Meeting the challenges of intraday liquidity management

12 October 2023

Simon Squire, global head of product management Clearance and Collateral Management at BNY Mellon, breaks down the significance of intraday liquidity, the market factors driving demand in this area and the release of intraday repo on the platform

Image: Simon Squire

Image: Simon Squire

Managing intraday liquidity is a top priority for financial firms and corporate treasurers. The consequences of mismanagement can lead to liquidity shortfalls or substantial financial costs. Regulators in the financial services industry are focused on how banks and other firms under their purview manage liquidity, including intraday, given that market disruptions could arise at any time from missteps or erroneous calculations.

After all, managing intraday liquidity is more than just an accounting exercise involving debits and credits. Cash inflows and outflows represent real transactions and the sequence, timing and shaping of those transactions throughout the day have a real-world impact on an institution’s liquidity profile and the cost to the business. External variables such as ever-changing economic and market conditions need to be considered. All of these factors have resulted in the need for increasingly flexible tools and infrastructure for market participants to manage intraday liquidity as efficiently as possible.

Defining intraday liquidity

Intraday liquidity in the context of financial firms and banks such as BNY Mellon can be defined as resources that can be used to fulfil payment, clearing and settlement obligations — sometimes referred to as ‘sources’ and ‘uses’.

Sources of intraday liquidity include opening cash balances, incoming cash wires, unencumbered securities, securities delivered versus payment (DVP) and access to intraday operational credit — whether committed or uncommitted — from Financial Market Infrastructure and Financial Market Utilities such as CCPs and agent banks.

Uses of intraday liquidity include outgoing cash wires, cash or securities collateral allocated to meet Financial Market Infrastructure or regulatory requirements, and securities received versus payment (RVP). Intraday liquidity is “the lifeblood of the financial system” for the smooth functioning of financial markets. Every source and use of intraday liquidity sends a signal that helps us to understand how the overall financial system is functioning.

Importance of intraday liquidity management

It is difficult to overstate the importance of managing intraday liquidity effectively. Firms across the financial industry need to have the right amount of liquidity available, and in the right currency, to meet obligations in a timely manner — not only in the normal course of business but also under adverse conditions. Many banks are required to account for intraday liquidity needs and stress-scenario requirements as part of their living recovery and resolution plans, which are updated annually.

Moreover, with intraday liquidity requirements being significant and growing, several firms are required to demonstrate their access to liquidity, including the ability to cover peak demand. Stress in the banking industry in March 2023 emphasised the criticality for banks to have access to additional sources of liquidity. A steady stream of new and evolving regulations has banks and broker-dealers placing further emphasis on their treasuries’ financial resource management and balance-sheet allocation across different lines of business and varying market conditions.

Market factors driving demand

The market environment is another factor that underscores the importance of managing intraday liquidity well. The cost of intraday liquidity has increased steadily as the Federal Reserve has raised interest rates from near zero to combat inflation. Gone are the days when intraday liquidity was extended at little to no cost. Quantitative tightening is also contributing to higher liquidity costs for banks. For example, as the Federal Reserve’s balance sheet shrinks, many commercial banks have begun to raise deposit rates exponentially to maintain their deposit base and liquidity levels.

If the Fed’s Overnight Reverse Repo facility (ON RRP) remains at elevated levels, it could pressure banks to defend liquidity levels more aggressively so they can cover liquidity for daily obligations. Changes in market structure are also driving the need for real-time liquidity management, including the movement to shorter settlement times — such as T+1 — and near real-time settlement of securities and payments using new tools and technologies.

A market for short-term liquidity consists of a borrower — an entity that needs to raise liquidity on a given day for a specific period of time — and a lender — a financial institution that has access to liquidity and the ability to lend it to other market participants.

Both parties benefit in different ways. For example, the borrower benefits by sourcing the liquidity needed, and the lender benefits by potentially creating revenue from excess liquidity which may have otherwise remained idle. A number of large depository institutions have excess cash on their balance sheets as do buy-side institutions, such as money market funds and hedge funds.

The transaction typically unfolds as an overnight repurchase agreement (repo) in which the borrower sources liquidity in exchange for collateral, while simultaneously agreeing to buy back the securities the next day at a specified financing rate.

How BNY Mellon is helping clients

A drawback of the vanilla repo is that its term is usually overnight, at a minimum, whereas the liquidity may only be required for a short period of time during the day. For example, several borrowers may choose to enter into repo agreements on an overnight basis to cover payment or other cash outflows for just an hour or even minutes during the morning. Overnight repo also limits the flexibility of the lender to have cash returned in periods shorter than a 24-hour timeframe.

