Cleared repo feels boost of monetary normalisation tailwind

24 January 2023

Bob Currie speaks to Eurex Repo’s Frank Gast, Carsten Hiller and Jonathan Lombardo about the rediscovery of GC Pooling as a liquidity management solution, steps to attract buy-side customers to cleared repo and the organisation’s strategic focus for 2023 and beyond

Image: Frank Gast

Image: Frank Gast

The European monetary policy environment has entered a phase of transition, moving from an extended period of low interest rates and abundant liquidity, fuelled by central bank liquidity support, to a post-pandemic landscape of accelerating inflation, rising interest rates and indication from central banks that they intend to accelerate the unwind of their asset purchase programmes.

European Central Bank (ECB) deputy president Luis de Guindos noted recently that the expansionary fiscal policy and accommodative monetary policy of recent years are now behind us and leading central banks have moved to a phase of “normalisation” — a strategy, in central banker jargon, that aims to shift monetary policy from an expansionary objective, designed to raise the path of inflation, to one designed to cement inflation at the central bank’s target level.

For the ECB, like the Bank of England and the Federal Reserve, this transition has been characterised by one of the most aggressive tightening phases in its history. The ECB confirmed at its December 2022 meeting that it will provide further details in February of its plans to reduce its Asset Purchase Programme (APP) holdings. It had already indicated in its autumn statements that it wished to recalibrate the terms of its Targeted Longer-term Refinancing Operations (TLTRO), with banks repaying €296 billion in TLTRO loans in November and €447 billion a month later, with a further €52 billion in TLTRO holdings also maturing in December.

According to Carsten Hiller, head of fixed income sales for Continental Europe for derivatives, funding and financing at Eurex, signals from the ECB from the late spring 2022 that it intended to raise interest rates have provided a stimulus to financing activity through Eurex Repo into H2 2022 and into the early weeks of 2023.

“With indication of proposed interest rate hikes, this has prompted a steepening of the yield curve and triggered the first term trading opportunities in GC Pooling for a number of years,” says Hiller. After almost a decade of negative interest rates, the ECB policy rate shifted back into positive territory in September, prompting a pick up in trading activity in GC Pooling, particularly for longer-dated trades.

During Q2 and Q3, Hiller notes that for overnight and short-dated transactions, trading activity continued to be dominated by buy-side firms using Eurex Repo as a cash management tool to invest their surplus liquidity. Moving into Q4, however, Hiller notes a stream of banking participants returning to the GC Pooling market — some of which had been absent for some time, given the ready access to funding through central bank liquidity support programmes. “As central bank normalisation measures have begun to take effect, this provided a stimulus for banks to step up their activity not only for specials trading but also for wider financing and liquidity management purposes”, says Hiller.

“While in the late spring and early summer 2022, activity was predominantly at the longer end, as we move into 2023 the majority of trading and volumes in GC Pooling has been in short maturities, from overnight up to one week,” adds Hiller. “This is a positive sign, with market participants starting to rediscover GC pooling as a liquidity management product.”

With these developments, Eurex Repo has seen powerful growth in its cleared repo markets, with total aggregate cleared volume rising 55 per cent year-on-year across all markets. Average daily traded volume for GC and Special Repo has grown approximately 58 per cent YoY.

For GC Pooling, average daily traded volumes have risen 51 per cent YoY, with tighter liquidity conditions in the eurozone motivating banks to re-examine their funding sources and with previously inactive bank participants returning to the GC Pooling marketplace.

Hiller expects this trend to accelerate during 2023. “We anticipate that activity in Eurex’s GC Pooling business will increase significantly, given the reduction in excess liquidity, the potential for further interest rate hikes and the more attractive GC Pooling rates for the market,” he says.

Buy-side access

Foremost in its development priorities, Eurex Repo is focused on attracting more buy-side customers into cleared repo, building GC Pooling volumes, and in improving market share in the B2B special and GC repo segments.

According to Jonathan Lombardo, Eurex Clearing’s head of FIC derivatives and repo sales for Northern Europe, this ambition to bring more buy-side firms into centrally cleared repo is part of Eurex’s broader strategy to promote buy-side clearing access for a wider range of instruments, including exchange-traded and OTC derivatives. “This sits at the heart of our focus for 2023 and into 2024,” he says. “Use of a CCP adds additional stability, standardisation and risk mitigation that fits well with a buy-side trading model. Beneficial owners are looking for direct access that allows them to have greater control over their clearing activity, to manage their risk in a centrally cleared environment and to have alternative options outside of traditional sponsored products. Eurex’s business continues to grow among asset managers, pensions and insurance funds that seek this additional choice and control.”

