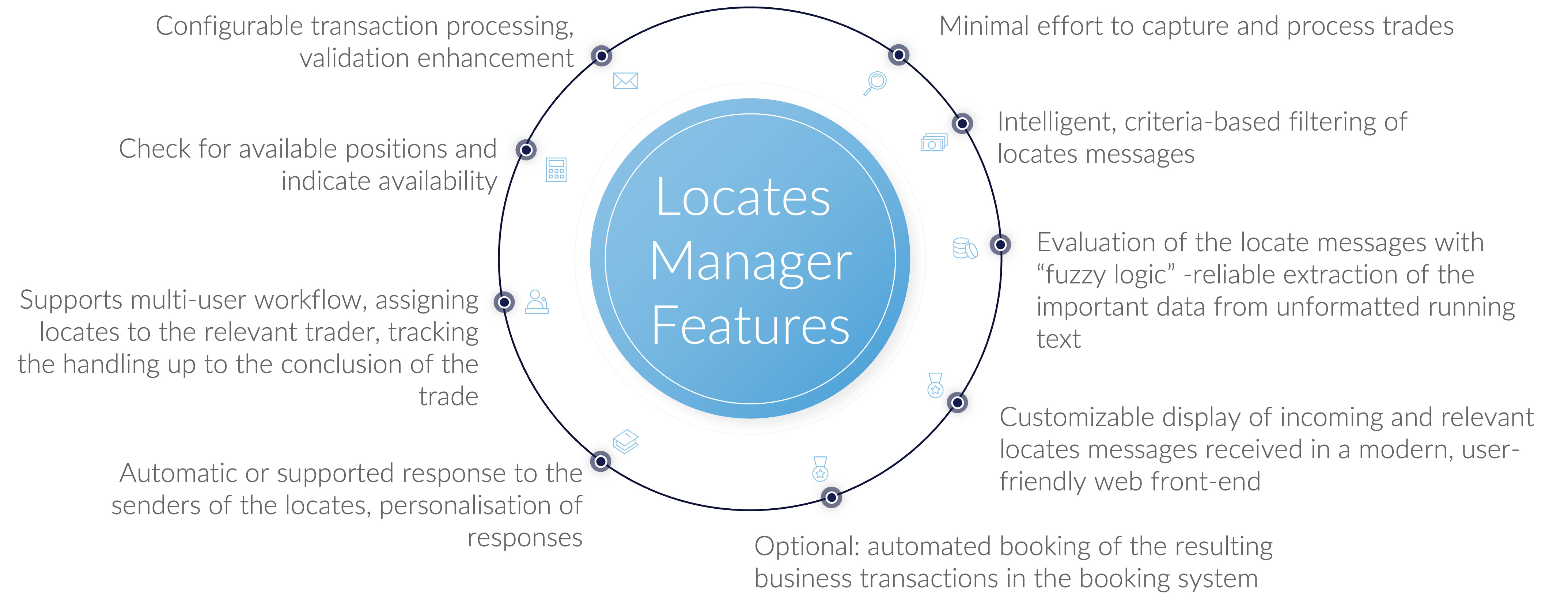

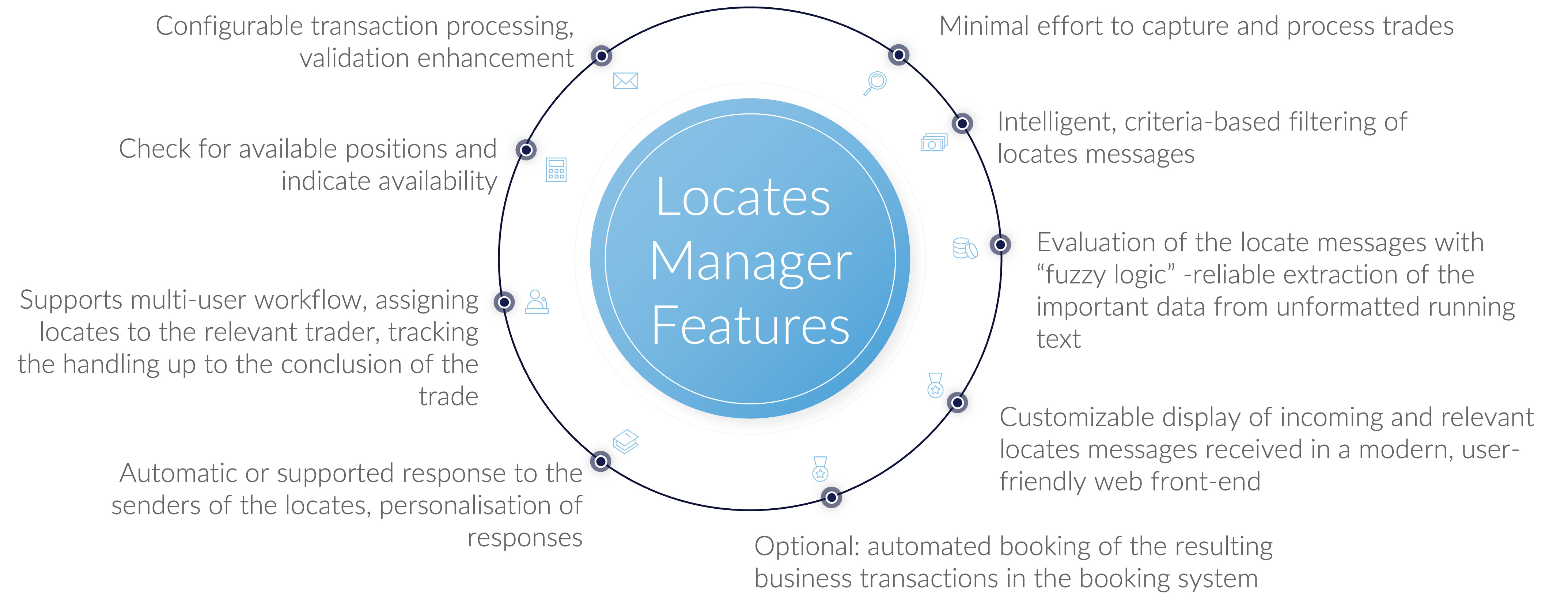

Figure 1

Comyno is proud to have played an active role in the achievement of this industry milestone and aims to maintain itself at the forefront of innovation. This includes ensuring the flexibility of the platform from a technology standpoint and continuously improving existing tools to optimise business processes.

One of these tools is the Locates Manager. This has been developed to provide trading desks with a sophisticated solution to manage the ever-growing number of locate messages which come in through various channels.

Comyno’s chief operating officer Frank Becker explains: “This is a problem for the trade desk today, as it will be tomorrow. The goal must be to process the trade initiation as quickly as possible, no matter what environment we are talking about — in the current legacy world or using any DLT-based solution in the future.”

Chief executive Markus Büttner adds: “Bringing structure and clarity to unstructured and diverse information is a challenge. There are countless locate messages with single or multiple security requests being sent every day. Each request contains more or less usable information, with the result that no trader can manage the process efficiently, hence facing the risk of errors.”

C-ONE Locates Manager

The software pre-processes locate requests originating from multiple sources and displays the messages in a standardised, easy-to-read format. The module significantly reduces the manual effort involved in responding to locate requests and, therefore, reducing response time to counterparties. Coupled with additional functionality such as automated replies and trade booking, efficient processing of incoming locate requests can be achieved with minimal manual effort.

