Solving for a crucial function

19 May 2023

FinOptSys CEO Divyesh Bhakta and chief quant officer Alfredo Hernandez discuss the complexities of collateral optimisation, while highlighting the key components that will make for a successful collateral management framework

Image: stock.adobe.com/dampoint

Image: stock.adobe.com/dampoint

Recent market stress, coupled with the ever growing regulatory environment, has emphasised the importance of developing and maintaining cutting-edge collateral management capabilities. It is not only essential for the effective monitoring and managing of credit risk exposure, but also for identifying counterparty stress and for enabling optimisation of collateral inventories during periods of high market volatility.

Managing collateral optimally can be extremely complex, not to mention costly. This is particularly true for large institutions that typically rely on a fragmented infrastructure, that operate in numerous regulatory jurisdictions, that have multiple counterparties, asset classes and oftentimes siloed businesses. This fragmented collateral management infrastructure leads not only to heavy reliance on error-prone manual intervention or processes across the transaction lifecycle, but also to a lack of ability to effectively analyse, forecast and manage collateral inventory and obligations. For many institutions, collateral management processes lack automation, which results in missed margin calls, suboptimal collateral allocations and opportunity costs in the form of missed revenue and higher funding costs.

One of the primary challenges of collateral management is balancing liquidity and cost. On one hand, collateral needs to be readily available to meet margin calls and other obligations, while on the other, keeping large inventories of high-quality liquid assets can be costly, as it ties up capital that could be deployed elsewhere. Moreover, collateral not actively utilised to generate income by taking advantage of investing opportunities and collateral transformations is a true opportunity cost to the institution.

We believe that the trade-off between different uses of financial assets should be optimised, while providing an efficient solution to satisfy margin requirements to different counterparties — conditional on their respective schedules, investment opportunities and additional set of financial resource constraints. For collateral management to be successful, it needs to efficiently optimise asset allocation across competing objectives: selection and pledging of collateral, funding, transformations and securities lending.

An important function of collateral management is margin optimisation, where assets are pledged to satisfy a diverse set of margin requirements for different counterparties. The final objectives can be both reducing cost and increasing liquidity, while satisfying margin calls. Ideally, this pre-trade portfolio optimises resources at the organisation level and ensures a stronger balance sheet with reduced margin costs, which will ultimately affect the bottom line.

Comprehensive collateral management should include efficient funding and collateral transformations. These actions can be represented by upgrading or downgrading collateral and must be driven by margin requirements and revenue generating opportunities. Collateral transformations involve converting one type of collateral into another.

This can be useful when a counterparty demands a specific type of collateral that is not readily available, or when there is excessive cost of holding a certain type of collateral. For instance, to meet the requirements of a counterparty or regulatory authority an institution may transform a lower-quality bond into a higher-quality bond (i.e. collateral upgrade). Also, by taking advantage of downgrades, institutions maximise the value of their collateral inventory, generating additional revenue.

Lastly, collateral management should also involve securities lending and borrowing. This important activity refers to transactions where assets are lent against collateral to be returned at some point in the future. Securities lending may involve lending out high-quality securities from collateral inventory to other market participants in exchange for a fee. This can be an additional source of income for institutions, as it allows them to earn a return on otherwise idle assets, while maintaining control of the collateral inventory. Furthermore, securities lending enhances the liquidity and flow of assets in the market as it provides an alternative source of funding for market participants that need to borrow securities to settle transactions. Therefore, both lenders and borrowers benefit.

It is worth noting that margin optimisation, collateral transformations and securities lending can also introduce additional risks and complexities into the collateral management process. For example, the borrower of securities may fail to return them on time, or the value of the collateral may decline rapidly, leading to a shortfall in margin. Institutions can carefully manage these risks by applying technologies to manage their collateral inventory and obligations, while reducing funding costs, maximising liquidity and benefiting from investment opportunities.

