UMR and FX clearing: a new landscape offering many benefits

22 November 2022

UMR adoption has generated an exponential growth in regulatory IM, driving more focus on collateral management and optimisation. Vinayak Dange, head of product management, clearing and reconciliation at Adenza, says firms stand to gain from FX clearing

Image: stock.adobe.com/James Thew

Image: stock.adobe.com/James Thew

The introduction of Uncleared Margin Rules (UMR) significantly impacted the foreign exchange (FX) clearing world. It substantially increased trading costs for uncleared derivatives and accelerated the expansion of clearing programmes globally.

It mandated that counterparties post a new two-way initial margin (IM) in segregated accounts. Although cash-settled products fall outside UMR, unsettled FX forwards are included in the Average Annual Notional Amount (AANA) calculation that determines whether a firm is in scope for UMR and, therefore, must post IM when it exceeds the relevant UMR threshold. The bilateral margin requirement created additional collateral and capital costs that incited firms to consider more cost-effective clearing channels.

Surge in FX Clearing

To avoid costly UMR compliance, firms now aim to reduce AANA by clearing more products. Central counterparty clearing houses (CCPs) offer FX netting, trade compression and cheaper IM, enabling firms to optimise their collateral positions on a portfolio basis and, thereby, decrease their operational and settlement costs.

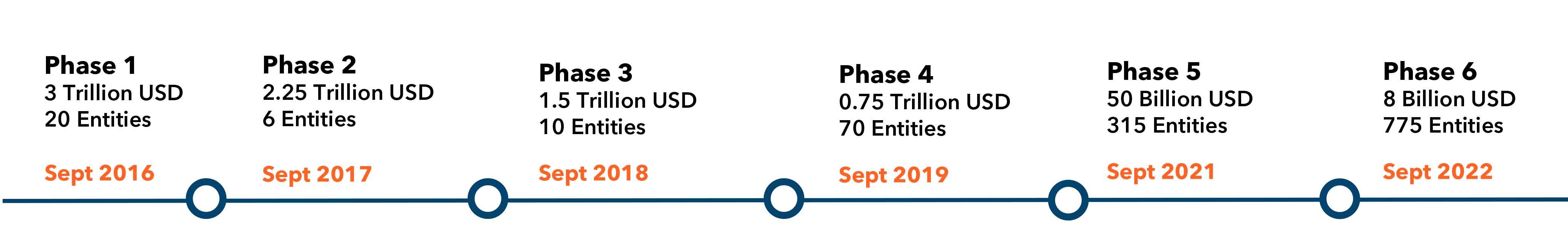

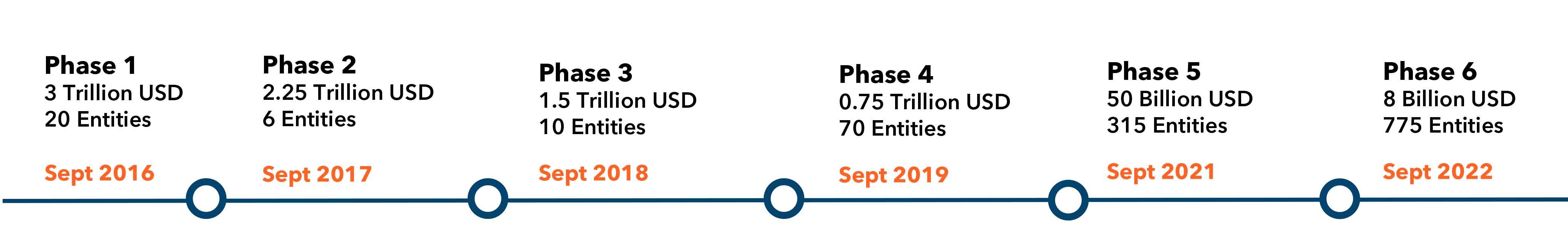

The UMR-driven push to clear more products has been one of the main drivers of a huge surge in demand for FX clearing and the commensurate expansion of CCPs’ support of vanilla FX products (spot, forwards, swaps). Firms clear FX via global CCPs for non-mandated products (e.g. FX non-deliverable forwards (NDF) and cash-settled FX products). Encompassing approximately 1,200 firms, UMR’s six phases have gone live, progressing as shown in Figure 1.