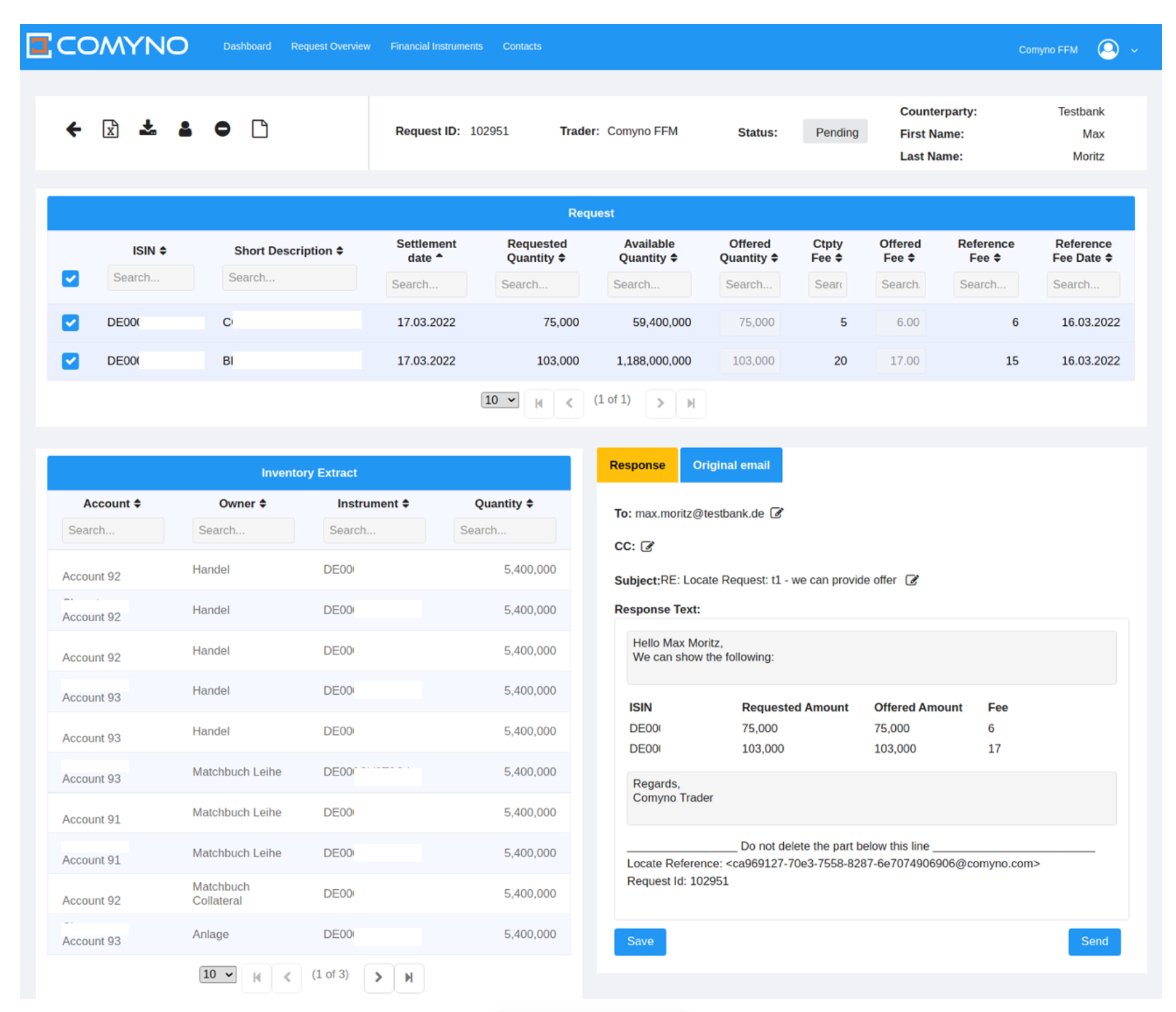

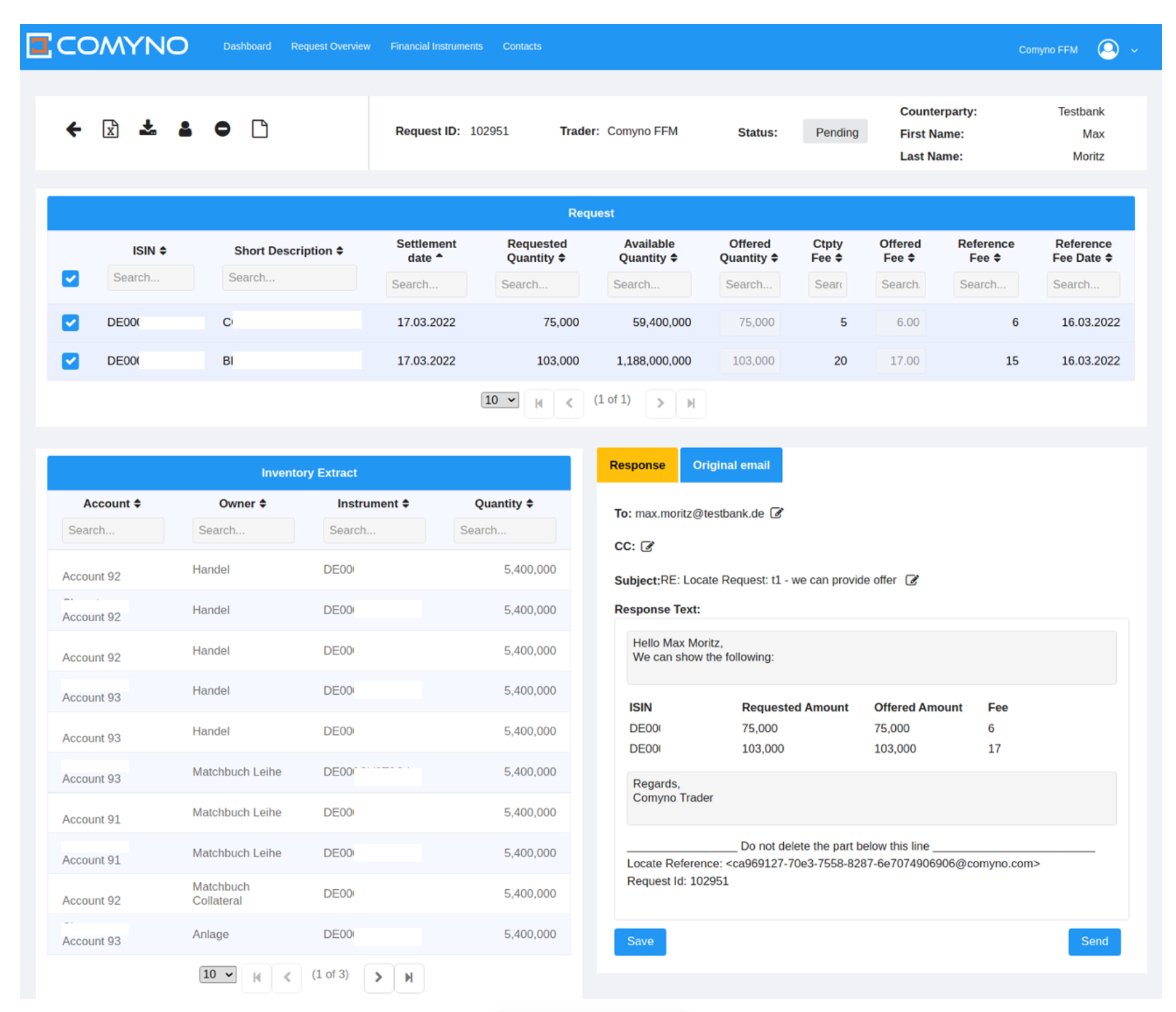

Figure 2

Comyno’s Locates Manager is a powerful tool. The potential lender is improving the utilisation of its inventory and increasing its revenues, while the requesting entity has an improved chance of finding securities in the depth of the pockets of its trading network. The traders can focus on concluding the trade itself, or on more complex activities, while the laborious, time-consuming tasks are covered by the Locates Manager.

The installation of the C-ONE Locates Manager does not even require implementation of a complex, much larger system environment. The dedicated module can be installed with limited interaction with the existing technology framework of the lending desk – just basic static data, the available inventory, and a connection to the email server to begin with.

This generates immediate benefit with limited effort and can be further integrated into the overall architecture if required.

The Locates Manager is part of a one-stop-shop approach offered by Comyno’s securities finance platform C-ONE in which the worlds of securities lending, repo and collateral management for ‘traditional’ and digital assets have merged.

Comyno’s hybrid platform

This hybrid platform supports securities lending and borrowing (SLB), collateral management, regulatory reporting and blockchain in one single source.

Depending on customer requirements C-ONE is available on-premises or as a software-as-a-service (SaaS) model. Its modular approach leads the securities finance business step by step into the future. A particular focus here is to expand the existing business while increasing profit simultaneously.