Through ISA Direct and ISA Direct Indemnified, Eurex Clearing aims to combine the benefits of direct clearing access for buy-side firms with the advantages of traditional sponsored access via a clearing member. This establishes a principal-client relationship between the buy-side firm and the CCP, but with a clearing agent performing additional service functions to enhance the clearing solution.

“From a beneficial owner standpoint, the ISA Direct model is now well established and we have several large institutional investors on board, including sizeable Dutch and German pension funds,” says Lombardo. “Our reach has also extended geographically to some large Nordic asset owners.” In many cases, these clients have been trading actively as cash investors to meet their liquidity management requirements. “But as interest rates rise and excess liquidity gradually declines, we expect more activity from this community — for example, also through long interest rate swap positions,” he says.

In turn, this activity has set the stage for the advance of Eurex Repo’s ISA Direct Indemnified, a solution targeted principally at hedge funds, which was technically launched in June 2022 and is now building activity from early adopter clients.

From the perspective of buy-side and banking customers, the ISA Direct Indemnified product has an important role in incubating new trading relationships, says Lombardo. As noted, this provides direct access for buy-side clients to cleared repo. For bank counterparties, this solution provides access to cash providers at significant capital saving by trading via a CCP. By enabling this repo trading activity to take place in a centrally cleared environment, this frees up critical balance sheet that the bank can commit to other business activities.

“In doing so, the objective is to extend cleared repo opportunities out to a new market segment,” says Frank Gast, managing director at Eurex Repo and head of Eurex fixed income, funding and financing sales for Europe. “This provides early mover advantage in a European marketplace where more and more clearing houses are likely to be seeking to extend direct clearing access for buy-side customers.”

The creation of the Eurex Clearing’s Partnership Program in 2018 has been important to the incubation of these direct access solutions targeted at the buy-side. The Partnership Program was created for the OTC interest rate derivatives segment in January 2018 and extended to the repo segment later that year, with the objective of improving service choice and efficiency for Special Repo and GC products and to encourage take up in the D2C repo segment. This provided revenue sharing opportunities to the 10 most active programme participants in the Special Repo and GC segments in Eurex Clearing, along with involvement in Eurex Clearing’s and Eurex Repo’s committee structure and governance. This provides a conduit through which repo trading and clearing customers can make recommendations to the Eurex Clearing and Eurex Repo executive boards through their participation in the Repo Board Advisory Committee.

This involvement from leading sell-side participants has been important in shaping the design of these direct access clearing solutions for buy-side customers, as well as supporting the pilot, testing and release of these solutions as clearing brokers.

Considered together, Gast indicates that this investment in new product solutions is translating into an expanding pipeline of new clients for the repo segment. “Although client expansion for GC Pooling was subdued for a time owing to the ready access to central bank liquidity, Eurex Repo now has a strong pipeline of clients waiting to onboard to the GC Pooling service and to ISA Direct,” says Gast. “Significantly, approximately 50 per cent of these prospect clients are buy-side firms.”

Moreover, while Eurex already has multiple members from the US or Asia connected for derivatives trading and clearing, it has previously only offered repo clearing to European-domiciled entities. This is changing with the launch of the ISA Direct Indemnified clearing model, with Eurex Repo now extending access through this channel for eligible Cayman Island-based entities.

Additionally, Eurex Repo intends to expand membership to US and Canadian-domiciled banks and broker-dealers in 2023, many of which are already active participants in European fixed income futures and options markets. “Direct access to Eurex for repo will enable these entities to manage their European government bond book more efficiently and to source governments deliverable in our suite of government bond futures,” says Gast.

