ESG’s impact on global equity lending market dynamics

30 August 2022

Firms that perform poorly on material ESG characteristics have lower levels of institutional ownership, increased levels of shorting, and higher levels of institutional investor engagement, according to research by State Street Associates. Travis Whitmore, head of securities finance research, and Christian Nadeau, quantitative researcher at State Street Associates, discuss the findings

Image: stock.adobe.com/Murrstock

Image: stock.adobe.com/Murrstock

It is well known that ESG has become an important factor in investment decision-making, but to what degree has it directly influenced the holdings of institutional investors and their engagement over proxy votes? What about the borrowing demand of short sellers? The paper referenced in this article looks to answer these questions with a unique empirical study of ESG’s effect on the global equities lending market. By combining equities lending, ESG, and proxy vote data, we quantify the impact ESG has had on lending supply, short-selling demand, and institutional investor engagement. Our findings suggest that ESG considerations are deeply embedded in the securities lending market and are growing in importance. Importantly, the analysis identifies ways in which institutional investors can balance the revenue earned through securities lending with the pursuit of their ESG objectives. This article is a short excerpt of our full paper.

Sourcing ESG, securities lending and institutional ownership data

The underlying data used in our study is sourced from several data sets. Firm-level ESG scores are produced by MSCI and measure a company’s resilience to long-term industry material ESG risks. Higher scores indicate better performance in mitigating ESG risks material to that industry. We use S&P Global Market Intelligence, formerly IHS Markit, to source daily global equities lending data, including fees, supply, demand, and utilisation. Institutional ownership is measured via the Thomson-Reuters Institutional Holdings (13F) database. The combined study covers roughly 3500 global equities from 2015 to 2021, including more than 33,000 proxy record dates.

