Rediscovering trade opportunities

24 March 2023

Katsuhiko Yamamoto, general manager of margin loan at Japan Securities Finance, breaks down how firms can use margin transactions for short selling activity, enabling them to short Japanese shares at a reasonable price

Image: Japan Securities Finance

Image: Japan Securities Finance

If you need to short sell shares, a common way is to borrow these shares from a securities lending market. However, there is a unique method called “margin transactions” in Japan. What is the advantage of margin transactions? Anyone can freely short the majority of more than 4,000 listed issues without the need for complicated prior contracts, negotiations or paperwork with lenders.

Margin transactions account for approximately 15 per cent of the total trading value on the Tokyo Stock Exchange and are involved in more than 60 per cent of trading by individual investors — proving to have a large presence on the stock market in Japan. Margin transactions are classified into two sections, according to the regulations of the stock exchange: standardised margin transactions with a settlement deadline; and negotiable margin transactions with a settlement deadline set at the discretion of the securities company.

Japan Securities Finance (JSF) administers margin loan transactions in standardised margin transactions, providing the ex-post loans for the funds and shares necessary for securities companies. Prime brokers usually need to procure shares in advance before short selling, owing to the short selling regulations in Japan. However, loans for margin transactions are built into standardised margin transactions. Therefore, participants can immediately short sell shares without procuring them in advance since this presents no conflict with naked-short selling regulations.

