What 12 months of market volatility means for securities finance

11 October 2022

It has been another unprecedented year, and markets are still adjusting to what the current macroeconomic climate means for trading and investment. There has been increased market volatility as a result, but this can also create opportunity, according to Curtis Dutton, global head of trading for securities lending at HSBC

Image: stock.adobe.com/freshidea

Image: stock.adobe.com/freshidea

For some time, market participants have talked about what a new normal might look like post-pandemic, but few expected the ‘norms’ we encounter today. Economic recovery from the effects of COVID-19 has been mixed, in the midst of rising inflation, slow growth, the Russia-Ukraine war, and the resulting global energy price and supply chain issues.

All of this has come after the global financial crisis of 2007 and 2008, when markets experienced very low interest rates, quantitative easing (QE) and loose liquidity. For some portfolio managers and many newcomers to the securities finance industry, the landscape has now shifted significantly from what had been familiar. Interest rates are rising, and more quantitative tapering (QT) is on the horizon — at least for the time being. What does this mean for financing and collateral markets?

A new era of volatility

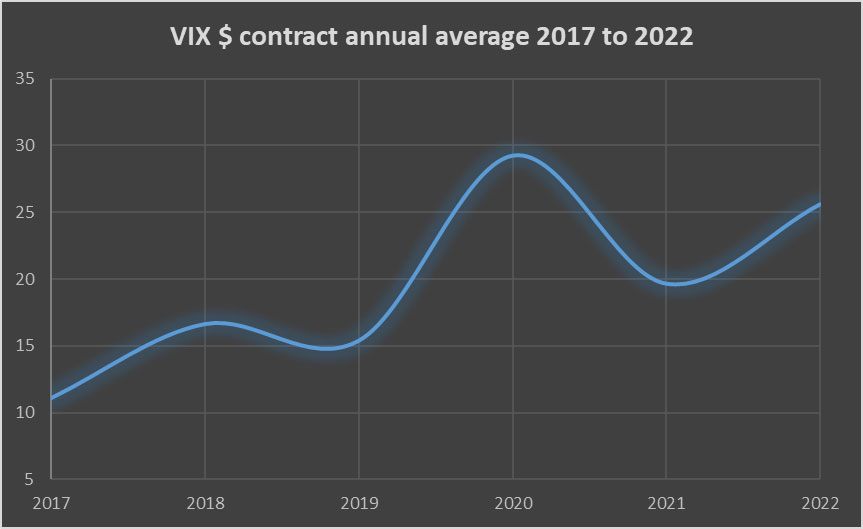

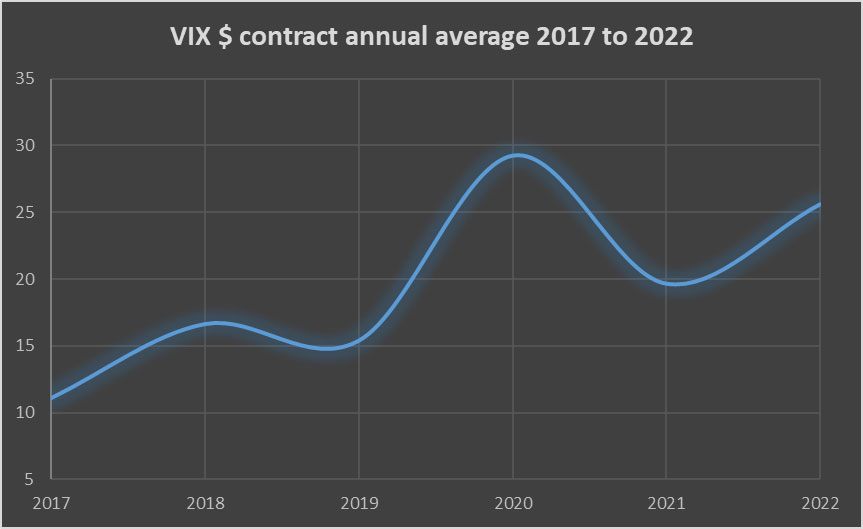

The economic effects of COVID-19 were, to some extent, cushioned due to the quick actions from central banks and governments to support the markets. However, 2022 has been the year for resurgence in deep volatility and market uncertainty, as evidenced in the swinging highs and lows of the VIX — the Chicago Board Options Exchange’s CBOE Volatility Index, a benchmark measure of the stock market’s expectation of volatility based on S&P 500 index options.

