UMR Compliance: have you ticked all the boxes?

11 October 2022

A change in attitude toward the collateral settlement process is imperative to reduce collateral fails, says Swapnil Deshmukh, senior business analyst for Securities Finance and Collateral Management at Broadridge

Image: stock.adobe.com/andranik123

Image: stock.adobe.com/andranik123

The financial crisis in 2008 and the collapse of Lehman Brothers sent shock waves through the financial industry, creating a ripple effect which eventually engulfed the entire financial world. It was evident and inevitable that more robust regulations were required to ensure the stability and good health of financial markets. The G20 economies sought help from the Basel Committee on Banking Supervision (BCBS) and the International Organisation of Securities Commissions (IOSCO) to regulate the over-the-counter (OTC) derivatives industry.

Among various other initiatives, Uncleared Margin Rules (UMR) were developed by BCBS and IOSCO to regulate non-cleared derivative transactions. The aim was to implement stringent measures for the participants in the OTC derivatives market. If one was to pose the question to market participants, “Are you finding it increasingly challenging and difficult to trade derivatives?”, the answer has been an emphatic “Yes”.

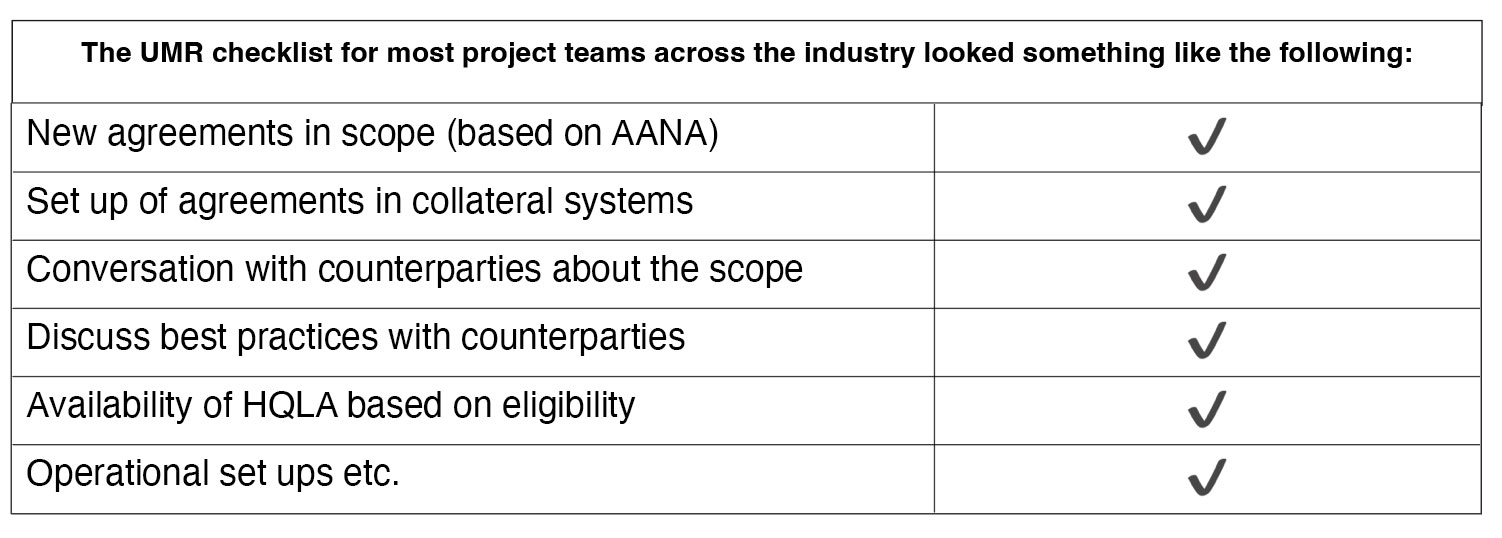

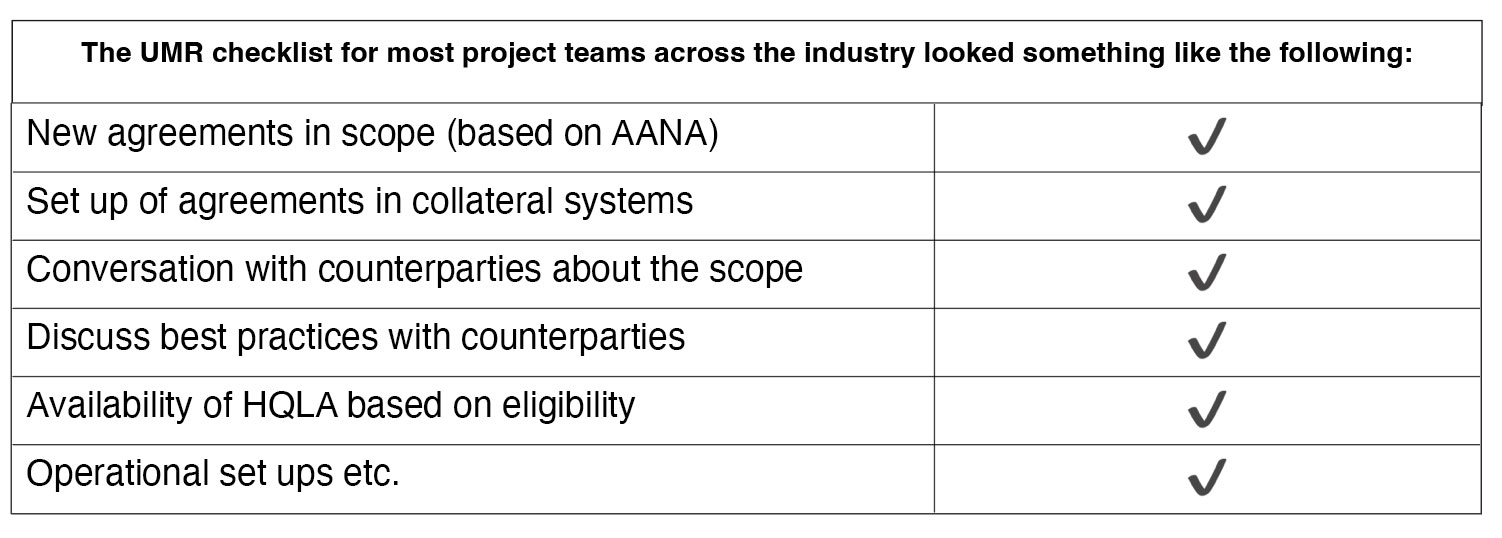

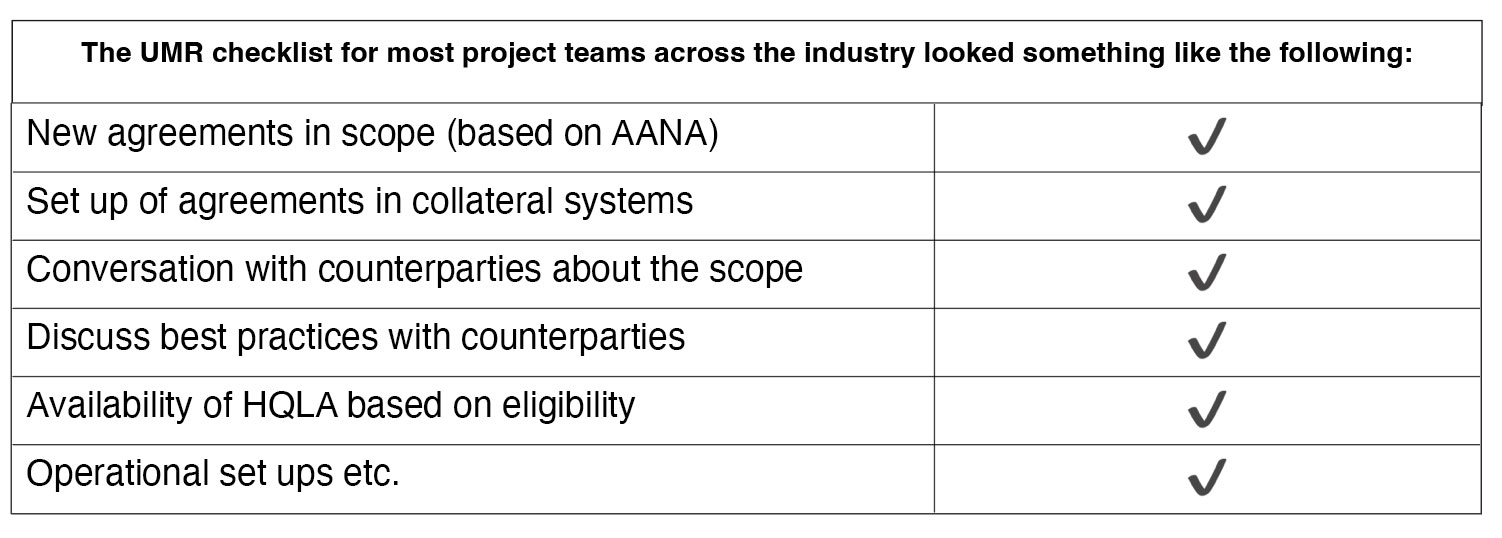

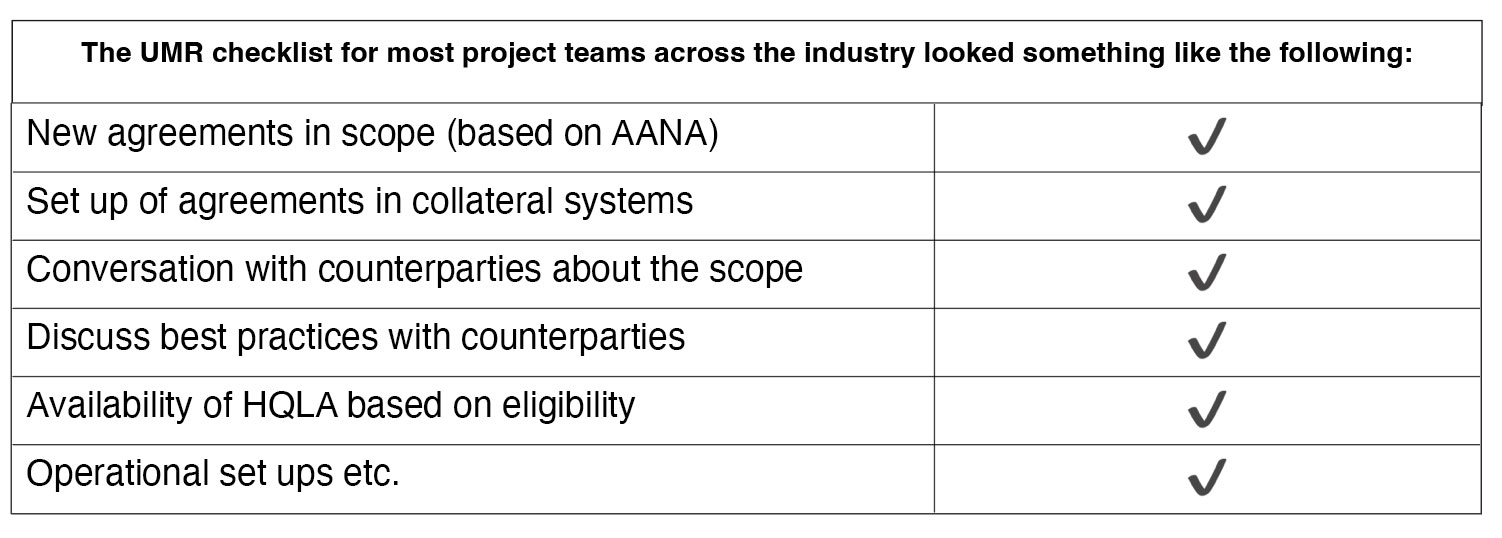

Figure 1