Enter the intraday repo. BNY Mellon’s Clearance and Collateral Management business is introducing the ability to source liquidity for precise periods of time through intraday repo on its triparty platform. Intraday repo will allow borrowers to specify the amount of time they need liquidity, without having to borrow for a full 24-hour period. It also opens the door to lending excess cash on an intraday basis.

BNY Mellon will launch intraday repo starting in Q4 2023. Participants will be able to access intraday repo via BNY Mellon’s existing triparty infrastructure, using a process that is similar to overnight repos, using their existing legal framework. The functionality will enable clients to instruct a same-day repo with specified start and end times using existing instruction channels.

The platform will reflect the trade as intraday, as opposed to overnight, open or term, and then will use the standard collateral and cash settlement infrastructure, whereby the allocation and return of eligible collateral settles intraday against payment. The trade will mature based on the agreed end-time and will automatically unwind under standard triparty arrangements. The triparty platform will calculate interest each minute based on the agreed rate, accruing from the time the trade is collateralised and funded until the agreed end time.

The importance of liquidity management, and more specifically intraday liquidity, will continue to be a key focus for the industry. BNY Mellon is actively exploring additional ways to unlock intraday liquidity using its triparty infrastructure along with other innovative solutions. In the current environment, secured intraday liquidity management capabilities may prove to be a valuable solution to the limitations of overnight repo for both borrowers and lenders.