This market volatility has its roots in the pandemic, but has been accentuated by the knock-on effect of the Ukraine-Russia war. With rising inflation, monetary tightening, supply chain issues, energy concerns, and a period of ‘re-globalisation’, the long-term macro and microeconomic picture is uncertain, but one thing is clear: volatility in the short-term is here to stay.

Comparing the three years before 2020 to the three years post-pandemic, the VIX index is now 72 per cent higher on a consistent basis than it was pre-pandemic, based on Bloomberg market pricing data sets (VIX) between January 2017 and September 2022. As is typical for the industry as a whole, securities financing markets should be quick and dynamic to adapt.

A 12-month lookback on securities financing

In equity financing markets, funding markets and repo, it has been an unprecedented year. A direct impact of the war between Russia and Ukraine was the suspension of Russian domestic securities settlement, as well as Russian GDR names under the sanctions regime, for international investors. This was compounded by Russian federal law, prohibiting Russian issuers from having their shares traded via ADRs and GDRs. Securities financing markets, for the most part, have stayed robust. However, the knock-on effect has been a cautious approach from market participants to using GDRs, in general, as an asset class for financing and collateral purposes.

Emerging market credit markets have also been affected. In the early part of 2022, yields for emerging market debt significantly rose as liquidity declined. More generally, reduced liquidity in emerging market sovereign debt, a steep short-term interest rate curve, the wind-down of the Corporate Sector Purchase Program (CSPP) in Europe, and the fragility of property company liabilities in Asia-Pacific, has resulted in a demand-supply dynamic that has seen spreads widen. This dynamic has almost doubled securities lending revenue for lenders of credit year-to-date, according to S&P Market Intelligence data. This comes after half a decade of consistent tightening spreads in the asset class.

Figure 1

Whereas liquidity in specific credit sectors, such as Eastern Europe, has fallen, this is causing some financing participants to look more closely at new pockets of liquidity and opportunity. Mobilising both dim sum and local currency debt, particularly in APAC, has been a focus area for HSBC’s securities lending business and this is likely to remain the case in 2023. Indeed, as market participants adjust and familiarise to this new period of volatility, so too international investors have wanted access to new emerging markets through equity financing. Saudi Arabia, Kuwait, Qatar, Dubai, Abu Dhabi, Korea and China’s Stock Connect are all markets where HSBC has been focusing on growing its securities financing product.

Indeed, emerging markets are being viewed increasingly favourably within the collateral suite, as collateral providers are looking to diversify their supply, given the fall in developed equity indices globally. This need to diversify collateral has increased, due in part to government bond inventories being encumbered by market participants for other purposes such as meeting obligations under Uncleared Margin Rules, as well as borrow demand for shorting through repo markets. Providers of collateral are needing to become increasingly intelligent about its use and how to extend their footprint: emerging markets, ETFs, convertible bonds and cash collateral have all been attracting increased attention — not only as funding opportunities, but also for the very purpose of diversification.

This focus on collateral has given fresh momentum to the integration of front and back office departments of asset managers, which has been a steady trend over the past decade. Increasingly, collateral application is now being considered as part of the portfolio management exercise, with many portfolios now being used purposefully and directly for collateral inventory by beneficial owners. This is clearly having additional impact on the natural supply of HQLA from financing agents.

Additionally, the prominence of quant and momentum strategies at hedge funds creates a high daily volume of demand for equities and bonds in a volatile environment, necessitating that agent lenders familiarise and work with beneficial owners in a way that ensures supply of securities is adding value. In part, this requires enhanced relationships and an aligned approach, and it also requires enhanced automation and technology in the securities financing product.

The rise in ETF revenues in securities financing year-to-date is a clear example of a momentum-driven “beta-strategy”. This trend makes it important to offer a fully STP and automated financing solution to provide the speed and efficiency needed to draw out price opportunities for end users. This has been a continued focus for HSBC, as well as integration across the securities financing supply chain (comprising funding, repo, collateral solutions, along with securities lending and borrowing), with the intention of making the process smoother when matching beneficial owners with end users to capture dynamic opportunities during a time of market volatility.

