The FinOptSys journey: not all fintechs are created equal

21 February 2023

Divyesh Bhakta, founder and CEO of FinOptSys, reveals the firm’s road to innovation through key partnerships, product offerings and combating challenges to build the core pieces of its platform

Image: Divyesh Bhakta

Image: Divyesh Bhakta

Fintech companies typically start with a common goal of creating technological solutions for existing inefficiencies. However, the road to innovation and a successful implementation can look vastly different for every organisation. The journey for FinOptSys has been a compelling one, which has incorporated dynamic innovation, perseverance and momentum building — all of which have proven to be accretive to an expanding client base and their evolving needs. At the core of this growth, there must be an indelible desire to make a difference in the industry and create a culture of core values and ethical practices.

Founded in late 2019 by market practitioners for market practitioners, FinOptSys is challenging the status quo and transforming the securities financing business globally. FinOptSys is a state-of-the-art cloud-based software-as-a-service (SaaS) platform that combines artificial intelligence (AI), machine learning, analytics and patent-pending algorithms to power peer-to-peer (P2P), across the entire spectrum of securities financing products (securities lending, repos, swaps) and collateral — including nontraditional and digital assets.

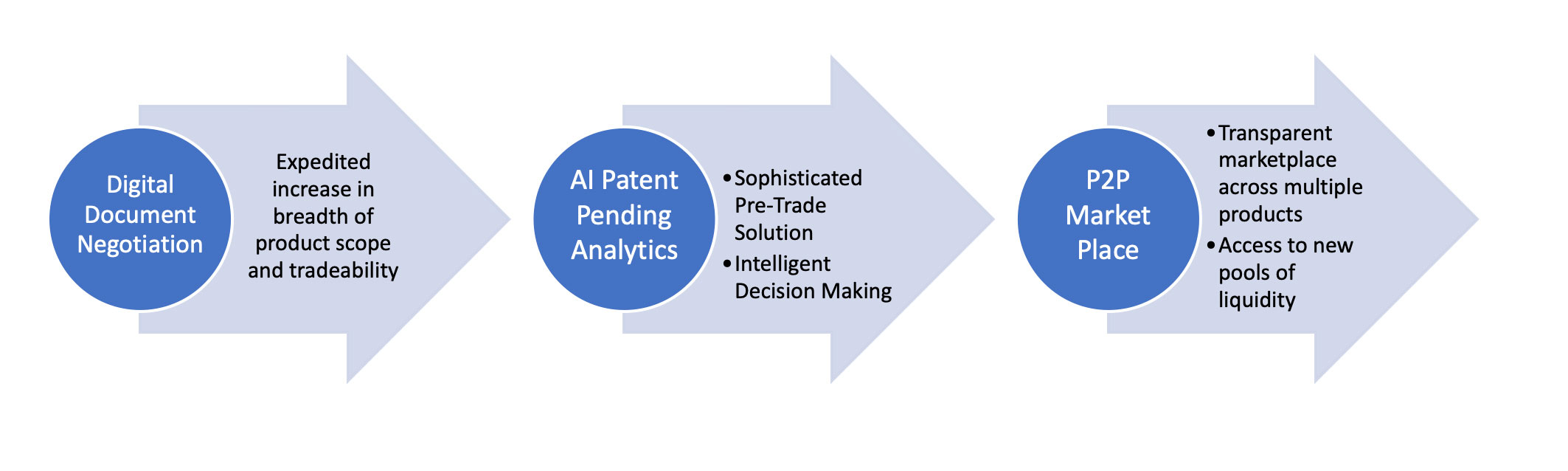

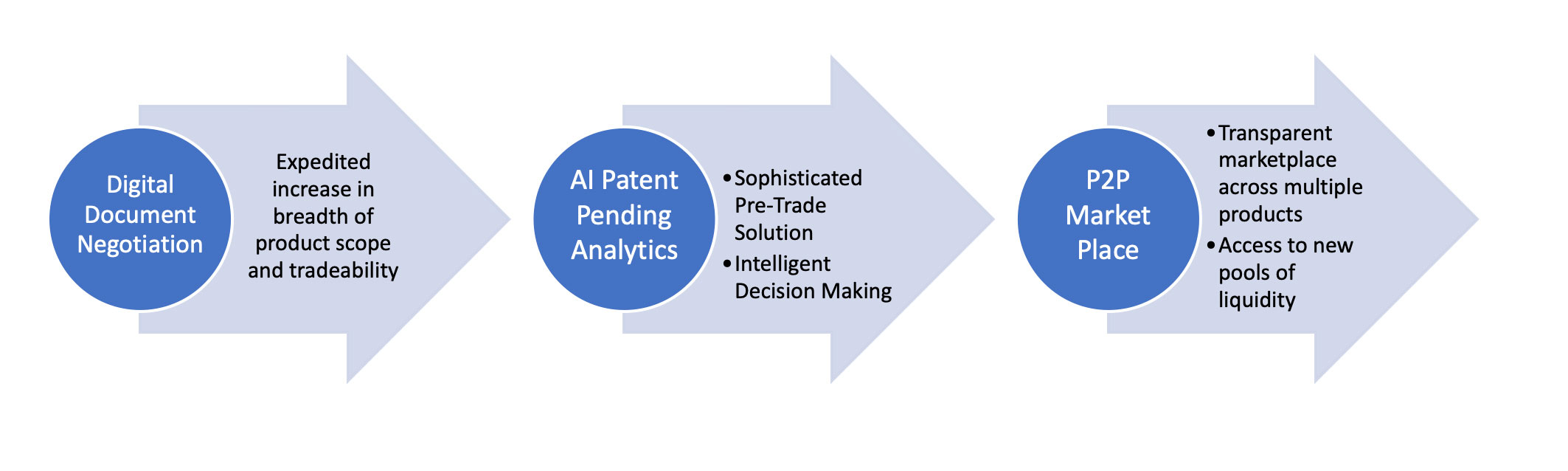

Figure 1

Originally created for the buy-side community to empower clients and enhance their collateral management activities, FinOptSys sought to build and provide an interactive P2P platform that would augment transparency, improve price discovery and increase liquidity in the marketplace. Then the world came to a halt during the global pandemic. This presented a unique challenge to growing the business, especially not having the required facetime and interaction to demo the platform to the buy side. Where there is adversity, there is also opportunity and FinOptSys used this time to expand and enhance its product offerings into a comprehensive, enterprise-wide solution.

This inflection point led to greater innovation on the platform vis-à-vis expanding the breadth of client types and enhancing a real-time analytics suite, thereby increasing client optionality, improving actionable decision-making and allowing firms to proactively manage their financial resources more efficiently. In addition, the creation of a document negotiation module using AI and machine learning allowed users to review, analyse and agree to legal contracts in a fraction of the time from normal convention. The FinOptSys platform transformed into a holistic securities financing solution for clients of any size, with very clear links within the value chain.