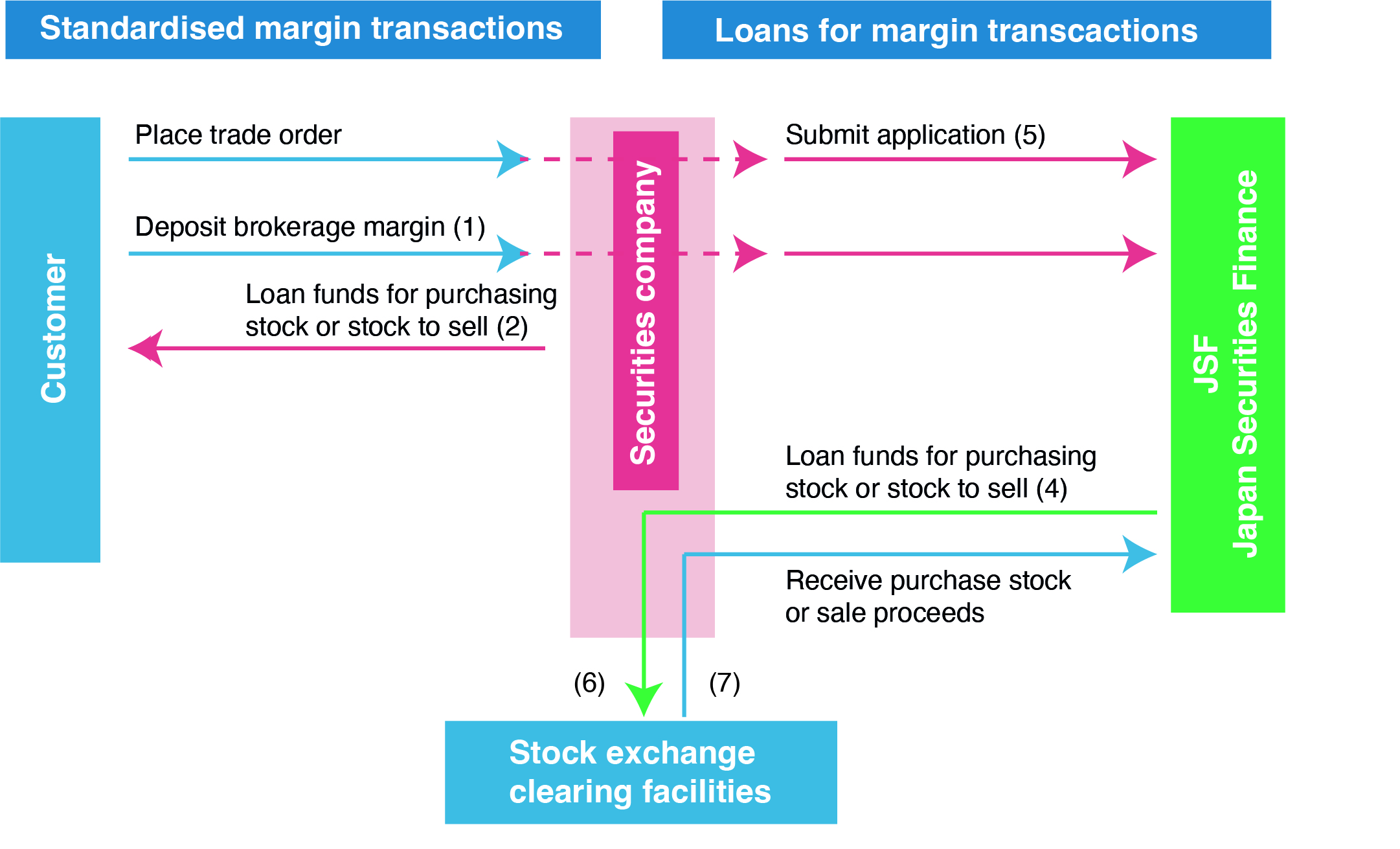

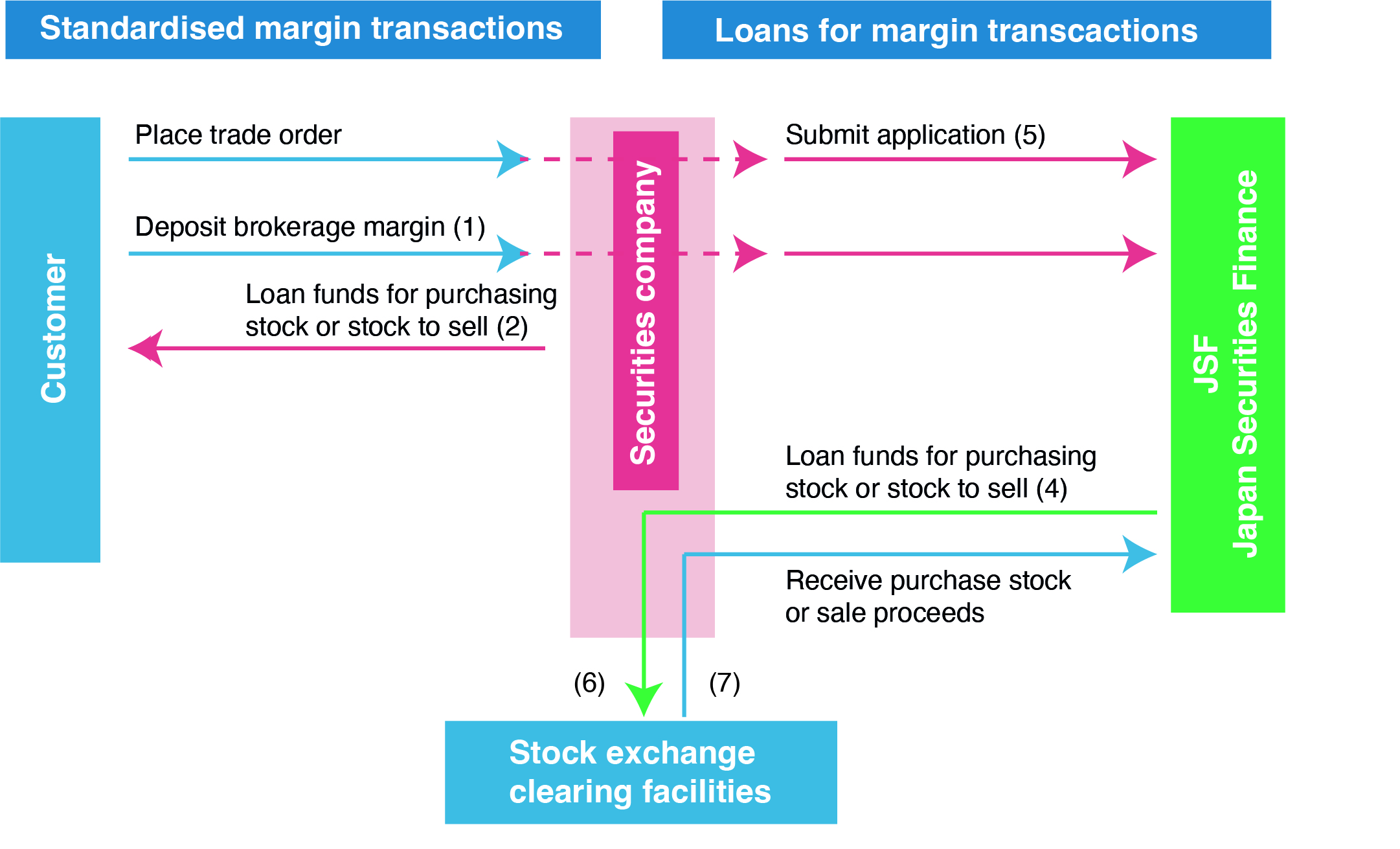

Figure 1

Standardised margin transactions

A standardised margin transaction (SMT) is one in which an investor provides a 30 per cent deposit to a securities company as collateral according to their own market forecast. The investor then trades shares by borrowing the funds to buy the shares, or the shares for sale from the securities company. These transactions are an effective investment tool which enable leveraged transactions and short selling for individual investors. They are also widely recognised as a means of hedging risk.

If a market participant were to believe that the price of a certain stock will fall in the future, they can use a SMT to borrow and sell those shares from a securities company, rather than borrowing those shares from a prime broker and selling them on the market. A participant can then repurchase the shares when their price drops within the repayment period — up to six months — and give them back to the securities company. They would then receive the difference in those prices. Moreover, losses through hedge selling can be avoided by using SMTs for hedging purposes and margin acquisition purposes.

Loans for margin transactions

Only securities finance companies licensed by the Prime Minister are permitted to offer loans for margin transactions (LMT), JSF is the only such securities finance company in Japan. A securities company which has received a trading order for an SMT from an investor can procure the funds and shares necessary for settlement by providing a certain level of collateral to JSF.