However, sophisticated OTC collateral management platforms and the phased approach of the UMR regulation has enabled market participants to adapt gradually to the requirements and comply with relative ease. The collateral management teams across derivatives markets have been busy since mid-to-late 2015 in assessing the requirements, determining in which phase their firm will be captured, and ensuring operational readiness by allocating substantial resources with an aim to seamlessly deliver a solution to comply with regulation.

Most of the resources available were directed towards the elements mentioned in the table above. However, the majority of industry participants did not allocate adequate resources and importance to the timely settlement of collateral. Considering that the main goal of collateral management is to ensure that counterparty default risk is mitigated, settlement of the agreed collateral should be the most fundamental task of any collateral management department. Over the years, collateral settlement fails have been viewed as an operational nuisance and have suffered from a laissez-faire attitude.

Historically, a typical day in a collateral management department looked like this:

• Run end-of-day process

• System checks to ensure that valuation date for all OTC derivative trades is the previous business day

• Issuing in-the-money margin calls (manually or automated via Acadia)

• Check if instructions for margin calls booked on the previous day have been released to the custodians

• Agreeing to margin calls issued by the counterparties

• Check and resolve if there are any breaks (disputes management)

• Check for collateral settlement fails (margin calls booked on the previous day)

The fact that checking collateral settlement fails was, and to some extent still is, at the bottom of this list is quite concerning. Over the years, industry participants have discussed and debated how best to ensure appropriate regulations are applied to the derivatives industry. However, not much attention has been paid to ensure that the collateral exchanged between two parties has settled in the market.

Industry participants generally exchange both cash and non-cash (mostly bonds) collateral to cover exposure for an OTC derivative agreement. Most buy-side firms are risk averse and do not exercise their right to rehypothecate, keeping the received collateral ringfenced. Consequently, one would expect a robust fails remediation process. These firms generally manage derivatives exposure on behalf of their clients and an increase in collateral fails amounts to failure in risk management services. The sell-side firms have been more welcoming to the idea of rehypothecation and manage their inventory as per in-house optimisation processes.

A cash collateral fail for a sell-side firm means uncollateralised exposure, which is of grave concern on its own. However, a non-cash collateral fail not only means uncollateralised exposure, but also, most likely, breaks the chain of collateral exchange. For instance, if the rehypothecated collateral is not received back in time, the option for the party involved is to either use securities from its own inventory or, in a worst-case scenario, to borrow it from the market. In either of the cases, there is additional cost to the trading books along with the already existing operational costs.

The introduction of UMR regulations and development of sophisticated OTC collateral management systems have moved in conjunction with each other for the past five or six years. The new and sophisticated OTC collateral management systems have ensured that the core margin call activities (issuing or agreeing margin calls) are a lot less time consuming compared with 5 to 10 years ago. For example, most industry participants use TriResolve for reconciliations of OTC derivatives trades, making the whole dispute resolution process quite seamless.

However, as an industry there has not been sufficient effort to address the issue of collateral fails. Ideally, there should be a zero-tolerance policy towards collateral settlement fails, but with the increase in margin call volumes under the UMR regime, some organisations have had to direct resources towards recruitment, driving the operational costs up and away from appropriately and decisively addressing collateral fails.

Figure 2

The International Swaps and Derivatives Association (ISDA) margin survey provides margin and collateral fails data for 2017 to 2021 in the table below. If one was to assume that, on average, 5 per cent of collateral exchanged results in fails, it is worth taking note of the implications and the cost of uncollateralised exposure in the derivatives industry.