Figure 1

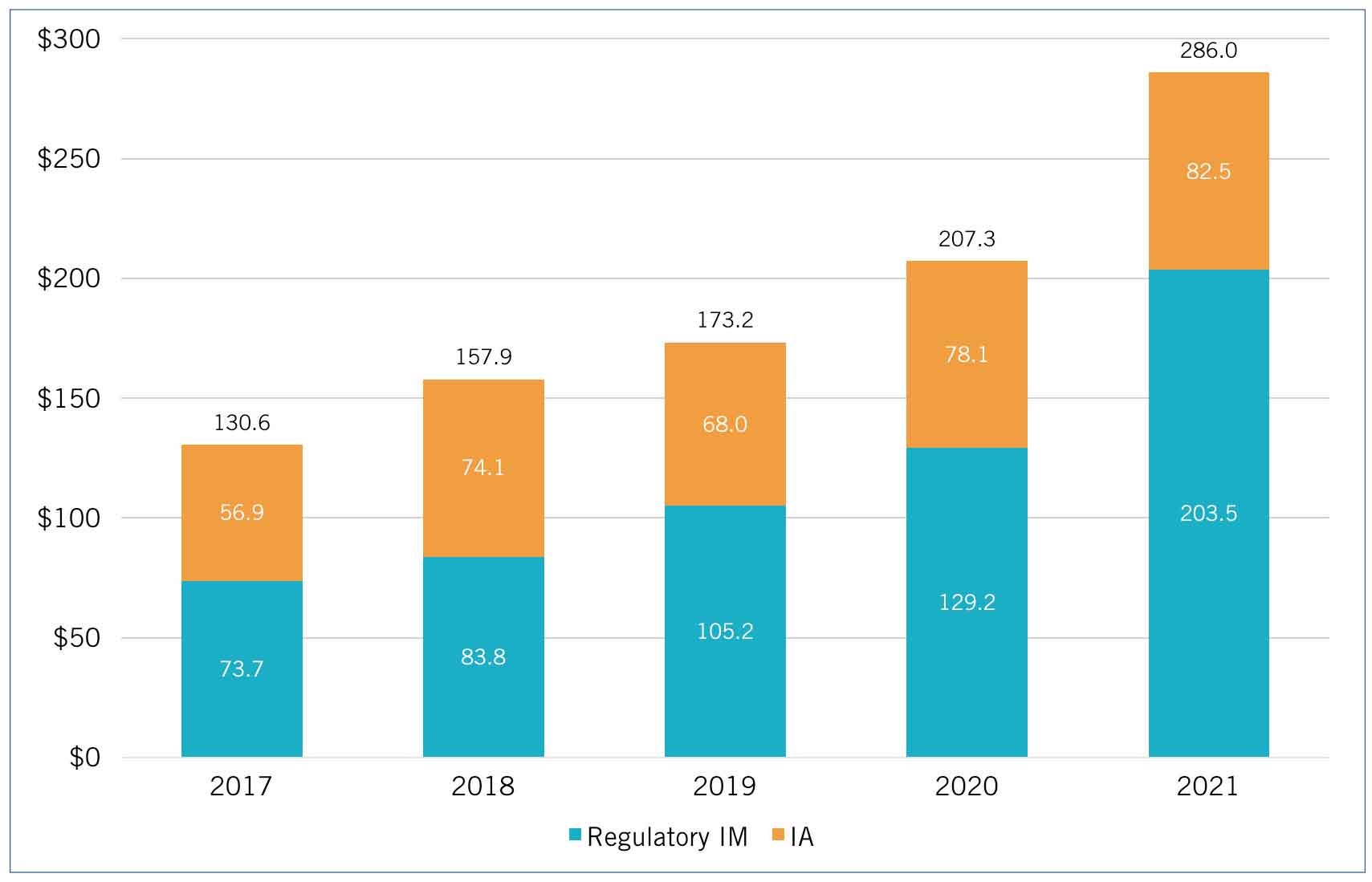

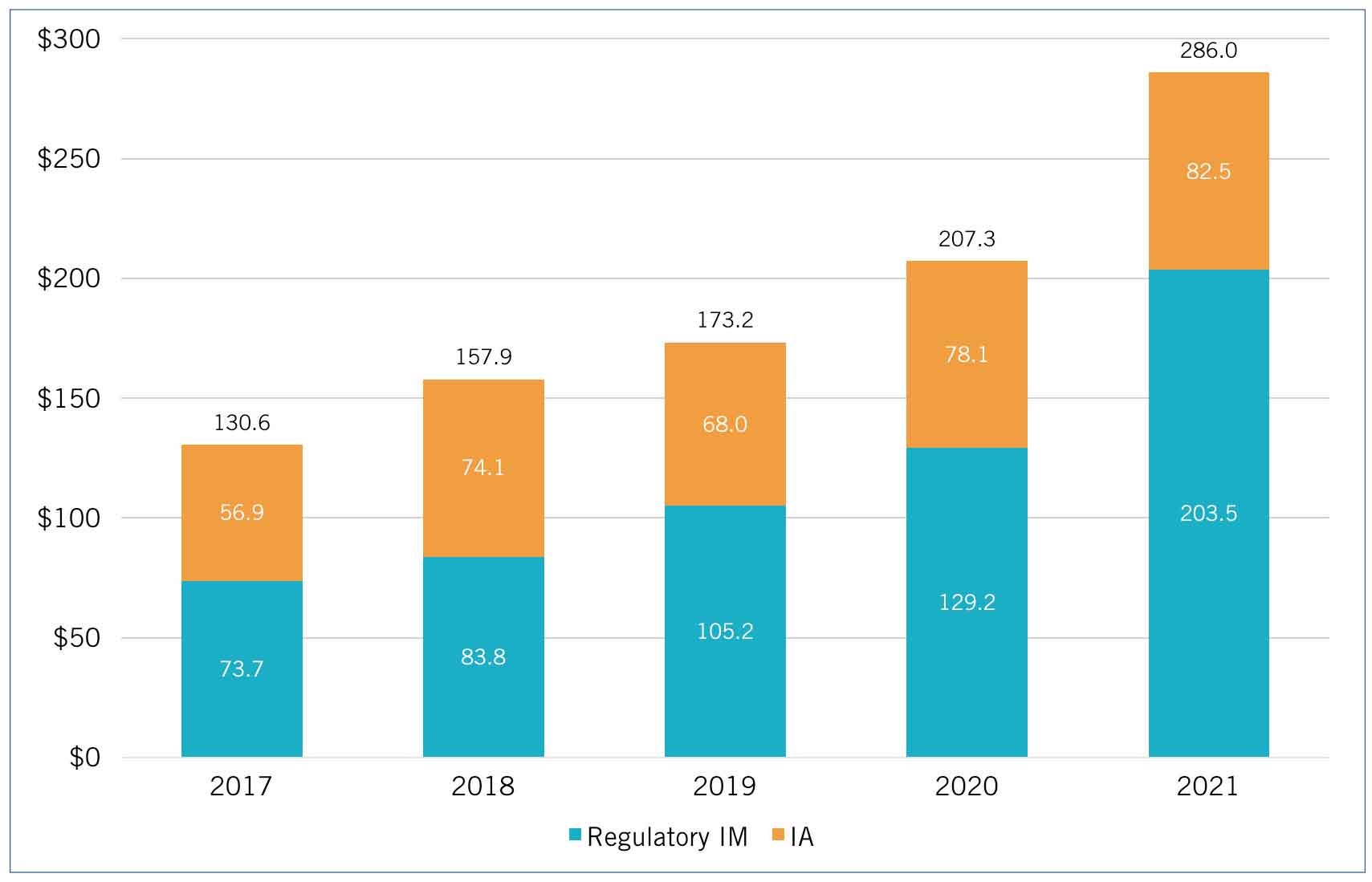

UMR adoption has generated an exponential growth in regulatory IM, driving more focus on collateral management and optimisation. In its Margin Survey Year-End 2021, ISDA notes that Phase 1 firms collected US$286.0 billion of IM for non-cleared derivatives transactions at year-end 2021, a 38.0 per cent increase versus the US$207.3 billion of IM that Phase 1 firms collected at year-end 2020 — as ISDA shows in Figure 2.

Figure 2

FX clearing’s many benefits

Across the board, firms can benefit by opting to clear all FX products, mandated or not. We discuss nine of the most compelling drivers here.

Capital efficiency and margin optimisation: At the start of FX clearing, studies were done to assess its benefits in the context of incoming margin rules. One such study was done by Greenwich Associates, titled “FX Options in the Age of Uncleared Margin Rules”, in which they indicated that FX options would require significantly less margin and capital and could be approximately 86 per cent more capital efficient than bilateral positions that need to post IM under UMR.

CCP clearing improves operational efficiency in addition to vastly improving balance-sheet positions and minimising other regulatory capital charges, as the following methodologic, transactional and experiential observations indicate.

Margin period of risk (MPOR): The ISDA Standard Initial Margin Model (SIMM), for example, uses a 10-day MPOR, whereas clearing houses (e.g. CME, LCH) use a five-day MPOR for house-clearing and a seven-day MPOR for client-clearing, resulting in lower margin exposures for cleared trades.

Risk-weighted assets (RWA): Basel III attributes lower counterparty risk-weights to a CCP than to a bilateral counterparty. Therefore, a firm’s RWA and leverage ratio profiles benefit, and the netting effects of consolidating positions against a single counterparty contribute to reducing overall capital requirements.

In addition to clearing bilateral products, firms clearing listed FX options through a CCP benefit from risk-offsetting and cross-margining methodologies by which their overall IM requirements decrease significantly. Given the UMR changes, and that firms have experienced a deterioration in the quality of bilateral FX options quotes, many traders now consider listed FX options as a viable alternative for managing their OTC portfolios.

To effectively select whether to use a cleared or uncleared channel and assess potential capital-reduction benefits, firms increasingly want the capability to simulate pre-trade IM at the portfolio level in real time — directly within their systems.

