The repo market is dead, long live the repo market!

18 April 2023

Cyril Louchtchay de Fleurian, consultant on repo markets and securities finance trades, argues that current inflationary pressures and central bank rate increases are delivering what 15 years of low interest rates have failed to do, reshaping a securities finance industry which has become vulnerable and outdated

Image: stock.adobe.com/Nadia

Image: stock.adobe.com/Nadia

We have been entering a VUCA environment: volatility, uncertainty, complexity, ambiguity.

This acronym, which was born in the military world, could perfectly characterise current Eurozone repo and money market conditions: increasing complexity, multiplying interactions, unprecedented phenomena, acceleration of cycles. What 15 years of low interest rates have not allowed, the current inflationary sequence and central bank rate increases — marked by a dislocation of liquidity — are delivering, reshaping the settings of a securities financing transactions industry which has become vulnerable and outdated.

Injections of liquidity against collateral, which began in 2008-9 have increased massively since 2015 and dramatically in 2020 and 2021. These have been skyrocketing the Eurozone money market into a new era which we are just beginning to understand.

The ECB's asset purchase programmes (traditional PSPP and pandemic emergency PEPP) are responsible for €5 trillion of liquidity injected; the long-term refinancing operations (TLTROs) are responsible for €2 trillion. According to data from the International Capital Markets Association (ICMA), there is currently 60 per cent excess liquidity, representing €4.2 trillion (ICMA January 2023), in the Euro banking system. This excess remains structural since liquidity is always stuck in one bank or another, but always held in an account with the central bank; it is a closed system. Liquidity cannot leave the Eurozone.

By definition this excess liquidity puts pressure on collateral that precisely embodies changes the Euro has gone through during the past 15 years, shaped by an ongoing crisis and unconventional monetary responses. This strain weakens the integrity of market channels, causing "minor" damage (like chaotic end-of-reserve periods, quarter and year-end reporting) and then generating major malfunctions, such as bubbles and frequent panics (2019-20-21-22) followed by emergency interventions driven by the central banks. In a market context where some basic mechanisms are disturbed — generating windfall effects (tiering phenomenon, TLTROs arbitrage) — such liquidity must be invested in the best possible way into "current opportunities", amplifying and crystallising the market's disruption. For instance, this may result in massive and unreasonable treasury bill purchases, with repo market rates being pulled down abnormally, disconnecting them from the rest of the money market and reinforcing the continued scarcity of collateral.

Such collateral overconsumption is also rooted in the growing needs of banks and final investors, forced by regulation to post ever more securities (i.e. massive requirements to meet LCR ratio obligations, UMR waves 1-7, and for clearing activities elsewhere). This "inflationary" phenomenon appears all the more powerful as the level of sovereign bonds issuance in Europe — while supported and driven by endemic indebtedness, up 5 per cent in 2023 compared to 2022 for a total amount of €1,200 billion — struggles to meet demand for collateral.

A second issue is that bank intermediation remains weak in the context of this money market dislocation. Bank intermediation is sometimes viewed as a necessary evil that is critical for the participation of buy-side players (insurance companies, pension plans, regulated money-market funds, liability-driven investors, real estate investment trusts, non-financial companies, etc.) — which is sometimes viewed as “the preserve” of banks, but heavily constrains the buy-side. In any case, bank intermediation has been severely impaired since the 2008-9 financial crisis and for good reason. Banks and dealers have reduced the part of the balance sheet allocated to repo business, as regulatory costs have increased sharply. Today, an incredible 40 to 45 basis points is charged to the customer to compensate bank balance sheets in Europe, according to ICMA.

As it stands, balance sheet availability has become a limited and expensive resource, which is complex to increase, especially in times of tension. The regulatory "tsunami" that hit banks in the past 15 years — severely limiting balance sheet capacity — has significantly eroded bank intermediation. This is now a major congestion point. It has become a point of discrimination, due to high prices, and leaves a fallow market in its wake.

The disequilibrium situation created by excess liquidity and the scarcity of high-quality liquid collateral, combined with the weakness of bank intermediation, could have killed off secured funding and the repo market, at least in its current form.