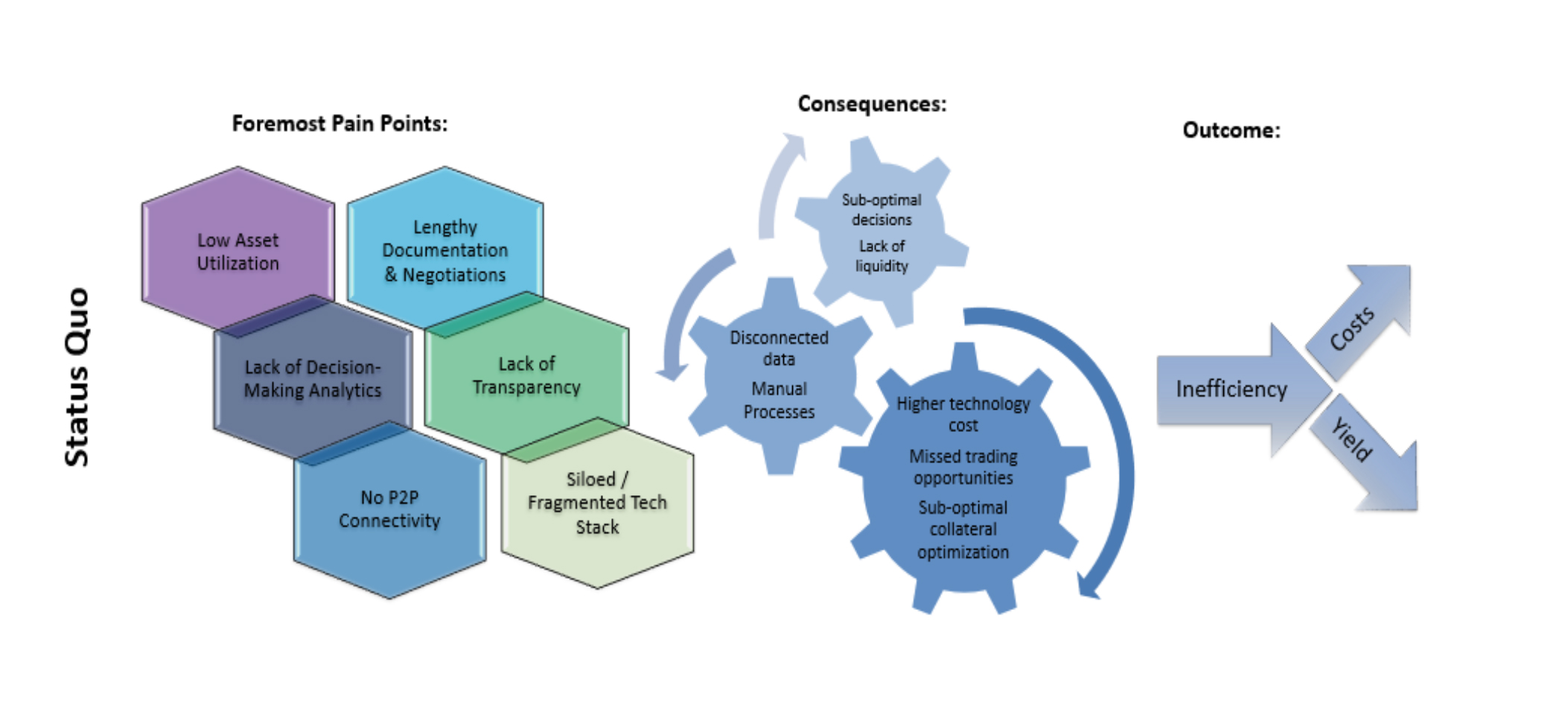

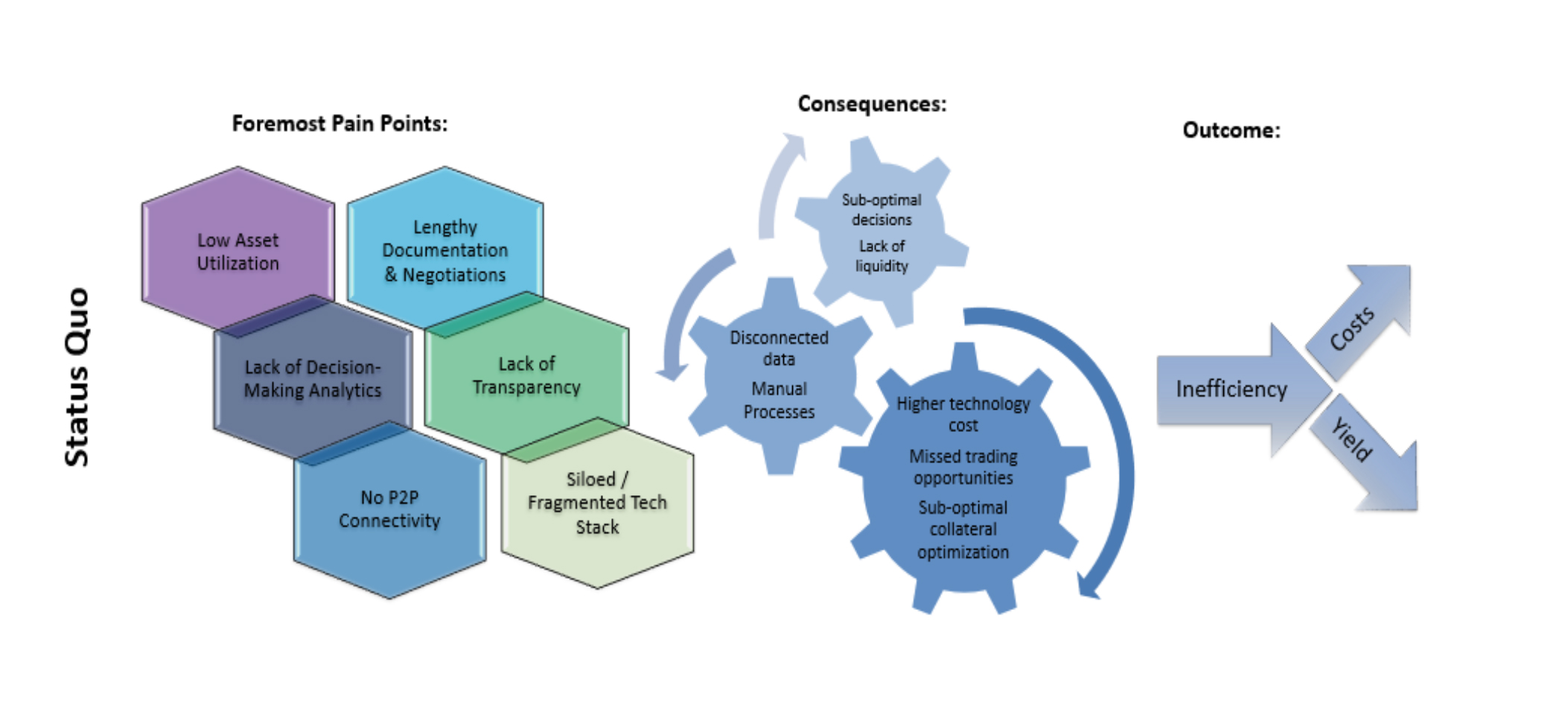

FinOptSys clients were now able to manage their balance sheets proactively and have access to a financial resource management platform that decreased cost, increased yield and asset utilisation, while also connecting to new sources of liquidity. During a pivotal period where product sales growth and financing stagnated due to global and industry challenges, FinOptSys focused on intense product development, and fostering change to meet the needs of the client, by providing a complete enterprise-wide, securities financing solution. Modular in nature and seamlessly sitting on top of any existing systems, clients can focus on how FinOptSys will complement their existing infrastructure, as opposed to what will need to be replaced. Emphasis on improving existing pain points, with up to 30 different modules to choose from, allows customers to move away from the status quo within the securities financing business.

Figure 1

The status quo is exacerbated by legacy systems and an inadequate technology stack to keep pace with dynamic trading requirements and evolving regulatory changes. FinOptSys enabled clients to approach their securities financing business through a holistic lens and reverse the inevitable outcomes of the status quo.

In late 2021, the breadth of the product offering for FinOptSys was very robust. Target clients were impressed and a true endorsement of the platform occurred during a demonstration for securities financing practitioners Roy Zimmerhansl and John Arnesen. As FinOptSys showed every facet of the platform, Zimmerhansl and Arnesen were actively looking for gaps in the system that were not considered. They were unable to ‘break’ the platform and agreed that — regardless of which discipline you come to securities finance from — FinOptSys can “cover your needs and a whole lot more”. This helped to further validate the FinOptSys strategy and vision.

