Navigating the complexities of the financial ecosystem

19 May 2023

In today’s fast-paced and evolving financial industry, technological advancements are crucial for streamlining processes and complying with regulatory obligations. Comyno COO Frank Becker explores the firm’s securities finance solution

Image: stock.adobe.com/ipopba

Image: stock.adobe.com/ipopba

From providing a platform for securities finance transactions and facilitating regulatory reporting to connecting seamlessly to distributed ledger technology (DLT) and blockchain platforms, Comyno’s C-ONE suite offers market participants the tools to navigate the complexities of the financial ecosystem. Additionally, through the firm’s partnership with SWIAT, Comyno is at the forefront of developing a blockchain-based financial market infrastructure for digital and traditional assets.

The securities financing market is still undergoing significant structural changes that require continuous optimisation measures. At the macro level, these changes include ever-increasing regulatory demands and process standardisation, which is leading to high costs and a large margin for human error. However, these problems are widespread in day-to-day business operations units and within the front office.

To counter these issues, an enhanced process of automation has to be implemented. Comyno offers a wide range of tools to improve the efficiency of business processes, increase the accuracy of tasks and speed up the flow of operations by minimising human interaction. It is about optimising process workflows to save time and costs while improving the quality and consistency of results.

Comyno’s C-ONE suite incorporates a front-to-back office solution which aims to facilitate interactions with a number of third-party service providers, including electronic trading platforms, trade repositories, triparty collateral agents and central counterparties (CCPs), which can be easily expanded in a plug-and-play manner. Once the first component is established, C-ONE can be linked to major DLT and blockchain platforms.

The suite offers a range of key functionalities including securities finance trading, automated locates management, regulatory reporting and standard connectivity to systems and service providers. Having all of these functionalities in one system is the main advantage. This provides a streamlined front-to-back solution that is easy to integrate and user-friendly.