Netting/Compression: Compression eliminates economically redundant derivatives positions and thereby reduces outstanding contracts. CCP-enabled FX blending further reduces the number of open trades while keeping the original risk profile the same and contributing to operational efficiency.

Tools help firms perform multilateral netting that:

• reduces gross and net notional positions

• enhances capital efficiency and leverage ratios

• helps manage counterparty credit risk

• reduces operational risks and costs

Fewer line items require less reconciliation and reduce netted settlement. Multilateral netting enables firms to hold a single position per instrument (e.g. CCY Pair/Settle Date), rather than servicing individual lines with each bilateral counterparty and holding complex ISDA master agreements and/or credit support annexes (CSA).

No disputes, less management: CCPs use standardised market data per industry best practice to calculate Variation Margin (VM), Price Alignment Interest (PAI) and a robust risk methodology to calculate IM. This discipline eliminates disputes on VM and IM calls versus bilateral trades.

Operational efficiency: Utilising a single clearing agreement provides access to the full liquidity available in FX futures and options and eliminates the need for complex ISDA agreements and/or CSAs with multiple bilateral counterparties.

Settlement and trading platforms support: CLS delivers settlement, processing and data solutions launched by CLSClearedFX — the first Payment-versus-Payment (PvP) settlement service specifically designed for OTC-cleared FX derivatives. The CCP CLS unique cycle provides settlement certainty and netting benefits for OTC FX and cross-currency swaps members. Therefore, CCPs and clearing members can settle cleared FX products safely and effectively.

Settlement netting: For those firms using self-clearing, CCP clearing can provide an effective mechanism to:

• free up bilateral credit lines

• access more liquidity providers

• achieve netting for daily settlements

• automate the trade allocation process

Buy-side firms can aggregate their positions in a single account directly with a CCP or via a futures commission merchant (FCM). This reduces settlement risk as most CCPs use CLS’s PvP, whereby all settlements are netted across positions by currency.

Cheapest-to-Deliver (CTD) collateral: While keeping a minimum margin level is critical, a key goal is to minimise collateral cost with CTD collateral. CCPs allow firms to post a variety of collateral, whereas bilateral CSAs limit collateral types (including government securities, ABS, MBS and corporate bonds). Some CCPs are using real-time collateral optimisation through Euroclear Bank, offering collateral allocation and substitution for FCMs and end users.

Ringfencing collateral: CCPs support various models such as the individual segregated model (asset seg/value seg), which allows firms to ringfence non-cash collateral and help safeguard underlying collateral from defaulting. These structures facilitate the porting of trades facing the defaulting FCM.