Volatility, uncertainty, complexity, ambiguity

The term ‘VUCA’, which is an acronym for volatility, uncertainty, complexity and ambiguity, was coined by the US Military at the end of the Cold War. It characterises a changing and abrupt dynamic that must be constantly adapted to. The world has shifted and a new normal is emerging, even though its outlines are not yet clearly defined and visible. www.vuca-world.org

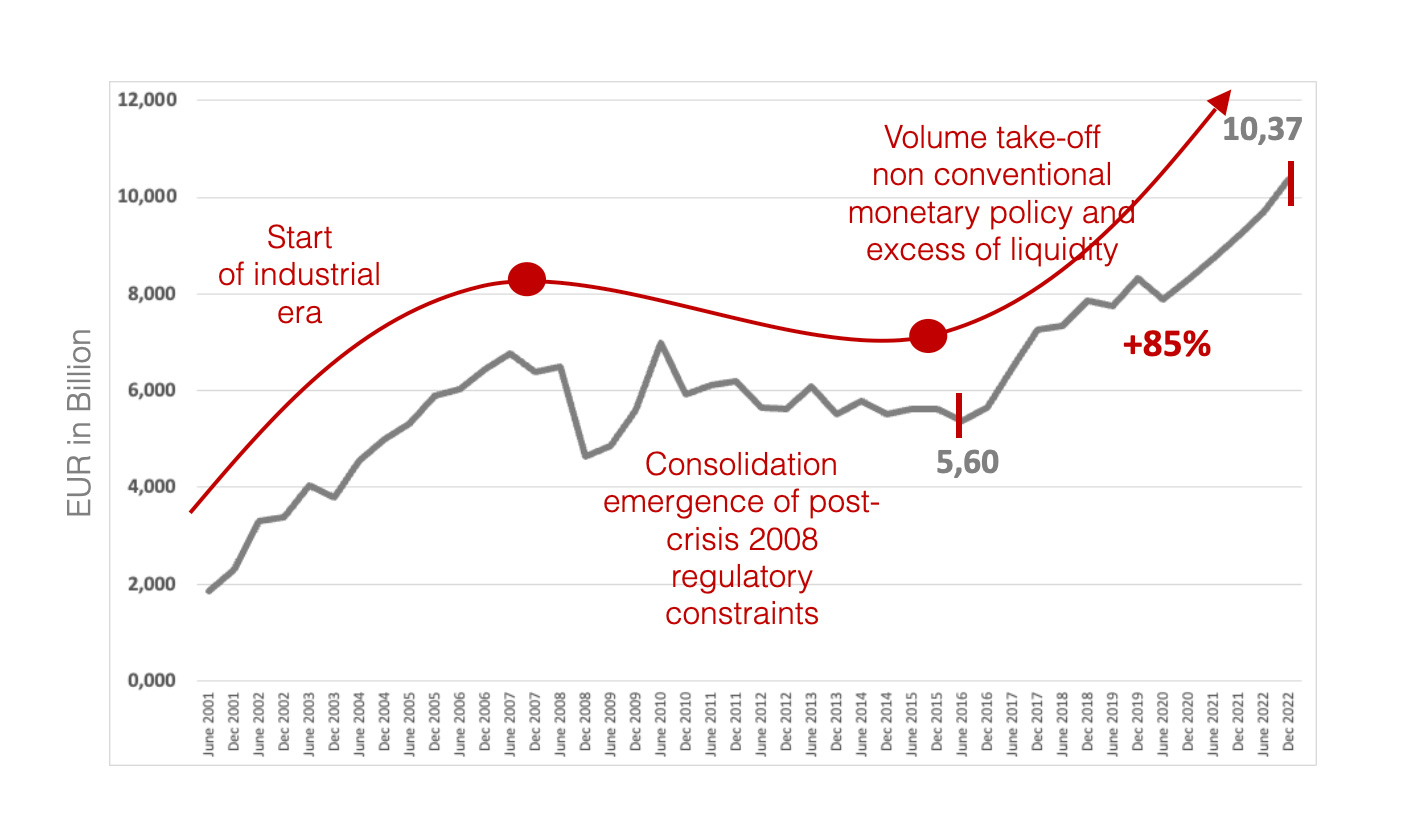

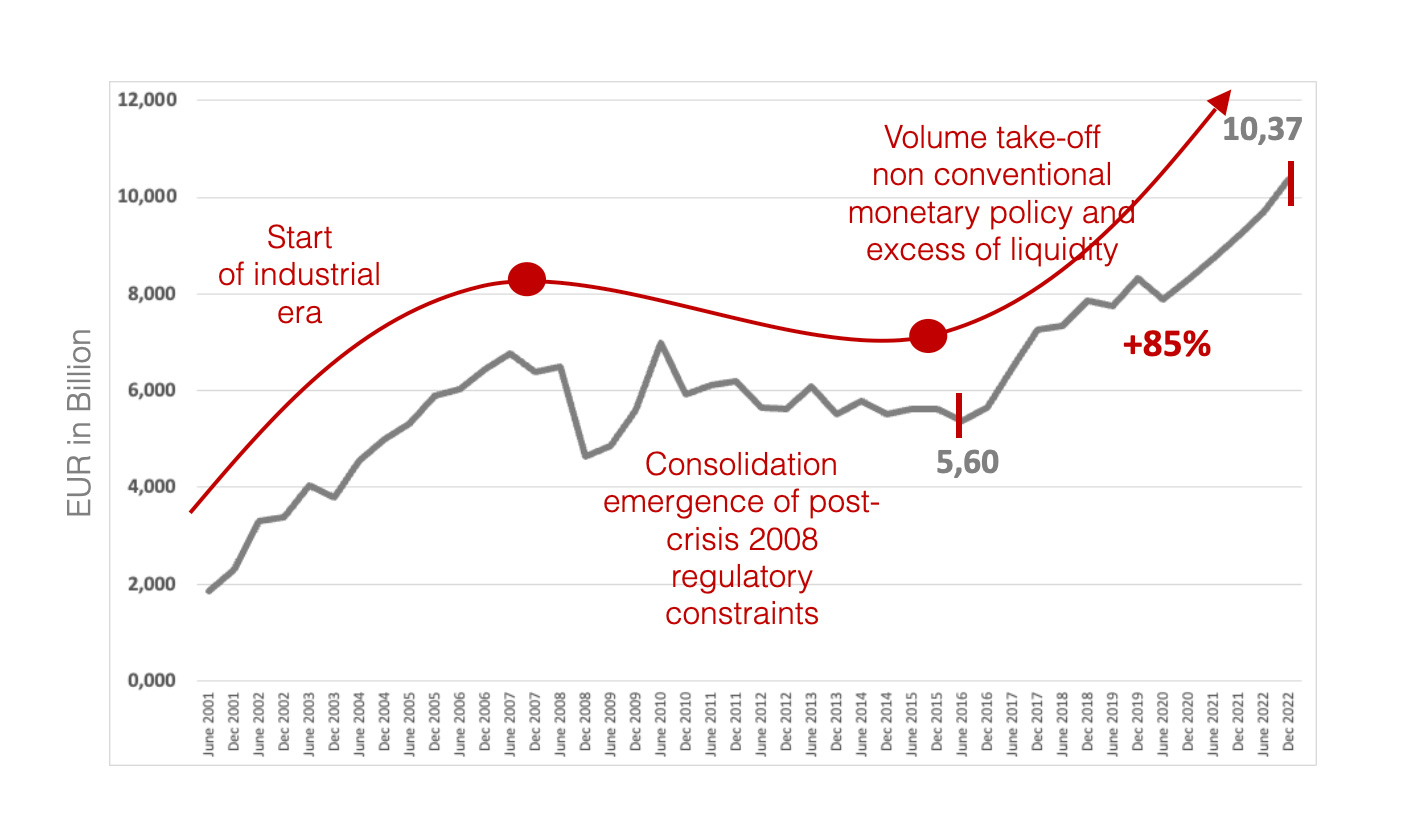

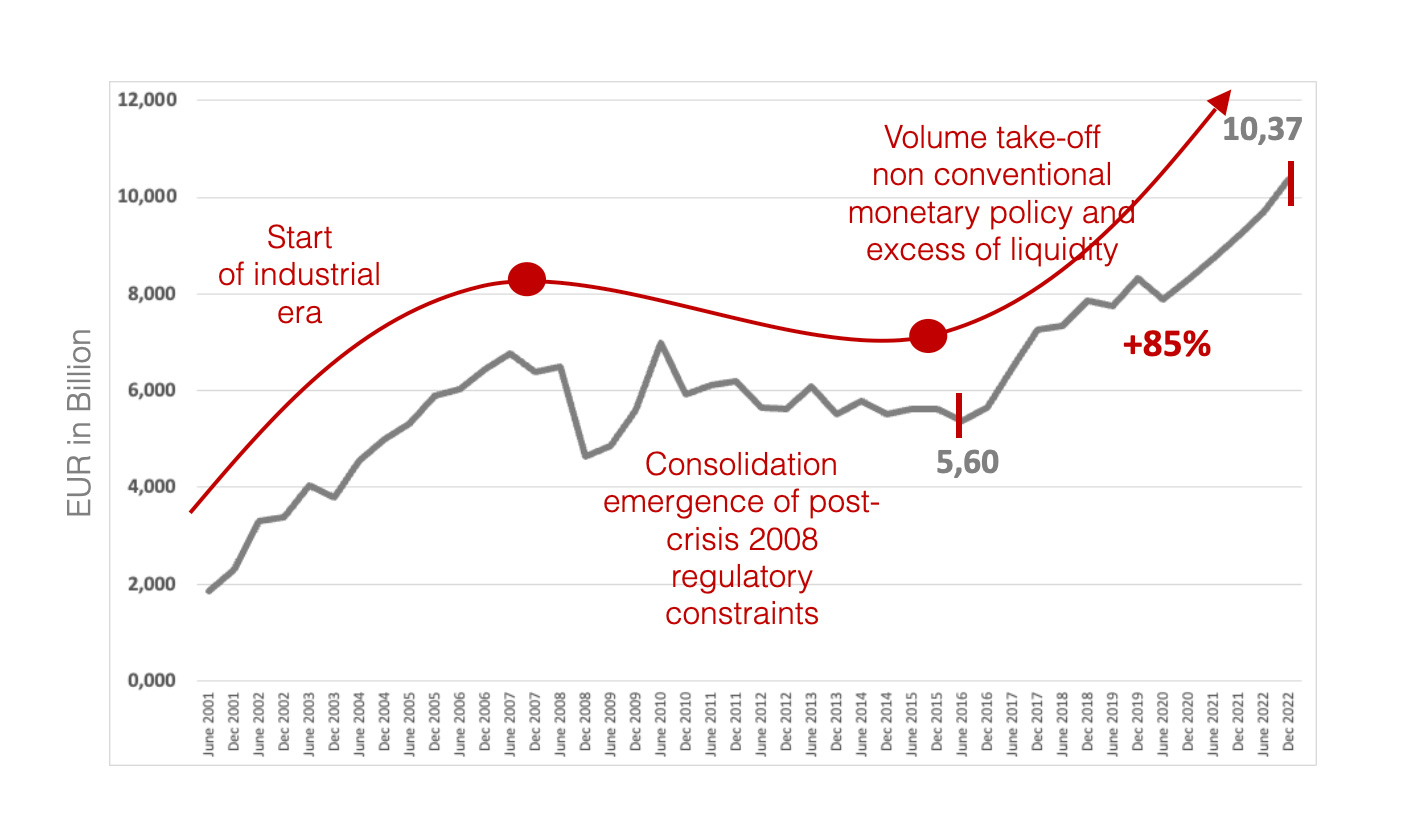

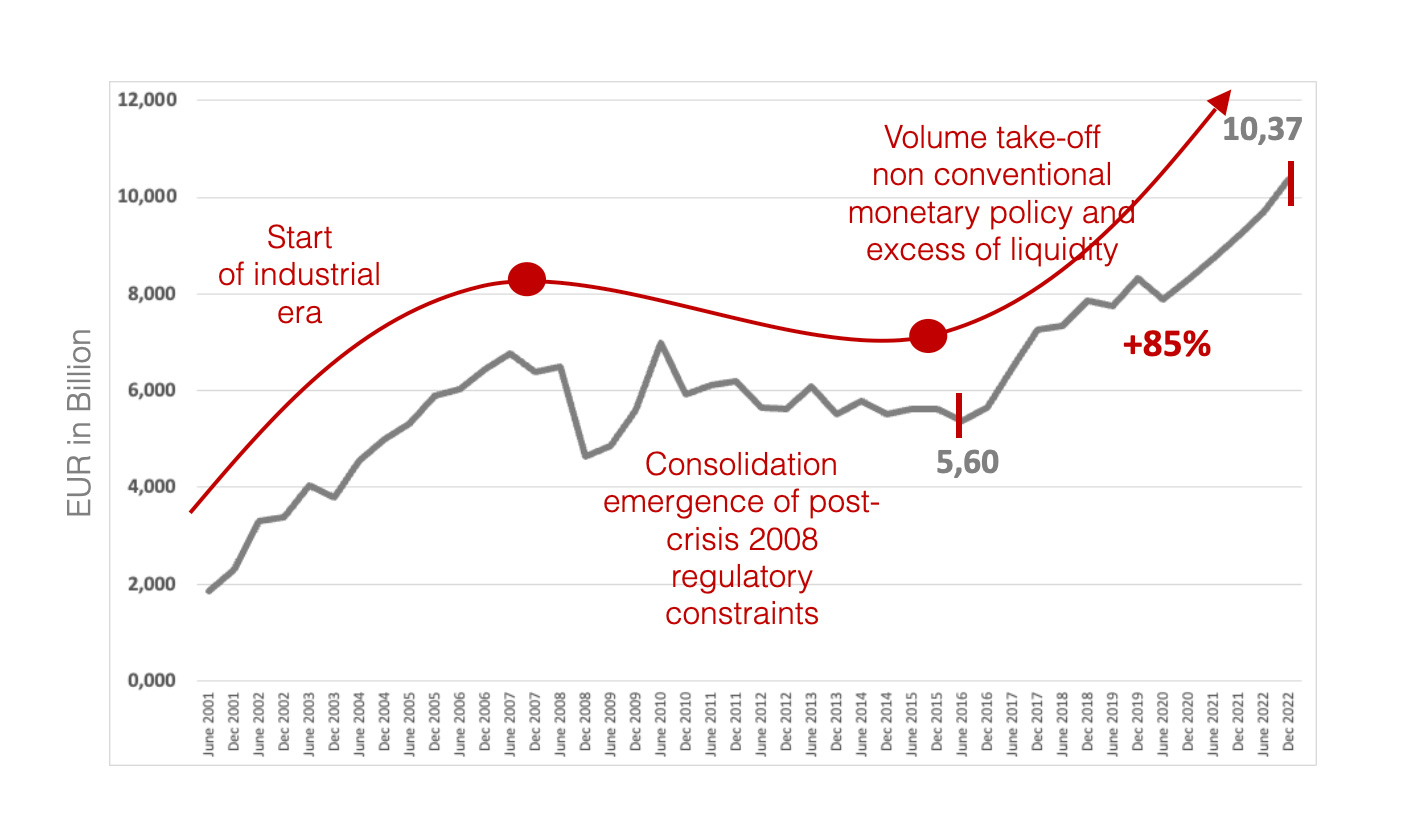

Obviously, flows are not down. Quite the opposite is the case; they are boosted by unconventional monetary policy, prompting an 85 per cent increase in repo market volume from 2015 to 2022. In reality, the days of the current market framework are numbered because it is unable to meet participants’ specific demands born from 15 years of crisis and regulatory proliferation. But it could be so much worse, and conditions are accumulating for a breakout. In a letter dated 25 October 2022, ICMA warned that such a worrying environment could imperil the transmission of monetary policy. Here we are.