It is quite evident that, even taking a conservative approach of 5 per cent for collateral fails, the uncollateralised exposure and the associated operational cost to industry participants is enormous. A detailed empirical analysis performed by PwC and the Depository Trust & Clearing Corporation (DTCC) prior to the start of UMR Phase 1 estimated this to be around 10 per cent by the time Phases 5 and 6 were implemented.

The question that regulators, government institutions, industry participants and their customers need to ask is, what does UMR compliance mean and what does “fully collateralised” mean? Does this merely mean that a financial institution is processing margin variation and initial margin calls daily, or that it is fully cognizant of how much of margin (IM and VM) exchanged has settled on the agreed value date?

There is a fair degree of consensus among industry participants that collateral settlement fails could be due to fundamental issues such as lack of infrastructure, limited resources or an increase in the volume of margin calls, for example. However, on the majority of occasions, collateral fails are a result of suboptimal processes for effective collateral settlement monitoring.

It is safe to infer that collateral settlement fails increase costs for an organisation, disturb market stability, they could cause reputational damage and, in the worst of all the cases, they raise questions about the effective management of counterparty risk. Even though BCBS and IOSCO have implemented UMR and have ensured that the majority of firms trading derivatives adhere to these rules, it is the responsibility of each organisation to ensure that they are fully compliant and genuinely fully collateralised.

It is imperative that there is a change in attitude from industry participants towards the collateral settlement process and the first step is to have a proactive approach to ensure that all collateral is settled in a timely manner. A platform that fully incorporates and integrates all aspects of collateral management, along with performing post-trade activities, is another important step that will help firms to reduce collateral fails.

Broadridge is investing heavily in providing such a solution for both cleared and non-cleared derivatives collateral management. Broadridge’s SFCM Collateral Management Module and the associated Asset Selection Module (ASM) has real time connectivity to electronic messaging services like Acadia, reconciliation platforms like TriResolve and all major custodians. An “everything under one roof” solution can help a collateral management team in ticking all the boxes, becoming more efficient and achieving full and real compliance with the regulation.

Among various other initiatives, Uncleared Margin Rules (UMR) were developed by BCBS and IOSCO to regulate non-cleared derivative transactions. The aim was to implement stringent measures for the participants in the OTC derivatives market. If one was to pose the question to market participants, “Are you finding it increasingly challenging and difficult to trade derivatives?”, the answer has been an emphatic “Yes”.

Figure 1

However, sophisticated OTC collateral management platforms and the phased approach of the UMR regulation has enabled market participants to adapt gradually to the requirements and comply with relative ease. The collateral management teams across derivatives markets have been busy since mid-to-late 2015 in assessing the requirements, determining in which phase their firm will be captured, and ensuring operational readiness by allocating substantial resources with an aim to seamlessly deliver a solution to comply with regulation.

Most of the resources available were directed towards the elements mentioned in the table above. However, the majority of industry participants did not allocate adequate resources and importance to the timely settlement of collateral. Considering that the main goal of collateral management is to ensure that counterparty default risk is mitigated, settlement of the agreed collateral should be the most fundamental task of any collateral management department. Over the years, collateral settlement fails have been viewed as an operational nuisance and have suffered from a laissez-faire attitude.

Historically, a typical day in a collateral management department looked like this:

• Run end-of-day process

• System checks to ensure that valuation date for all OTC derivative trades is the previous business day

• Issuing in-the-money margin calls (manually or automated via Acadia)

• Check if instructions for margin calls booked on the previous day have been released to the custodians

• Agreeing to margin calls issued by the counterparties

• Check and resolve if there are any breaks (disputes management)

• Check for collateral settlement fails (margin calls booked on the previous day)

The fact that checking collateral settlement fails was, and to some extent still is, at the bottom of this list is quite concerning. Over the years, industry participants have discussed and debated how best to ensure appropriate regulations are applied to the derivatives industry. However, not much attention has been paid to ensure that the collateral exchanged between two parties has settled in the market.