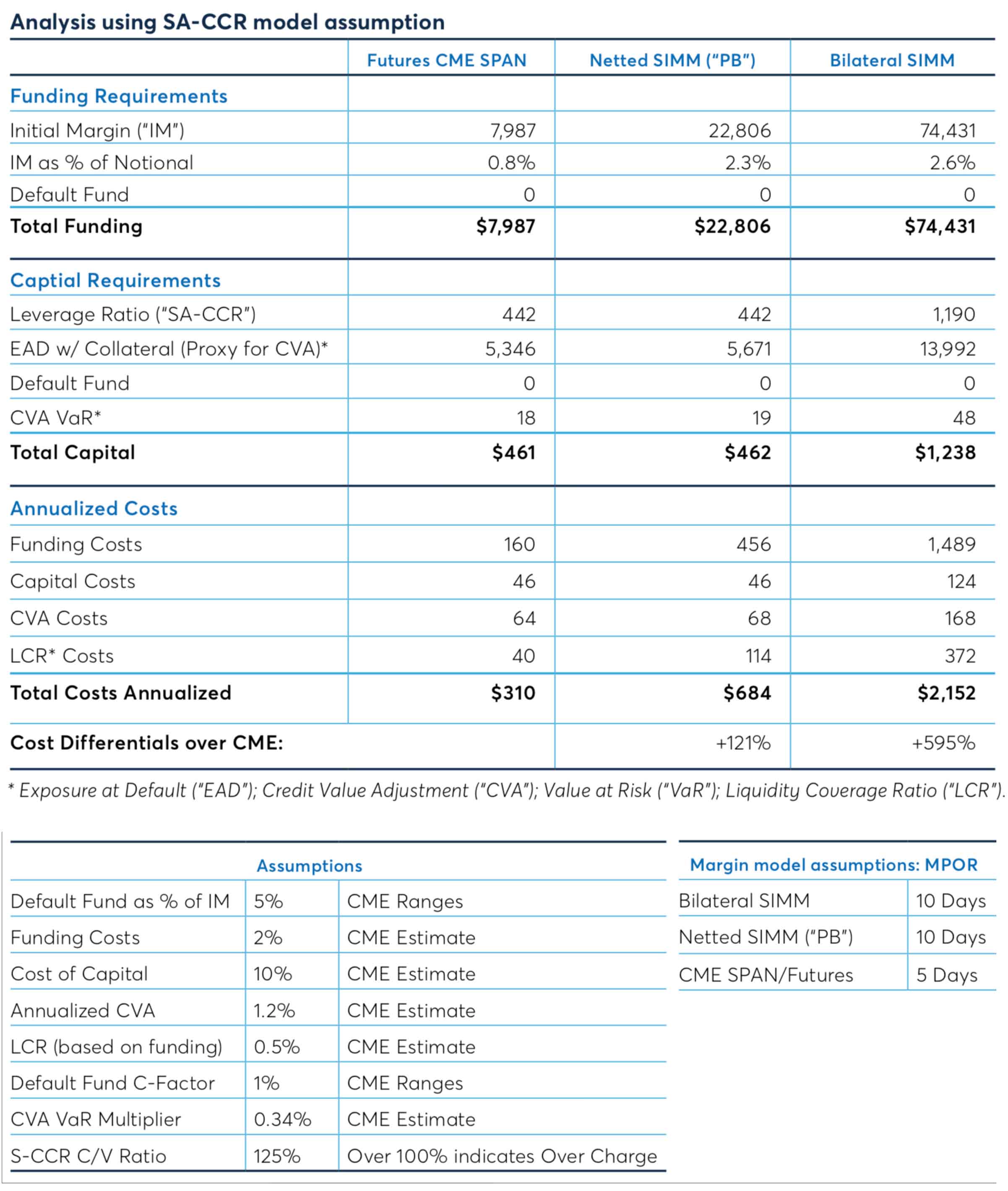

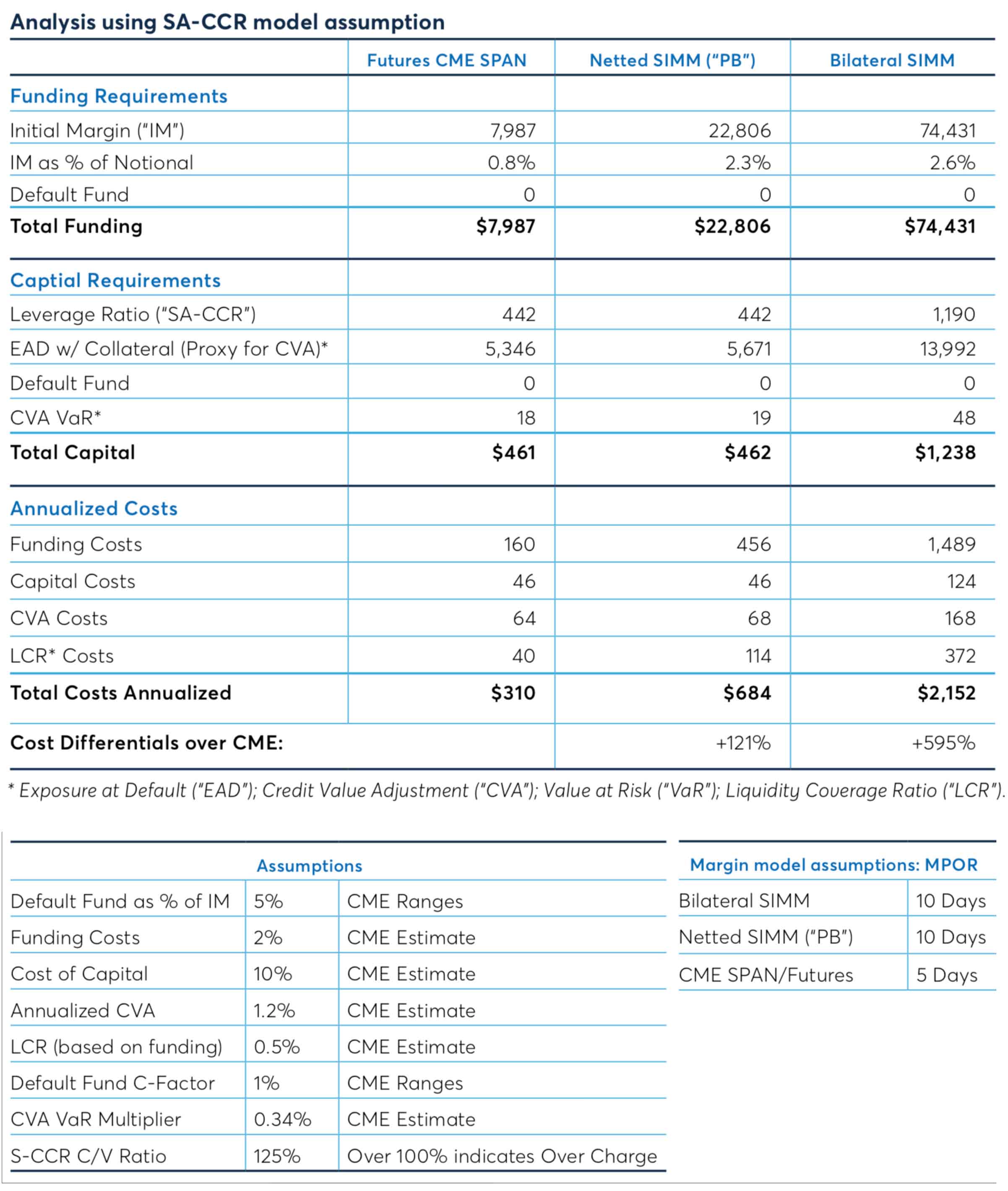

Portfolio/cross-margining and capital reduction: Regulatory bodies have authorised CCPs to conduct portfolio margining across exchange-traded derivatives (ETD) and OTC FX products. Trading in a regulated, transparent, all-to-all marketplace with firm liquidity offers attractive qualitative benefits. Quantitatively, it also helps reduce counterparty credit risk (CCR). According to the CME Group, a listed FX Options portfolio reduces IM to 0.8 per cent of notional compared with 2.6 per cent of notional for a comparable portfolio with bilateral SIMM requirements. This approach results in a cost differential of 595 per cent, as delineated in Figure 3 from the CME's article, titled "Listed FX Options: A Capital-efficient Low-cost Solution".

Figure 3

The benefits of clearing extend to CCR and related capital costs. Per Basel III reforms, financial institutions are now subject to the standardised approach for counterparty credit risk’s (SA-CCR) capital charge. Optimised collateralised exposure can significantly reduce SA-CCR if firms clear their OTC trades. Indeed, the MPOR for cleared trades drops from 10 days (for non-cleared) to five to seven days. Cleared trades are aggregated in a CCP or clearing member netting set, which generates additional risk netting resulting in smaller exposures. Lastly, smaller risk weights are applied to cleared trades, contributing to lower RWA.