European REPO market outstanding

Source ICMA & ERCC Oct. 2022

What emerges from this light and dark? An analysis of the European repo market partly answers this question: with a total outstanding of €10.37 trillion, the market is made up of a dealer-to-dealer (D2D) segment, 60 per cent cleared, mainly electronic, offering full STP, based on vanilla flows and poorly triparty. The other half of the market is the dealer-to-client (D2C) segment: a non-cleared, non-electronic, non-triparty market that offers poor STP rates and is not transparent. In other words, we are talking here about a second-hand repo market network which no longer serves the interests of participants and threatens global balance through the contagion effect.

So the market has reached a crossroads just before a major change, offering bank intermediation a chance to completely transform itself. Banks are quietly shifting from the role of counterparty (principal) to that of guarantor (agent). The D2C model might move to a "client-to-client" model: exit the "matched-book" activity, exit the balance sheet impact and risk capital. Banks would now only be responsible for guaranteeing the credit risk of its clients, giving them the opportunity to deal directly with each other (i.e. via a peer-to peer model). For a few basis points — typically from 5 to 8 bps — banks can support the operational process, that is the liquidation of the collateral, in case of client default. This model can be used in addition to the clearing facility, even though it does not provide a complete solution to the equation. Actually, “sponsored clearing” capability simply replaces one counterparty with another — the clearing house instead of the bank.

Source CLdF Consulting Dec. 2022

Despite the key advantages of netting and low consumption of risk-weighted assets (RWA) — which generate increasing volumes in the US — this cleared model for the buy-side is failing to convince European markets so far, with many believing that it is too costly and complex to implement. In this regard, we have the FICC's Sponsored Clearing offer in the US and those offered by Eurex or LCH in Europe.

The same concept based on the “bank as a guarantor” principle is even more promising as it works well without a clearing house. This allows a much larger and more diverse range of counterparties to access the market, while restoring banks to their original and central role as "risk taker" without being a counterparty — with a profitable business case at stake.

We are talking here about a guaranteed and indemnified repo model demonstrated by some fintechs and by custodians. Actually, international custodians have a significant comparative time-to-market advantage here, as they already have a large number of buy-side customers in their books. This is the case for State Street, for example, which launched its Venturi trading platform at the end of 2022. This may be particularly suitable for transactions between long cash money market funds facing hedge funds, for example, which are structurally liquidity borrowers.

