Intraday repo: how DLT will transform the short-term funding markets

20 July 2023

Broadridge’s Paul Chiappetta, vice president of product management, and Bonita Blaney, senior director product management, review the advantages offered by intraday repo and how new technologies are changing the dynamic to allow a new go-to source of short-term funding

Image: stock.adobe.com/blacksalmon

Image: stock.adobe.com/blacksalmon

The development of intraday repo could represent one of the most important innovations in the history of global repo trading. Until very recently, intraday repo was almost exclusively restricted to certain forms of central bank repo. Today, major banks such as J.P. Morgan, UBS and DBS are executing intraday repos on systems such as Broadridge’s Distributed Ledger Repo (DLR) and J.P. Morgan’s Onyx.

Both systems use distributed ledger technology (DLT) that provides the velocity, transparency and security needed to make intraday repo possible. As other banks and buy-side firms explore extending their repo businesses to intraday trading, these DLT solutions appear poised to transform the market — and potentially save banks and brokers millions of dollars every year.

An imperfect tool

Repo has long been an essential tool for managing liquidity. Throughout the course of a day, banks, broker-dealers and other market participants experience both predictable and unpredictable cash flows.

Predictable cash flows include securities settlement, the dollar legs of foreign exchange transactions, maturing loans or securities and corporate actions. Unpredictable cash flow events include margin calls from central counterparties (CCPs), new securities lending transactions, the cash-flow impact of settlement failures, and the transfer of funds by clients of banks and broker-dealers using gross settlement mechanisms such as Fedwire.

Figure 1

The hard-to-project nature of these intraday cash flows can result in clearing account deficits lasting minutes or hours. Even so-called “predictable” cash flows can contribute to deficits, since in many cases the precise timing of the cash-flow event within the business day is not known in advance.

Account deficits expose market participants to some significant costs. Daylight overdrafts are fees charged by the Federal Reserve to member banks for negative balances in an institution’s account at any point in a business day. If a bank is connected to Fedwire, the Federal Reserve guarantees to make payment with daylight overdraft — non-banks can also have daylight overdrafts on their clearing accounts.

Collateralised forms of borrowing and lending, such as overnight repo, help market participants avoid deficits and daylight overdrafts, reducing credit risk for the lender and interest charges for the borrower. Funds lent against high-quality collateral such as treasuries can be delivered almost instantly. However, overnight repo transactions are hardly an ideal solution in that the bank or broker-dealer is often stuck paying the cost of overnight interest to cover account deficits that may only last minutes.

In 2021, the Federal Reserve of New York reviewed data from the Fixed Income Clearing Corporation (FICC) and general collateral finance (GCF) markets to analyse the timing of overnight repo trades, or trades in which the near leg settles today and the far leg settles the following business day. The study found that the majority of “overnight” trades are executed in the early morning. Almost two-thirds of treasury FICC delivery-versus-payment (DvP) repo volume was completed between 07:00 (when the market opened) and 08:30. In overnight treasury GCF, 62 per cent was completed by 08:30. For both markets, around 90 per cent of trading was completed by midday.

So why are so many banks and broker-dealers looking to secure overnight funding so early in the day? According to the Fed report: “The factor that market participants most consistently cite is the start of daylight overdraft fees assessed by clearing banks at 08:30 to dealers that have not funded their clearing accounts. These fees are particularly meaningful for smaller, independent broker-dealers that raise a substantial portion of their funding in interdealer repo. Therefore, smaller dealers make every effort to fund as early as possible.”

These results suggest that banks and broker-dealers could be spending millions of dollars for overnight funding that they would not need if they had access to shorter-term funding.

Saving market participants millions

The obvious solution to the problem is intraday repo. Sometimes called micro-funding or repo-by-the-minute, intraday repo is a standard repo trade with both the start and end leg settling on the same settlement date. Intraday repo provides flexibility in funding, giving a dealer the option to fund themselves for an hour or two to cover liquidity spikes that may occur throughout the day, mitigating the financial impacts that would otherwise be caused by such fluctuation.

An intraday repo trade can last for minutes to hours, with the cash lender receiving a fee for their principal investment rather than a standard repo rate. This fee can be determined either as a set amount for a specified period of time as agreed at the outset of the trade or calculated dynamically by applying a rate for every minute the loan is open, and then creating a fee for the aggregation of those per-minute charges.

Poised to transform repo markets

The only thing preventing intraday repo from becoming a go-to source of short-term funding for banks and broker-dealers has been the fact that the traditional infrastructure simply was not built to complete and settle trades in minutes or hours.