GC regeneration

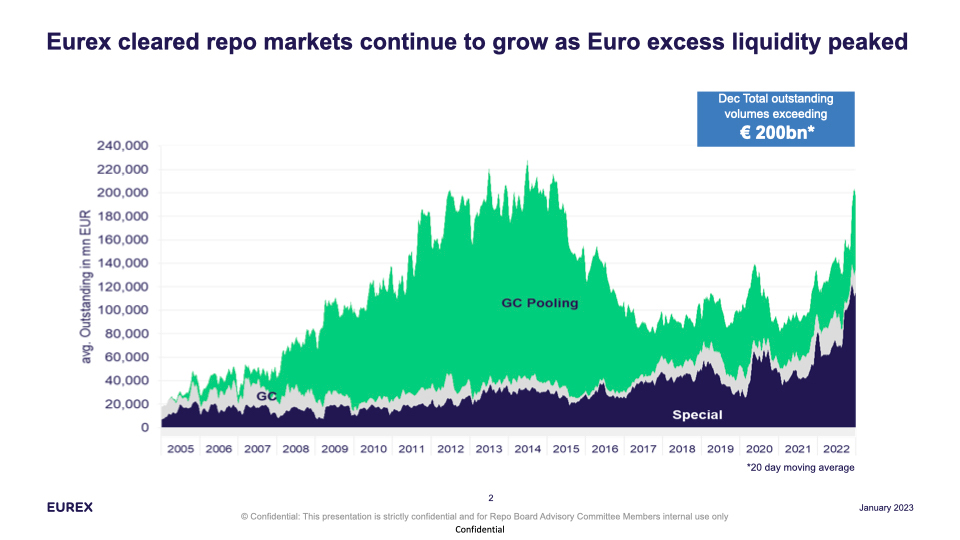

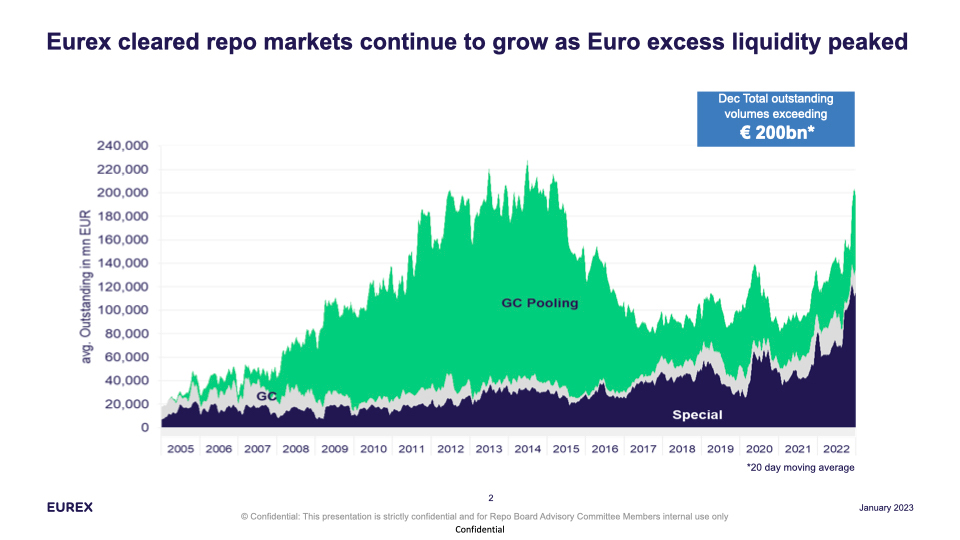

A mark of the regeneration of the GC Pooling market during 2022 is that combined outstanding across Eurex’s Specials Repo and GC financing segments currently stands at close to €200 billion, more than 80 per cent of its peak value of €240 billion attained in 2015 (see fig 1). Significantly, in 2015 more than four-fifths of this notional outstanding was represented by GC financing, with less than 20 per cent coming from specials. In 2023, the picture looks very different, with close to two-thirds of this notional outstanding generated from Specials Repo, with the balance coming from GC.

Figure 1

In recent times, Specials Repo through the Eurex Repo platform has been a major revenue driver, confirms Gast, particularly to support a number of European debt management offices which have supplemented sovereign debt issuance via auctions with financing of government bond issues via Eurex Repo. This includes active financing activities against German government bonds, but also in French and Spanish government bonds for which there has been strong borrower demand.

Additionally, Eurex Repo retains a dominant position in the Supranationals, Sub-sovereigns and Agencies (SSA) segment. “This is a rapidly growing area on our trading platform and a vibrant part of the Next Generation Capital (NGC) markets,” says Gast.

However, the aim is not to force central clearing onto all trading scenarios. “We have sometimes been told by market participants that central clearing is not the solution to all their problems,” says Gast. “But that is not the objective in creating these clearing solutions.”