FinOptSys had built the core pieces of a comprehensive securities financing solution, addressing multiple pain points. Creating the product is essential, but so is listening to your customers and having a core team of experienced market specialists and technology experts that can foster a culture of efficient collaboration. This is the FinOptSys way and it helped build significant momentum in a short period of time.

In 2022, this momentum led to the official announcement of a key partnership between FinOptSys and State Street with the launch of Venturi, a global P2P repo financing marketplace. This significant achievement and milestone for both firms not only enables buy-side institutions to expand their financing options through participation in an increasingly transparent and growing P2P ecosystem, but also allows them to do so with trade-level indemnification.

As global institutions’ appetite for P2P securities financing continues to grow, this marketplace partnership will allow lenders and borrowers to transact directly, without the need for traditional banks and broker dealers, if they so desire. Venturi aims to inject greater liquidity into the marketplace and provide an attractive, alternative financing mechanism for investors, borrowers and beneficial owners, including pension funds, asset managers and insurance companies.

In alignment with State Street’s commitment to P2P, FinOptSys provided innovative and patent-pending AI analytics to power a P2P platform, which will enable programme participants to tap into an unprecedented level of connectivity and marketplace efficiency in securities financing. The commitment FinOptSys made to strengthen its platform capabilities during adverse times resulted in a more ‘ready-to-go’ and impactful solution for market participants when the State Street partnership was forged.

Future today

The core of FinOptSys’ promise to clients is to deliver solutions for the future, today. FinOptSys was able to carry the momentum into 2023 by forming a strategic partnership with S&P Global Market Intelligence to help deliver securities financing market data and services, including an extended range of analytical tools.

Clients demand greater transparency, and so by combining the two platforms, both firms’ clients will have the much-needed transparency in the equity and fixed-income securities financing business to make informed decisions within their organisations. This will lead to higher yields, lower costs and increased asset utilisation for clients.

By utilising streamlined workflow, this solution allows users to access the securities financing market through a P2P marketplace that provides point-to-point negotiation capabilities, along with features including trade level indemnification, compliance, counterparty and collateral eligibility checks, as well as restricted list feeds. Investing in data helps clients to gain valuable insight, leading to informed investment decisions. This partnership further strengthened the breadth and robustness of the FinOptSys platform.

With key strategic partnerships and growth prospects in place, FinOptSys was better positioned to turn its vision of transforming the securities financing business into a profitable long-term strategy. Earlier this year, FinOptSys completed its first tranche of Series A funding with backing from State Street. One of the primary focal points of capital deployment is to add further innovation to its current suite of modules, as innovation is an iterative process.

FinOptSys plans to not only revolutionise and standardise the securities financing industry, but also to form the foundation to deliver market efficiency, connectivity, liquidity, revenue generation, risk management and transparency to the broader financial markets.

Developing the right corporate culture is crucial for efficient product development, ethical decision-making and execution of business objectives. FinOptSys’ culture reflects its identity and is deeply rooted in talent attraction and retention, team and partner building and living its core values day-in and day-out.

From its early days, an integral core value for FinOptSys has been about giving back. In living its principles of giving back, FinOptSys welcomed military veteran owned and operated investment bank Drexel Hamilton onto its platform. Creating this cornerstone partnership goes beyond providing Drexel Hamilton with the capabilities to support and scale its specialty finance business. It opens the door for future initiatives with Drexel Hamilton to support its social mission of hiring, mentoring and providing opportunities for US veterans within the financial services sector.

Every fintech journey is different, with multiple challenges along the way. The path for FinOptSys has been anchored in holistic platform development across multiple products, for various client segments. The impact of using AI analytics to power a P2P marketplace will not only increase liquidity and transparency, but will also transform the securities finance business into a more efficient industry.