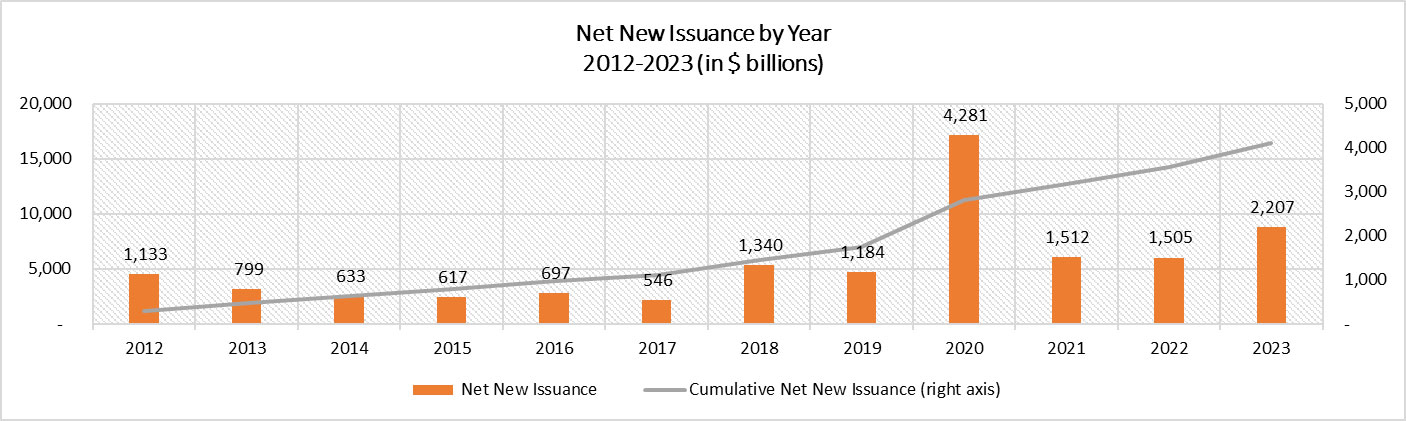

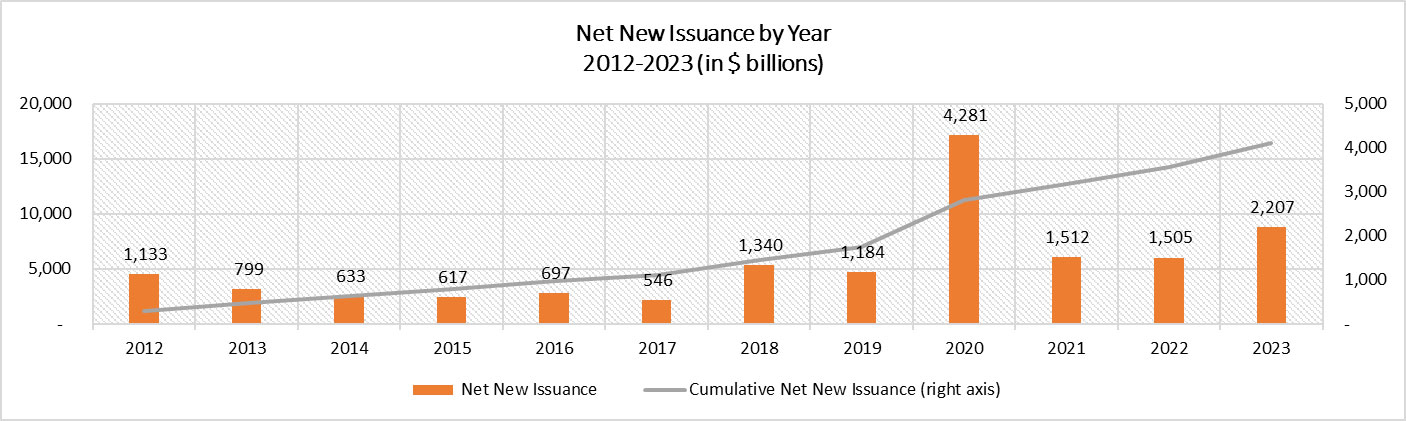

Figure 1

Source: U.S. Department of Treasury (Treasury Direct), BNY Mellon Analysis

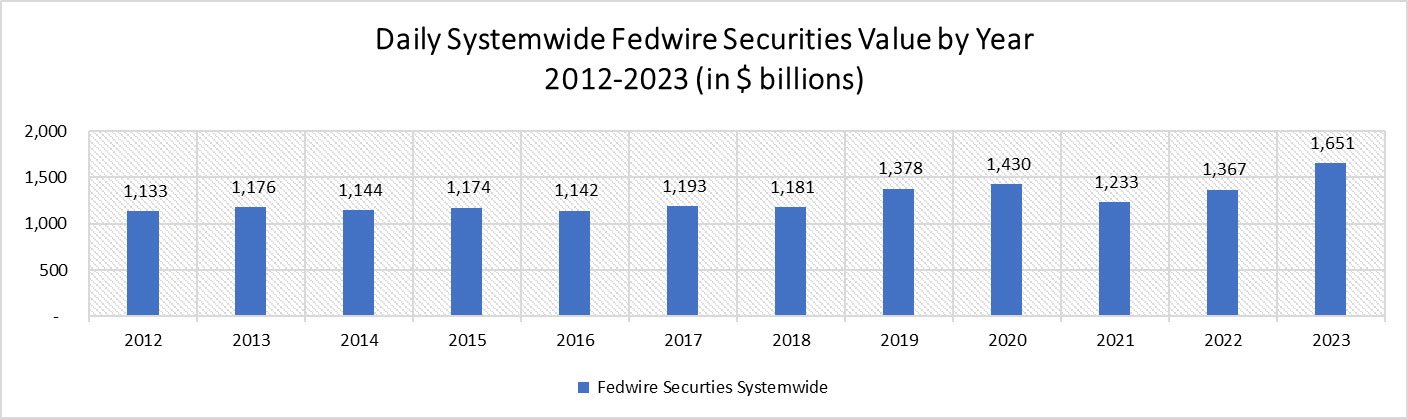

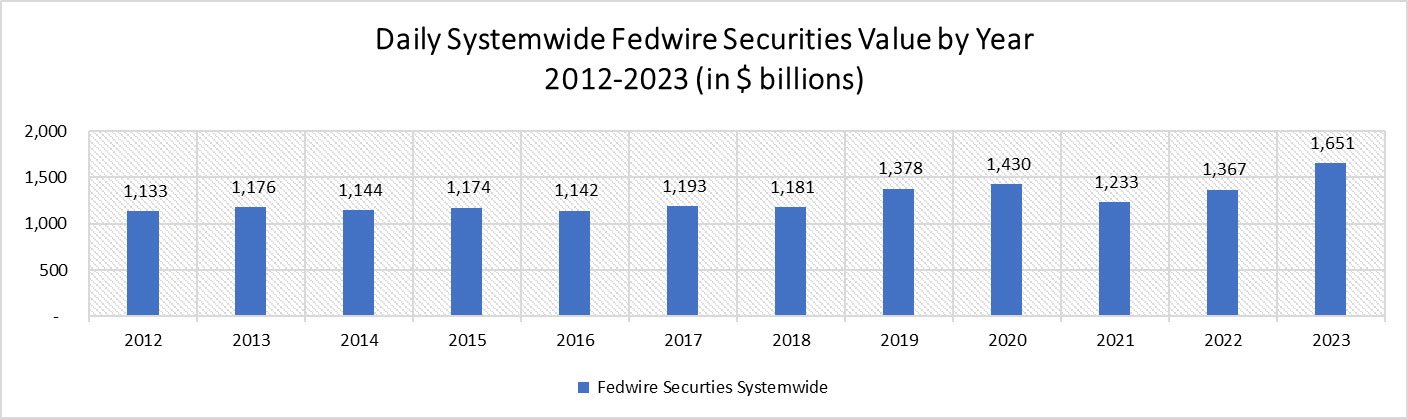

Figure 2

Source: The Federal Reserve (Fedwire Securities Service Volume and Value Statistics), BNY Mellon Analysis