Managing collateral allocations optimally has multiple advantages such as increasing balance sheet liquidity, reducing cost while meeting collateral exposures, reducing the risk of margin calls when mark-to-market goes against the position, among other benefits. As a result, collateral management becomes crucial to the efficient and smooth operation of many financial institutions.

By properly defining an optimisation problem and using mathematical algorithms systematically, institutions can determine the optimal allocation of collateral, considering countless factors such as credit risk, liquidity, cost, funding and transformation, to name a few. For instance, a collateral optimisation model can help identify the most efficient way to use available collateral to satisfy margin requirements, while minimising the cost of holding excess inventory.

Current research

Despite its importance, there is limited research literature on collateral optimisation. Collateral management frameworks tend to focus on simple versions of the margin optimisation problem, with a limited number of constraints and a single objective, namely cheapest-to-deliver. In addition, given the nature of the problem, there may be multiple steps involved in the optimal management of collateral. However, existing literature tends to find solutions by solving sequential problems, using the output from a previous problem to find the solution to the next one and so on.

For example, a generic framework may involve the formulation of a linear programme with a single objective and a limited set of constraints, such as concentration limits on asset types and individual securities. These models are usually tested with hypothetical datasets. Although this is a viable approach, as it allows them to simulate scenarios not observed with real data, it lacks structure and flexibility to solve larger problems, for example, a large number of counterparty and margin type pairs, as well as multiple funding sources.

However, when multiple objectives are involved, such as funding and margin, standard algorithms become difficult to implement due to their sequential approach, therefore obscuring the usefulness of collateral management models. At FinOptSys, we think this approach is not only inefficient but fails to capture a holistic optimal solution, which should involve trade-offs for all securities allocations available.

As a result, a sound collateral management framework takes a comprehensive approach to solve the problem optimally. Our collateral management solution makes several ‘decisions’ redundant, such as which objectives to optimise first, emphasising concrete actions for the best use of securities given all available trade-offs. In summary, our algorithm finds a holistic optimal solution which simultaneously maximises multiple objectives, subject to a diverse set of constraints that bound the solution set and make the allocation portfolios realistic, efficient and easy to implement.

A comprehensive framework

Ideally, a holistic and comprehensive collateral management framework is designed to increase the operational efficiency and transparency of the allocation process by consolidating all collateral assets and management functions under one system. In addition, the introduction of fully digitised schedules for margin and transformations allows for a seamless execution of the allocation process, where eligibility criteria is fully integrated within the model and seamlessly updated. The full integration of the model within the FinOptSys platform allows interaction with other modules such as our patent-pending (allowed) Activity Based Collateral Modelling (ABCM) Analytics, reflecting real-time sources and uses of collateral.

The collateral management algorithm implements a single-step mixed integer linear programme to solve a collateral optimisation problem given a diverse set of inputs and constraints. The purpose of this allocation is to meet collateral obligations while maximising asset liquidity and reducing the ‘risk’ of pledged portfolios. Additionally, it finds cheapest-to-deliver securities and optimal funding sources, while it searches for potential investment opportunities in the form of collateral transformations and securities lending activity.