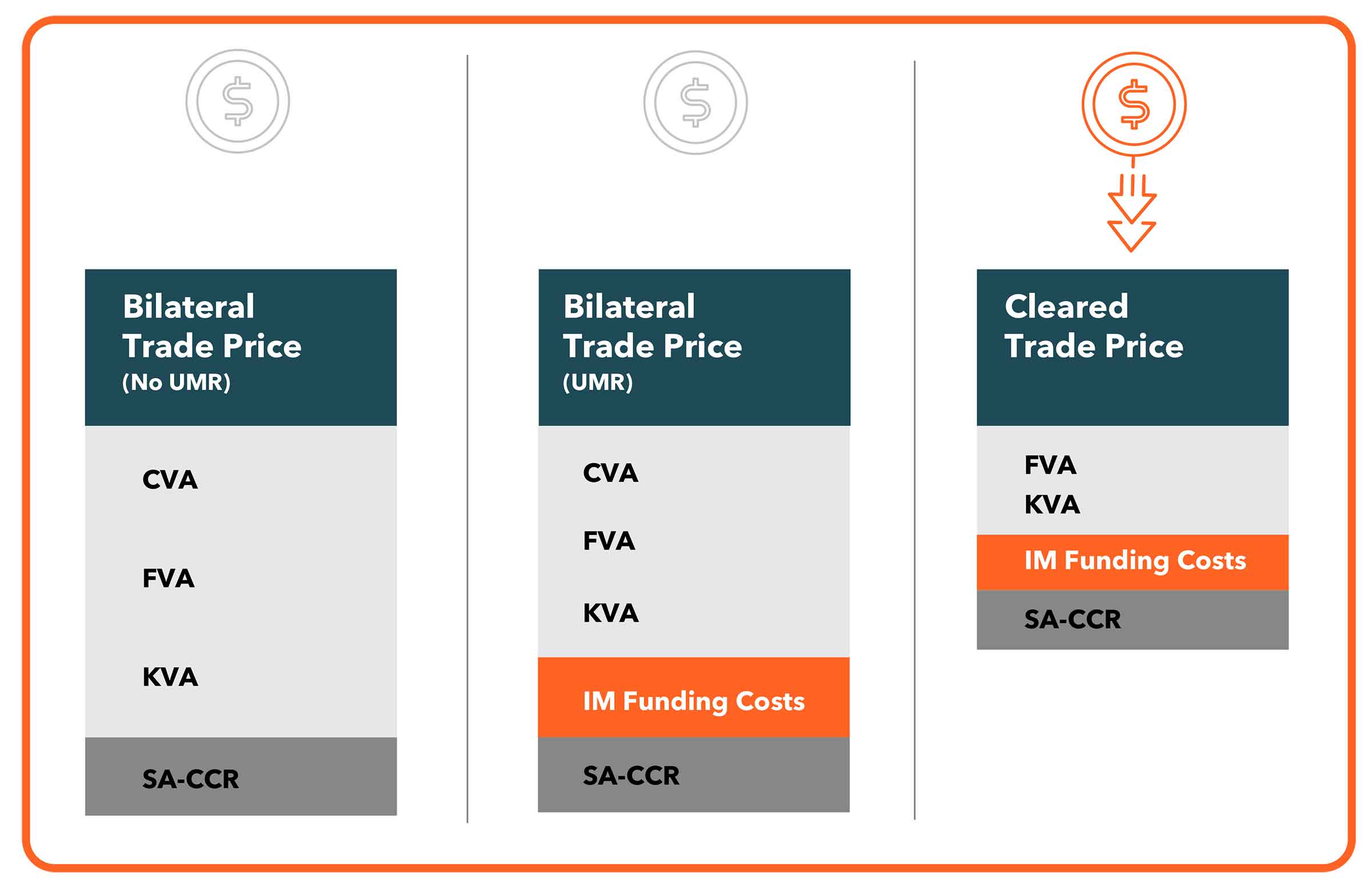

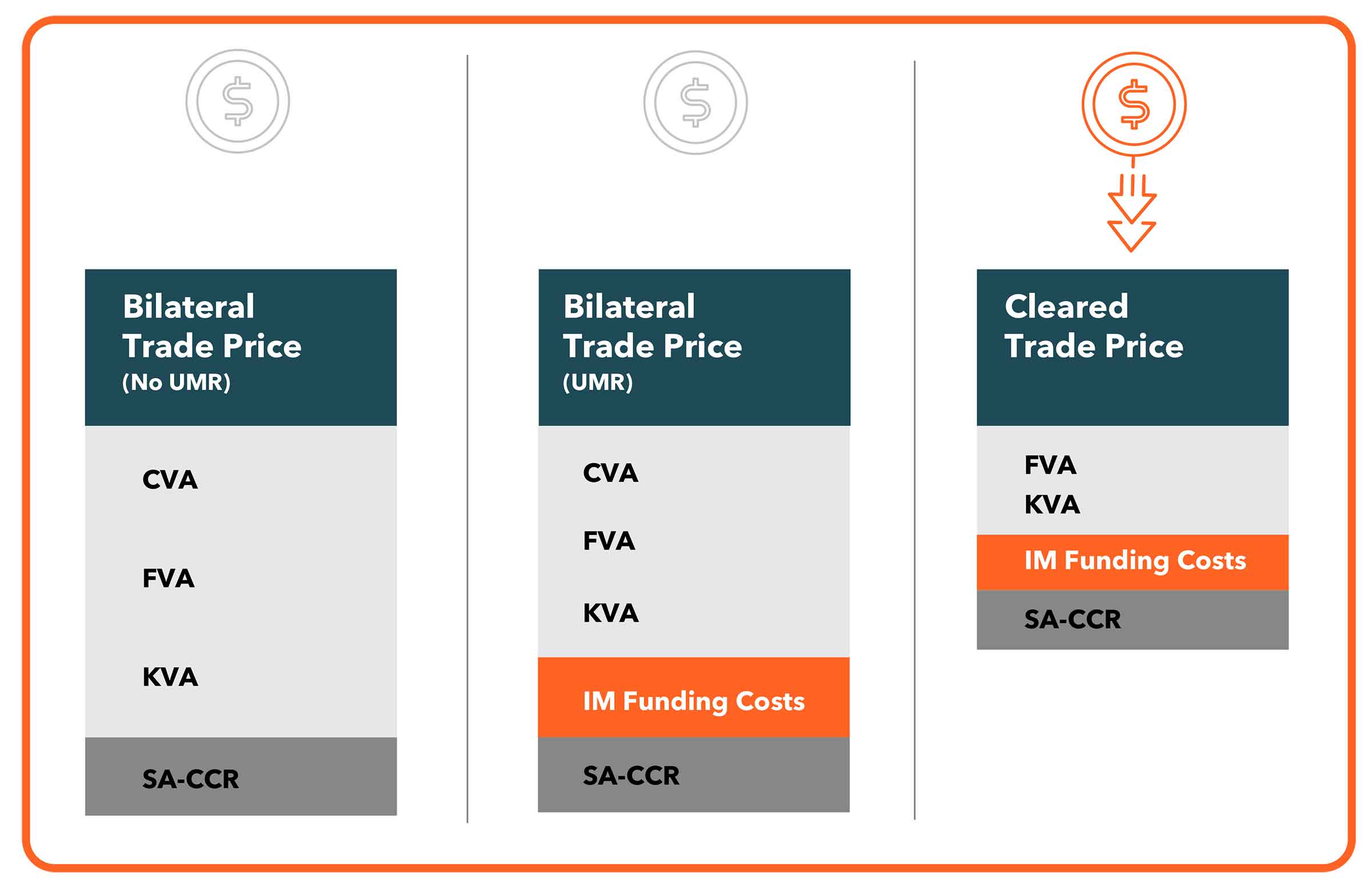

In summary, by selecting clearing channels, the total cost of the trade can be fully optimised as shown in Figure 4, illustrating trade decomposition into XVA (credit valuation adjustment (CVA), funding valuation adjustment (FVA) and capital valuation adjustment (KVA)), IM and SA-CCR exposure.

