Guaranteed Repo: How banks can intermediate with less impact on their financial resources

11 June 2024

Shiv Rao, chairman and founder of Sunthay, reviews the proposed regulations providing barriers for repo market participants, and explores how the firm’s joint initiative with Bloomberg and Euroclear aims to help reduce the impact of these upcoming requirements

Image: stock.adobe/Lerbank-bbk22

Image: stock.adobe/Lerbank-bbk22

Globally, the funding market is enormous. In the US alone, primary dealers’ outstanding repo and reverse repo exposure totalled an average daily US$5.7 trillion in January, according to data from the Securities Industry and Financial Markets Association (SIFMA).

A repurchase agreement is, in effect, a short-term collateralised loan. One party sells a security — a US Treasury note, for example — to another and agrees to buy it back, typically the next day. The interest paid for this financing is the repo rate. Reverse repo is the same transaction from the perspective of the buyer of the security in its first leg. Institutions that hold a lot of bonds, such as broker-dealers or hedge funds, can turn to the market to borrow cheaply, using these assets as collateral. Other entities with a lot of cash, such as money market funds, can use repo transactions to earn a safe return.

Banks play a crucial intermediary role in this market. They facilitate transactions between parties that would not normally trade directly with one another — a hedge fund and a money market fund, for example. A rule adopted by the US Securities and Exchange Commission (SEC) in December 2023 could add to costs, by requiring the clearing of most repo transactions.

In addition, proposed regulations would raise capital requirements on banks, potentially making them less economical, causing the banks to become reluctant to participate in the market. Guaranteed Repo, a joint initiative between Bloomberg, Euroclear and Sunthay, can help to reduce the impact of these regulations.

What is Guaranteed Repo?

Guaranteed Repo is a trading solution for credit-intermediated repo transactions. The concept was developed by Sunthay, which supplies standardised guarantee documentation. Bloomberg hosts electronic trading, and Euroclear provides post-trade settlement and collateral management.

Guaranteed Repo is designed to enable banks to continue their roles as intermediaries in repo markets without using their balance sheets. Unlike with some other types of repo arrangements, banks are not counterparties in Guaranteed Repo trades — they neither lend to the hedge fund, nor borrow from the money market fund. Instead, those traders deal directly with one another through the functionality. The bank’s role is to serve as a contingent obligor — it promises to step in should there be a default by the party whose performance it is guaranteeing.

Clearing requirements

In December 2023, the SEC adopted a rule that will require clearing of all US Treasury-backed repo transactions in which at least one counterparty is a direct participant in a covered clearing agency (CCA). Direct participants are primarily the banks and broker-dealers that are full members of the CCA. Because most expected users of Guaranteed Repo are not direct participants in the CCA, their transactions are excluded from the clearing requirement.

In the US, the only repo CCA is the Fixed Income Clearing Corporation (FICC). It offers several clearing models, the most widely used of which is called sponsored repo. For banks, sponsored repo is based on a principal model. In it, sponsoring members, such as banks and broker-dealers that are full members of FICC, enter into principal transactions with sponsored members — typically entities such as hedge funds and money market funds that are not full members — and subsequently novate, or reassign, these principal transactions to FICC.

Sponsoring members guarantee the performance of sponsored members to FICC. These guarantees result in risk-weighted assets (RWAs) on both the repo and reverse repo leg transactions, that are identical to equivalent uncleared bilateral repo transactions.

Sponsored repo transactions maintain leverage in the financial system at the same level as uncleared bilateral transactions, as novation transfers leverage from the banking system to FICC, with losses mutualised among members. By contrast, Guaranteed Repo reduces financial system leverage by making banks contingent obligors rather than principals.

Guaranteed Repo complements clearing by offering repo market participants an alternative that achieves similar goals, potentially at a lower cost. As a result, transactions that are unprofitable for banks if cleared could become profitable.

Basel III Endgame

The Basel Committee on Banking Supervision (BCBS) has come to a consensus on the minimum capital standards that they would enforce on banks. The 45 central banks and regulatory agencies that make up the committee membership have begun to formulate the local rules, implementing the final accord in their 28 countries and jurisdictions.

When implemented, the standards are expected to increase capital requirements overall for a number of banks. While changes in the amount of capital required for secured funding transactions — including repo and securities lending transactions — are likely to be quite benign for many, the overall increase in the amount of capital that banks need to hold will make them focus on efficiency across all business lines.

US regulators were the first to release proposed rules. The Federal Reserve, Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) promulgated a notice of proposed rulemaking in July 2023. The proposed rule would have resulted in the US ‘gold plating’ the consensus rules by adopting higher capital requirements for US banks relative to other jurisdictions. Following extensive pushback from market participants, US regulators announced that they are reviewing the proposed rule.