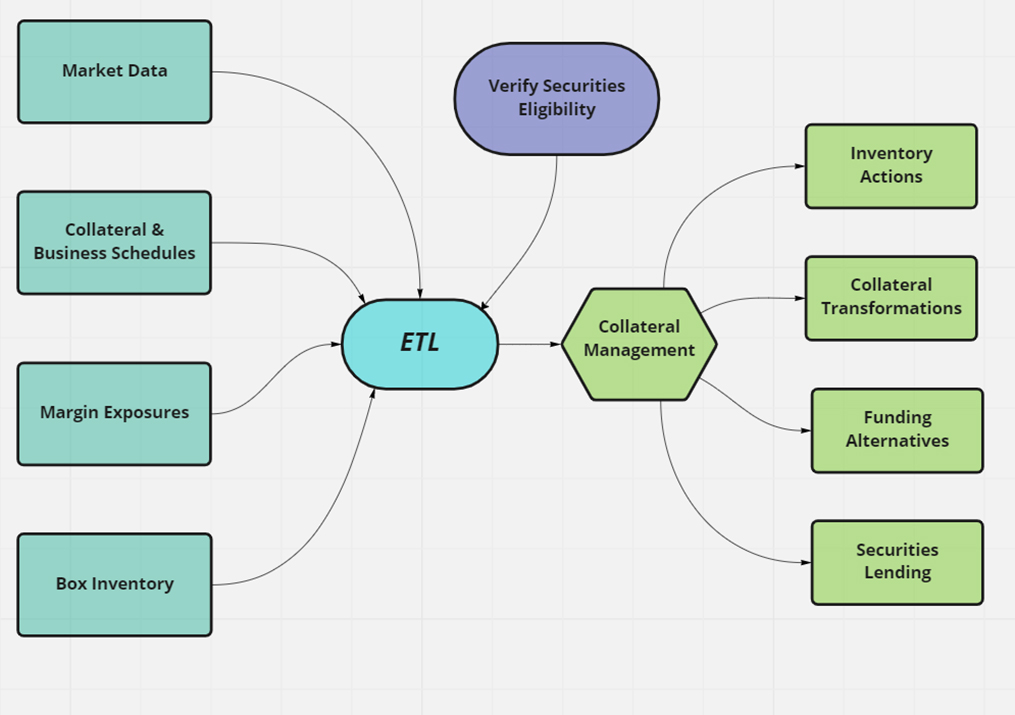

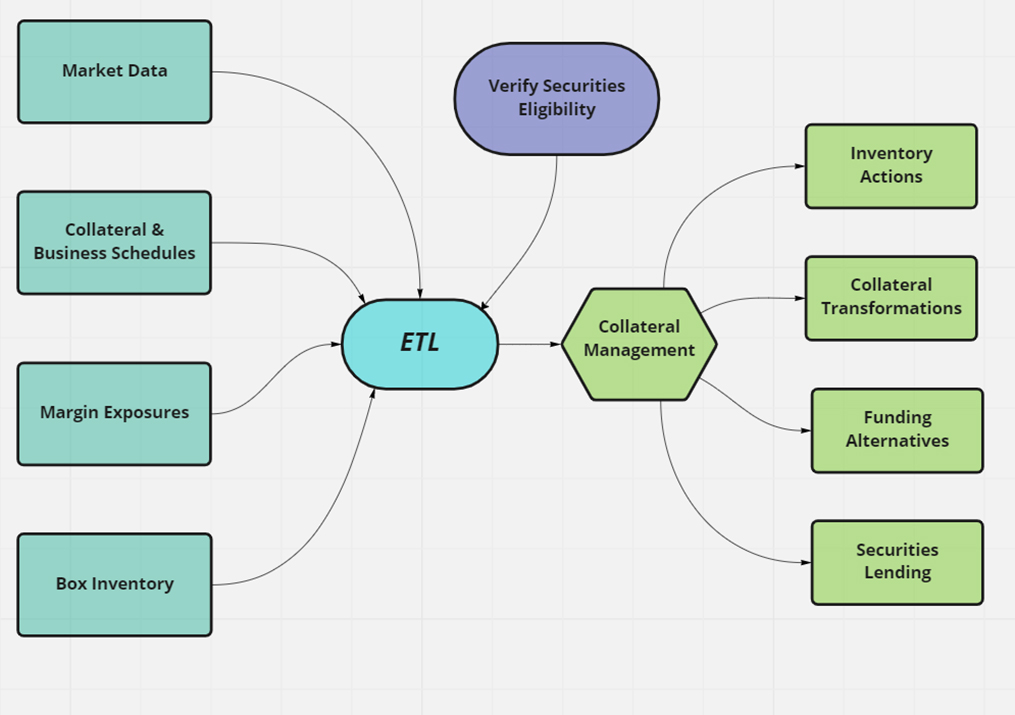

Figure 1 shows inputs to the model, as well as selected actions to be taken given competing optimal objectives. Note that the eligibility criteria is seamlessly incorporated into the model and is taken into account when constructing the model, given all required inputs.