Reflecting on the latest regulatory developments, the securities financing market is subject to the Securities Financing Transactions Regulation (SFTR) and, now, the new introduction of the Central Securities Depositories Regulation’s (CSDR’s) Settlement Discipline Regime across the EU. The need to sharpen operational procedures has therefore become increasingly important, with market participants becoming more discerning about settlement efficiency in Europe.

What lies ahead

For collateral agents and securities lenders, the new challenge will be how they differentiate themselves. As difficulty in corporate supply chains and energy prices translates into earnings and into central bank policies, market volatility is likely to continue in the the short-to-medium term.

A key lesson from 2022, which is likely to be just as applicable for 2023, is that while volatility can be a headwind, it can also open up new avenues and opportunities for intelligent securities lenders. Dynamic trading strategies, for example, may involve fluctuating or structured demand for collateral and directional interests. Asia and the Middle East also offer potential for securities lenders to generate new revenue streams.

With enhanced volatility, and the need for more sophisticated investment management decisions, partnerships and integration will create an environment for securities financing to evolve further.

ESG investing will continue to be a focus for institutional investors, and, therefore, fund managers will seek out ESG assets, even in conditions of market volatility. There is no standardised framework, as yet, for ESG securities lending, but the introduction of the EU’s Sustainable Finance Disclosure Regulation (SFDR), and other comparable regulation, should help to address this — prompting greater disclosure of the sustainability features of financial products.

Intelligent securities lending in 2023

While inflation may peak and interest rates may stabilise, there is likely to be continued uncertainty around timing and other macroeconomic trends. However, the right securities financing agent, the right partnerships and the right strategy can help find and capture the revenue opportunities that volatility presents.

From emerging market possibilities to alternative forms of collateral, to ethical investment, there will be a new perspective on the securities lending market that can provide market participants with a competitive advantage. A globally diversified outlook will be important — combined with investment and trading strategies that recognise the current market risks, but also the opportunities for growth, in what has arguably become the new normal.

All of this has come after the global financial crisis of 2007 and 2008, when markets experienced very low interest rates, quantitative easing (QE) and loose liquidity. For some portfolio managers and many newcomers to the securities finance industry, the landscape has now shifted significantly from what had been familiar. Interest rates are rising, and more quantitative tapering (QT) is on the horizon — at least for the time being. What does this mean for financing and collateral markets?

A new era of volatility

The economic effects of COVID-19 were, to some extent, cushioned due to the quick actions from central banks and governments to support the markets. However, 2022 has been the year for resurgence in deep volatility and market uncertainty, as evidenced in the swinging highs and lows of the VIX — the Chicago Board Options Exchange’s CBOE Volatility Index, a benchmark measure of the stock market’s expectation of volatility based on S&P 500 index options.

This market volatility has its roots in the pandemic, but has been accentuated by the knock-on effect of the Ukraine-Russia war. With rising inflation, monetary tightening, supply chain issues, energy concerns, and a period of ‘re-globalisation’, the long-term macro and microeconomic picture is uncertain, but one thing is clear: volatility in the short-term is here to stay.

Comparing the three years before 2020 to the three years post-pandemic, the VIX index is now 72 per cent higher on a consistent basis than it was pre-pandemic, based on Bloomberg market pricing data sets (VIX) between January 2017 and September 2022. As is typical for the industry as a whole, securities financing markets should be quick and dynamic to adapt.

A 12-month lookback on securities financing

In equity financing markets, funding markets and repo, it has been an unprecedented year. A direct impact of the war between Russia and Ukraine was the suspension of Russian domestic securities settlement, as well as Russian GDR names under the sanctions regime, for international investors. This was compounded by Russian federal law, prohibiting Russian issuers from having their shares traded via ADRs and GDRs. Securities financing markets, for the most part, have stayed robust. However, the knock-on effect has been a cautious approach from market participants to using GDRs, in general, as an asset class for financing and collateral purposes.

Emerging market credit markets have also been affected. In the early part of 2022, yields for emerging market debt significantly rose as liquidity declined. More generally, reduced liquidity in emerging market sovereign debt, a steep short-term interest rate curve, the wind-down of the Corporate Sector Purchase Program (CSPP) in Europe, and the fragility of property company liabilities in Asia-Pacific, has resulted in a demand-supply dynamic that has seen spreads widen. This dynamic has almost doubled securities lending revenue for lenders of credit year-to-date, according to S&P Market Intelligence data. This comes after half a decade of consistent tightening spreads in the asset class.