Rather, he says, central clearing offers a valuable risk management tool, the benefits of multilateral netting and anonymity, and significant improvements in capital efficiency — benefits that clearing customers should be able to access when appropriate. “The benefits of credit risk mitigation, stability and capital efficiency should not be understated, particularly in stress conditions,” adds Lombardo. “But we do not advance central clearing as a universal solution for every trading relationship and transaction.”

Looking back to 2005 when GC Pooling was first introduced, Gast recalls how it received initial feedback from some organisations indicating they did not have a need for a centrally cleared solution for financing GC baskets. With the arrival of the 2008 financial crisis, however, many recognised its value when financing dried up through other channels. “In this context, the GC Pooling market was one of the few funding channels to keep functioning, supported by the risk management benefits, standardisation and anonymity afforded by the CCP,” says Gast. “For some banks, continued access to this GC Pooling liquidity source was essential to their survival.”

ECMS

In early December, the ECB Governing Council took a decision to delay the launch of the Eurosystem Collateral Management System (ECMS), moving the release date back from November 2023 to 8 April 2024. This decision was taken to minimise the impact of a four-month delay in the release of the upgraded TARGET2, the Eurosystem’s new real-time gross settlement system, which was moved to 20 October 2022.

Clearstream has been making detailed preparations with clients during 2022 to accommodate the release of ECMS, the Eurosystem’s centralised platform for collateral management that will replace the 20 existing collateral management systems run by national central banks to support monetary policy credit operations.

To manage internal preparations with clients, Clearstream completed a large technical migration for GC Pooling at the end of October, migrating more than 140 joint clients of Eurex Repo, Eurex Clearing and Clearstream onto the new account structure and collateral agreements that will support ECMS when it goes live under the revised launch schedule. This new configuration will enable central bank money settlement of GC Pooling collateral baskets via dedicated cash accounts in TARGET2-Securities (T2S), offering real DvP settlement in T2S, rather than conditional DvP previously offered when GC Pooling baskets settled on the T2 platform. Among other benefits, this transition will also support partial settlement, providing a mechanism to boost settlement efficiency and reducing fail rates for collateral settlement via ECMS.

While this complex migration resulted in a slight tail off in GC Pooling volumes in October through to mid-November, Frank Gast explains that this migration and testing programme is now complete for more than 140 clients, confirming their readiness to settle collateral through ECMS when this goes live and their alignment with the new Single Collateral Management Rulebook for Europe (SCORE) that will define the regulatory framework for ECMS operations.

Sustainable finance

In parallel with the strategic priorities highlighted in this article, Deutsche Börse Group continues to work with HQLAX — as major shareholder and Trusted Third Party (TTP) — to support efficient collateral transformation trading, through which collateral can be exchanged on a delivery-versus-delivery basis through tokenised transfer of ownership, without the need to move the underlying securities between the counterparties’ custodian accounts.

More broadly, Eurex is confident that GC Pooling will play a vital role in banks’ financing strategies with the pick up in term repo volumes and short-term financing activity observed in late 2022 and into 2023 and beyond. With the ECB tightening scrutiny of banks’ financing sources — its concerns about banks’ heavy reliance on TLTRO III funding were foremost in its Supervision Priorities for 2023-25 — it is likely to monitor bank TLTRO exit strategies closely to ensure that banks are able to diversify their funding structures and develop credible multi-year funding plans. “We believe that cleared repo offers unparalleled advantages for balance sheet management through multilateral netting, which can be maximised with client adoption of direct access repo clearing models,” says Hiller.

More broadly, there is potential for strong growth in repo transactions which are related to sustainable finance. The green transition to a carbon-neutral world is likely to require large amounts of funding, as confirmed recently by the Climate Bonds Initiative which proposes that annual issuance of close to US$5 trillion in green bonds will be required by 2025 to support this green transition.

To complement this, central banks are expected to adapt their collateral frameworks to require ESG-compliant collateral in credit operations. The ECB is likely to limit the share of pledged assets issued by entities with a high carbon footprint and may impose special conditions on central bank operations, requiring that collateral used to access central bank liquidity must meet required sustainability criteria.

Additionally, under the EU Taxonomy, the introduction of the Green Asset Ratio will require, by 2024 at latest, that banks invest a specified percentage of their assets in green projects and sustainable assets.

“It is in exactly these areas that the repo market can play an active role with regard to sustainable finance and with providing liquidity for primary and secondary markets, as well as supporting diversified access to funding,” concludes Gast.