Figure 4

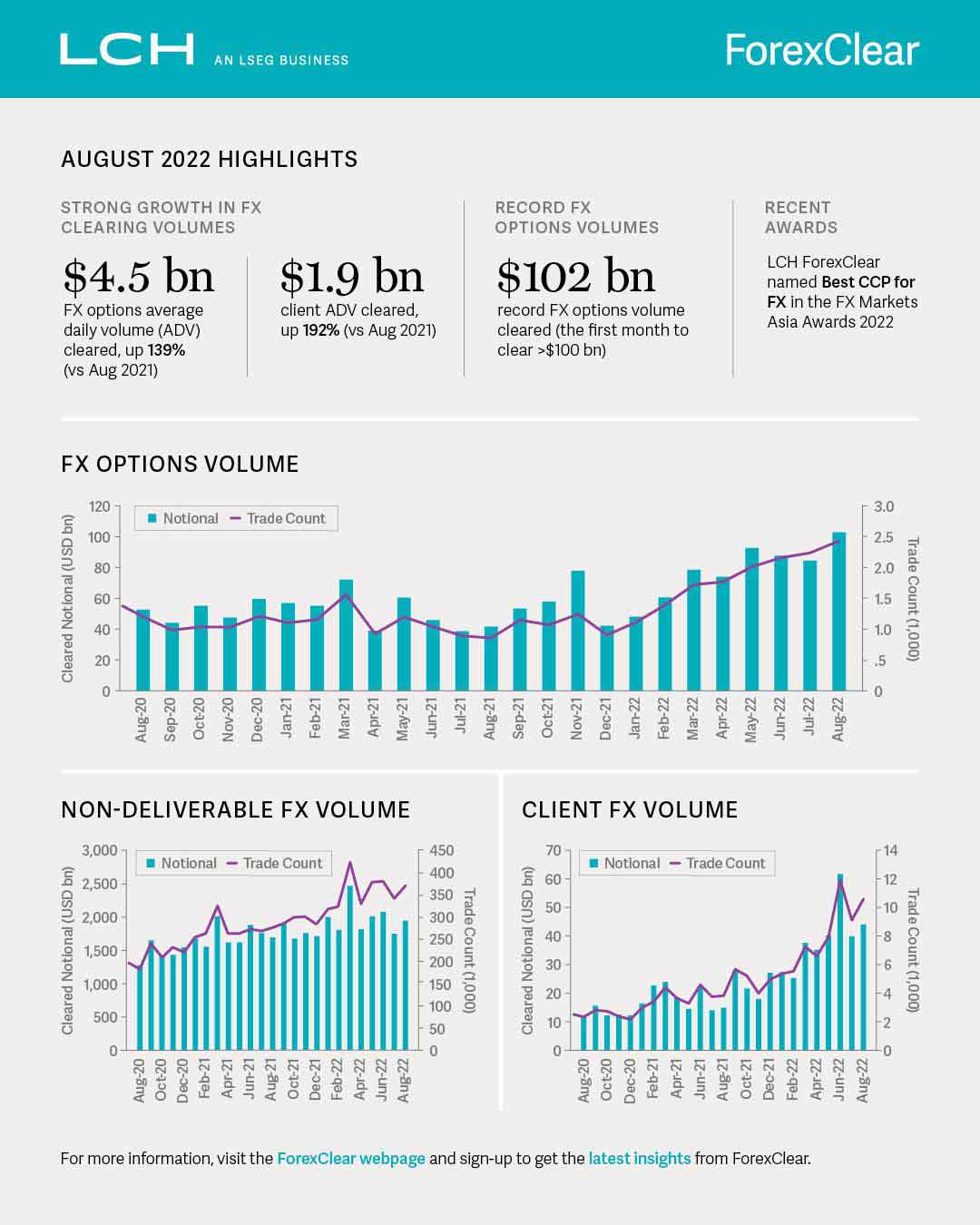

A dramatically changed landscape

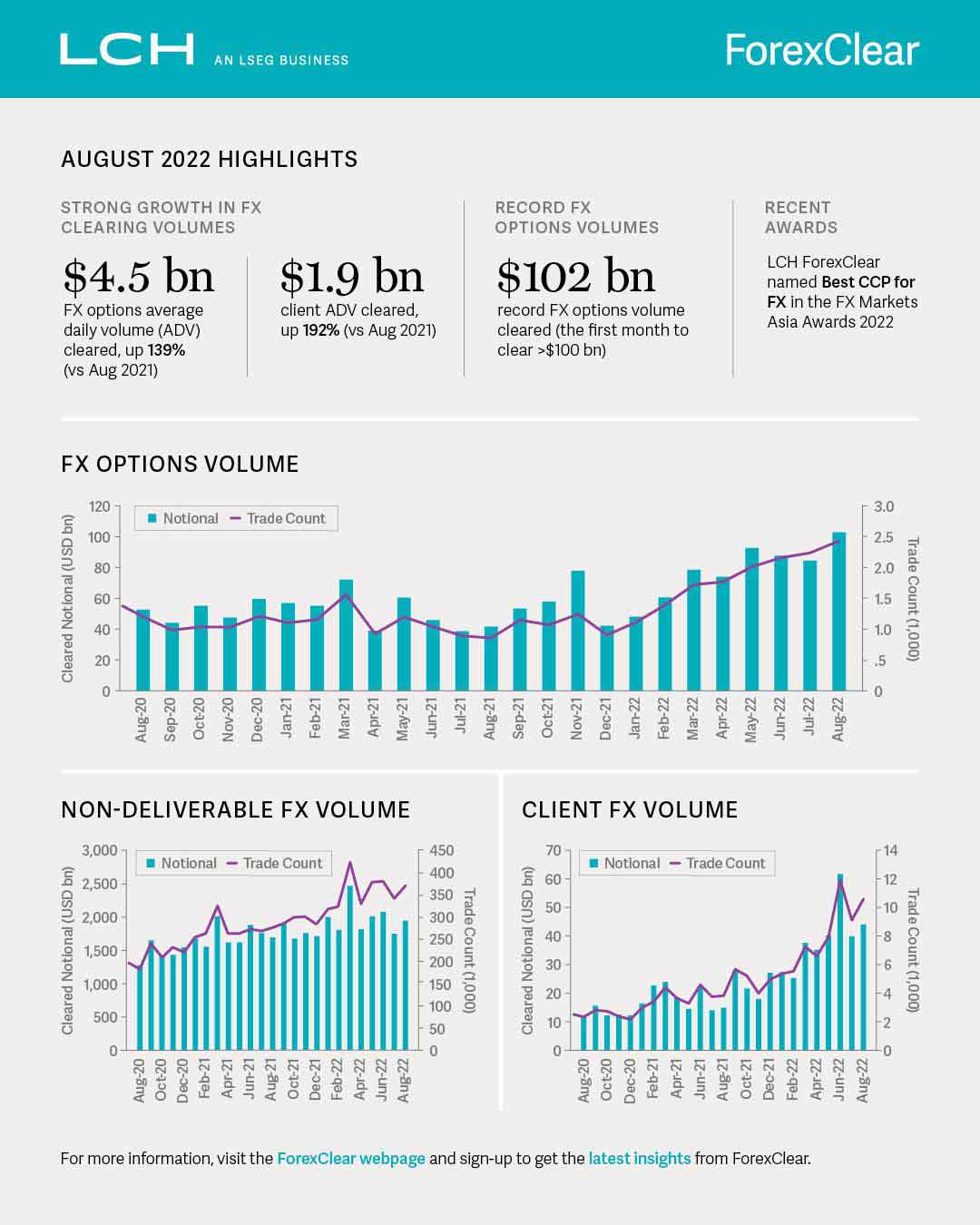

Overall, firms are on board with FX clearing to avoid the costly UMR margins and to leverage the operational and capital efficiency offered by the clearing world. The UMR Phase 6 cohort go-live on 1 September 2022 added approximately 800 entities to the expanded clearing landscape. We expect continued growth across participants, trade volumes and FX product types. The LCH’s data of August 2022, shown in Figure 5 on the followng page, substantiates this growth trend.