Figure 1

Whereas liquidity in specific credit sectors, such as Eastern Europe, has fallen, this is causing some financing participants to look more closely at new pockets of liquidity and opportunity. Mobilising both dim sum and local currency debt, particularly in APAC, has been a focus area for HSBC’s securities lending business and this is likely to remain the case in 2023. Indeed, as market participants adjust and familiarise to this new period of volatility, so too international investors have wanted access to new emerging markets through equity financing. Saudi Arabia, Kuwait, Qatar, Dubai, Abu Dhabi, Korea and China’s Stock Connect are all markets where HSBC has been focusing on growing its securities financing product.

Indeed, emerging markets are being viewed increasingly favourably within the collateral suite, as collateral providers are looking to diversify their supply, given the fall in developed equity indices globally. This need to diversify collateral has increased, due in part to government bond inventories being encumbered by market participants for other purposes such as meeting obligations under Uncleared Margin Rules, as well as borrow demand for shorting through repo markets. Providers of collateral are needing to become increasingly intelligent about its use and how to extend their footprint: emerging markets, ETFs, convertible bonds and cash collateral have all been attracting increased attention — not only as funding opportunities, but also for the very purpose of diversification.

This focus on collateral has given fresh momentum to the integration of front and back office departments of asset managers, which has been a steady trend over the past decade. Increasingly, collateral application is now being considered as part of the portfolio management exercise, with many portfolios now being used purposefully and directly for collateral inventory by beneficial owners. This is clearly having additional impact on the natural supply of HQLA from financing agents.

Additionally, the prominence of quant and momentum strategies at hedge funds creates a high daily volume of demand for equities and bonds in a volatile environment, necessitating that agent lenders familiarise and work with beneficial owners in a way that ensures supply of securities is adding value. In part, this requires enhanced relationships and an aligned approach, and it also requires enhanced automation and technology in the securities financing product.

The rise in ETF revenues in securities financing year-to-date is a clear example of a momentum-driven “beta-strategy”. This trend makes it important to offer a fully STP and automated financing solution to provide the speed and efficiency needed to draw out price opportunities for end users. This has been a continued focus for HSBC, as well as integration across the securities financing supply chain (comprising funding, repo, collateral solutions, along with securities lending and borrowing), with the intention of making the process smoother when matching beneficial owners with end users to capture dynamic opportunities during a time of market volatility.

Reflecting on the latest regulatory developments, the securities financing market is subject to the Securities Financing Transactions Regulation (SFTR) and, now, the new introduction of the Central Securities Depositories Regulation’s (CSDR’s) Settlement Discipline Regime across the EU. The need to sharpen operational procedures has therefore become increasingly important, with market participants becoming more discerning about settlement efficiency in Europe.

What lies ahead

For collateral agents and securities lenders, the new challenge will be how they differentiate themselves. As difficulty in corporate supply chains and energy prices translates into earnings and into central bank policies, market volatility is likely to continue in the the short-to-medium term.

A key lesson from 2022, which is likely to be just as applicable for 2023, is that while volatility can be a headwind, it can also open up new avenues and opportunities for intelligent securities lenders. Dynamic trading strategies, for example, may involve fluctuating or structured demand for collateral and directional interests. Asia and the Middle East also offer potential for securities lenders to generate new revenue streams.

With enhanced volatility, and the need for more sophisticated investment management decisions, partnerships and integration will create an environment for securities financing to evolve further.

ESG investing will continue to be a focus for institutional investors, and, therefore, fund managers will seek out ESG assets, even in conditions of market volatility. There is no standardised framework, as yet, for ESG securities lending, but the introduction of the EU’s Sustainable Finance Disclosure Regulation (SFDR), and other comparable regulation, should help to address this — prompting greater disclosure of the sustainability features of financial products.

Intelligent securities lending in 2023

While inflation may peak and interest rates may stabilise, there is likely to be continued uncertainty around timing and other macroeconomic trends. However, the right securities financing agent, the right partnerships and the right strategy can help find and capture the revenue opportunities that volatility presents.

From emerging market possibilities to alternative forms of collateral, to ethical investment, there will be a new perspective on the securities lending market that can provide market participants with a competitive advantage. A globally diversified outlook will be important — combined with investment and trading strategies that recognise the current market risks, but also the opportunities for growth, in what has arguably become the new normal.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times