Let’s be real: this move has just begun. But we can assume it might expand rapidly. Firstly, because this model can be replicated easily as a puzzle to be put together – there is no specific IP. This means that a wide variety of players will be able to get to grips with this topic, including trading platforms, tri-party agents or even ad hoc partnerships — such as with a fintech, CSD or ICSD, or with an exchange, for instance.

Another benefit is that this will enable a rapid ramp-up as several regulatory "options" can be chosen depending on the typology of service level, the geographical location and the architecture set up. The platform may or may not be regulated and, if it is, different models are possible: a regulated market (RM) managed by a market operator, a multilateral-trading facility (MTF) or an organised-trading facility (OTF), both of which can be operated by a market operator or by an investment service provider.

Nevertheless, the cost of a licence is not neutral and players that are already regulated will have a head start in taking market share. In France, trading platform managers are jointly supervised both by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and the Autorité des Marchés Financiers (AMF) under the EU’s MiFID II. For the buy-side community, the choice of a transactional process fluctuates between the cost of the transaction and credit exposure to the counterparty. There is no holy grail in this respect.

However, benefits of guaranteed and indemnified repo include substantial cost savings for users, price transparency, ease of onboarding, STP execution, and potentially natural connection to DLT technologies, tokenised and durable assets.

On the legal side, this also facilitates use of an all-to-all standard version of the General Master Repurchase Agreement (GMRA), allowing trading parties to sign a single multilateral contract instead of multiple bilateral contracts. In this spirit, the Financial Security Board (FSB) itself has recently encouraged participation of non-banking firms to support the development of all-to-all electronic execution services to facilitate market access for end-investors.

As much as Uber and eBay created huge value for end retail-customers, guaranteed and indemnified peer-to-peer (P2P) repo offers a similar, duplicable and decentralised value proposition for the benefit of buy-side players in the repo space.

It is obvious that we are not just talking here about some technical developments, but rather an idiosyncratic reshaping of the repo market, meaning a decisive step ahead towards a shift in gravity. Buy-side players used to facing banks and dealers so far will face clearing houses more regularly in future and will increasingly deal with each other on a peer-to-peer basis. For banks and dealers, this is not so much a trend of "disintermediation" but a tactical repositioning of the intermediation model.

As a result, both technical ecosystem and trading flow capacities will need to be revisited along the value chain — including electronic trading platforms, order flow management, collateral management and optimisation applications, pre- and post-transaction data providers, and so on.

On top of that, guaranteed and indemnified repo bears the seeds of "credit normalisation" for some buy-side players, involving the first step of their next interaction with central bank monetary policy as is already the case in the US market. This is a highly strategic topic that is still taboo in the Eurozone, but will definitely fuel both the central bank's current macroeconomic (relating to intervention in the economy, investment guidance) and microeconomic (encouraging innovation and business modernisation) progress.

With all due caution, both the ECB and wider regulators should promote this type of solution which introduces a type of new systemic anchoring for the market. One of the underlying objectives of monetary policy is to maintain government bond rates at a level that preserves solvency of EU governments. As part of the normalisation of its monetary policy (QExit), the ECB's challenge will be to manage a reduction of its balance sheet without major impact on rates. This will have to be synchronised with an increase in government bonds issued in the market and therefore held in clients' accounts with depositories and clearing houses. Guaranteed and indemnified repo is becoming one of the important tools in facilitating this strategic shift and, therefore, a tangible promise of renewed liquidity contributing to both market stability and resilience.

This acronym, which was born in the military world, could perfectly characterise current Eurozone repo and money market conditions: increasing complexity, multiplying interactions, unprecedented phenomena, acceleration of cycles. What 15 years of low interest rates have not allowed, the current inflationary sequence and central bank rate increases — marked by a dislocation of liquidity — are delivering, reshaping the settings of a securities financing transactions industry which has become vulnerable and outdated.

Injections of liquidity against collateral, which began in 2008-9 have increased massively since 2015 and dramatically in 2020 and 2021. These have been skyrocketing the Eurozone money market into a new era which we are just beginning to understand.

The ECB's asset purchase programmes (traditional PSPP and pandemic emergency PEPP) are responsible for €5 trillion of liquidity injected; the long-term refinancing operations (TLTROs) are responsible for €2 trillion. According to data from the International Capital Markets Association (ICMA), there is currently 60 per cent excess liquidity, representing €4.2 trillion (ICMA January 2023), in the Euro banking system. This excess remains structural since liquidity is always stuck in one bank or another, but always held in an account with the central bank; it is a closed system. Liquidity cannot leave the Eurozone.