Figure 5

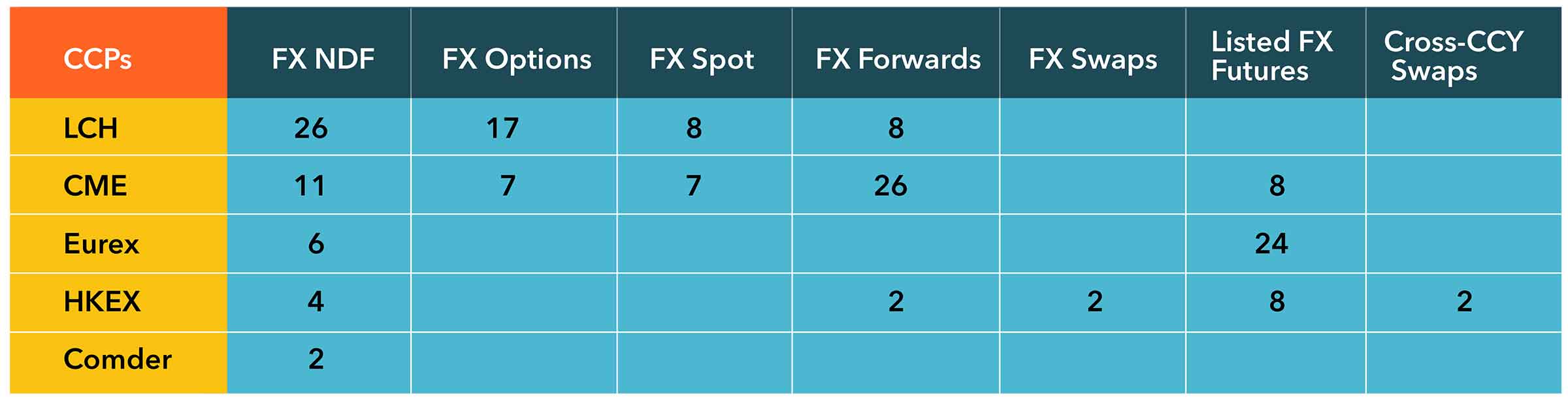

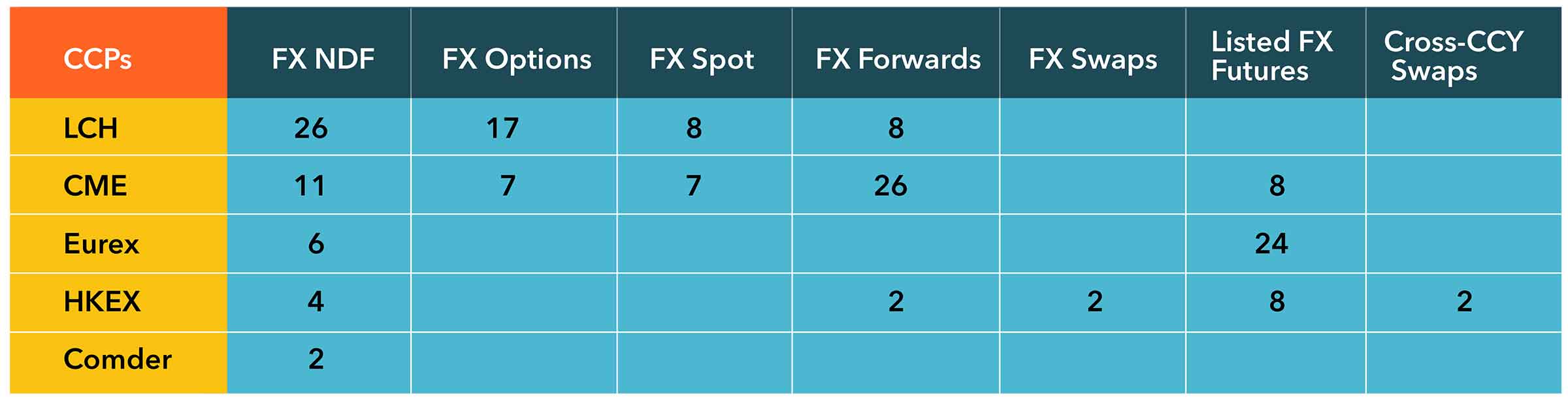

FX clearing coverage is expanding, with numerous FX programmes offered by clearing providers, as illustrated by our tabulation of 2 November 2022, shown in Figure 6 on the following page. We expect these offerings to grow over the next few years.

Figure 6

Gaining from change

Considering the changes and benefits highlighted here, firms stand to gain from the FX clearing function’s dramatic change — an expansion boosted by mandatory clearing, UMR, and CCPs’ attractive cross-margining, netting and compression programmes.

To take full advantage of this surge in FX clearing, firms need end-to-end clearing, collateral and risk mitigation with TCO optimisation. Selecting a utility or managed-service model enables firms to quickly onboard and/or start self- and client-clearing businesses without the burdens of maintaining system infrastructure, connectivity to various CCPs, software implementation and upgrades, and BAU clearing operations staff.

In closing, we share our key learning from this discussion. We will continue to face unpredictable change in the margin, collateral and clearing landscapes. Only by being proactively ready for change will firms be able to adapt, evolve and optimise. Opting for a consolidated, cloud-based utility model will help firms future proof their capital markets platform and capitalise on the many benefits of FX clearing.

Copyright © 2022, Calypso Technology, Inc. and AxiomSL, Inc. All rights are reserved. The copyright in the content of this article (other than any third-party comments and quotations) are owned by Calypso Technology, Inc. and AxiomSL, Inc., respectively. No part of this article may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of Calypso Technology, Inc. and AxiomSL, Inc.

Please see additional legal terms by visiting https://adenza.com/additional-legal-terms

It mandated that counterparties post a new two-way initial margin (IM) in segregated accounts. Although cash-settled products fall outside UMR, unsettled FX forwards are included in the Average Annual Notional Amount (AANA) calculation that determines whether a firm is in scope for UMR and, therefore, must post IM when it exceeds the relevant UMR threshold. The bilateral margin requirement created additional collateral and capital costs that incited firms to consider more cost-effective clearing channels.

Surge in FX Clearing

To avoid costly UMR compliance, firms now aim to reduce AANA by clearing more products. Central counterparty clearing houses (CCPs) offer FX netting, trade compression and cheaper IM, enabling firms to optimise their collateral positions on a portfolio basis and, thereby, decrease their operational and settlement costs.

The UMR-driven push to clear more products has been one of the main drivers of a huge surge in demand for FX clearing and the commensurate expansion of CCPs’ support of vanilla FX products (spot, forwards, swaps). Firms clear FX via global CCPs for non-mandated products (e.g. FX non-deliverable forwards (NDF) and cash-settled FX products). Encompassing approximately 1,200 firms, UMR’s six phases have gone live, progressing as shown in Figure 1.

Figure 1

UMR adoption has generated an exponential growth in regulatory IM, driving more focus on collateral management and optimisation. In its Margin Survey Year-End 2021, ISDA notes that Phase 1 firms collected US$286.0 billion of IM for non-cleared derivatives transactions at year-end 2021, a 38.0 per cent increase versus the US$207.3 billion of IM that Phase 1 firms collected at year-end 2020 — as ISDA shows in Figure 2.

Figure 2

FX clearing’s many benefits

Across the board, firms can benefit by opting to clear all FX products, mandated or not. We discuss nine of the most compelling drivers here.

Capital efficiency and margin optimisation: At the start of FX clearing, studies were done to assess its benefits in the context of incoming margin rules. One such study was done by Greenwich Associates, titled “FX Options in the Age of Uncleared Margin Rules”, in which they indicated that FX options would require significantly less margin and capital and could be approximately 86 per cent more capital efficient than bilateral positions that need to post IM under UMR.

CCP clearing improves operational efficiency in addition to vastly improving balance-sheet positions and minimising other regulatory capital charges, as the following methodologic, transactional and experiential observations indicate.