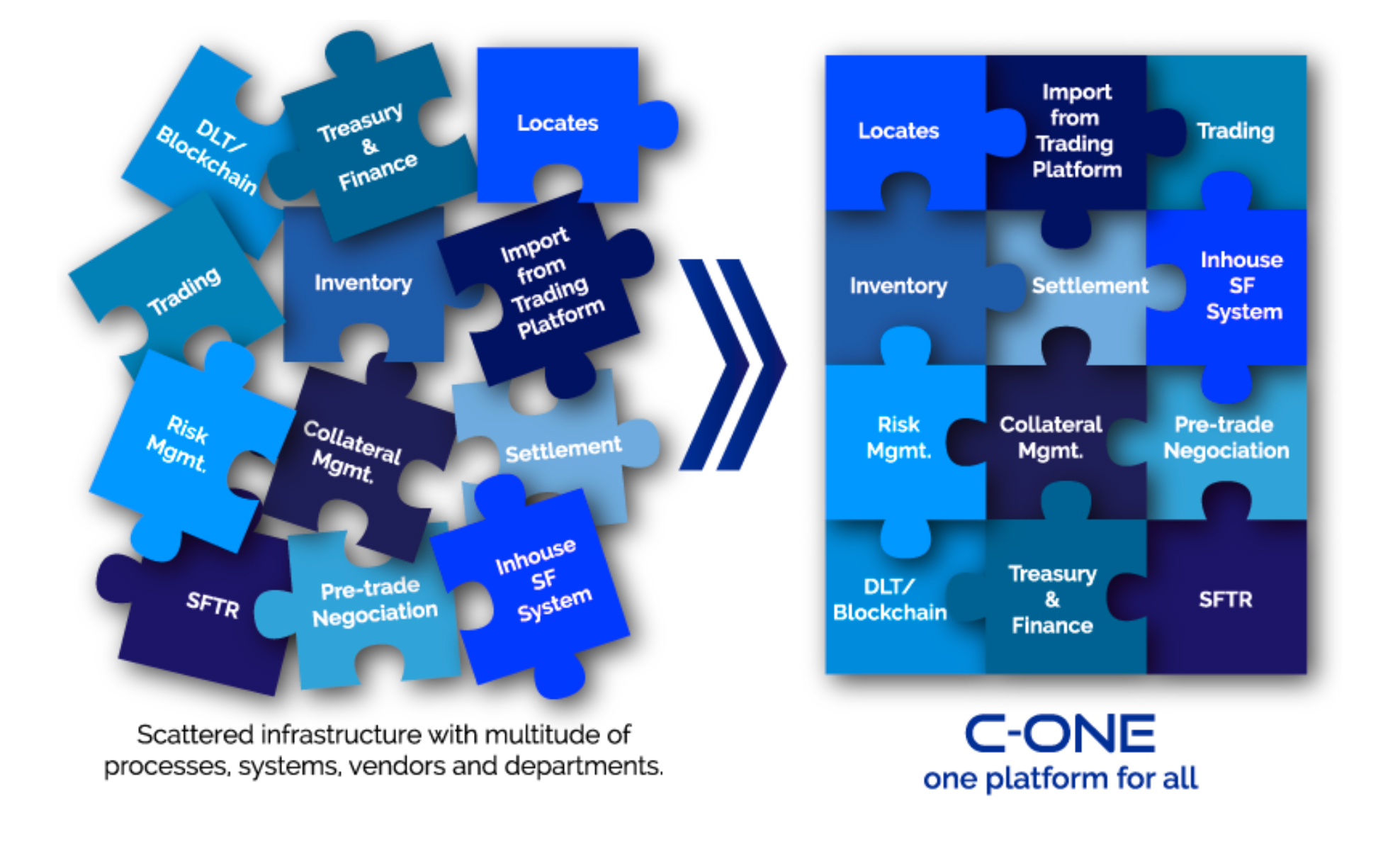

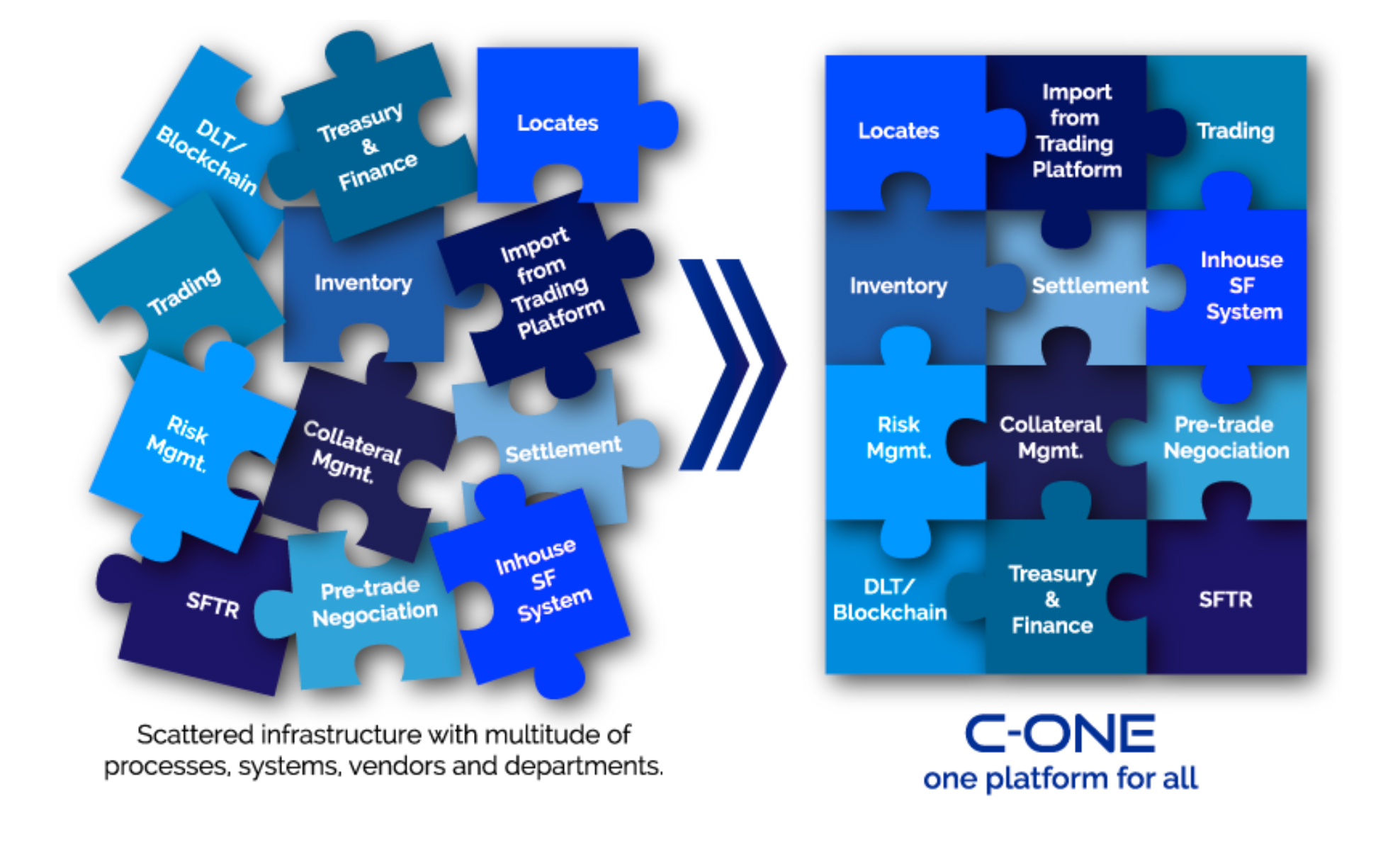

Figure 3

The innovative C-ONE suite offers a complete solution for securities finance trading and collateral management, covering the complete value chain of the corresponding transactions. It is built as a ‘hybrid platform’, incorporating features for an in-house trading and collateral management system, a multi-entity and multi-product platform across asset classes.

This enables clients not only to manage their whole securities finance business with C-ONE, but also grants online access to and for their clients and counterparts, including white-labelling potential simply via the web. C-ONE provides seamless possibilities for position sharing, locates management as well as affirmation processes. Furthermore, clients and counterparts can see ‘their side’ of the trading activity, as well as ‘their side’ of the collateral and exposure management. Even the profit and loss (PnL) features can be used by all entities with access to the platform.

One of the biggest cost drivers for the industry is the multitude of internal and external parties involved in securities finance transactions. The variety of software systems and IT components, as well as a big number of manual workarounds and interfaces which are necessary to fill gaps, lead to high inefficiencies. Comyno has tackled this industry challenge for the benefit of our market with its C-ONE solution: with an extensive modular approach that covers the whole value chain, both from a business and technical perspective.