Figure 1: sample inputs and actions for the FinOptSys collateral management framework.

The algorithm is then presented as a unified framework where the collateral allocation problem is solved in a single step by simultaneously analysing the trade-offs of uses for different securities, while satisfying margin requirements given eligibility criteria derived from individual schedules. These trade-offs are captured by different linear objectives, which may have weightings based on the current environment or on user preferences; the model objectives can be described as a combination of portfolios that will simultaneously maximise liquidity, minimise cost, maximise revenue, while searching for the cheapest funding.

To find a feasible and viable solution, the optimisation problem constraints need to be well defined. Constraints are broken down into three distinct categories:

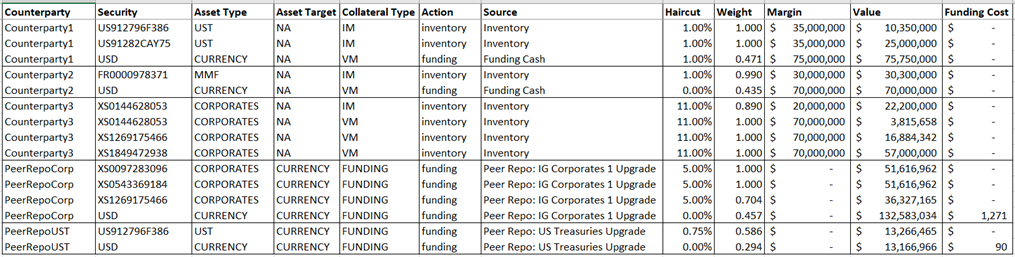

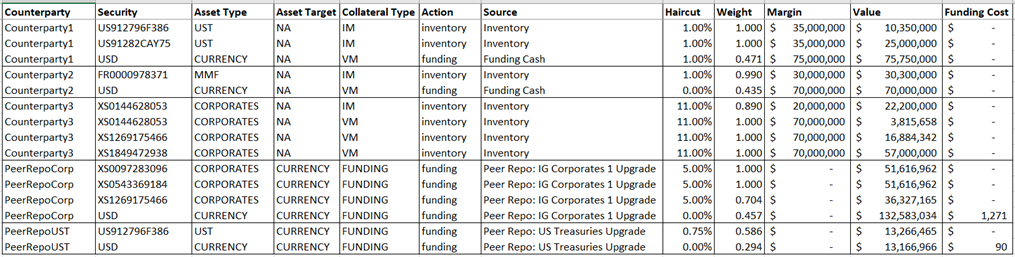

Figure 2: sample data set from optimal allocation output.

1. eligibility constraints: given by margin and business schedules. These constraints are essential for the model allocation to be compliant with agreements among all counterparties involved in the transactions

2. accounting constraints: given by asset availability and the uses of such assets. Considering we are solving multiple problems with one optimisation algorithm, these constraints link otherwise distinct actions to interact with each other

3. efficiency constraints: these constraints are important to avoid wasting scarce resources. This can be represented by overallocation of collateral, overpaying for funding opportunities, or missed opportunity costs by not taking advantage of revenue generating actions, among others. In addition, this category includes a regularisation constraint, where a substantial number of transactions are penalised, and finds a solution with the least number of transactions possible, seamlessly reducing trading costs

The model output represents a set of portfolios which maximise a linear combination of objectives, given the three sets of constraints. Consequently, the final output shows optimal margin allocation, cheapest funding opportunities and provides suggestions to invest idle securities to generate extra income. It provides clear and actionable portfolios for all possible collateral obligations and uses.

Moreover, the table is broken down by actions, counterparty and source, highlighting additional relevant fields that can be used for analysis and to better understand the optimal allocation.

This idea is represented in Figure 2, which shows a sample output table where different actions are shown to be optimal given initial inventory, margin requirements, funding availability and lending opportunities. For example, Counterparty1’s IM margin is satisfied with US Treasuries from inventory, while VM margin is using cash, funded with two different repo programmes.