While a revised US proposed rule might dial back some of the impact of the original proposal, the impact of the global consensus rules is nevertheless likely to be quite punitive on secured funding transactions. Chief among the consensus revisions to existing rules is a sharply reduced ability for banks to use internal models to determine counterparty risk weights. This change is likely to substantially increase risk weights — and RWAs — for exposures to unrated and low-rated counterparties.

The Endgame rules could therefore produce a counterintuitive effect: banks’ exposures to low-risk entities could result in substantially higher RWAs than exposures to higher-risk entities. That result derives from a repo desk convention. A substantial portion of banks’ uncleared bilateral repo trades that provide funding to end users, such as hedge funds, are transacted with zero per cent haircuts — meaning that the cash equals the value of the securities. Conversely, banks generally post haircuts — typically two per cent for government bond-backed trades — when they raise funding from end providers such as money market funds.

Guaranteed Repo will result in substantially lower RWAs than other repo trading models, thereby lowering the amount of capital needed. The reason being that banks’ credit exposures are limited to one counterparty in the transaction — the trader they are guaranteeing. By contrast, other repo trading models cause banks to have exposure to two counterparties.

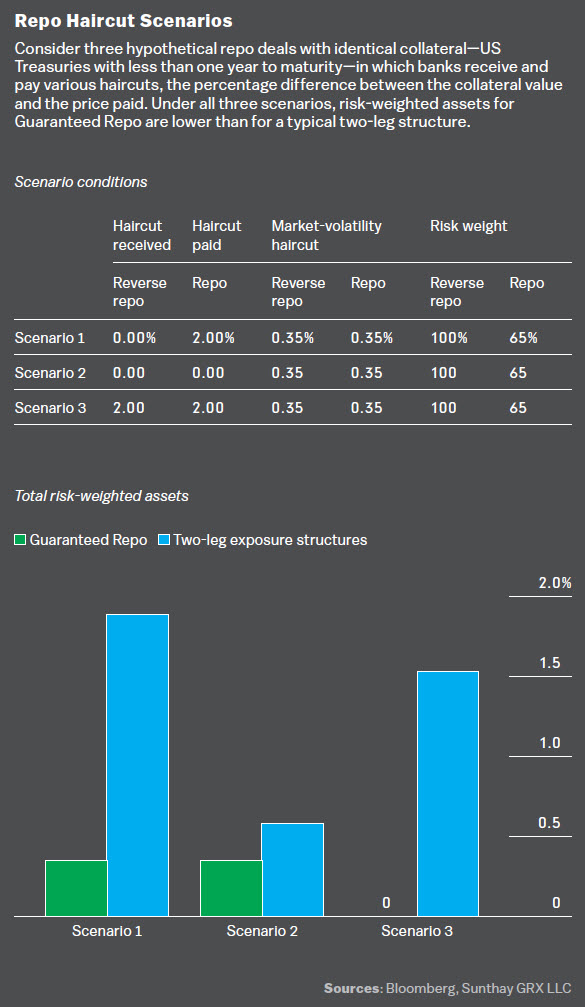

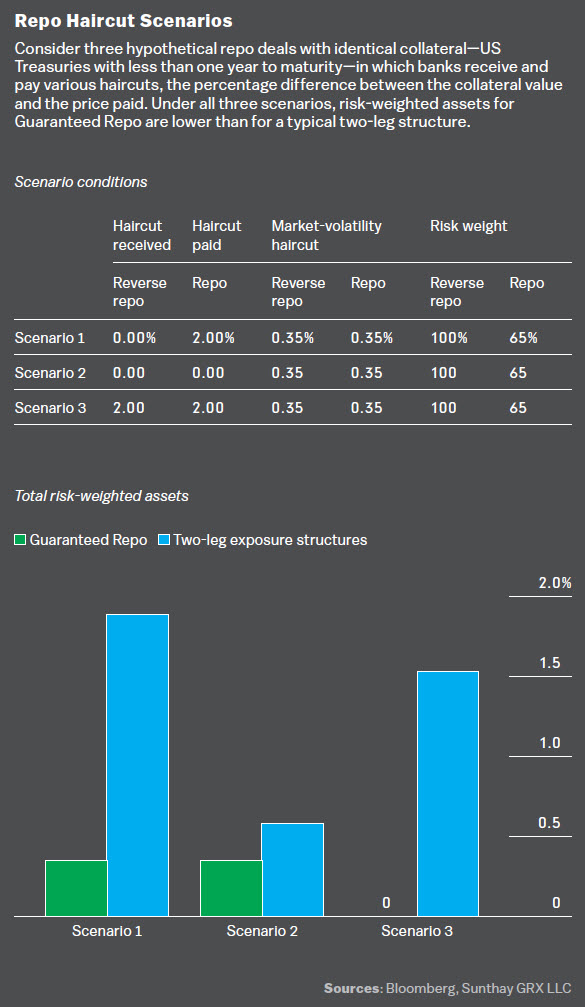

Consider three hypothetical scenarios that show the lower RWAs in Guaranteed Repo (Figure 1). Scenario 1 represents banks’ typical exposure from a two-leg trade — the bank receives a zero per cent haircut from its hedge fund counterparty and posts a two per cent haircut to its money market fund counterparty. Scenario 2 sets both haircuts to zero per cent, and Scenario 3 sets them both to two per cent. The risk weights for the counterparties are 100 per cent for the leg involving the non-investment-grade counterparty, such as the hedge fund, and 65 per cent for the leg with the investment-grade counterparty.