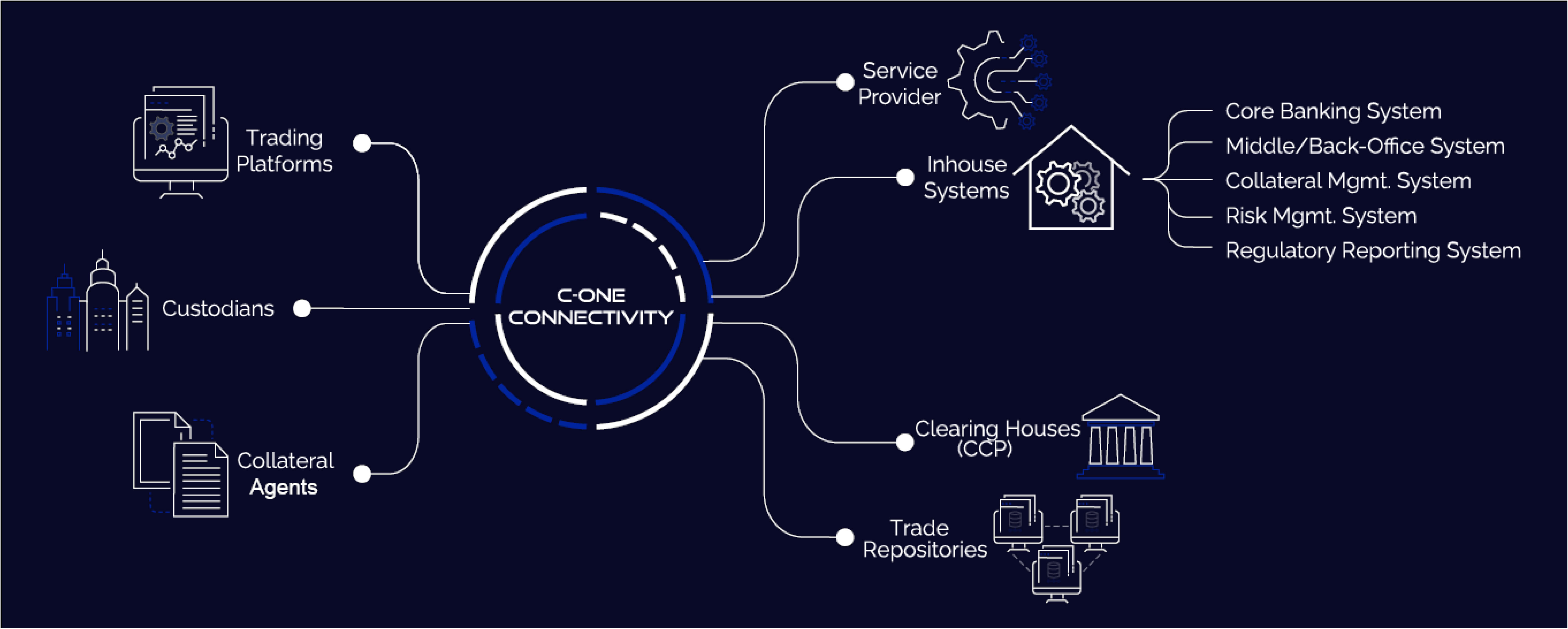

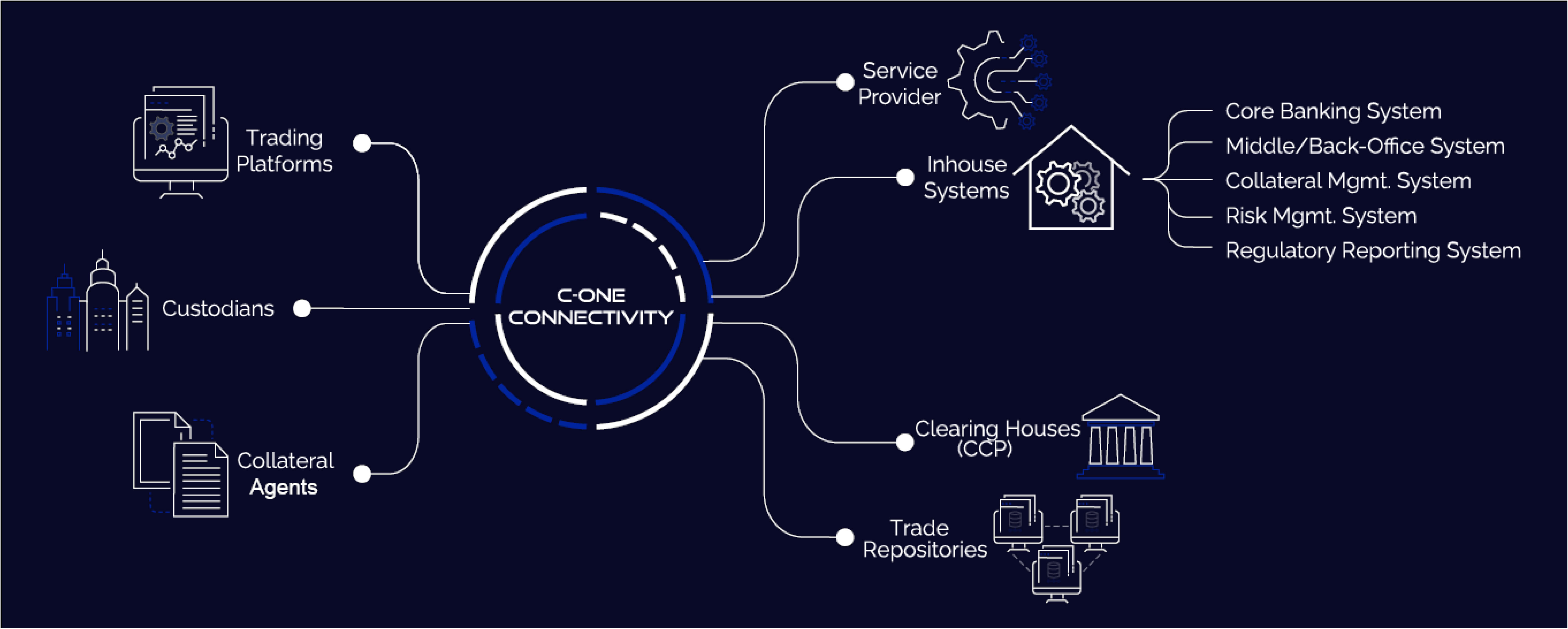

Figure 1: C-ONE suite

The suite is based on the data integration layer C-ONE Connectivity — a data integration platform that enables seamless interoperability between heterogeneous systems. This platform allows for the integration of in-house systems for core banking, collateral management and risk management, with external service and data providers such as clearing houses, trade repositories and trading platforms.

