Native digital assets – maximising the benefits of digitisation

02 May 2023

In a two-part article, buy-side business process and technology specialist Dr Ian Hunt explores why the popular view of digital assets is wrong and outlines the benefits that use of native digital assets can bring to securities finance

Image: stock.adobe.com/GustavsMD

Image: stock.adobe.com/GustavsMD

It is a common view in sections of the news media that ‘digital assets’ are the same thing as cryptocurrencies. More sophisticated observers may be aware that tokenised versions of conventional assets exist and they often label these as ‘digital assets’ also. There is a problem with this view: cryptos are currencies, not assets as such, and tokenised conventional assets are conventional, not digital. The missing components, and the components that will be transformative, are native digital assets, and they are what this two-part article is about.

New model of investment

We have spent many years developing and implementing incremental improvements to financial markets, operations and technology. We have tried to reduce the risks and costs inherent in our conventional models of investment, added new entities to patch over cracks, offshored and outsourced to reduce resource costs, and automated processes wherever we can. Despite this, we are nowhere near to a single coherent operating model, nor anything close to an issuance model that directly represents the real purpose of our industry.

In our conventional world of assets and transactions, each asset class has its own issuance model — how it is created, issued and owned — and its own operating model, defining how it is managed, traded and settled. These tend to be very complex and involve many entities, processes and controls. This combination of the multiple asset classes, operating models, entities, processes and controls drives a firestorm of regulation, which adds its own complexity to an already convoluted picture.

The smart token model proposed here eradicates this complexity and reduces the cost and risk that are its inevitable consequences. The smart token model is a single, simple digital issuance model and a single, simple operating model for all assets. It enables us to issue and own all digital assets in the same form and to manage, trade and settle transactions in those assets in the same way, whatever the asset is that we are seeking to issue and trade.

The model aims to provide a practical method of operation for a fully digital ecosystem. “Fully digital” in this context means that all value and all transactions exist only in digital form: there is no use of conventional issuance, registry, custody, banking or payment and delivery rails. Pools of value are in the form of tokens on a digital ledger and all movements of value are flows of tokens between addresses on the digital ledger. The existence of a token at a node on the ledger is proof of the ownership — of whatever that token represents — by the owner of that node. We refer to ‘nodes’ in this paper, but these may also be referred to as ‘wallets’ or ‘addresses’.

The benefits of the smart token model are profound. This eliminates the boundaries between asset classes and allows us to build whatever assets and transactions that we want and that are useful to issuers and investors. It enables the issuer of capital to create exactly the funding that they want and enables the asset owner to seek precise matches to their investment requirements. The model brings orders, executions, entitlements, corporate actions, income, securitisations, collateral and liabilities into the same simple operating model as trades. Asset servicing disappears as a result and trading and settlements become simple and fully automated.