In turn, given different collateral schedules, money market funds and cash are used for Counterparty2’s margin, while Corporates are used to satisfy Counterparty3’s margin. Note that the table is clear and specific in terms of the allocation and in the use of individual securities, sources and actions. In addition, it provides a list of relevant fields, such as haircuts, weight allocation and funding costs, among others.

Conclusion

Collateral management is a crucial function for financial institutions and has taken a more prominent role in recent years. The challenges experienced by seasoned market practitioners and clients have highlighted the need to review and improve end-to-end collateral processes, from front-office secured funding and financing activities through middle- and back-office operational margin and settlement functions. Moreover, they have increased the importance of collateral analytics, optimisation capabilities, and the need for automated operational processes and workflow to effectively manage collateral.

The lack of a collateral management comprehensive solution problem led us to the development and deployment of our innovative solution with its optimisation algorithms, which incorporate machine learning models and artificial intelligence. This will not only help institutions achieve optimal allocations of collateral given ever changing and dynamic requirements, but will also suggest substitutions, transformations and investment opportunities, therefore increasing efficiency in the collateral portfolio while generating passive income and enhancing liquidity.

The ability to run these algorithms on demand increases the role and importance of proper collateral management, especially after recent increases in interest rates and a potential recession in the economy that can make certain institutions more vulnerable to liquidity runs and counterparty risk.

We believe firms should invest in their front-office trading and optimisation infrastructure and review whether they should invest in further uplifting operational capabilities in-house or outsource these functions to an asset servicing provider. Ultimately, significant control, cost and financial resource efficiency needs to be achieved through investment in front-to-back collateral management processes — such as those offered by FinOptSys, delivering solutions for the future, today!

Managing collateral optimally can be extremely complex, not to mention costly. This is particularly true for large institutions that typically rely on a fragmented infrastructure, that operate in numerous regulatory jurisdictions, that have multiple counterparties, asset classes and oftentimes siloed businesses. This fragmented collateral management infrastructure leads not only to heavy reliance on error-prone manual intervention or processes across the transaction lifecycle, but also to a lack of ability to effectively analyse, forecast and manage collateral inventory and obligations. For many institutions, collateral management processes lack automation, which results in missed margin calls, suboptimal collateral allocations and opportunity costs in the form of missed revenue and higher funding costs.

One of the primary challenges of collateral management is balancing liquidity and cost. On one hand, collateral needs to be readily available to meet margin calls and other obligations, while on the other, keeping large inventories of high-quality liquid assets can be costly, as it ties up capital that could be deployed elsewhere. Moreover, collateral not actively utilised to generate income by taking advantage of investing opportunities and collateral transformations is a true opportunity cost to the institution.

We believe that the trade-off between different uses of financial assets should be optimised, while providing an efficient solution to satisfy margin requirements to different counterparties — conditional on their respective schedules, investment opportunities and additional set of financial resource constraints. For collateral management to be successful, it needs to efficiently optimise asset allocation across competing objectives: selection and pledging of collateral, funding, transformations and securities lending.

An important function of collateral management is margin optimisation, where assets are pledged to satisfy a diverse set of margin requirements for different counterparties. The final objectives can be both reducing cost and increasing liquidity, while satisfying margin calls. Ideally, this pre-trade portfolio optimises resources at the organisation level and ensures a stronger balance sheet with reduced margin costs, which will ultimately affect the bottom line.

Comprehensive collateral management should include efficient funding and collateral transformations. These actions can be represented by upgrading or downgrading collateral and must be driven by margin requirements and revenue generating opportunities. Collateral transformations involve converting one type of collateral into another.

This can be useful when a counterparty demands a specific type of collateral that is not readily available, or when there is excessive cost of holding a certain type of collateral. For instance, to meet the requirements of a counterparty or regulatory authority an institution may transform a lower-quality bond into a higher-quality bond (i.e. collateral upgrade). Also, by taking advantage of downgrades, institutions maximise the value of their collateral inventory, generating additional revenue.