European Central Bank (ECB) deputy president Luis de Guindos noted recently that the expansionary fiscal policy and accommodative monetary policy of recent years are now behind us and leading central banks have moved to a phase of “normalisation” — a strategy, in central banker jargon, that aims to shift monetary policy from an expansionary objective, designed to raise the path of inflation, to one designed to cement inflation at the central bank’s target level.

For the ECB, like the Bank of England and the Federal Reserve, this transition has been characterised by one of the most aggressive tightening phases in its history. The ECB confirmed at its December 2022 meeting that it will provide further details in February of its plans to reduce its Asset Purchase Programme (APP) holdings. It had already indicated in its autumn statements that it wished to recalibrate the terms of its Targeted Longer-term Refinancing Operations (TLTRO), with banks repaying €296 billion in TLTRO loans in November and €447 billion a month later, with a further €52 billion in TLTRO holdings also maturing in December.

According to Carsten Hiller, head of fixed income sales for Continental Europe for derivatives, funding and financing at Eurex, signals from the ECB from the late spring 2022 that it intended to raise interest rates have provided a stimulus to financing activity through Eurex Repo into H2 2022 and into the early weeks of 2023.

“With indication of proposed interest rate hikes, this has prompted a steepening of the yield curve and triggered the first term trading opportunities in GC Pooling for a number of years,” says Hiller. After almost a decade of negative interest rates, the ECB policy rate shifted back into positive territory in September, prompting a pick up in trading activity in GC Pooling, particularly for longer-dated trades.

During Q2 and Q3, Hiller notes that for overnight and short-dated transactions, trading activity continued to be dominated by buy-side firms using Eurex Repo as a cash management tool to invest their surplus liquidity. Moving into Q4, however, Hiller notes a stream of banking participants returning to the GC Pooling market — some of which had been absent for some time, given the ready access to funding through central bank liquidity support programmes. “As central bank normalisation measures have begun to take effect, this provided a stimulus for banks to step up their activity not only for specials trading but also for wider financing and liquidity management purposes”, says Hiller.

“While in the late spring and early summer 2022, activity was predominantly at the longer end, as we move into 2023 the majority of trading and volumes in GC Pooling has been in short maturities, from overnight up to one week,” adds Hiller. “This is a positive sign, with market participants starting to rediscover GC pooling as a liquidity management product.”

With these developments, Eurex Repo has seen powerful growth in its cleared repo markets, with total aggregate cleared volume rising 55 per cent year-on-year across all markets. Average daily traded volume for GC and Special Repo has grown approximately 58 per cent YoY.

For GC Pooling, average daily traded volumes have risen 51 per cent YoY, with tighter liquidity conditions in the eurozone motivating banks to re-examine their funding sources and with previously inactive bank participants returning to the GC Pooling marketplace.

Hiller expects this trend to accelerate during 2023. “We anticipate that activity in Eurex’s GC Pooling business will increase significantly, given the reduction in excess liquidity, the potential for further interest rate hikes and the more attractive GC Pooling rates for the market,” he says.

Buy-side access

Foremost in its development priorities, Eurex Repo is focused on attracting more buy-side customers into cleared repo, building GC Pooling volumes, and in improving market share in the B2B special and GC repo segments.

According to Jonathan Lombardo, Eurex Clearing’s head of FIC derivatives and repo sales for Northern Europe, this ambition to bring more buy-side firms into centrally cleared repo is part of Eurex’s broader strategy to promote buy-side clearing access for a wider range of instruments, including exchange-traded and OTC derivatives. “This sits at the heart of our focus for 2023 and into 2024,” he says. “Use of a CCP adds additional stability, standardisation and risk mitigation that fits well with a buy-side trading model. Beneficial owners are looking for direct access that allows them to have greater control over their clearing activity, to manage their risk in a centrally cleared environment and to have alternative options outside of traditional sponsored products. Eurex’s business continues to grow among asset managers, pensions and insurance funds that seek this additional choice and control.”

Through ISA Direct and ISA Direct Indemnified, Eurex Clearing aims to combine the benefits of direct clearing access for buy-side firms with the advantages of traditional sponsored access via a clearing member. This establishes a principal-client relationship between the buy-side firm and the CCP, but with a clearing agent performing additional service functions to enhance the clearing solution.

“From a beneficial owner standpoint, the ISA Direct model is now well established and we have several large institutional investors on board, including sizeable Dutch and German pension funds,” says Lombardo. “Our reach has also extended geographically to some large Nordic asset owners.” In many cases, these clients have been trading actively as cash investors to meet their liquidity management requirements. “But as interest rates rise and excess liquidity gradually declines, we expect more activity from this community — for example, also through long interest rate swap positions,” he says.