What our industry is for

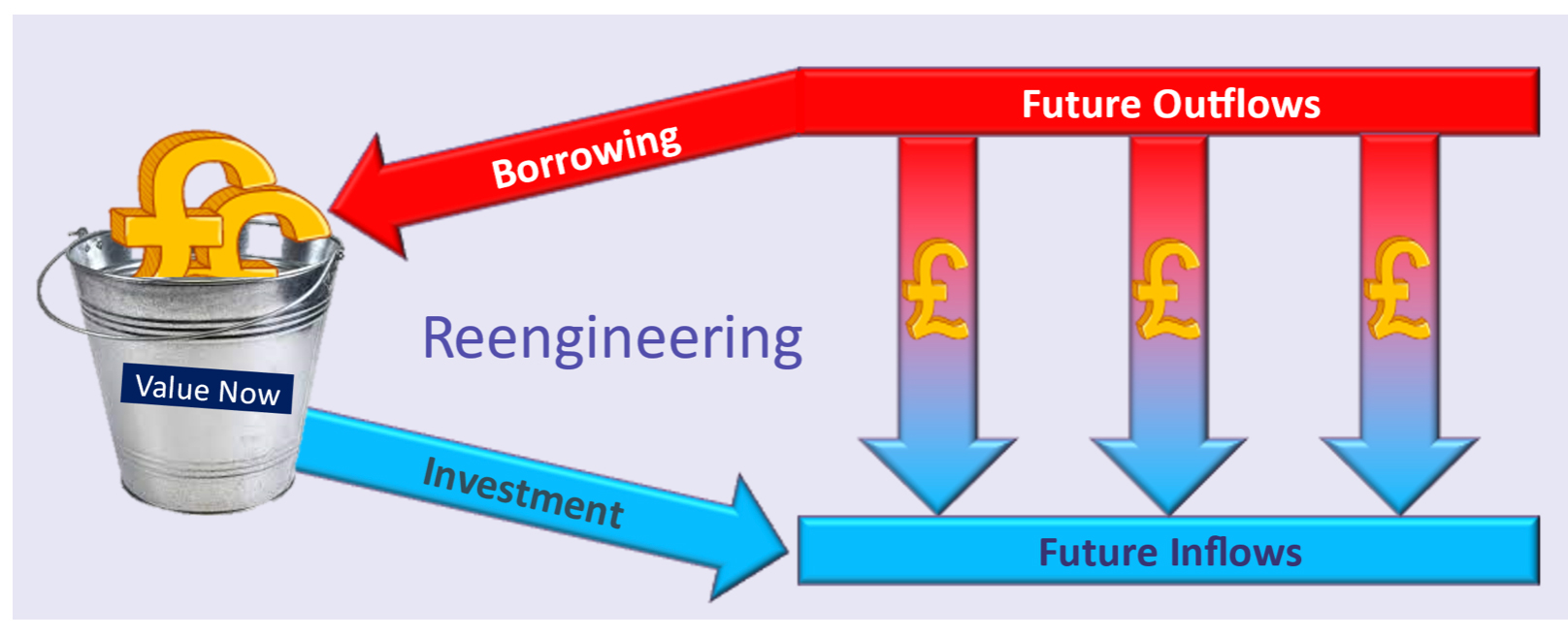

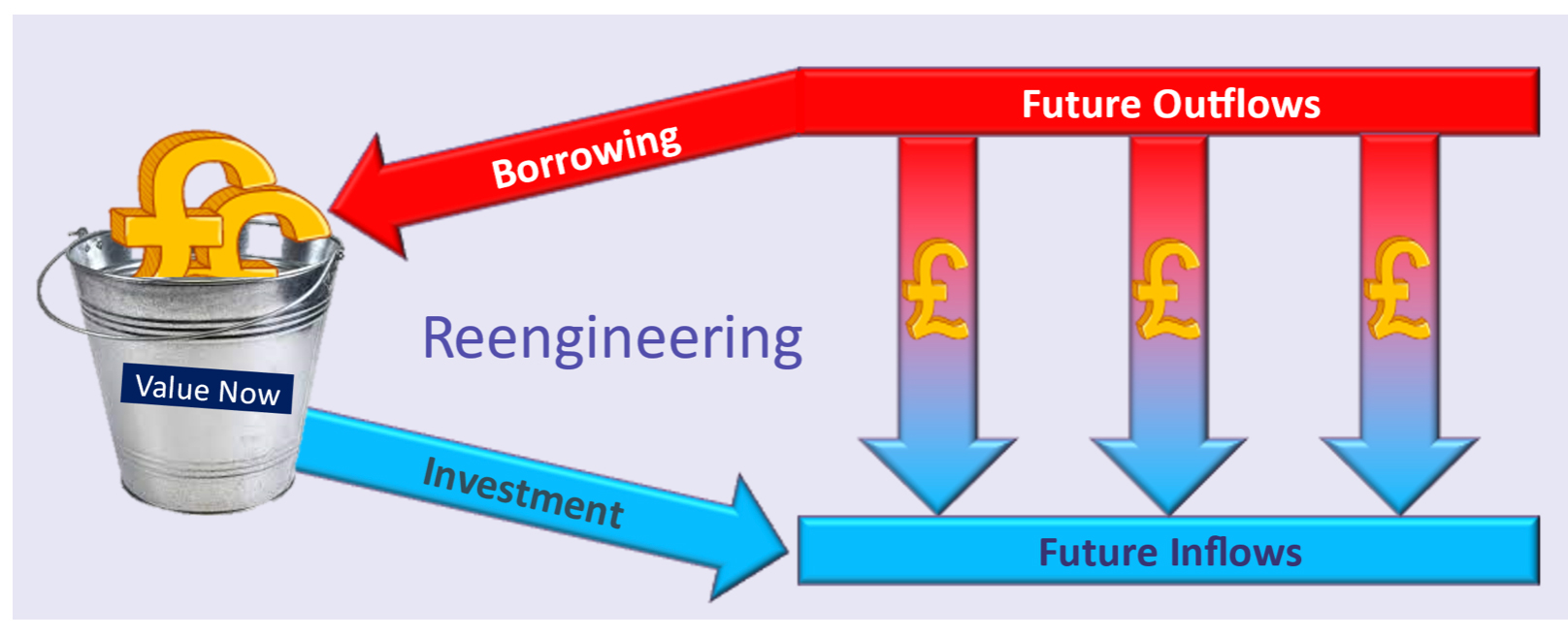

If we strip away the blizzard of entities and activities engaged in what we currently do and let the snow settle, then it becomes clear that the finance industry only manages two related things and its purpose is to reengineer one into (and out of) the other. These are:

Current pots of value

Future flows of value

Figure 1

To deliver investment, we re-engineer a current pot of value into a set of future inflows. To deliver borrowing, we do the converse and re-engineer future outflows into a current pot of value. That is all that we really do. Everything else that exists or happens in finance is there to aid and abet delivery to these fundamental objectives.

The players who really matter in our industry are obvious when the purpose of the industry itself becomes clear: they are the investors (or ‘asset owners’ in the institutional world) and the borrowers (or ‘capital issuers’). These are the players who make, or who want to receive, the future flows and who need, or who want to defer, current value. Everyone else in the business is there only to serve the needs of these ultimate participants and only deserves their place in the industry if they genuinely make it easier, cheaper or safer for investors and borrowers to achieve their goals.

Why the model is like it is

There are hundreds of projects tokenising conventional assets. They may be worthy, but not one of them will transform the industry.

Tokenised conventional assets are just that: slightly sexier versions of conventional assets. The only digital thing about them is their title — i.e. their ownership — which exists on-ledger. Their regulations, controlling entities, operating models and terms and conditions are unchanged and still exist wholly off-ledger. Registry, trading and fractionalisation are easier with tokenised assets, but not much else is. Native digital assets are not conventional assets in a sexier wrapper. They are wholly different and do not conform to the straightjacket of current instrument classes.

In conventional finance, each asset type is wrapped up in law and regulation as if it were a coherent ‘thing’: it is valued, risk managed and traded as a single indivisible whole. A consequence of the smart token model is that what we commonly call “assets” are not coherent, unitary things at all, but are really just collections of commitments to future flows of value. That value is often, but not always, represented in cash.

In a purely digital ecosystem, all pots of value are tokens and all movements of value are a flow of tokens on the digital ledger. In this context, current value is represented by tokens — generally cash tokens — and native digital assets can only be one thing: commitments to future flows of tokens. It is as simple as that. This maps the purpose of the industry very effectively: it is all about the management of current pots of value and future flows of value, in token form, because we are in a wholly digital context.

So digital asset tokens should represent commitments to future flows, not title to conventional assets.

Making tokens smart

In this context, the native digital asset tokens are like IOUs — they are representations of liabilities, held by the lender as a pledge until the borrower discharges its debt, and are then handed back to the borrower. The next big step is to make the tokens themselves control what goes on: they need to be smart and potent. The difference with smart tokens is that it is the tokens themselves that make the repayment happen, not the parties to the debt.

Making tokens smart sounds complex, as if they will be like full business systems in their own right. However, because the only thing that happens on the digital ledger is the movement of tokens between nodes, the only thing that a smart token can do is to move tokens — itself or others — between nodes. That means that smart tokens are relatively simple entities — they just need to know what they have to do, when they need to do it, and according to which constraints. Then they require the potency to do it, where the ‘it’ is just moving tokens on the digital ledger.

When the tokens are smart and potent, many of the processes that are carried out in the conventional world by regulated entities — for example order management, execution, entitlement calculation, corporate actions, income payments, securitisations and collateral transfers — are carried out automatically by the tokens themselves. This may sound concerning — that tokens should be making transfers of value without human intervention — but the tokens are not making any of this up. They are just giving effect to what the parties to a transaction have already agreed will happen.

The two big ideas

The key steps that get us from conventional tokenisation to the smart token model are twofold:

• First, we recognise that native digital assets are (and can only be) commitments to future flows of tokens, so we issue digital asset tokens that represent those flow commitments, rather than issuing them to represent title to conventional assets.

• Second, we make the tokens that constitute native digital assets smart, so that they can initiate and deliver, as well as describe, the committed flows of tokens.

That’s all. Once we take on board these two fundamental ideas, the smart token model becomes clear and the seismic potential of native digital assets opens up to us. Every asset is issued in the same way, every transaction follows the same operating model and regulation shrinks from a firestorm to a candle flame.