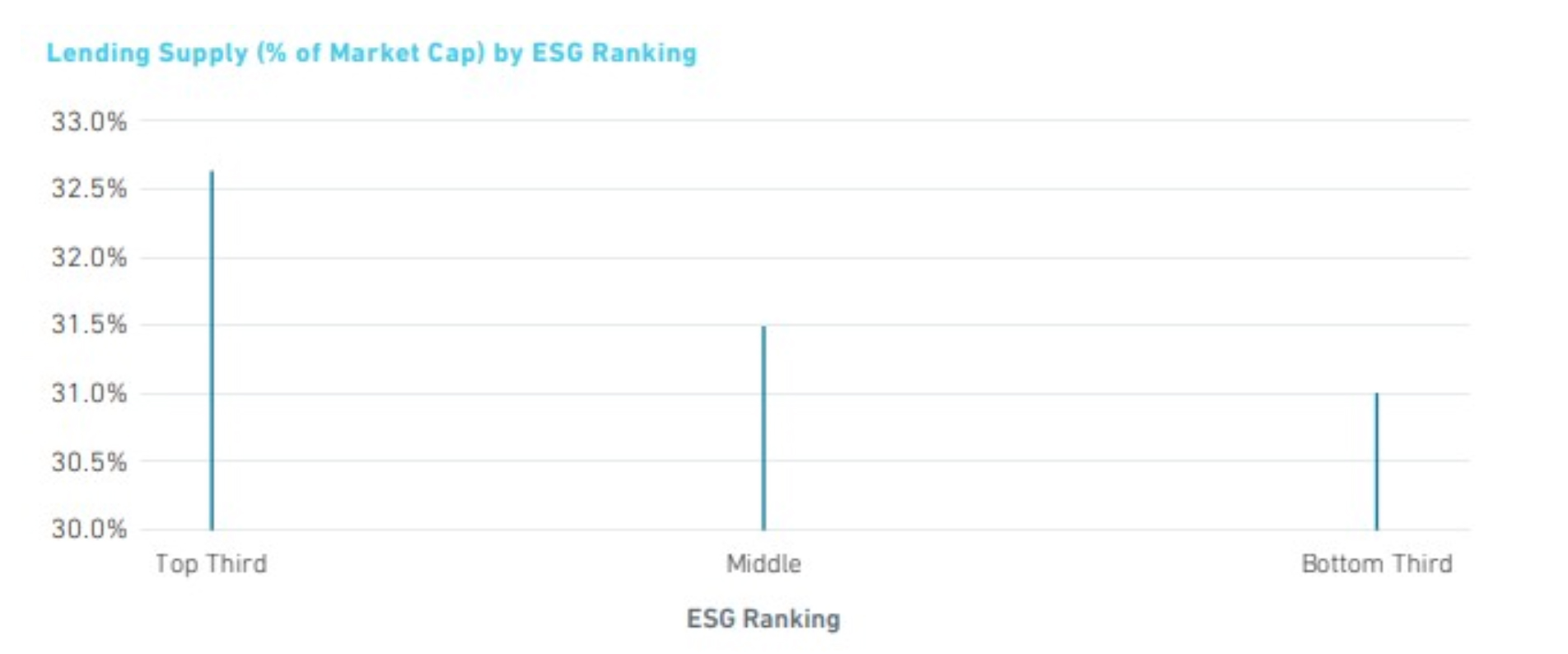

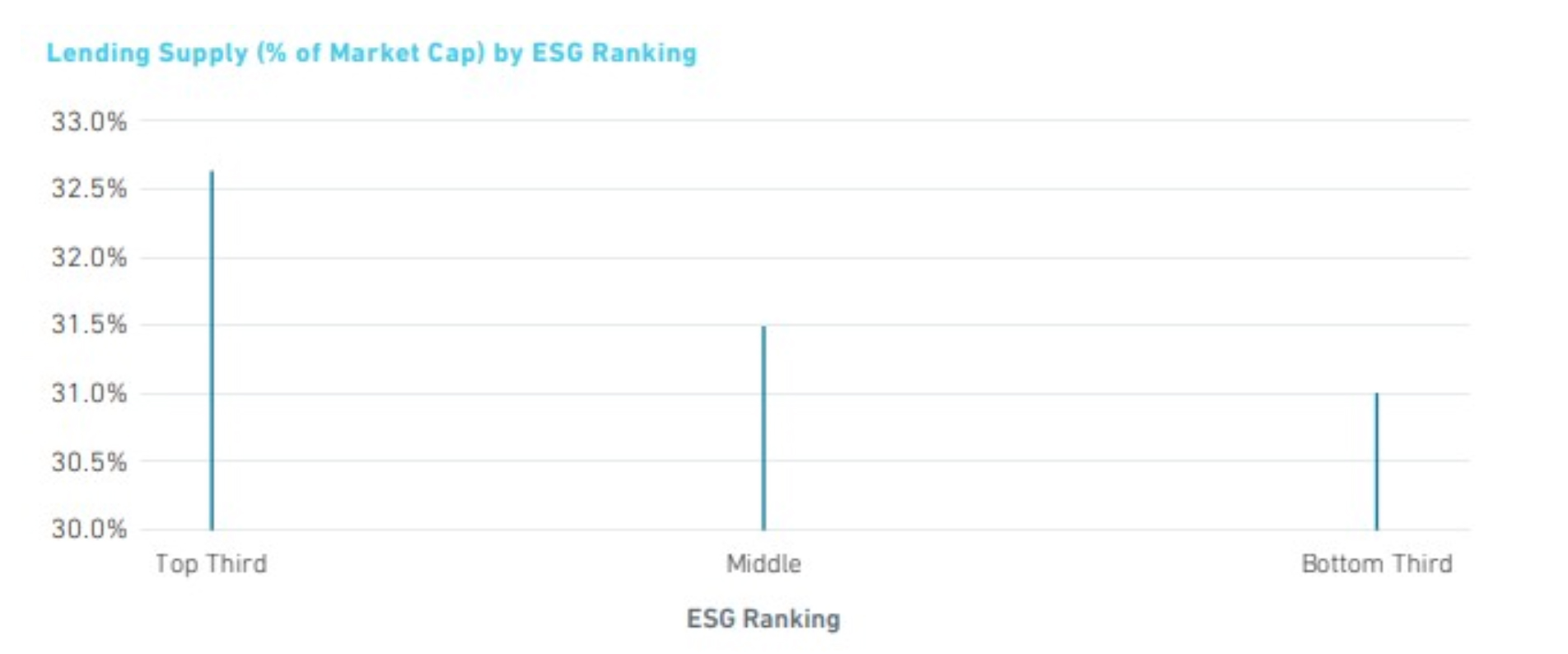

Figure 1

ESG and securities lending supply

The first question we look to answer is, how does the ESG performance of a firm correlate with its level of securities lending supply? Taking a high-level approach, we rank the yearly average ESG scores of each company and group them into terciles — the bottom tercile being the poorest performing. It is clear in Figure 1 that companies performing poorly on material ESG attributes have fewer shares available for lending relative to their market cap – close to 1.5 per cent on average.