In turn, this activity has set the stage for the advance of Eurex Repo’s ISA Direct Indemnified, a solution targeted principally at hedge funds, which was technically launched in June 2022 and is now building activity from early adopter clients.

From the perspective of buy-side and banking customers, the ISA Direct Indemnified product has an important role in incubating new trading relationships, says Lombardo. As noted, this provides direct access for buy-side clients to cleared repo. For bank counterparties, this solution provides access to cash providers at significant capital saving by trading via a CCP. By enabling this repo trading activity to take place in a centrally cleared environment, this frees up critical balance sheet that the bank can commit to other business activities.

“In doing so, the objective is to extend cleared repo opportunities out to a new market segment,” says Frank Gast, managing director at Eurex Repo and head of Eurex fixed income, funding and financing sales for Europe. “This provides early mover advantage in a European marketplace where more and more clearing houses are likely to be seeking to extend direct clearing access for buy-side customers.”

The creation of the Eurex Clearing’s Partnership Program in 2018 has been important to the incubation of these direct access solutions targeted at the buy-side. The Partnership Program was created for the OTC interest rate derivatives segment in January 2018 and extended to the repo segment later that year, with the objective of improving service choice and efficiency for Special Repo and GC products and to encourage take up in the D2C repo segment. This provided revenue sharing opportunities to the 10 most active programme participants in the Special Repo and GC segments in Eurex Clearing, along with involvement in Eurex Clearing’s and Eurex Repo’s committee structure and governance. This provides a conduit through which repo trading and clearing customers can make recommendations to the Eurex Clearing and Eurex Repo executive boards through their participation in the Repo Board Advisory Committee.

This involvement from leading sell-side participants has been important in shaping the design of these direct access clearing solutions for buy-side customers, as well as supporting the pilot, testing and release of these solutions as clearing brokers.

Considered together, Gast indicates that this investment in new product solutions is translating into an expanding pipeline of new clients for the repo segment. “Although client expansion for GC Pooling was subdued for a time owing to the ready access to central bank liquidity, Eurex Repo now has a strong pipeline of clients waiting to onboard to the GC Pooling service and to ISA Direct,” says Gast. “Significantly, approximately 50 per cent of these prospect clients are buy-side firms.”

Moreover, while Eurex already has multiple members from the US or Asia connected for derivatives trading and clearing, it has previously only offered repo clearing to European-domiciled entities. This is changing with the launch of the ISA Direct Indemnified clearing model, with Eurex Repo now extending access through this channel for eligible Cayman Island-based entities.

Additionally, Eurex Repo intends to expand membership to US and Canadian-domiciled banks and broker-dealers in 2023, many of which are already active participants in European fixed income futures and options markets. “Direct access to Eurex for repo will enable these entities to manage their European government bond book more efficiently and to source governments deliverable in our suite of government bond futures,” says Gast.

GC regeneration

A mark of the regeneration of the GC Pooling market during 2022 is that combined outstanding across Eurex’s Specials Repo and GC financing segments currently stands at close to €200 billion, more than 80 per cent of its peak value of €240 billion attained in 2015 (see fig 1). Significantly, in 2015 more than four-fifths of this notional outstanding was represented by GC financing, with less than 20 per cent coming from specials. In 2023, the picture looks very different, with close to two-thirds of this notional outstanding generated from Specials Repo, with the balance coming from GC.

Figure 1

In recent times, Specials Repo through the Eurex Repo platform has been a major revenue driver, confirms Gast, particularly to support a number of European debt management offices which have supplemented sovereign debt issuance via auctions with financing of government bond issues via Eurex Repo. This includes active financing activities against German government bonds, but also in French and Spanish government bonds for which there has been strong borrower demand.

Additionally, Eurex Repo retains a dominant position in the Supranationals, Sub-sovereigns and Agencies (SSA) segment. “This is a rapidly growing area on our trading platform and a vibrant part of the Next Generation Capital (NGC) markets,” says Gast.

However, the aim is not to force central clearing onto all trading scenarios. “We have sometimes been told by market participants that central clearing is not the solution to all their problems,” says Gast. “But that is not the objective in creating these clearing solutions.”