Margin period of risk (MPOR): The ISDA Standard Initial Margin Model (SIMM), for example, uses a 10-day MPOR, whereas clearing houses (e.g. CME, LCH) use a five-day MPOR for house-clearing and a seven-day MPOR for client-clearing, resulting in lower margin exposures for cleared trades.

Risk-weighted assets (RWA): Basel III attributes lower counterparty risk-weights to a CCP than to a bilateral counterparty. Therefore, a firm’s RWA and leverage ratio profiles benefit, and the netting effects of consolidating positions against a single counterparty contribute to reducing overall capital requirements.

In addition to clearing bilateral products, firms clearing listed FX options through a CCP benefit from risk-offsetting and cross-margining methodologies by which their overall IM requirements decrease significantly. Given the UMR changes, and that firms have experienced a deterioration in the quality of bilateral FX options quotes, many traders now consider listed FX options as a viable alternative for managing their OTC portfolios.

To effectively select whether to use a cleared or uncleared channel and assess potential capital-reduction benefits, firms increasingly want the capability to simulate pre-trade IM at the portfolio level in real time — directly within their systems.

Netting/Compression: Compression eliminates economically redundant derivatives positions and thereby reduces outstanding contracts. CCP-enabled FX blending further reduces the number of open trades while keeping the original risk profile the same and contributing to operational efficiency.

Tools help firms perform multilateral netting that:

• reduces gross and net notional positions

• enhances capital efficiency and leverage ratios

• helps manage counterparty credit risk

• reduces operational risks and costs

Fewer line items require less reconciliation and reduce netted settlement. Multilateral netting enables firms to hold a single position per instrument (e.g. CCY Pair/Settle Date), rather than servicing individual lines with each bilateral counterparty and holding complex ISDA master agreements and/or credit support annexes (CSA).

No disputes, less management: CCPs use standardised market data per industry best practice to calculate Variation Margin (VM), Price Alignment Interest (PAI) and a robust risk methodology to calculate IM. This discipline eliminates disputes on VM and IM calls versus bilateral trades.

Operational efficiency: Utilising a single clearing agreement provides access to the full liquidity available in FX futures and options and eliminates the need for complex ISDA agreements and/or CSAs with multiple bilateral counterparties.

Settlement and trading platforms support: CLS delivers settlement, processing and data solutions launched by CLSClearedFX — the first Payment-versus-Payment (PvP) settlement service specifically designed for OTC-cleared FX derivatives. The CCP CLS unique cycle provides settlement certainty and netting benefits for OTC FX and cross-currency swaps members. Therefore, CCPs and clearing members can settle cleared FX products safely and effectively.

Settlement netting: For those firms using self-clearing, CCP clearing can provide an effective mechanism to:

• free up bilateral credit lines

• access more liquidity providers

• achieve netting for daily settlements

• automate the trade allocation process

Buy-side firms can aggregate their positions in a single account directly with a CCP or via a futures commission merchant (FCM). This reduces settlement risk as most CCPs use CLS’s PvP, whereby all settlements are netted across positions by currency.

Cheapest-to-Deliver (CTD) collateral: While keeping a minimum margin level is critical, a key goal is to minimise collateral cost with CTD collateral. CCPs allow firms to post a variety of collateral, whereas bilateral CSAs limit collateral types (including government securities, ABS, MBS and corporate bonds). Some CCPs are using real-time collateral optimisation through Euroclear Bank, offering collateral allocation and substitution for FCMs and end users.

Ringfencing collateral: CCPs support various models such as the individual segregated model (asset seg/value seg), which allows firms to ringfence non-cash collateral and help safeguard underlying collateral from defaulting. These structures facilitate the porting of trades facing the defaulting FCM.

Portfolio/cross-margining and capital reduction: Regulatory bodies have authorised CCPs to conduct portfolio margining across exchange-traded derivatives (ETD) and OTC FX products. Trading in a regulated, transparent, all-to-all marketplace with firm liquidity offers attractive qualitative benefits. Quantitatively, it also helps reduce counterparty credit risk (CCR). According to the CME Group, a listed FX Options portfolio reduces IM to 0.8 per cent of notional compared with 2.6 per cent of notional for a comparable portfolio with bilateral SIMM requirements. This approach results in a cost differential of 595 per cent, as delineated in Figure 3 from the CME's article, titled "Listed FX Options: A Capital-efficient Low-cost Solution".

Figure 3

The benefits of clearing extend to CCR and related capital costs. Per Basel III reforms, financial institutions are now subject to the standardised approach for counterparty credit risk’s (SA-CCR) capital charge. Optimised collateralised exposure can significantly reduce SA-CCR if firms clear their OTC trades. Indeed, the MPOR for cleared trades drops from 10 days (for non-cleared) to five to seven days. Cleared trades are aggregated in a CCP or clearing member netting set, which generates additional risk netting resulting in smaller exposures. Lastly, smaller risk weights are applied to cleared trades, contributing to lower RWA.

In summary, by selecting clearing channels, the total cost of the trade can be fully optimised as shown in Figure 4, illustrating trade decomposition into XVA (credit valuation adjustment (CVA), funding valuation adjustment (FVA) and capital valuation adjustment (KVA)), IM and SA-CCR exposure.

Figure 4

A dramatically changed landscape

Overall, firms are on board with FX clearing to avoid the costly UMR margins and to leverage the operational and capital efficiency offered by the clearing world. The UMR Phase 6 cohort go-live on 1 September 2022 added approximately 800 entities to the expanded clearing landscape. We expect continued growth across participants, trade volumes and FX product types. The LCH’s data of August 2022, shown in Figure 5 on the followng page, substantiates this growth trend.

Figure 5

FX clearing coverage is expanding, with numerous FX programmes offered by clearing providers, as illustrated by our tabulation of 2 November 2022, shown in Figure 6 on the following page. We expect these offerings to grow over the next few years.

Figure 6

Gaining from change

Considering the changes and benefits highlighted here, firms stand to gain from the FX clearing function’s dramatic change — an expansion boosted by mandatory clearing, UMR, and CCPs’ attractive cross-margining, netting and compression programmes.

To take full advantage of this surge in FX clearing, firms need end-to-end clearing, collateral and risk mitigation with TCO optimisation. Selecting a utility or managed-service model enables firms to quickly onboard and/or start self- and client-clearing businesses without the burdens of maintaining system infrastructure, connectivity to various CCPs, software implementation and upgrades, and BAU clearing operations staff.

In closing, we share our key learning from this discussion. We will continue to face unpredictable change in the margin, collateral and clearing landscapes. Only by being proactively ready for change will firms be able to adapt, evolve and optimise. Opting for a consolidated, cloud-based utility model will help firms future proof their capital markets platform and capitalise on the many benefits of FX clearing.

Copyright © 2022, Calypso Technology, Inc. and AxiomSL, Inc. All rights are reserved. The copyright in the content of this article (other than any third-party comments and quotations) are owned by Calypso Technology, Inc. and AxiomSL, Inc., respectively. No part of this article may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of Calypso Technology, Inc. and AxiomSL, Inc.

Please see additional legal terms by visiting https://adenza.com/additional-legal-terms

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times