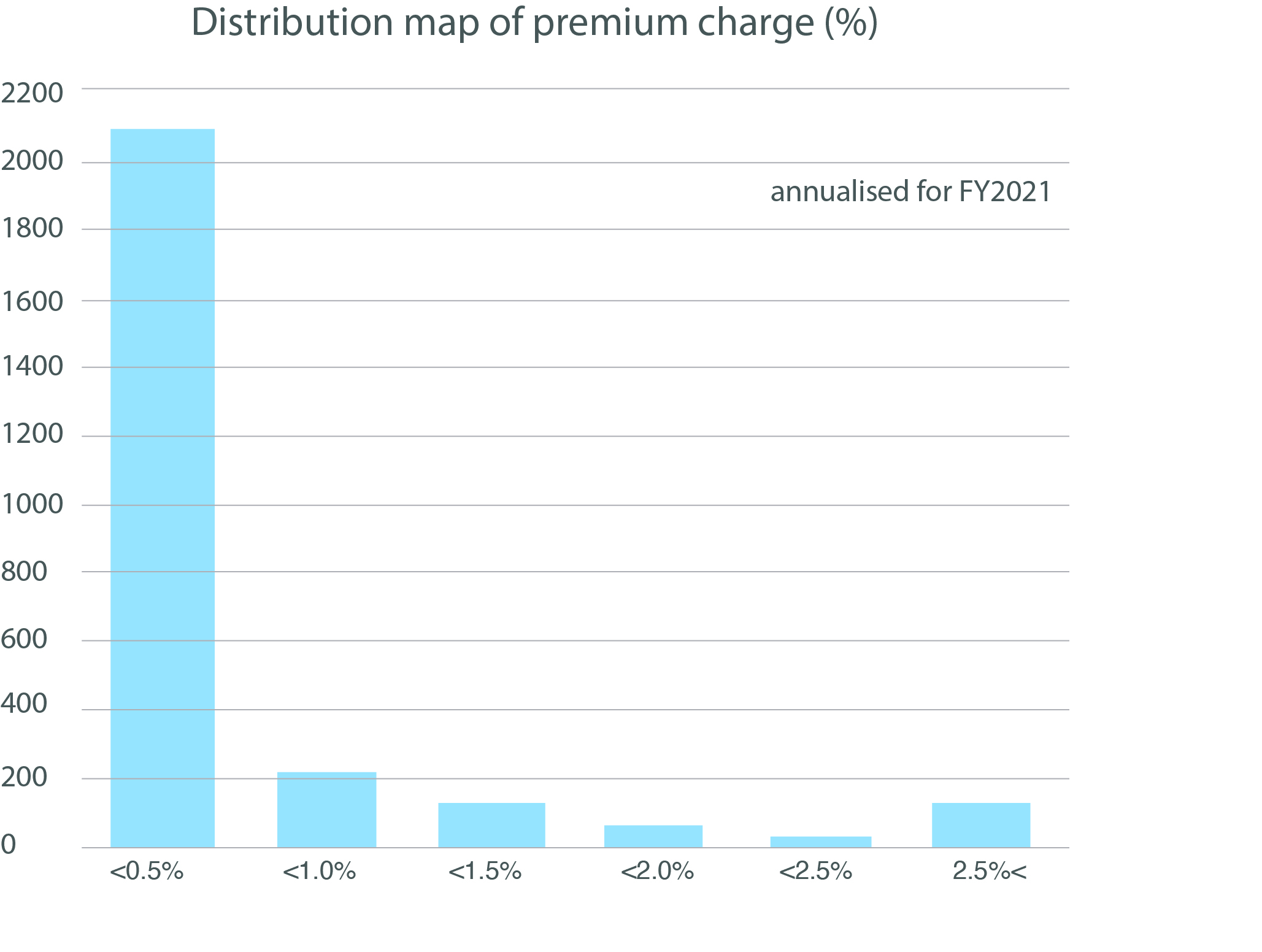

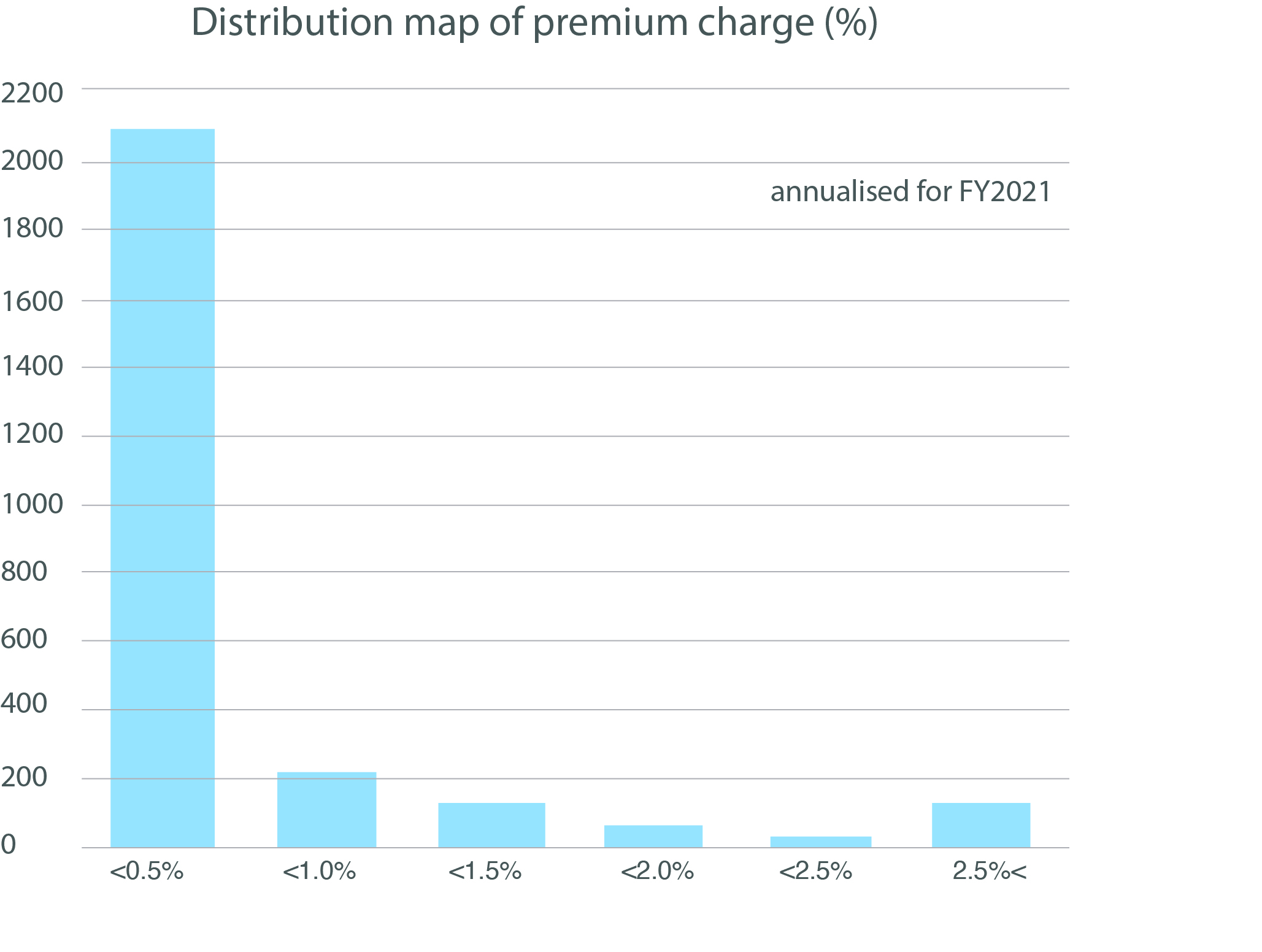

How do you procure the funds and shares necessary for loans for margin transactions? Given our high credit rating (S&P A rating), JSF can borrow the necessary funds from financial markets. Meanwhile, JSF procures the number of shares necessary from securities companies and institutional investors through an auction process. The JSF auction is held the day after the trading date and the cost determined in the auction process is called the premium charge rate. This rate is set in advance by the table corresponding to the amount of investment.

Margin sellers pay a uniform premium charge according to the standardised margin selling balance. On the other hand, auction participants and margin buyers can receive these premium charges according to the number of shares they successfully bid for and the standardised margin buying balance.

The premium charge rate is an indicator of the supply and demand of the stock loan market in Japan. If the premium charge rises sharply, it has the effect of encouraging margin sellers to clear their accounts and new margin buyers to enter the market. In general, the balance between margin buying and margin selling reaches an equilibrium through self-adjustment with such premium charges. Nevertheless, if the outlook for procurement through the auction process is unclear due to special factors — such as sudden price fluctuations, corporate actions and listings which carry over into the next fiscal year from application — JSF will issue a warning or suspend applications in the use of stock loans according to the situation, thereby controlling the increase in excessive selling through such measures.

Utilisation of margin selling

Market participants can freely short 60 per cent of more than 4,000 listed issues in SMTs — but that figure becomes more than 90 per cent if only looking at the highly liquid prime market. It is an important choice to consider when any issues are eligible for margin selling and there is no availability on the stock lending market. If that happens, firms should consider shorting it by using an SMT.