Lastly, collateral management should also involve securities lending and borrowing. This important activity refers to transactions where assets are lent against collateral to be returned at some point in the future. Securities lending may involve lending out high-quality securities from collateral inventory to other market participants in exchange for a fee. This can be an additional source of income for institutions, as it allows them to earn a return on otherwise idle assets, while maintaining control of the collateral inventory. Furthermore, securities lending enhances the liquidity and flow of assets in the market as it provides an alternative source of funding for market participants that need to borrow securities to settle transactions. Therefore, both lenders and borrowers benefit.

It is worth noting that margin optimisation, collateral transformations and securities lending can also introduce additional risks and complexities into the collateral management process. For example, the borrower of securities may fail to return them on time, or the value of the collateral may decline rapidly, leading to a shortfall in margin. Institutions can carefully manage these risks by applying technologies to manage their collateral inventory and obligations, while reducing funding costs, maximising liquidity and benefiting from investment opportunities.

Managing collateral allocations optimally has multiple advantages such as increasing balance sheet liquidity, reducing cost while meeting collateral exposures, reducing the risk of margin calls when mark-to-market goes against the position, among other benefits. As a result, collateral management becomes crucial to the efficient and smooth operation of many financial institutions.

By properly defining an optimisation problem and using mathematical algorithms systematically, institutions can determine the optimal allocation of collateral, considering countless factors such as credit risk, liquidity, cost, funding and transformation, to name a few. For instance, a collateral optimisation model can help identify the most efficient way to use available collateral to satisfy margin requirements, while minimising the cost of holding excess inventory.

Current research

Despite its importance, there is limited research literature on collateral optimisation. Collateral management frameworks tend to focus on simple versions of the margin optimisation problem, with a limited number of constraints and a single objective, namely cheapest-to-deliver. In addition, given the nature of the problem, there may be multiple steps involved in the optimal management of collateral. However, existing literature tends to find solutions by solving sequential problems, using the output from a previous problem to find the solution to the next one and so on.

For example, a generic framework may involve the formulation of a linear programme with a single objective and a limited set of constraints, such as concentration limits on asset types and individual securities. These models are usually tested with hypothetical datasets. Although this is a viable approach, as it allows them to simulate scenarios not observed with real data, it lacks structure and flexibility to solve larger problems, for example, a large number of counterparty and margin type pairs, as well as multiple funding sources.

However, when multiple objectives are involved, such as funding and margin, standard algorithms become difficult to implement due to their sequential approach, therefore obscuring the usefulness of collateral management models. At FinOptSys, we think this approach is not only inefficient but fails to capture a holistic optimal solution, which should involve trade-offs for all securities allocations available.

As a result, a sound collateral management framework takes a comprehensive approach to solve the problem optimally. Our collateral management solution makes several ‘decisions’ redundant, such as which objectives to optimise first, emphasising concrete actions for the best use of securities given all available trade-offs. In summary, our algorithm finds a holistic optimal solution which simultaneously maximises multiple objectives, subject to a diverse set of constraints that bound the solution set and make the allocation portfolios realistic, efficient and easy to implement.

A comprehensive framework

Ideally, a holistic and comprehensive collateral management framework is designed to increase the operational efficiency and transparency of the allocation process by consolidating all collateral assets and management functions under one system. In addition, the introduction of fully digitised schedules for margin and transformations allows for a seamless execution of the allocation process, where eligibility criteria is fully integrated within the model and seamlessly updated. The full integration of the model within the FinOptSys platform allows interaction with other modules such as our patent-pending (allowed) Activity Based Collateral Modelling (ABCM) Analytics, reflecting real-time sources and uses of collateral.

The collateral management algorithm implements a single-step mixed integer linear programme to solve a collateral optimisation problem given a diverse set of inputs and constraints. The purpose of this allocation is to meet collateral obligations while maximising asset liquidity and reducing the ‘risk’ of pledged portfolios. Additionally, it finds cheapest-to-deliver securities and optimal funding sources, while it searches for potential investment opportunities in the form of collateral transformations and securities lending activity.