Digital initiatives in securities finance

Current digital initiatives in securities finance are almost all based on conventional assets, and deploy those assets as collateral in upgrades, in OTC credit agreements, in loans, or in repo transactions. These are prominent examples of the tokenisation of wholly conventional assets.

This is not to say that these initiatives are without value: they deliver precisely the benefits that accrue from replacing conventional delivery rails with on-ledger token-transfer. While the asset is conventional, and exists wholly off-ledger, the title to the asset is digitised and exists on the digital ledger in token form. It is generally easier, quicker and cheaper to move tokens on a digital ledger than to move assets between custodian or depositary accounts. This allows us to increase the frequency of collateral movements: by doing so, we reduce daylight exposure, while also reducing costs.

In most initiatives, the cash side of financing transactions is conventional and depends on conventional payment infrastructure. This means coordination between payments off-ledger and the movement of title on-ledger. In more ambitious projects, the cash side of transactions may be represented on-ledger also, but this has been restricted in most cases to commercial bank-issued digital currency, such as JPM Coin. This facilitates atomic settlement, giving the benefit of locked ‘delivery versus delivery’, and removes the need to align with off-ledger payments.

So there are benefits in tokenising conventional collateral, but these are dwarfed by the benefits of native digital assets.

Part two of this article - Native digital assets in securities finance

New model of investment

We have spent many years developing and implementing incremental improvements to financial markets, operations and technology. We have tried to reduce the risks and costs inherent in our conventional models of investment, added new entities to patch over cracks, offshored and outsourced to reduce resource costs, and automated processes wherever we can. Despite this, we are nowhere near to a single coherent operating model, nor anything close to an issuance model that directly represents the real purpose of our industry.

In our conventional world of assets and transactions, each asset class has its own issuance model — how it is created, issued and owned — and its own operating model, defining how it is managed, traded and settled. These tend to be very complex and involve many entities, processes and controls. This combination of the multiple asset classes, operating models, entities, processes and controls drives a firestorm of regulation, which adds its own complexity to an already convoluted picture.

The smart token model proposed here eradicates this complexity and reduces the cost and risk that are its inevitable consequences. The smart token model is a single, simple digital issuance model and a single, simple operating model for all assets. It enables us to issue and own all digital assets in the same form and to manage, trade and settle transactions in those assets in the same way, whatever the asset is that we are seeking to issue and trade.

The model aims to provide a practical method of operation for a fully digital ecosystem. “Fully digital” in this context means that all value and all transactions exist only in digital form: there is no use of conventional issuance, registry, custody, banking or payment and delivery rails. Pools of value are in the form of tokens on a digital ledger and all movements of value are flows of tokens between addresses on the digital ledger. The existence of a token at a node on the ledger is proof of the ownership — of whatever that token represents — by the owner of that node. We refer to ‘nodes’ in this paper, but these may also be referred to as ‘wallets’ or ‘addresses’.

The benefits of the smart token model are profound. This eliminates the boundaries between asset classes and allows us to build whatever assets and transactions that we want and that are useful to issuers and investors. It enables the issuer of capital to create exactly the funding that they want and enables the asset owner to seek precise matches to their investment requirements. The model brings orders, executions, entitlements, corporate actions, income, securitisations, collateral and liabilities into the same simple operating model as trades. Asset servicing disappears as a result and trading and settlements become simple and fully automated.

What our industry is for

If we strip away the blizzard of entities and activities engaged in what we currently do and let the snow settle, then it becomes clear that the finance industry only manages two related things and its purpose is to reengineer one into (and out of) the other. These are:

Current pots of value

Future flows of value

Figure 1

To deliver investment, we re-engineer a current pot of value into a set of future inflows. To deliver borrowing, we do the converse and re-engineer future outflows into a current pot of value. That is all that we really do. Everything else that exists or happens in finance is there to aid and abet delivery to these fundamental objectives.

The players who really matter in our industry are obvious when the purpose of the industry itself becomes clear: they are the investors (or ‘asset owners’ in the institutional world) and the borrowers (or ‘capital issuers’). These are the players who make, or who want to receive, the future flows and who need, or who want to defer, current value. Everyone else in the business is there only to serve the needs of these ultimate participants and only deserves their place in the industry if they genuinely make it easier, cheaper or safer for investors and borrowers to achieve their goals.