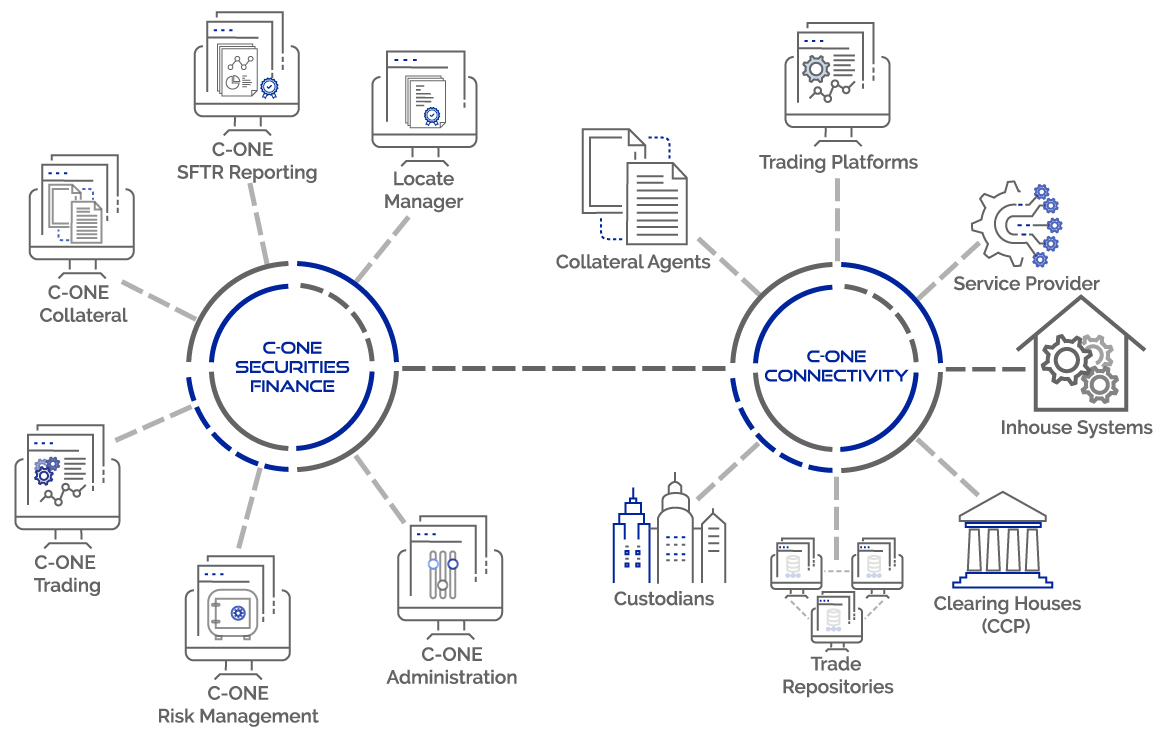

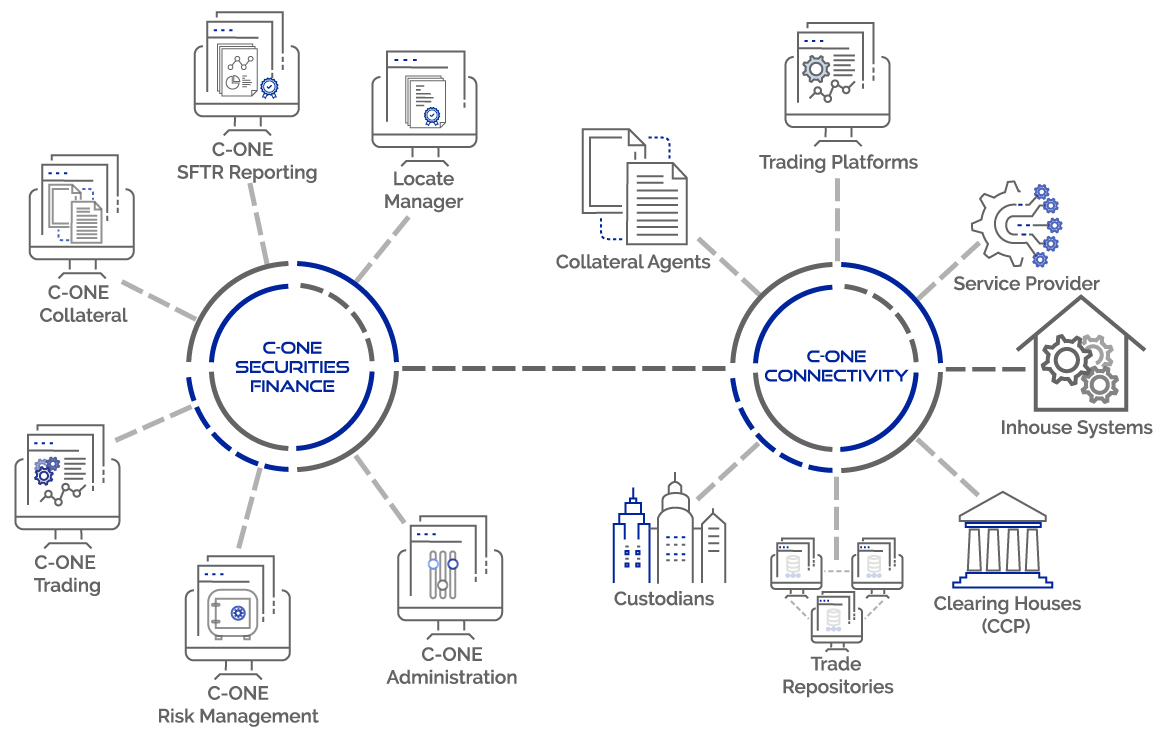

Figure 4

“Launching Comyno´s hybrid platform C-ONE at your company means moving your securities finance business onto an efficient, modern, and state of the art system. Low entry costs and customised solutions through its modular and extensible approach boost profits right from the start. The emerging area of digital assets paves the way for Comyno to add more modules to cover the entire ‘digitised’ lifecycle,” explains Markus Büttner

But how can this hassle be stopped? It is worth taking a closer look at Comyno.

Founded almost two decades ago, Comyno pivoted from a specialised consulting firm into a software development boutique for the securities finance industry. Its unique combination of strategy, business and IT expertise found its purpose in the creation of Comyno’s modular trading software, C-ONE.

Leading private and public financial institutions, asset managers, clearing houses and triparty agents trust Comyno’s services and products. Further development and expansion are managed by its founder Markus Büttner, Admir Spahic and Frank Becker.

A particular focus lies on trend identification and innovation, as well as value-added enhancements of its hybrid platform. The solution not only covers the entire value chain of current securities finance business processes, but already has a proven track record in the execution of blockchain-based trades.