C-ONE Connectivity is a specialised solution designed to meet the complex security finance requirements of our clients, offering advanced features like an enhanced error and anomaly management system for high availability and resilient operations. With a comprehensive range of tools and plug-ins, our clients can efficiently cover all securities finance-related topics.

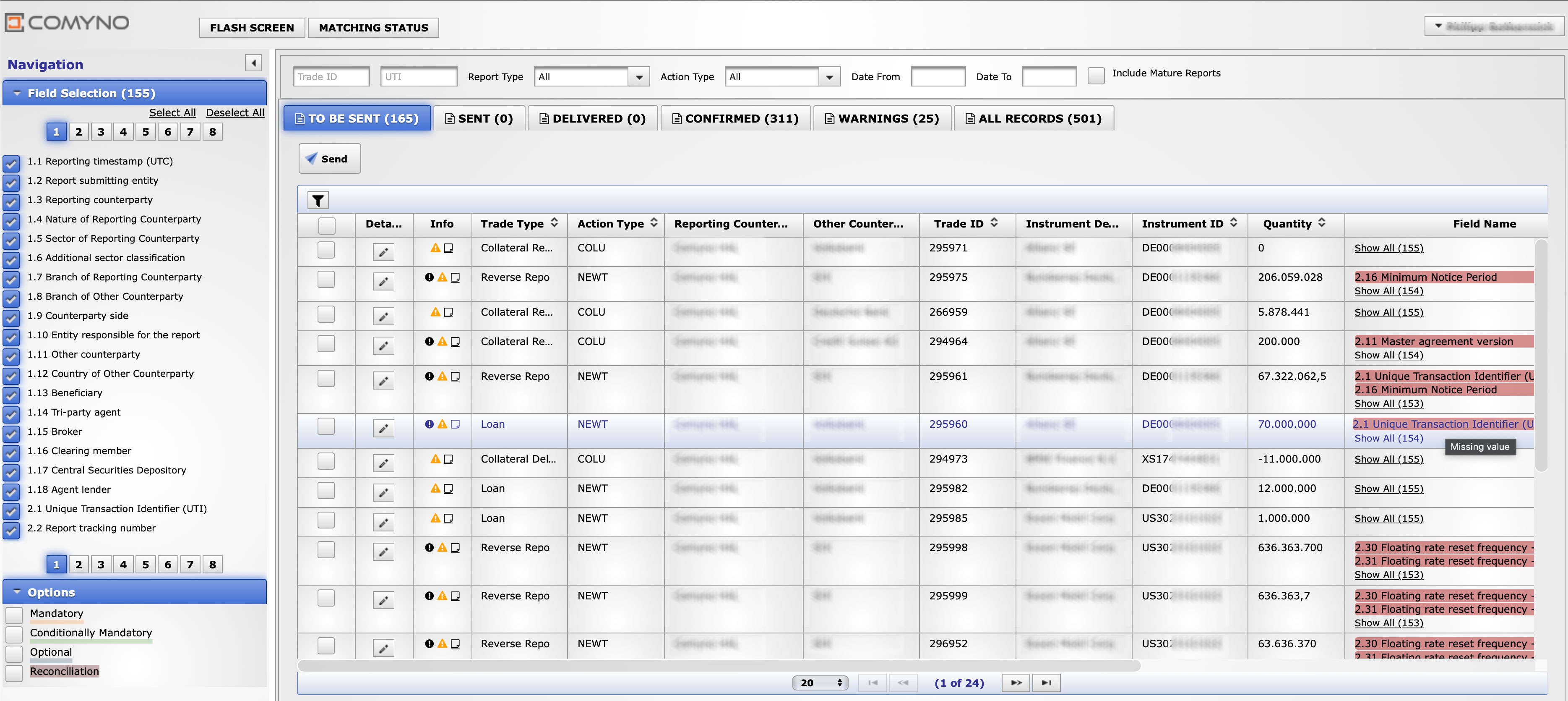