Case study: primary dealers, clearing banks and the US Treasury market

The US Treasury market is the deepest and the most liquid government securities market in the world. Its successful functioning depends on the daily clearing and settlement of hundreds of thousands of transactions. It relies on broker dealers, including primary dealers that serve as counterparties of the Federal Reserve Bank of New York; clearing banks, firms that clear and settle book-entry securities including US Treasury and agency securities; and the Fixed Income Clearing Corporation (FICC), which serves as a central counterparty to a number of Treasury market transactions.

Substantial growth in clearing volumes in recent years reflects a combination of increases in both issuance and trading volumes of US debt, as well as increased market volatility and uncertainty around monetary policy. Intraday liquidity, which is provided by clearing banks in the form of secured credit, is an integral part of the clearing process. Clearing banks may require margin to cover and collateralise extensions of intraday credit and can also apply incremental surcharges for its use. Such charges can incentivise borrowers to prefund trades or implement operational efficiencies to reduce reliance on clearing bank credit.

To raise liquidity to cover purchases of government securities, dealers can resort to bilateral or triparty repo for financing. While triparty repo can offer an operationally efficient way to finance securities, dealers may still have funding gaps during the business day. When such gaps arise, dealers could resort to intraday credit from clearing banks or other sources of liquidity, which can be costly. A market for intraday repo may be a more economical solution for this temporary liquidity need. Generally speaking, the need for cash or relatively rapid and efficient access to it seems likely to increase as excess reserves in the US banking system decline.

After all, managing intraday liquidity is more than just an accounting exercise involving debits and credits. Cash inflows and outflows represent real transactions and the sequence, timing and shaping of those transactions throughout the day have a real-world impact on an institution’s liquidity profile and the cost to the business. External variables such as ever-changing economic and market conditions need to be considered. All of these factors have resulted in the need for increasingly flexible tools and infrastructure for market participants to manage intraday liquidity as efficiently as possible.

Defining intraday liquidity

Intraday liquidity in the context of financial firms and banks such as BNY Mellon can be defined as resources that can be used to fulfil payment, clearing and settlement obligations — sometimes referred to as ‘sources’ and ‘uses’.

Sources of intraday liquidity include opening cash balances, incoming cash wires, unencumbered securities, securities delivered versus payment (DVP) and access to intraday operational credit — whether committed or uncommitted — from Financial Market Infrastructure and Financial Market Utilities such as CCPs and agent banks.

Uses of intraday liquidity include outgoing cash wires, cash or securities collateral allocated to meet Financial Market Infrastructure or regulatory requirements, and securities received versus payment (RVP). Intraday liquidity is “the lifeblood of the financial system” for the smooth functioning of financial markets. Every source and use of intraday liquidity sends a signal that helps us to understand how the overall financial system is functioning.

Importance of intraday liquidity management

It is difficult to overstate the importance of managing intraday liquidity effectively. Firms across the financial industry need to have the right amount of liquidity available, and in the right currency, to meet obligations in a timely manner — not only in the normal course of business but also under adverse conditions. Many banks are required to account for intraday liquidity needs and stress-scenario requirements as part of their living recovery and resolution plans, which are updated annually.

Moreover, with intraday liquidity requirements being significant and growing, several firms are required to demonstrate their access to liquidity, including the ability to cover peak demand. Stress in the banking industry in March 2023 emphasised the criticality for banks to have access to additional sources of liquidity. A steady stream of new and evolving regulations has banks and broker-dealers placing further emphasis on their treasuries’ financial resource management and balance-sheet allocation across different lines of business and varying market conditions.

Market factors driving demand

The market environment is another factor that underscores the importance of managing intraday liquidity well. The cost of intraday liquidity has increased steadily as the Federal Reserve has raised interest rates from near zero to combat inflation. Gone are the days when intraday liquidity was extended at little to no cost. Quantitative tightening is also contributing to higher liquidity costs for banks. For example, as the Federal Reserve’s balance sheet shrinks, many commercial banks have begun to raise deposit rates exponentially to maintain their deposit base and liquidity levels.