Rather, he says, central clearing offers a valuable risk management tool, the benefits of multilateral netting and anonymity, and significant improvements in capital efficiency — benefits that clearing customers should be able to access when appropriate. “The benefits of credit risk mitigation, stability and capital efficiency should not be understated, particularly in stress conditions,” adds Lombardo. “But we do not advance central clearing as a universal solution for every trading relationship and transaction.”

Looking back to 2005 when GC Pooling was first introduced, Gast recalls how it received initial feedback from some organisations indicating they did not have a need for a centrally cleared solution for financing GC baskets. With the arrival of the 2008 financial crisis, however, many recognised its value when financing dried up through other channels. “In this context, the GC Pooling market was one of the few funding channels to keep functioning, supported by the risk management benefits, standardisation and anonymity afforded by the CCP,” says Gast. “For some banks, continued access to this GC Pooling liquidity source was essential to their survival.”

ECMS

In early December, the ECB Governing Council took a decision to delay the launch of the Eurosystem Collateral Management System (ECMS), moving the release date back from November 2023 to 8 April 2024. This decision was taken to minimise the impact of a four-month delay in the release of the upgraded TARGET2, the Eurosystem’s new real-time gross settlement system, which was moved to 20 October 2022.

Clearstream has been making detailed preparations with clients during 2022 to accommodate the release of ECMS, the Eurosystem’s centralised platform for collateral management that will replace the 20 existing collateral management systems run by national central banks to support monetary policy credit operations.

To manage internal preparations with clients, Clearstream completed a large technical migration for GC Pooling at the end of October, migrating more than 140 joint clients of Eurex Repo, Eurex Clearing and Clearstream onto the new account structure and collateral agreements that will support ECMS when it goes live under the revised launch schedule. This new configuration will enable central bank money settlement of GC Pooling collateral baskets via dedicated cash accounts in TARGET2-Securities (T2S), offering real DvP settlement in T2S, rather than conditional DvP previously offered when GC Pooling baskets settled on the T2 platform. Among other benefits, this transition will also support partial settlement, providing a mechanism to boost settlement efficiency and reducing fail rates for collateral settlement via ECMS.

While this complex migration resulted in a slight tail off in GC Pooling volumes in October through to mid-November, Frank Gast explains that this migration and testing programme is now complete for more than 140 clients, confirming their readiness to settle collateral through ECMS when this goes live and their alignment with the new Single Collateral Management Rulebook for Europe (SCORE) that will define the regulatory framework for ECMS operations.

Sustainable finance

In parallel with the strategic priorities highlighted in this article, Deutsche Börse Group continues to work with HQLAX — as major shareholder and Trusted Third Party (TTP) — to support efficient collateral transformation trading, through which collateral can be exchanged on a delivery-versus-delivery basis through tokenised transfer of ownership, without the need to move the underlying securities between the counterparties’ custodian accounts.

More broadly, Eurex is confident that GC Pooling will play a vital role in banks’ financing strategies with the pick up in term repo volumes and short-term financing activity observed in late 2022 and into 2023 and beyond. With the ECB tightening scrutiny of banks’ financing sources — its concerns about banks’ heavy reliance on TLTRO III funding were foremost in its Supervision Priorities for 2023-25 — it is likely to monitor bank TLTRO exit strategies closely to ensure that banks are able to diversify their funding structures and develop credible multi-year funding plans. “We believe that cleared repo offers unparalleled advantages for balance sheet management through multilateral netting, which can be maximised with client adoption of direct access repo clearing models,” says Hiller.

More broadly, there is potential for strong growth in repo transactions which are related to sustainable finance. The green transition to a carbon-neutral world is likely to require large amounts of funding, as confirmed recently by the Climate Bonds Initiative which proposes that annual issuance of close to US$5 trillion in green bonds will be required by 2025 to support this green transition.

To complement this, central banks are expected to adapt their collateral frameworks to require ESG-compliant collateral in credit operations. The ECB is likely to limit the share of pledged assets issued by entities with a high carbon footprint and may impose special conditions on central bank operations, requiring that collateral used to access central bank liquidity must meet required sustainability criteria.

Additionally, under the EU Taxonomy, the introduction of the Green Asset Ratio will require, by 2024 at latest, that banks invest a specified percentage of their assets in green projects and sustainable assets.

“It is in exactly these areas that the repo market can play an active role with regard to sustainable finance and with providing liquidity for primary and secondary markets, as well as supporting diversified access to funding,” concludes Gast.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times