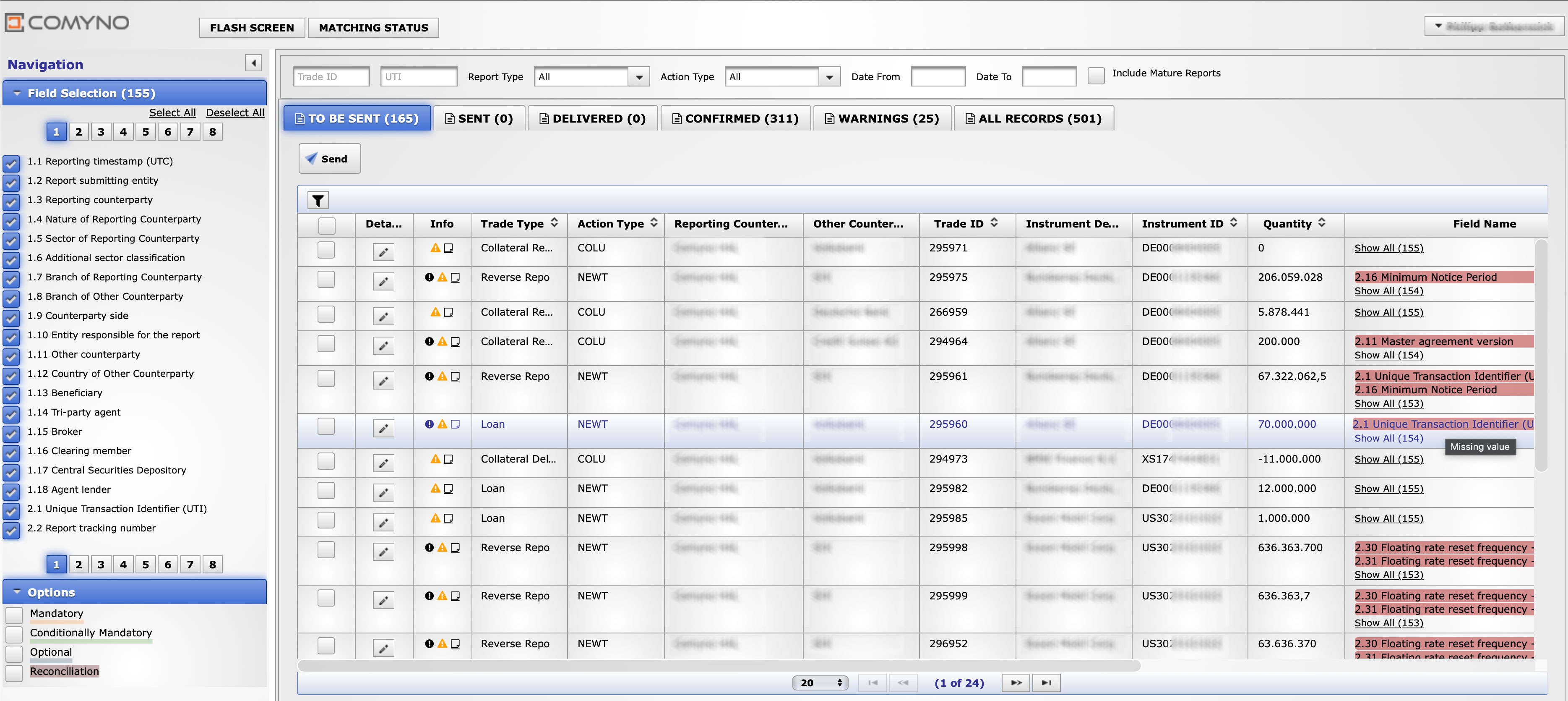

One significant component that has gained importance in recent years is the integration with a trade repository for Securities Financing Transactions Regulation (SFTR) reporting. C-ONE Security Finance complements C-ONE Connectivity in that regard by offering a SFTR front end that integrates with the trade repository to streamline reporting and compliance processes.