If the Fed’s Overnight Reverse Repo facility (ON RRP) remains at elevated levels, it could pressure banks to defend liquidity levels more aggressively so they can cover liquidity for daily obligations. Changes in market structure are also driving the need for real-time liquidity management, including the movement to shorter settlement times — such as T+1 — and near real-time settlement of securities and payments using new tools and technologies.

A market for short-term liquidity consists of a borrower — an entity that needs to raise liquidity on a given day for a specific period of time — and a lender — a financial institution that has access to liquidity and the ability to lend it to other market participants.

Both parties benefit in different ways. For example, the borrower benefits by sourcing the liquidity needed, and the lender benefits by potentially creating revenue from excess liquidity which may have otherwise remained idle. A number of large depository institutions have excess cash on their balance sheets as do buy-side institutions, such as money market funds and hedge funds.

The transaction typically unfolds as an overnight repurchase agreement (repo) in which the borrower sources liquidity in exchange for collateral, while simultaneously agreeing to buy back the securities the next day at a specified financing rate.

How BNY Mellon is helping clients

A drawback of the vanilla repo is that its term is usually overnight, at a minimum, whereas the liquidity may only be required for a short period of time during the day. For example, several borrowers may choose to enter into repo agreements on an overnight basis to cover payment or other cash outflows for just an hour or even minutes during the morning. Overnight repo also limits the flexibility of the lender to have cash returned in periods shorter than a 24-hour timeframe.

Enter the intraday repo. BNY Mellon’s Clearance and Collateral Management business is introducing the ability to source liquidity for precise periods of time through intraday repo on its triparty platform. Intraday repo will allow borrowers to specify the amount of time they need liquidity, without having to borrow for a full 24-hour period. It also opens the door to lending excess cash on an intraday basis.

BNY Mellon will launch intraday repo starting in Q4 2023. Participants will be able to access intraday repo via BNY Mellon’s existing triparty infrastructure, using a process that is similar to overnight repos, using their existing legal framework. The functionality will enable clients to instruct a same-day repo with specified start and end times using existing instruction channels.

The platform will reflect the trade as intraday, as opposed to overnight, open or term, and then will use the standard collateral and cash settlement infrastructure, whereby the allocation and return of eligible collateral settles intraday against payment. The trade will mature based on the agreed end-time and will automatically unwind under standard triparty arrangements. The triparty platform will calculate interest each minute based on the agreed rate, accruing from the time the trade is collateralised and funded until the agreed end time.

The importance of liquidity management, and more specifically intraday liquidity, will continue to be a key focus for the industry. BNY Mellon is actively exploring additional ways to unlock intraday liquidity using its triparty infrastructure along with other innovative solutions. In the current environment, secured intraday liquidity management capabilities may prove to be a valuable solution to the limitations of overnight repo for both borrowers and lenders.

Figure 1

Source: U.S. Department of Treasury (Treasury Direct), BNY Mellon Analysis

Figure 2

Source: The Federal Reserve (Fedwire Securities Service Volume and Value Statistics), BNY Mellon Analysis

Case study: primary dealers, clearing banks and the US Treasury market

The US Treasury market is the deepest and the most liquid government securities market in the world. Its successful functioning depends on the daily clearing and settlement of hundreds of thousands of transactions. It relies on broker dealers, including primary dealers that serve as counterparties of the Federal Reserve Bank of New York; clearing banks, firms that clear and settle book-entry securities including US Treasury and agency securities; and the Fixed Income Clearing Corporation (FICC), which serves as a central counterparty to a number of Treasury market transactions.

Substantial growth in clearing volumes in recent years reflects a combination of increases in both issuance and trading volumes of US debt, as well as increased market volatility and uncertainty around monetary policy. Intraday liquidity, which is provided by clearing banks in the form of secured credit, is an integral part of the clearing process. Clearing banks may require margin to cover and collateralise extensions of intraday credit and can also apply incremental surcharges for its use. Such charges can incentivise borrowers to prefund trades or implement operational efficiencies to reduce reliance on clearing bank credit.

To raise liquidity to cover purchases of government securities, dealers can resort to bilateral or triparty repo for financing. While triparty repo can offer an operationally efficient way to finance securities, dealers may still have funding gaps during the business day. When such gaps arise, dealers could resort to intraday credit from clearing banks or other sources of liquidity, which can be costly. A market for intraday repo may be a more economical solution for this temporary liquidity need. Generally speaking, the need for cash or relatively rapid and efficient access to it seems likely to increase as excess reserves in the US banking system decline.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times