By definition this excess liquidity puts pressure on collateral that precisely embodies changes the Euro has gone through during the past 15 years, shaped by an ongoing crisis and unconventional monetary responses. This strain weakens the integrity of market channels, causing "minor" damage (like chaotic end-of-reserve periods, quarter and year-end reporting) and then generating major malfunctions, such as bubbles and frequent panics (2019-20-21-22) followed by emergency interventions driven by the central banks. In a market context where some basic mechanisms are disturbed — generating windfall effects (tiering phenomenon, TLTROs arbitrage) — such liquidity must be invested in the best possible way into "current opportunities", amplifying and crystallising the market's disruption. For instance, this may result in massive and unreasonable treasury bill purchases, with repo market rates being pulled down abnormally, disconnecting them from the rest of the money market and reinforcing the continued scarcity of collateral.

Such collateral overconsumption is also rooted in the growing needs of banks and final investors, forced by regulation to post ever more securities (i.e. massive requirements to meet LCR ratio obligations, UMR waves 1-7, and for clearing activities elsewhere). This "inflationary" phenomenon appears all the more powerful as the level of sovereign bonds issuance in Europe — while supported and driven by endemic indebtedness, up 5 per cent in 2023 compared to 2022 for a total amount of €1,200 billion — struggles to meet demand for collateral.

A second issue is that bank intermediation remains weak in the context of this money market dislocation. Bank intermediation is sometimes viewed as a necessary evil that is critical for the participation of buy-side players (insurance companies, pension plans, regulated money-market funds, liability-driven investors, real estate investment trusts, non-financial companies, etc.) — which is sometimes viewed as “the preserve” of banks, but heavily constrains the buy-side. In any case, bank intermediation has been severely impaired since the 2008-9 financial crisis and for good reason. Banks and dealers have reduced the part of the balance sheet allocated to repo business, as regulatory costs have increased sharply. Today, an incredible 40 to 45 basis points is charged to the customer to compensate bank balance sheets in Europe, according to ICMA.

As it stands, balance sheet availability has become a limited and expensive resource, which is complex to increase, especially in times of tension. The regulatory "tsunami" that hit banks in the past 15 years — severely limiting balance sheet capacity — has significantly eroded bank intermediation. This is now a major congestion point. It has become a point of discrimination, due to high prices, and leaves a fallow market in its wake.

The disequilibrium situation created by excess liquidity and the scarcity of high-quality liquid collateral, combined with the weakness of bank intermediation, could have killed off secured funding and the repo market, at least in its current form.

Volatility, uncertainty, complexity, ambiguity

The term ‘VUCA’, which is an acronym for volatility, uncertainty, complexity and ambiguity, was coined by the US Military at the end of the Cold War. It characterises a changing and abrupt dynamic that must be constantly adapted to. The world has shifted and a new normal is emerging, even though its outlines are not yet clearly defined and visible. www.vuca-world.org

Obviously, flows are not down. Quite the opposite is the case; they are boosted by unconventional monetary policy, prompting an 85 per cent increase in repo market volume from 2015 to 2022. In reality, the days of the current market framework are numbered because it is unable to meet participants’ specific demands born from 15 years of crisis and regulatory proliferation. But it could be so much worse, and conditions are accumulating for a breakout. In a letter dated 25 October 2022, ICMA warned that such a worrying environment could imperil the transmission of monetary policy. Here we are.

European REPO market outstanding

Source ICMA & ERCC Oct. 2022

What emerges from this light and dark? An analysis of the European repo market partly answers this question: with a total outstanding of €10.37 trillion, the market is made up of a dealer-to-dealer (D2D) segment, 60 per cent cleared, mainly electronic, offering full STP, based on vanilla flows and poorly triparty. The other half of the market is the dealer-to-client (D2C) segment: a non-cleared, non-electronic, non-triparty market that offers poor STP rates and is not transparent. In other words, we are talking here about a second-hand repo market network which no longer serves the interests of participants and threatens global balance through the contagion effect.

So the market has reached a crossroads just before a major change, offering bank intermediation a chance to completely transform itself. Banks are quietly shifting from the role of counterparty (principal) to that of guarantor (agent). The D2C model might move to a "client-to-client" model: exit the "matched-book" activity, exit the balance sheet impact and risk capital. Banks would now only be responsible for guaranteeing the credit risk of its clients, giving them the opportunity to deal directly with each other (i.e. via a peer-to peer model). For a few basis points — typically from 5 to 8 bps — banks can support the operational process, that is the liquidation of the collateral, in case of client default. This model can be used in addition to the clearing facility, even though it does not provide a complete solution to the equation. Actually, “sponsored clearing” capability simply replaces one counterparty with another — the clearing house instead of the bank.