In our full paper, we test the statistical significance of this relationship against other market factors that influence securities lending supply.

What explains this relationship? Digging deeper, we find two contributing factors. The biggest contributor, not surprisingly, is the level of institutional ownership. As ESG has become an important factor in the investment decision making process, institutions have increasingly shifted ownership away from stocks that perform poorly on ESG characteristics to stocks considered more sustainable. This trend has increased sixteen-fold since 2015, indicating that ESG is rapidly growing in importance in explaining institutional holdings.

Institutions also seem to restrict the lending of shares of poorly performing ESG companies, which may be the result of prioritised engagement and long-term stewardship (turnaround) efforts among ‘unsustainable’ firms. This is apparent when we observe the level of securities lending supply relative to institutional ownership, resulting in a difference of approximately 1.7 per cent of market cap.

ESG effects on short-selling demand

Given lower supply levels for poorly ranked ESG stocks, are these stocks more expensive to short? What about short sellers, do they demand more of these stocks? Does this mean lenders can earn more on them? Let’s start with what we expect to find.

With lower levels of aggregate supply and demand being equal, we expect poorly ranked ESG stocks to be more expensive to short, thus providing an opportunity for lenders to earn higher revenue. Indeed, this is what we observe. Levels of utilisation for poorly performing ESG firms are significantly greater than strong performers. This, in turn, impacts borrowing fees, which are on average almost twice as high for the bottom third of poorly ranked ESG firms. As with supply, the difference in demand between positively and negatively ranked ESG firms increased substantially over the years since 2015.

This trend holds intra-industry as well. For example, in Figure 2, we isolate demand as a proportion of market cap within the energy industry. We find that companies in the bottom third of ESG scores are nearly twice as expensive, and have double the level of shorting demand, compared to their peers. This suggests that green shorting is an active endeavour rather than blanket selling of ESG-risky industries.

Supply and demand dynamics over proxy record dates

Proxy events serve as an important channel for institutions to exert their influence and long-term company vision, a process often required by law and scrutinised by third parties. To participate in a proxy vote, firms must hold the shares of a company on the proxy record date. To accomplish this, institutional investors wanting to engage in a proxy vote must recall or restrict their supply of shares before this date.

As we expected, we observe a significant decrease in available lending supply in the 30 days leading up to the record date. Immediately after the record date, supply snaps back, accounting for a 1 per cent increase in securities lending supply relative to a firm’s market cap, on average.

Figure 2

When we examine this through the lens of ESG, there are some interesting observations. At the sector level (GICS level 1), we expect to observe increased engagement (proxied by changes in supply leading up to proxy record date) in sectors that are “at risk” of negative ESG-shocks. Indeed, we find that sectors such as energy, utilities, and materials have twice the level of engagement than those less at risk, depicted in Figure 3.

We also expect the average level of institutional engagement to be higher for firms performing poorly on their ESG attributes, as we expect investors to push for more positive ESG outcomes through their voting power. Our evidence contradicts this, as it does not show a significant difference in engagement at the stock level (i.e. engagement is similar across the bottom third and top third of ESG ranked stocks).

However, when we consider the opportunity cost of restricting and recalling the bottom ranked ESG securities, an intriguing story emerges. Poorly ranked ESG firms earn twice the level of revenue over proxy record dates, which suggests institutional investors are willing to forgo twice the amount of revenue in order to engage with those firms.

Figure 3

Conclusion

We find evidence that ESG considerations play an important role in institutional investment decisions, which in turn has significant implications on the securities lending market. There are lower levels of institutional ownership, increased levels of shorting, and more engagement for firms that perform poorly on material ESG characteristics. We observe these trends strengthening through time as ESG characteristics appear to become more ingrained in the decision making of institutional investors. We hope that this helps market participants think through their securities lending programmes and understand how ESG is impacting the market as a whole.

Our full paper can be found on the State Street website.

Or read the full paper here.

Sourcing ESG, securities lending and institutional ownership data

The underlying data used in our study is sourced from several data sets. Firm-level ESG scores are produced by MSCI and measure a company’s resilience to long-term industry material ESG risks. Higher scores indicate better performance in mitigating ESG risks material to that industry. We use S&P Global Market Intelligence, formerly IHS Markit, to source daily global equities lending data, including fees, supply, demand, and utilisation. Institutional ownership is measured via the Thomson-Reuters Institutional Holdings (13F) database. The combined study covers roughly 3500 global equities from 2015 to 2021, including more than 33,000 proxy record dates.