Industry participants generally exchange both cash and non-cash (mostly bonds) collateral to cover exposure for an OTC derivative agreement. Most buy-side firms are risk averse and do not exercise their right to rehypothecate, keeping the received collateral ringfenced. Consequently, one would expect a robust fails remediation process. These firms generally manage derivatives exposure on behalf of their clients and an increase in collateral fails amounts to failure in risk management services. The sell-side firms have been more welcoming to the idea of rehypothecation and manage their inventory as per in-house optimisation processes.

A cash collateral fail for a sell-side firm means uncollateralised exposure, which is of grave concern on its own. However, a non-cash collateral fail not only means uncollateralised exposure, but also, most likely, breaks the chain of collateral exchange. For instance, if the rehypothecated collateral is not received back in time, the option for the party involved is to either use securities from its own inventory or, in a worst-case scenario, to borrow it from the market. In either of the cases, there is additional cost to the trading books along with the already existing operational costs.

The introduction of UMR regulations and development of sophisticated OTC collateral management systems have moved in conjunction with each other for the past five or six years. The new and sophisticated OTC collateral management systems have ensured that the core margin call activities (issuing or agreeing margin calls) are a lot less time consuming compared with 5 to 10 years ago. For example, most industry participants use TriResolve for reconciliations of OTC derivatives trades, making the whole dispute resolution process quite seamless.

However, as an industry there has not been sufficient effort to address the issue of collateral fails. Ideally, there should be a zero-tolerance policy towards collateral settlement fails, but with the increase in margin call volumes under the UMR regime, some organisations have had to direct resources towards recruitment, driving the operational costs up and away from appropriately and decisively addressing collateral fails.

Figure 2

The International Swaps and Derivatives Association (ISDA) margin survey provides margin and collateral fails data for 2017 to 2021 in the table below. If one was to assume that, on average, 5 per cent of collateral exchanged results in fails, it is worth taking note of the implications and the cost of uncollateralised exposure in the derivatives industry.

It is quite evident that, even taking a conservative approach of 5 per cent for collateral fails, the uncollateralised exposure and the associated operational cost to industry participants is enormous. A detailed empirical analysis performed by PwC and the Depository Trust & Clearing Corporation (DTCC) prior to the start of UMR Phase 1 estimated this to be around 10 per cent by the time Phases 5 and 6 were implemented.

The question that regulators, government institutions, industry participants and their customers need to ask is, what does UMR compliance mean and what does “fully collateralised” mean? Does this merely mean that a financial institution is processing margin variation and initial margin calls daily, or that it is fully cognizant of how much of margin (IM and VM) exchanged has settled on the agreed value date?

There is a fair degree of consensus among industry participants that collateral settlement fails could be due to fundamental issues such as lack of infrastructure, limited resources or an increase in the volume of margin calls, for example. However, on the majority of occasions, collateral fails are a result of suboptimal processes for effective collateral settlement monitoring.

It is safe to infer that collateral settlement fails increase costs for an organisation, disturb market stability, they could cause reputational damage and, in the worst of all the cases, they raise questions about the effective management of counterparty risk. Even though BCBS and IOSCO have implemented UMR and have ensured that the majority of firms trading derivatives adhere to these rules, it is the responsibility of each organisation to ensure that they are fully compliant and genuinely fully collateralised.

It is imperative that there is a change in attitude from industry participants towards the collateral settlement process and the first step is to have a proactive approach to ensure that all collateral is settled in a timely manner. A platform that fully incorporates and integrates all aspects of collateral management, along with performing post-trade activities, is another important step that will help firms to reduce collateral fails.

Broadridge is investing heavily in providing such a solution for both cleared and non-cleared derivatives collateral management. Broadridge’s SFCM Collateral Management Module and the associated Asset Selection Module (ASM) has real time connectivity to electronic messaging services like Acadia, reconciliation platforms like TriResolve and all major custodians. An “everything under one roof” solution can help a collateral management team in ticking all the boxes, becoming more efficient and achieving full and real compliance with the regulation.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times