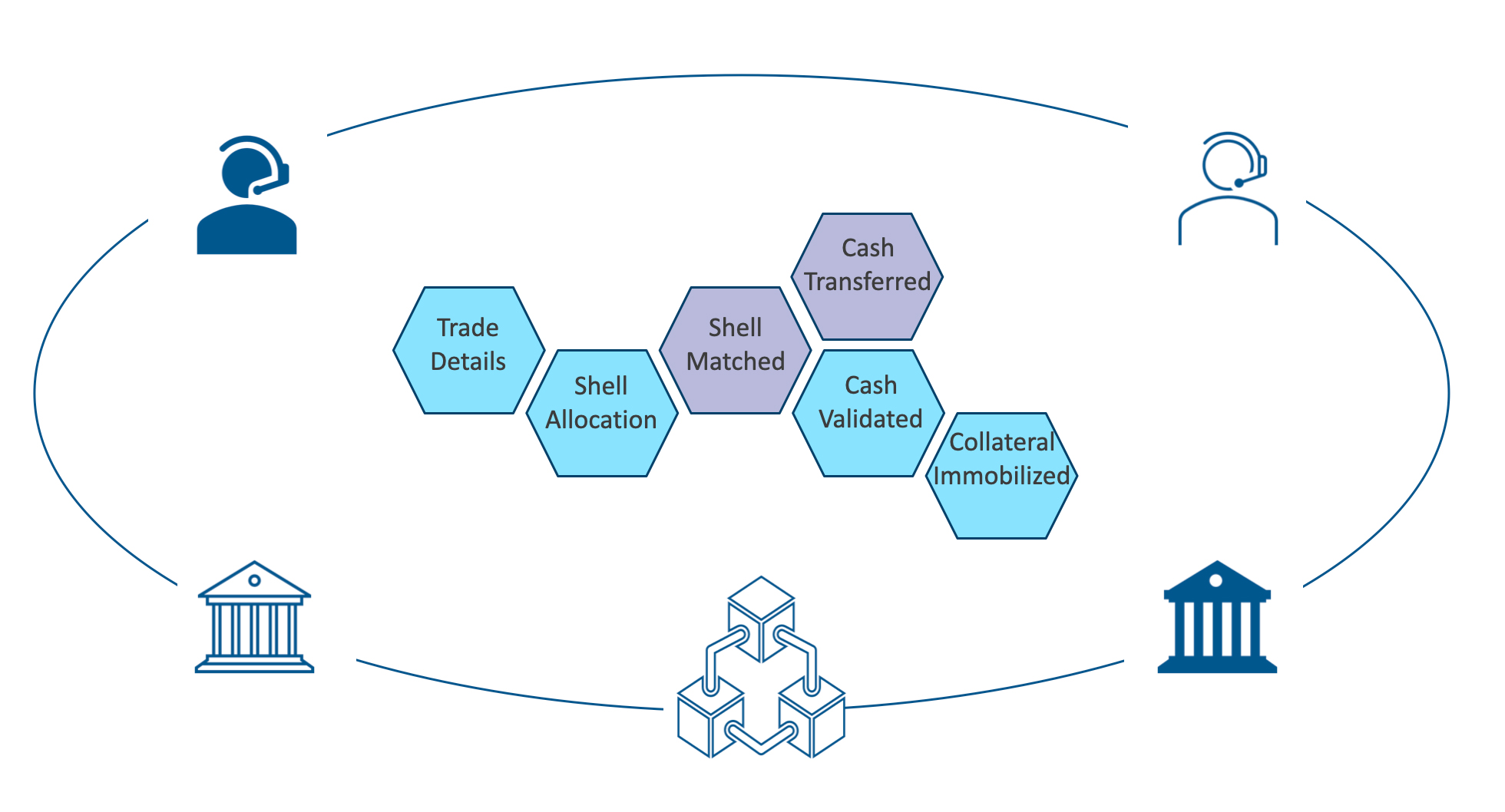

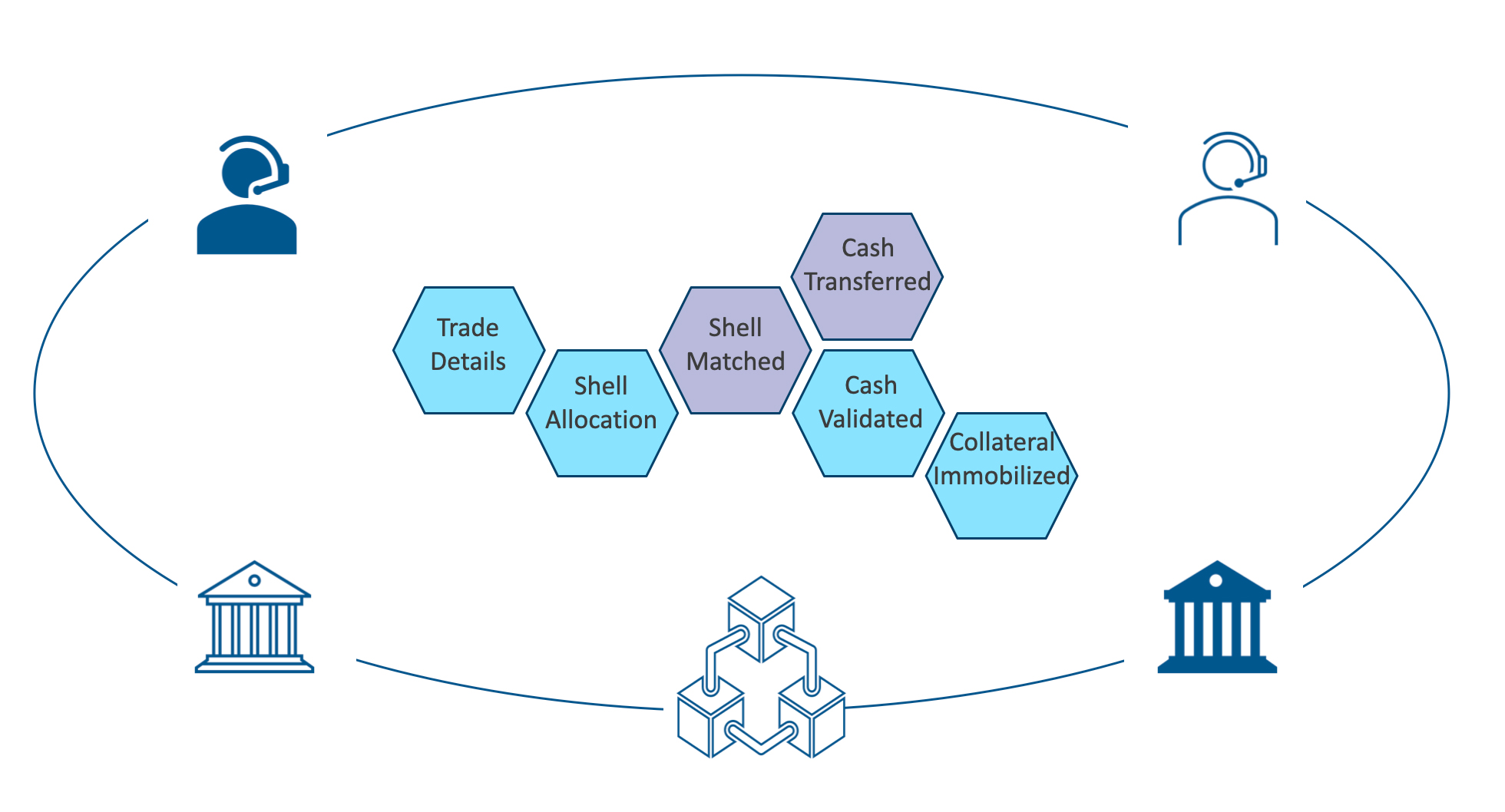

The emergence of DLT has changed that dynamic completely. DLT provides the velocity required to instantaneously agree, execute and settle an intraday repo transaction. In a DLT environment, collateral does not need to be physically transferred. Instead, the underlying security is immobilised, with ownership maintained through smart contracts utilising a digital representation of collateral.

The smart-contract methodology employed by solutions like Broadridge’s DLR platform streamlines the process by creating a mutualised workflow, allowing the cash lender and securities borrower to see the entire lifecycle of the trade in real-time. This synchronisation allows both parties to monitor cash and securities and track the fee accrual throughout the duration of the trade, ensuring accurate settlement at a precise, predetermined time.

These blockchain-enabled solutions can integrate with front-end systems used by banks and broker-dealers. That ability allows intraday repo transactions to seamlessly flow into existing daily firm financing and position management workflows. Users can enter intraday repo transactions manually, or trades can be fed into the front-end system via automated trade feeds, simultaneously updating positions in real-time and passing the trade details to the DLT solution for settlement and processing.

Interest is calculated from a fee entered on the trade. Because that fee and interest payment cover an interval shorter than the minimum overnight term, the cost will be significantly lower than the standard repo rate currently entered on non-intraday overnight, term and open repo transactions.

As these DLT solutions take root among sell-side firms and begin to attract securities lenders from the buy side, they are poised to transform short-term funding markets, potentially saving banks, broker-dealers and other market participants millions.

Both systems use distributed ledger technology (DLT) that provides the velocity, transparency and security needed to make intraday repo possible. As other banks and buy-side firms explore extending their repo businesses to intraday trading, these DLT solutions appear poised to transform the market — and potentially save banks and brokers millions of dollars every year.

An imperfect tool

Repo has long been an essential tool for managing liquidity. Throughout the course of a day, banks, broker-dealers and other market participants experience both predictable and unpredictable cash flows.