Figure 1

ESG and securities lending supply

The first question we look to answer is, how does the ESG performance of a firm correlate with its level of securities lending supply? Taking a high-level approach, we rank the yearly average ESG scores of each company and group them into terciles — the bottom tercile being the poorest performing. It is clear in Figure 1 that companies performing poorly on material ESG attributes have fewer shares available for lending relative to their market cap – close to 1.5 per cent on average.

In our full paper, we test the statistical significance of this relationship against other market factors that influence securities lending supply.

What explains this relationship? Digging deeper, we find two contributing factors. The biggest contributor, not surprisingly, is the level of institutional ownership. As ESG has become an important factor in the investment decision making process, institutions have increasingly shifted ownership away from stocks that perform poorly on ESG characteristics to stocks considered more sustainable. This trend has increased sixteen-fold since 2015, indicating that ESG is rapidly growing in importance in explaining institutional holdings.

Institutions also seem to restrict the lending of shares of poorly performing ESG companies, which may be the result of prioritised engagement and long-term stewardship (turnaround) efforts among ‘unsustainable’ firms. This is apparent when we observe the level of securities lending supply relative to institutional ownership, resulting in a difference of approximately 1.7 per cent of market cap.

ESG effects on short-selling demand

Given lower supply levels for poorly ranked ESG stocks, are these stocks more expensive to short? What about short sellers, do they demand more of these stocks? Does this mean lenders can earn more on them? Let’s start with what we expect to find.

With lower levels of aggregate supply and demand being equal, we expect poorly ranked ESG stocks to be more expensive to short, thus providing an opportunity for lenders to earn higher revenue. Indeed, this is what we observe. Levels of utilisation for poorly performing ESG firms are significantly greater than strong performers. This, in turn, impacts borrowing fees, which are on average almost twice as high for the bottom third of poorly ranked ESG firms. As with supply, the difference in demand between positively and negatively ranked ESG firms increased substantially over the years since 2015.

This trend holds intra-industry as well. For example, in Figure 2, we isolate demand as a proportion of market cap within the energy industry. We find that companies in the bottom third of ESG scores are nearly twice as expensive, and have double the level of shorting demand, compared to their peers. This suggests that green shorting is an active endeavour rather than blanket selling of ESG-risky industries.

Supply and demand dynamics over proxy record dates

Proxy events serve as an important channel for institutions to exert their influence and long-term company vision, a process often required by law and scrutinised by third parties. To participate in a proxy vote, firms must hold the shares of a company on the proxy record date. To accomplish this, institutional investors wanting to engage in a proxy vote must recall or restrict their supply of shares before this date.

As we expected, we observe a significant decrease in available lending supply in the 30 days leading up to the record date. Immediately after the record date, supply snaps back, accounting for a 1 per cent increase in securities lending supply relative to a firm’s market cap, on average.

Figure 2

When we examine this through the lens of ESG, there are some interesting observations. At the sector level (GICS level 1), we expect to observe increased engagement (proxied by changes in supply leading up to proxy record date) in sectors that are “at risk” of negative ESG-shocks. Indeed, we find that sectors such as energy, utilities, and materials have twice the level of engagement than those less at risk, depicted in Figure 3.

We also expect the average level of institutional engagement to be higher for firms performing poorly on their ESG attributes, as we expect investors to push for more positive ESG outcomes through their voting power. Our evidence contradicts this, as it does not show a significant difference in engagement at the stock level (i.e. engagement is similar across the bottom third and top third of ESG ranked stocks).

However, when we consider the opportunity cost of restricting and recalling the bottom ranked ESG securities, an intriguing story emerges. Poorly ranked ESG firms earn twice the level of revenue over proxy record dates, which suggests institutional investors are willing to forgo twice the amount of revenue in order to engage with those firms.

Figure 3

Conclusion

We find evidence that ESG considerations play an important role in institutional investment decisions, which in turn has significant implications on the securities lending market. There are lower levels of institutional ownership, increased levels of shorting, and more engagement for firms that perform poorly on material ESG characteristics. We observe these trends strengthening through time as ESG characteristics appear to become more ingrained in the decision making of institutional investors. We hope that this helps market participants think through their securities lending programmes and understand how ESG is impacting the market as a whole.

Our full paper can be found on the State Street website.

Or read the full paper here.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times