As previously described, the costs incurred in margin selling consist of the premium charge (there are also many issues which may not incur a premium charge) and the lending fee set by the securities company — which differs for each securities company.

The premium charge is determined on the day after the trading date. Uncertainty remains for firms because the procurement cost is finalised ex-post facto. However, looking at the historical data, there are many cases in which the costs involved in margin selling are lower than the cost of borrowing on the securities lending market. In particular, it is possible to find many issues which are comparatively less expensive if using margin selling among those which are difficult to borrow with high market rates.

One of the reasons for this is that almost no professional investors have entered the SMTs market, most users tend to be individual investors in Japan. The preferences of professional investors and individual investors are often divided. Firms can now short Japanese shares at a reasonable price with SMTs without paying high fees on the securities lending market. The historical data of LMT can be obtained from Nasdaq Data Link (https://data.nasdaq.com).

Figure 2

The mechanism of SMTs is complicated, as we have explained. Nevertheless, it is a very interesting system, unique to Japan, which enables firms to short a wide range of issues. Firms can start to engage in these transactions at any time by opening a margin trading account with a securities company in Japan.

Margin transactions account for approximately 15 per cent of the total trading value on the Tokyo Stock Exchange and are involved in more than 60 per cent of trading by individual investors — proving to have a large presence on the stock market in Japan. Margin transactions are classified into two sections, according to the regulations of the stock exchange: standardised margin transactions with a settlement deadline; and negotiable margin transactions with a settlement deadline set at the discretion of the securities company.