This is only the beginning of the FinOptSys journey. Solving for today’s inefficiencies is a good start, but the FinOptSys promise to create solutions for the future, today, is paramount to success and sustainability. Navigating the regulatory landscape, preparing for same-day settlement, incorporating digital assets into the balance sheet — these are the realities of the future for all market participants. The team of experienced market practitioners at FinOptSys have not only identified these future realities, but have been preparing to address the challenges through continued innovation of their product suite.

FinOptSys is empowering industry participants of today, with the necessary arsenal to solve for what’s coming tomorrow!

Founded in late 2019 by market practitioners for market practitioners, FinOptSys is challenging the status quo and transforming the securities financing business globally. FinOptSys is a state-of-the-art cloud-based software-as-a-service (SaaS) platform that combines artificial intelligence (AI), machine learning, analytics and patent-pending algorithms to power peer-to-peer (P2P), across the entire spectrum of securities financing products (securities lending, repos, swaps) and collateral — including nontraditional and digital assets.

Figure 1

Originally created for the buy-side community to empower clients and enhance their collateral management activities, FinOptSys sought to build and provide an interactive P2P platform that would augment transparency, improve price discovery and increase liquidity in the marketplace. Then the world came to a halt during the global pandemic. This presented a unique challenge to growing the business, especially not having the required facetime and interaction to demo the platform to the buy side. Where there is adversity, there is also opportunity and FinOptSys used this time to expand and enhance its product offerings into a comprehensive, enterprise-wide solution.

This inflection point led to greater innovation on the platform vis-à-vis expanding the breadth of client types and enhancing a real-time analytics suite, thereby increasing client optionality, improving actionable decision-making and allowing firms to proactively manage their financial resources more efficiently. In addition, the creation of a document negotiation module using AI and machine learning allowed users to review, analyse and agree to legal contracts in a fraction of the time from normal convention. The FinOptSys platform transformed into a holistic securities financing solution for clients of any size, with very clear links within the value chain.

FinOptSys clients were now able to manage their balance sheets proactively and have access to a financial resource management platform that decreased cost, increased yield and asset utilisation, while also connecting to new sources of liquidity. During a pivotal period where product sales growth and financing stagnated due to global and industry challenges, FinOptSys focused on intense product development, and fostering change to meet the needs of the client, by providing a complete enterprise-wide, securities financing solution. Modular in nature and seamlessly sitting on top of any existing systems, clients can focus on how FinOptSys will complement their existing infrastructure, as opposed to what will need to be replaced. Emphasis on improving existing pain points, with up to 30 different modules to choose from, allows customers to move away from the status quo within the securities financing business.

Figure 1

The status quo is exacerbated by legacy systems and an inadequate technology stack to keep pace with dynamic trading requirements and evolving regulatory changes. FinOptSys enabled clients to approach their securities financing business through a holistic lens and reverse the inevitable outcomes of the status quo.

In late 2021, the breadth of the product offering for FinOptSys was very robust. Target clients were impressed and a true endorsement of the platform occurred during a demonstration for securities financing practitioners Roy Zimmerhansl and John Arnesen. As FinOptSys showed every facet of the platform, Zimmerhansl and Arnesen were actively looking for gaps in the system that were not considered. They were unable to ‘break’ the platform and agreed that — regardless of which discipline you come to securities finance from — FinOptSys can “cover your needs and a whole lot more”. This helped to further validate the FinOptSys strategy and vision.

FinOptSys had built the core pieces of a comprehensive securities financing solution, addressing multiple pain points. Creating the product is essential, but so is listening to your customers and having a core team of experienced market specialists and technology experts that can foster a culture of efficient collaboration. This is the FinOptSys way and it helped build significant momentum in a short period of time.