Source CLdF Consulting Dec. 2022

Despite the key advantages of netting and low consumption of risk-weighted assets (RWA) — which generate increasing volumes in the US — this cleared model for the buy-side is failing to convince European markets so far, with many believing that it is too costly and complex to implement. In this regard, we have the FICC's Sponsored Clearing offer in the US and those offered by Eurex or LCH in Europe.

The same concept based on the “bank as a guarantor” principle is even more promising as it works well without a clearing house. This allows a much larger and more diverse range of counterparties to access the market, while restoring banks to their original and central role as "risk taker" without being a counterparty — with a profitable business case at stake.

We are talking here about a guaranteed and indemnified repo model demonstrated by some fintechs and by custodians. Actually, international custodians have a significant comparative time-to-market advantage here, as they already have a large number of buy-side customers in their books. This is the case for State Street, for example, which launched its Venturi trading platform at the end of 2022. This may be particularly suitable for transactions between long cash money market funds facing hedge funds, for example, which are structurally liquidity borrowers.

Let’s be real: this move has just begun. But we can assume it might expand rapidly. Firstly, because this model can be replicated easily as a puzzle to be put together – there is no specific IP. This means that a wide variety of players will be able to get to grips with this topic, including trading platforms, tri-party agents or even ad hoc partnerships — such as with a fintech, CSD or ICSD, or with an exchange, for instance.

Another benefit is that this will enable a rapid ramp-up as several regulatory "options" can be chosen depending on the typology of service level, the geographical location and the architecture set up. The platform may or may not be regulated and, if it is, different models are possible: a regulated market (RM) managed by a market operator, a multilateral-trading facility (MTF) or an organised-trading facility (OTF), both of which can be operated by a market operator or by an investment service provider.

Nevertheless, the cost of a licence is not neutral and players that are already regulated will have a head start in taking market share. In France, trading platform managers are jointly supervised both by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and the Autorité des Marchés Financiers (AMF) under the EU’s MiFID II. For the buy-side community, the choice of a transactional process fluctuates between the cost of the transaction and credit exposure to the counterparty. There is no holy grail in this respect.

However, benefits of guaranteed and indemnified repo include substantial cost savings for users, price transparency, ease of onboarding, STP execution, and potentially natural connection to DLT technologies, tokenised and durable assets.

On the legal side, this also facilitates use of an all-to-all standard version of the General Master Repurchase Agreement (GMRA), allowing trading parties to sign a single multilateral contract instead of multiple bilateral contracts. In this spirit, the Financial Security Board (FSB) itself has recently encouraged participation of non-banking firms to support the development of all-to-all electronic execution services to facilitate market access for end-investors.

As much as Uber and eBay created huge value for end retail-customers, guaranteed and indemnified peer-to-peer (P2P) repo offers a similar, duplicable and decentralised value proposition for the benefit of buy-side players in the repo space.

It is obvious that we are not just talking here about some technical developments, but rather an idiosyncratic reshaping of the repo market, meaning a decisive step ahead towards a shift in gravity. Buy-side players used to facing banks and dealers so far will face clearing houses more regularly in future and will increasingly deal with each other on a peer-to-peer basis. For banks and dealers, this is not so much a trend of "disintermediation" but a tactical repositioning of the intermediation model.

As a result, both technical ecosystem and trading flow capacities will need to be revisited along the value chain — including electronic trading platforms, order flow management, collateral management and optimisation applications, pre- and post-transaction data providers, and so on.

On top of that, guaranteed and indemnified repo bears the seeds of "credit normalisation" for some buy-side players, involving the first step of their next interaction with central bank monetary policy as is already the case in the US market. This is a highly strategic topic that is still taboo in the Eurozone, but will definitely fuel both the central bank's current macroeconomic (relating to intervention in the economy, investment guidance) and microeconomic (encouraging innovation and business modernisation) progress.

With all due caution, both the ECB and wider regulators should promote this type of solution which introduces a type of new systemic anchoring for the market. One of the underlying objectives of monetary policy is to maintain government bond rates at a level that preserves solvency of EU governments. As part of the normalisation of its monetary policy (QExit), the ECB's challenge will be to manage a reduction of its balance sheet without major impact on rates. This will have to be synchronised with an increase in government bonds issued in the market and therefore held in clients' accounts with depositories and clearing houses. Guaranteed and indemnified repo is becoming one of the important tools in facilitating this strategic shift and, therefore, a tangible promise of renewed liquidity contributing to both market stability and resilience.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times