Japan Securities Finance (JSF) administers margin loan transactions in standardised margin transactions, providing the ex-post loans for the funds and shares necessary for securities companies. Prime brokers usually need to procure shares in advance before short selling, owing to the short selling regulations in Japan. However, loans for margin transactions are built into standardised margin transactions. Therefore, participants can immediately short sell shares without procuring them in advance since this presents no conflict with naked-short selling regulations.

Figure 1

Standardised margin transactions

A standardised margin transaction (SMT) is one in which an investor provides a 30 per cent deposit to a securities company as collateral according to their own market forecast. The investor then trades shares by borrowing the funds to buy the shares, or the shares for sale from the securities company. These transactions are an effective investment tool which enable leveraged transactions and short selling for individual investors. They are also widely recognised as a means of hedging risk.

If a market participant were to believe that the price of a certain stock will fall in the future, they can use a SMT to borrow and sell those shares from a securities company, rather than borrowing those shares from a prime broker and selling them on the market. A participant can then repurchase the shares when their price drops within the repayment period — up to six months — and give them back to the securities company. They would then receive the difference in those prices. Moreover, losses through hedge selling can be avoided by using SMTs for hedging purposes and margin acquisition purposes.

Loans for margin transactions

Only securities finance companies licensed by the Prime Minister are permitted to offer loans for margin transactions (LMT), JSF is the only such securities finance company in Japan. A securities company which has received a trading order for an SMT from an investor can procure the funds and shares necessary for settlement by providing a certain level of collateral to JSF.

How do you procure the funds and shares necessary for loans for margin transactions? Given our high credit rating (S&P A rating), JSF can borrow the necessary funds from financial markets. Meanwhile, JSF procures the number of shares necessary from securities companies and institutional investors through an auction process. The JSF auction is held the day after the trading date and the cost determined in the auction process is called the premium charge rate. This rate is set in advance by the table corresponding to the amount of investment.

Margin sellers pay a uniform premium charge according to the standardised margin selling balance. On the other hand, auction participants and margin buyers can receive these premium charges according to the number of shares they successfully bid for and the standardised margin buying balance.

The premium charge rate is an indicator of the supply and demand of the stock loan market in Japan. If the premium charge rises sharply, it has the effect of encouraging margin sellers to clear their accounts and new margin buyers to enter the market. In general, the balance between margin buying and margin selling reaches an equilibrium through self-adjustment with such premium charges. Nevertheless, if the outlook for procurement through the auction process is unclear due to special factors — such as sudden price fluctuations, corporate actions and listings which carry over into the next fiscal year from application — JSF will issue a warning or suspend applications in the use of stock loans according to the situation, thereby controlling the increase in excessive selling through such measures.

Utilisation of margin selling

Market participants can freely short 60 per cent of more than 4,000 listed issues in SMTs — but that figure becomes more than 90 per cent if only looking at the highly liquid prime market. It is an important choice to consider when any issues are eligible for margin selling and there is no availability on the stock lending market. If that happens, firms should consider shorting it by using an SMT.

As previously described, the costs incurred in margin selling consist of the premium charge (there are also many issues which may not incur a premium charge) and the lending fee set by the securities company — which differs for each securities company.

The premium charge is determined on the day after the trading date. Uncertainty remains for firms because the procurement cost is finalised ex-post facto. However, looking at the historical data, there are many cases in which the costs involved in margin selling are lower than the cost of borrowing on the securities lending market. In particular, it is possible to find many issues which are comparatively less expensive if using margin selling among those which are difficult to borrow with high market rates.

One of the reasons for this is that almost no professional investors have entered the SMTs market, most users tend to be individual investors in Japan. The preferences of professional investors and individual investors are often divided. Firms can now short Japanese shares at a reasonable price with SMTs without paying high fees on the securities lending market. The historical data of LMT can be obtained from Nasdaq Data Link (https://data.nasdaq.com).

Figure 2

The mechanism of SMTs is complicated, as we have explained. Nevertheless, it is a very interesting system, unique to Japan, which enables firms to short a wide range of issues. Firms can start to engage in these transactions at any time by opening a margin trading account with a securities company in Japan.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times