Predictable cash flows include securities settlement, the dollar legs of foreign exchange transactions, maturing loans or securities and corporate actions. Unpredictable cash flow events include margin calls from central counterparties (CCPs), new securities lending transactions, the cash-flow impact of settlement failures, and the transfer of funds by clients of banks and broker-dealers using gross settlement mechanisms such as Fedwire.

Figure 1

The hard-to-project nature of these intraday cash flows can result in clearing account deficits lasting minutes or hours. Even so-called “predictable” cash flows can contribute to deficits, since in many cases the precise timing of the cash-flow event within the business day is not known in advance.

Account deficits expose market participants to some significant costs. Daylight overdrafts are fees charged by the Federal Reserve to member banks for negative balances in an institution’s account at any point in a business day. If a bank is connected to Fedwire, the Federal Reserve guarantees to make payment with daylight overdraft — non-banks can also have daylight overdrafts on their clearing accounts.

Collateralised forms of borrowing and lending, such as overnight repo, help market participants avoid deficits and daylight overdrafts, reducing credit risk for the lender and interest charges for the borrower. Funds lent against high-quality collateral such as treasuries can be delivered almost instantly. However, overnight repo transactions are hardly an ideal solution in that the bank or broker-dealer is often stuck paying the cost of overnight interest to cover account deficits that may only last minutes.

In 2021, the Federal Reserve of New York reviewed data from the Fixed Income Clearing Corporation (FICC) and general collateral finance (GCF) markets to analyse the timing of overnight repo trades, or trades in which the near leg settles today and the far leg settles the following business day. The study found that the majority of “overnight” trades are executed in the early morning. Almost two-thirds of treasury FICC delivery-versus-payment (DvP) repo volume was completed between 07:00 (when the market opened) and 08:30. In overnight treasury GCF, 62 per cent was completed by 08:30. For both markets, around 90 per cent of trading was completed by midday.

So why are so many banks and broker-dealers looking to secure overnight funding so early in the day? According to the Fed report: “The factor that market participants most consistently cite is the start of daylight overdraft fees assessed by clearing banks at 08:30 to dealers that have not funded their clearing accounts. These fees are particularly meaningful for smaller, independent broker-dealers that raise a substantial portion of their funding in interdealer repo. Therefore, smaller dealers make every effort to fund as early as possible.”

These results suggest that banks and broker-dealers could be spending millions of dollars for overnight funding that they would not need if they had access to shorter-term funding.

Saving market participants millions

The obvious solution to the problem is intraday repo. Sometimes called micro-funding or repo-by-the-minute, intraday repo is a standard repo trade with both the start and end leg settling on the same settlement date. Intraday repo provides flexibility in funding, giving a dealer the option to fund themselves for an hour or two to cover liquidity spikes that may occur throughout the day, mitigating the financial impacts that would otherwise be caused by such fluctuation.

An intraday repo trade can last for minutes to hours, with the cash lender receiving a fee for their principal investment rather than a standard repo rate. This fee can be determined either as a set amount for a specified period of time as agreed at the outset of the trade or calculated dynamically by applying a rate for every minute the loan is open, and then creating a fee for the aggregation of those per-minute charges.

Poised to transform repo markets

The only thing preventing intraday repo from becoming a go-to source of short-term funding for banks and broker-dealers has been the fact that the traditional infrastructure simply was not built to complete and settle trades in minutes or hours.

The emergence of DLT has changed that dynamic completely. DLT provides the velocity required to instantaneously agree, execute and settle an intraday repo transaction. In a DLT environment, collateral does not need to be physically transferred. Instead, the underlying security is immobilised, with ownership maintained through smart contracts utilising a digital representation of collateral.

The smart-contract methodology employed by solutions like Broadridge’s DLR platform streamlines the process by creating a mutualised workflow, allowing the cash lender and securities borrower to see the entire lifecycle of the trade in real-time. This synchronisation allows both parties to monitor cash and securities and track the fee accrual throughout the duration of the trade, ensuring accurate settlement at a precise, predetermined time.

These blockchain-enabled solutions can integrate with front-end systems used by banks and broker-dealers. That ability allows intraday repo transactions to seamlessly flow into existing daily firm financing and position management workflows. Users can enter intraday repo transactions manually, or trades can be fed into the front-end system via automated trade feeds, simultaneously updating positions in real-time and passing the trade details to the DLT solution for settlement and processing.

Interest is calculated from a fee entered on the trade. Because that fee and interest payment cover an interval shorter than the minimum overnight term, the cost will be significantly lower than the standard repo rate currently entered on non-intraday overnight, term and open repo transactions.

As these DLT solutions take root among sell-side firms and begin to attract securities lenders from the buy side, they are poised to transform short-term funding markets, potentially saving banks, broker-dealers and other market participants millions.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times