The SFTR solution offered by Comyno simplifies the reporting process for financial institutions by automating the creation and submission of SFT reports. The solution is versatile and adaptable, accommodating different types of SFTs and asset classes. Clients can easily manage their reporting duties and track data quality through the user-friendly interface. The solution also includes an advanced data validation engine to ensure the accuracy and completeness of reports — including the visualisation of the specific table, field numbers and the given error reason — before transferring the data to the trade repository.

Figure 2: C-ONE Connectivity

Configurable notifications promptly alert clients to rejected reports or erroneous fields, helping them take immediate action and avoid penalties. Not only does the reporting GUI facilitate a company’s own SFTR reporting, but it also allows for delegated SFTR reporting on behalf of clients. This is particularly beneficial for financial institutions who offer the reporting service to clients as smaller Tier 2 banks with limited back- and middle-office resources.

One of the most significant advantages of the C-ONE suite is its connection to DLT and blockchain platforms, supporting the current digital market demands. The suite is also ready for the transition of markets to broader DLT networks. Comyno has been at the forefront of supporting the development of a blockchain-based financial market infrastructure for digital and traditional assets, from and for regulated financial entities, called SWIAT.

Figure 3: SFTR Dashboard

SWIAT is a joint venture between DekaBank, LBBW, Standard Chartered and Comyno. The company is further enhancing the platform, technically and functionally with Comyno. SWIAT provides a decentralised financial infrastructure and enables frictionless, real-time custody and settlement environment across asset classes between different global jurisdictions.

After demonstrating the possibilities and advantages of blockchains for securities lending in the past, Comyno is now expanding its capabilities to fully exploit the potential of this technology. SWIAT aims to eliminate market and infrastructure inefficiencies. Manual workflows from deal origination to settlement and daily security events with reconciliation are addressed directly with the platform. Through the uniform and standardised booking of transactions on the blockchain, sources of errors are minimised, leading to greater efficiency and cost savings.

The risk of collateralisation and associated counterparty risk are also considered, with a new trading type named “delivery-versus-delivery”. This allows for immediate collateralisation of the transaction, extending the settlement of both trades simultaneously and without delay to eliminate underlying trading and counterparty risk. Due to the immediate fail-free settlement of the transaction and the uniform data set for both parties, regulatory reporting can be initiated and implemented immediately, enabling even faster reconciliation of the transaction by the regulator.

By implementing Comyno’s C-ONE suite, our clients are able to upgrade their securities finance business to a cutting-edge, modern and efficient system. The platform’s modular and extensible approach allows for customised solutions at low entry costs, leading to increased profits right from the beginning. As digital assets and blockchain technology become increasingly relevant, we are well-positioned for future business.

Comyno’s expertise in the securities finance industry, combined with SWIAT’s cutting-edge blockchain technology, provides market participants with a powerful tool to navigate the complexities of the rapidly evolving financial ecosystem.

The securities financing market is still undergoing significant structural changes that require continuous optimisation measures. At the macro level, these changes include ever-increasing regulatory demands and process standardisation, which is leading to high costs and a large margin for human error. However, these problems are widespread in day-to-day business operations units and within the front office.

To counter these issues, an enhanced process of automation has to be implemented. Comyno offers a wide range of tools to improve the efficiency of business processes, increase the accuracy of tasks and speed up the flow of operations by minimising human interaction. It is about optimising process workflows to save time and costs while improving the quality and consistency of results.

Comyno’s C-ONE suite incorporates a front-to-back office solution which aims to facilitate interactions with a number of third-party service providers, including electronic trading platforms, trade repositories, triparty collateral agents and central counterparties (CCPs), which can be easily expanded in a plug-and-play manner. Once the first component is established, C-ONE can be linked to major DLT and blockchain platforms.