Figure 1 shows inputs to the model, as well as selected actions to be taken given competing optimal objectives. Note that the eligibility criteria is seamlessly incorporated into the model and is taken into account when constructing the model, given all required inputs.

Figure 1: sample inputs and actions for the FinOptSys collateral management framework.

The algorithm is then presented as a unified framework where the collateral allocation problem is solved in a single step by simultaneously analysing the trade-offs of uses for different securities, while satisfying margin requirements given eligibility criteria derived from individual schedules. These trade-offs are captured by different linear objectives, which may have weightings based on the current environment or on user preferences; the model objectives can be described as a combination of portfolios that will simultaneously maximise liquidity, minimise cost, maximise revenue, while searching for the cheapest funding.

To find a feasible and viable solution, the optimisation problem constraints need to be well defined. Constraints are broken down into three distinct categories:

Figure 2: sample data set from optimal allocation output.

1. eligibility constraints: given by margin and business schedules. These constraints are essential for the model allocation to be compliant with agreements among all counterparties involved in the transactions

2. accounting constraints: given by asset availability and the uses of such assets. Considering we are solving multiple problems with one optimisation algorithm, these constraints link otherwise distinct actions to interact with each other

3. efficiency constraints: these constraints are important to avoid wasting scarce resources. This can be represented by overallocation of collateral, overpaying for funding opportunities, or missed opportunity costs by not taking advantage of revenue generating actions, among others. In addition, this category includes a regularisation constraint, where a substantial number of transactions are penalised, and finds a solution with the least number of transactions possible, seamlessly reducing trading costs

The model output represents a set of portfolios which maximise a linear combination of objectives, given the three sets of constraints. Consequently, the final output shows optimal margin allocation, cheapest funding opportunities and provides suggestions to invest idle securities to generate extra income. It provides clear and actionable portfolios for all possible collateral obligations and uses.

Moreover, the table is broken down by actions, counterparty and source, highlighting additional relevant fields that can be used for analysis and to better understand the optimal allocation.

This idea is represented in Figure 2, which shows a sample output table where different actions are shown to be optimal given initial inventory, margin requirements, funding availability and lending opportunities. For example, Counterparty1’s IM margin is satisfied with US Treasuries from inventory, while VM margin is using cash, funded with two different repo programmes.

In turn, given different collateral schedules, money market funds and cash are used for Counterparty2’s margin, while Corporates are used to satisfy Counterparty3’s margin. Note that the table is clear and specific in terms of the allocation and in the use of individual securities, sources and actions. In addition, it provides a list of relevant fields, such as haircuts, weight allocation and funding costs, among others.

Conclusion

Collateral management is a crucial function for financial institutions and has taken a more prominent role in recent years. The challenges experienced by seasoned market practitioners and clients have highlighted the need to review and improve end-to-end collateral processes, from front-office secured funding and financing activities through middle- and back-office operational margin and settlement functions. Moreover, they have increased the importance of collateral analytics, optimisation capabilities, and the need for automated operational processes and workflow to effectively manage collateral.

The lack of a collateral management comprehensive solution problem led us to the development and deployment of our innovative solution with its optimisation algorithms, which incorporate machine learning models and artificial intelligence. This will not only help institutions achieve optimal allocations of collateral given ever changing and dynamic requirements, but will also suggest substitutions, transformations and investment opportunities, therefore increasing efficiency in the collateral portfolio while generating passive income and enhancing liquidity.

The ability to run these algorithms on demand increases the role and importance of proper collateral management, especially after recent increases in interest rates and a potential recession in the economy that can make certain institutions more vulnerable to liquidity runs and counterparty risk.

We believe firms should invest in their front-office trading and optimisation infrastructure and review whether they should invest in further uplifting operational capabilities in-house or outsource these functions to an asset servicing provider. Ultimately, significant control, cost and financial resource efficiency needs to be achieved through investment in front-to-back collateral management processes — such as those offered by FinOptSys, delivering solutions for the future, today!

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times