Supporting the world´s first DvD transaction in real-time

Comyno supported two German banks to conduct a securities lending transaction without prior collateralisation. The trade was processed on a blockchain-based digital securities platform using Comyno’s securities finance software C-ONE.

The trading parties point out that the delivery-versus-delivery (DvD) transaction makes the established collateral requirements unnecessary. Transfers occur directly between custodian banks without moving securities between accounts at the CSD. This does not involve tokenisation and can eliminate the chains of custody that have traditionally supported securities lending activity. Trade and settlement can now take place almost simultaneously for such securities transactions. This reduces counterparty risk, as well as delivering a range of other resource-saving benefits.

Figure 1

Comyno is proud to have played an active role in the achievement of this industry milestone and aims to maintain itself at the forefront of innovation. This includes ensuring the flexibility of the platform from a technology standpoint and continuously improving existing tools to optimise business processes.

One of these tools is the Locates Manager. This has been developed to provide trading desks with a sophisticated solution to manage the ever-growing number of locate messages which come in through various channels.

Comyno’s chief operating officer Frank Becker explains: “This is a problem for the trade desk today, as it will be tomorrow. The goal must be to process the trade initiation as quickly as possible, no matter what environment we are talking about — in the current legacy world or using any DLT-based solution in the future.”

Chief executive Markus Büttner adds: “Bringing structure and clarity to unstructured and diverse information is a challenge. There are countless locate messages with single or multiple security requests being sent every day. Each request contains more or less usable information, with the result that no trader can manage the process efficiently, hence facing the risk of errors.”

C-ONE Locates Manager

The software pre-processes locate requests originating from multiple sources and displays the messages in a standardised, easy-to-read format. The module significantly reduces the manual effort involved in responding to locate requests and, therefore, reducing response time to counterparties. Coupled with additional functionality such as automated replies and trade booking, efficient processing of incoming locate requests can be achieved with minimal manual effort.

Figure 2

Comyno’s Locates Manager is a powerful tool. The potential lender is improving the utilisation of its inventory and increasing its revenues, while the requesting entity has an improved chance of finding securities in the depth of the pockets of its trading network. The traders can focus on concluding the trade itself, or on more complex activities, while the laborious, time-consuming tasks are covered by the Locates Manager.

The installation of the C-ONE Locates Manager does not even require implementation of a complex, much larger system environment. The dedicated module can be installed with limited interaction with the existing technology framework of the lending desk – just basic static data, the available inventory, and a connection to the email server to begin with.

This generates immediate benefit with limited effort and can be further integrated into the overall architecture if required.

The Locates Manager is part of a one-stop-shop approach offered by Comyno’s securities finance platform C-ONE in which the worlds of securities lending, repo and collateral management for ‘traditional’ and digital assets have merged.

Comyno’s hybrid platform

This hybrid platform supports securities lending and borrowing (SLB), collateral management, regulatory reporting and blockchain in one single source.

Depending on customer requirements C-ONE is available on-premises or as a software-as-a-service (SaaS) model. Its modular approach leads the securities finance business step by step into the future. A particular focus here is to expand the existing business while increasing profit simultaneously.

Figure 3

The innovative C-ONE suite offers a complete solution for securities finance trading and collateral management, covering the complete value chain of the corresponding transactions. It is built as a ‘hybrid platform’, incorporating features for an in-house trading and collateral management system, a multi-entity and multi-product platform across asset classes.

This enables clients not only to manage their whole securities finance business with C-ONE, but also grants online access to and for their clients and counterparts, including white-labelling potential simply via the web. C-ONE provides seamless possibilities for position sharing, locates management as well as affirmation processes. Furthermore, clients and counterparts can see ‘their side’ of the trading activity, as well as ‘their side’ of the collateral and exposure management. Even the profit and loss (PnL) features can be used by all entities with access to the platform.

One of the biggest cost drivers for the industry is the multitude of internal and external parties involved in securities finance transactions. The variety of software systems and IT components, as well as a big number of manual workarounds and interfaces which are necessary to fill gaps, lead to high inefficiencies. Comyno has tackled this industry challenge for the benefit of our market with its C-ONE solution: with an extensive modular approach that covers the whole value chain, both from a business and technical perspective.

Figure 4

“Launching Comyno´s hybrid platform C-ONE at your company means moving your securities finance business onto an efficient, modern, and state of the art system. Low entry costs and customised solutions through its modular and extensible approach boost profits right from the start. The emerging area of digital assets paves the way for Comyno to add more modules to cover the entire ‘digitised’ lifecycle,” explains Markus Büttner

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times