The suite offers a range of key functionalities including securities finance trading, automated locates management, regulatory reporting and standard connectivity to systems and service providers. Having all of these functionalities in one system is the main advantage. This provides a streamlined front-to-back solution that is easy to integrate and user-friendly.

Figure 1: C-ONE suite

The suite is based on the data integration layer C-ONE Connectivity — a data integration platform that enables seamless interoperability between heterogeneous systems. This platform allows for the integration of in-house systems for core banking, collateral management and risk management, with external service and data providers such as clearing houses, trade repositories and trading platforms.

C-ONE Connectivity is a specialised solution designed to meet the complex security finance requirements of our clients, offering advanced features like an enhanced error and anomaly management system for high availability and resilient operations. With a comprehensive range of tools and plug-ins, our clients can efficiently cover all securities finance-related topics.

One significant component that has gained importance in recent years is the integration with a trade repository for Securities Financing Transactions Regulation (SFTR) reporting. C-ONE Security Finance complements C-ONE Connectivity in that regard by offering a SFTR front end that integrates with the trade repository to streamline reporting and compliance processes.

The SFTR solution offered by Comyno simplifies the reporting process for financial institutions by automating the creation and submission of SFT reports. The solution is versatile and adaptable, accommodating different types of SFTs and asset classes. Clients can easily manage their reporting duties and track data quality through the user-friendly interface. The solution also includes an advanced data validation engine to ensure the accuracy and completeness of reports — including the visualisation of the specific table, field numbers and the given error reason — before transferring the data to the trade repository.

Figure 2: C-ONE Connectivity

Configurable notifications promptly alert clients to rejected reports or erroneous fields, helping them take immediate action and avoid penalties. Not only does the reporting GUI facilitate a company’s own SFTR reporting, but it also allows for delegated SFTR reporting on behalf of clients. This is particularly beneficial for financial institutions who offer the reporting service to clients as smaller Tier 2 banks with limited back- and middle-office resources.

One of the most significant advantages of the C-ONE suite is its connection to DLT and blockchain platforms, supporting the current digital market demands. The suite is also ready for the transition of markets to broader DLT networks. Comyno has been at the forefront of supporting the development of a blockchain-based financial market infrastructure for digital and traditional assets, from and for regulated financial entities, called SWIAT.

Figure 3: SFTR Dashboard

SWIAT is a joint venture between DekaBank, LBBW, Standard Chartered and Comyno. The company is further enhancing the platform, technically and functionally with Comyno. SWIAT provides a decentralised financial infrastructure and enables frictionless, real-time custody and settlement environment across asset classes between different global jurisdictions.

After demonstrating the possibilities and advantages of blockchains for securities lending in the past, Comyno is now expanding its capabilities to fully exploit the potential of this technology. SWIAT aims to eliminate market and infrastructure inefficiencies. Manual workflows from deal origination to settlement and daily security events with reconciliation are addressed directly with the platform. Through the uniform and standardised booking of transactions on the blockchain, sources of errors are minimised, leading to greater efficiency and cost savings.

The risk of collateralisation and associated counterparty risk are also considered, with a new trading type named “delivery-versus-delivery”. This allows for immediate collateralisation of the transaction, extending the settlement of both trades simultaneously and without delay to eliminate underlying trading and counterparty risk. Due to the immediate fail-free settlement of the transaction and the uniform data set for both parties, regulatory reporting can be initiated and implemented immediately, enabling even faster reconciliation of the transaction by the regulator.

By implementing Comyno’s C-ONE suite, our clients are able to upgrade their securities finance business to a cutting-edge, modern and efficient system. The platform’s modular and extensible approach allows for customised solutions at low entry costs, leading to increased profits right from the beginning. As digital assets and blockchain technology become increasingly relevant, we are well-positioned for future business.

Comyno’s expertise in the securities finance industry, combined with SWIAT’s cutting-edge blockchain technology, provides market participants with a powerful tool to navigate the complexities of the rapidly evolving financial ecosystem.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times