In 2022, this momentum led to the official announcement of a key partnership between FinOptSys and State Street with the launch of Venturi, a global P2P repo financing marketplace. This significant achievement and milestone for both firms not only enables buy-side institutions to expand their financing options through participation in an increasingly transparent and growing P2P ecosystem, but also allows them to do so with trade-level indemnification.

As global institutions’ appetite for P2P securities financing continues to grow, this marketplace partnership will allow lenders and borrowers to transact directly, without the need for traditional banks and broker dealers, if they so desire. Venturi aims to inject greater liquidity into the marketplace and provide an attractive, alternative financing mechanism for investors, borrowers and beneficial owners, including pension funds, asset managers and insurance companies.

In alignment with State Street’s commitment to P2P, FinOptSys provided innovative and patent-pending AI analytics to power a P2P platform, which will enable programme participants to tap into an unprecedented level of connectivity and marketplace efficiency in securities financing. The commitment FinOptSys made to strengthen its platform capabilities during adverse times resulted in a more ‘ready-to-go’ and impactful solution for market participants when the State Street partnership was forged.

Future today

The core of FinOptSys’ promise to clients is to deliver solutions for the future, today. FinOptSys was able to carry the momentum into 2023 by forming a strategic partnership with S&P Global Market Intelligence to help deliver securities financing market data and services, including an extended range of analytical tools.

Clients demand greater transparency, and so by combining the two platforms, both firms’ clients will have the much-needed transparency in the equity and fixed-income securities financing business to make informed decisions within their organisations. This will lead to higher yields, lower costs and increased asset utilisation for clients.

By utilising streamlined workflow, this solution allows users to access the securities financing market through a P2P marketplace that provides point-to-point negotiation capabilities, along with features including trade level indemnification, compliance, counterparty and collateral eligibility checks, as well as restricted list feeds. Investing in data helps clients to gain valuable insight, leading to informed investment decisions. This partnership further strengthened the breadth and robustness of the FinOptSys platform.

With key strategic partnerships and growth prospects in place, FinOptSys was better positioned to turn its vision of transforming the securities financing business into a profitable long-term strategy. Earlier this year, FinOptSys completed its first tranche of Series A funding with backing from State Street. One of the primary focal points of capital deployment is to add further innovation to its current suite of modules, as innovation is an iterative process.

FinOptSys plans to not only revolutionise and standardise the securities financing industry, but also to form the foundation to deliver market efficiency, connectivity, liquidity, revenue generation, risk management and transparency to the broader financial markets.

Developing the right corporate culture is crucial for efficient product development, ethical decision-making and execution of business objectives. FinOptSys’ culture reflects its identity and is deeply rooted in talent attraction and retention, team and partner building and living its core values day-in and day-out.

From its early days, an integral core value for FinOptSys has been about giving back. In living its principles of giving back, FinOptSys welcomed military veteran owned and operated investment bank Drexel Hamilton onto its platform. Creating this cornerstone partnership goes beyond providing Drexel Hamilton with the capabilities to support and scale its specialty finance business. It opens the door for future initiatives with Drexel Hamilton to support its social mission of hiring, mentoring and providing opportunities for US veterans within the financial services sector.

Every fintech journey is different, with multiple challenges along the way. The path for FinOptSys has been anchored in holistic platform development across multiple products, for various client segments. The impact of using AI analytics to power a P2P marketplace will not only increase liquidity and transparency, but will also transform the securities finance business into a more efficient industry.

This is only the beginning of the FinOptSys journey. Solving for today’s inefficiencies is a good start, but the FinOptSys promise to create solutions for the future, today, is paramount to success and sustainability. Navigating the regulatory landscape, preparing for same-day settlement, incorporating digital assets into the balance sheet — these are the realities of the future for all market participants. The team of experienced market practitioners at FinOptSys have not only identified these future realities, but have been preparing to address the challenges through continued innovation of their product suite.

FinOptSys is empowering industry participants of today, with the necessary arsenal to solve for what’s coming tomorrow!

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times