Why the model is like it is

There are hundreds of projects tokenising conventional assets. They may be worthy, but not one of them will transform the industry.

Tokenised conventional assets are just that: slightly sexier versions of conventional assets. The only digital thing about them is their title — i.e. their ownership — which exists on-ledger. Their regulations, controlling entities, operating models and terms and conditions are unchanged and still exist wholly off-ledger. Registry, trading and fractionalisation are easier with tokenised assets, but not much else is. Native digital assets are not conventional assets in a sexier wrapper. They are wholly different and do not conform to the straightjacket of current instrument classes.

In conventional finance, each asset type is wrapped up in law and regulation as if it were a coherent ‘thing’: it is valued, risk managed and traded as a single indivisible whole. A consequence of the smart token model is that what we commonly call “assets” are not coherent, unitary things at all, but are really just collections of commitments to future flows of value. That value is often, but not always, represented in cash.

In a purely digital ecosystem, all pots of value are tokens and all movements of value are a flow of tokens on the digital ledger. In this context, current value is represented by tokens — generally cash tokens — and native digital assets can only be one thing: commitments to future flows of tokens. It is as simple as that. This maps the purpose of the industry very effectively: it is all about the management of current pots of value and future flows of value, in token form, because we are in a wholly digital context.

So digital asset tokens should represent commitments to future flows, not title to conventional assets.

Making tokens smart

In this context, the native digital asset tokens are like IOUs — they are representations of liabilities, held by the lender as a pledge until the borrower discharges its debt, and are then handed back to the borrower. The next big step is to make the tokens themselves control what goes on: they need to be smart and potent. The difference with smart tokens is that it is the tokens themselves that make the repayment happen, not the parties to the debt.

Making tokens smart sounds complex, as if they will be like full business systems in their own right. However, because the only thing that happens on the digital ledger is the movement of tokens between nodes, the only thing that a smart token can do is to move tokens — itself or others — between nodes. That means that smart tokens are relatively simple entities — they just need to know what they have to do, when they need to do it, and according to which constraints. Then they require the potency to do it, where the ‘it’ is just moving tokens on the digital ledger.

When the tokens are smart and potent, many of the processes that are carried out in the conventional world by regulated entities — for example order management, execution, entitlement calculation, corporate actions, income payments, securitisations and collateral transfers — are carried out automatically by the tokens themselves. This may sound concerning — that tokens should be making transfers of value without human intervention — but the tokens are not making any of this up. They are just giving effect to what the parties to a transaction have already agreed will happen.

The two big ideas

The key steps that get us from conventional tokenisation to the smart token model are twofold:

• First, we recognise that native digital assets are (and can only be) commitments to future flows of tokens, so we issue digital asset tokens that represent those flow commitments, rather than issuing them to represent title to conventional assets.

• Second, we make the tokens that constitute native digital assets smart, so that they can initiate and deliver, as well as describe, the committed flows of tokens.

That’s all. Once we take on board these two fundamental ideas, the smart token model becomes clear and the seismic potential of native digital assets opens up to us. Every asset is issued in the same way, every transaction follows the same operating model and regulation shrinks from a firestorm to a candle flame.

Digital initiatives in securities finance

Current digital initiatives in securities finance are almost all based on conventional assets, and deploy those assets as collateral in upgrades, in OTC credit agreements, in loans, or in repo transactions. These are prominent examples of the tokenisation of wholly conventional assets.

This is not to say that these initiatives are without value: they deliver precisely the benefits that accrue from replacing conventional delivery rails with on-ledger token-transfer. While the asset is conventional, and exists wholly off-ledger, the title to the asset is digitised and exists on the digital ledger in token form. It is generally easier, quicker and cheaper to move tokens on a digital ledger than to move assets between custodian or depositary accounts. This allows us to increase the frequency of collateral movements: by doing so, we reduce daylight exposure, while also reducing costs.

In most initiatives, the cash side of financing transactions is conventional and depends on conventional payment infrastructure. This means coordination between payments off-ledger and the movement of title on-ledger. In more ambitious projects, the cash side of transactions may be represented on-ledger also, but this has been restricted in most cases to commercial bank-issued digital currency, such as JPM Coin. This facilitates atomic settlement, giving the benefit of locked ‘delivery versus delivery’, and removes the need to align with off-ledger payments.

So there are benefits in tokenising conventional collateral, but these are dwarfed by the benefits of native digital assets.

Part two of this article - Native digital assets in securities finance

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times