Figure 1

The chart highlights the RWAs under the single transaction exposure formula for Guaranteed Repo trades compared with two-leg structures. Eliminating repo leg exposures causes RWAs for Guaranteed Repo transactions to be substantially lower than the other structure in all three haircut scenarios. In fact, in Scenario 3, RWAs for Guaranteed Repo are zero because the haircut received on the loan to the hedge fund is greater than the standard minimum required market-volatility haircut.

G-SIB surcharge

Financial institutions deemed as global systemically important banks (G-SIBs) are assigned an additional capital surcharge based on a number of metrics such as size and interconnectedness. This additional G-SIB surcharge can substantially increase capital requirements for banks, making them reluctant to expand their intermediation activities when market disruptions occur. The surcharge increases in large increments (50 basis points in the US, for example), making the marginal transaction that tips a bank into the next higher surcharge bucket very costly. As a result, banks are highly resistant to engage in the marginal transaction.

Guaranteed Repo transactions can help banks maintain their critical intermediary roles when the marginal transaction is expensive. Most elements of the calculation do not apply to Guaranteed Repo transactions, particularly the US Method 2 calculation, which reflects a bank’s reliance on short-term wholesale funding. Because banks are contingent obligors in these transactions, they do not incur short-term liabilities. So that element of the G-SIB surcharge calculation does not apply. While making the incremental surcharge step more granular (as US regulators have proposed) can reduce the cost of the marginal transaction, it is nevertheless expensive. Guaranteed Repo is more efficient in helping banks to increase their intermediation in stressed periods than other alternatives.

Regulators have also moved to eliminate ‘window dressing’ for the purpose of managing the G-SIB surcharge, by requiring the stock elements of the surcharge to be calculated based on daily averages. As Guaranteed Repo transactions are not included in most elements of the G-SIB surcharge calculation, banks can use it to maintain their support of repo markets at current intra-reporting period levels.

Other regulatory benefits

Guaranteed Repo transactions are excluded from the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) calculations. Guarantees furnished by banks are neither credit facilities nor liquidity facilities under the LCR. And because banks are not principals to transactions, the NSFR does not apply.

Injecting liquidity

Central banks’ liquidity facilities are generally only available to regulated banks. Regulators rely on banks to deploy the liquidity to sectors and clients in need. The past few years have shown that balance sheet and capital constraints can limit the ability of banks to act as liquidity conduits.

Guaranteed Repo can help address these constraints. From an operational perspective, Guaranteed Repo trades are executed and settled directly by end users, without reliance on intermediate transactions with banks. Central banks can use this direct access method to rapidly direct liquidity toward entities or sectors experiencing stress. Collateral eligibility and haircuts can be predetermined, and eligible counterparties and guarantors can execute standardised documentation in advance.

In summary, Guaranteed Repo can potentially reinforce systemic resilience. It reduces systemwide leverage, thereby lowering contagion risk. It diffuses risk among market participants, reducing concentration. It requires less intraday liquidity systemwide, decreasing the risk of disruptions caused by an inability to settle transactions. And it reduces costs for market participants, as collateral and cash move directly between end users and providers.

A repurchase agreement is, in effect, a short-term collateralised loan. One party sells a security — a US Treasury note, for example — to another and agrees to buy it back, typically the next day. The interest paid for this financing is the repo rate. Reverse repo is the same transaction from the perspective of the buyer of the security in its first leg. Institutions that hold a lot of bonds, such as broker-dealers or hedge funds, can turn to the market to borrow cheaply, using these assets as collateral. Other entities with a lot of cash, such as money market funds, can use repo transactions to earn a safe return.

Banks play a crucial intermediary role in this market. They facilitate transactions between parties that would not normally trade directly with one another — a hedge fund and a money market fund, for example. A rule adopted by the US Securities and Exchange Commission (SEC) in December 2023 could add to costs, by requiring the clearing of most repo transactions.

In addition, proposed regulations would raise capital requirements on banks, potentially making them less economical, causing the banks to become reluctant to participate in the market. Guaranteed Repo, a joint initiative between Bloomberg, Euroclear and Sunthay, can help to reduce the impact of these regulations.

What is Guaranteed Repo?

Guaranteed Repo is a trading solution for credit-intermediated repo transactions. The concept was developed by Sunthay, which supplies standardised guarantee documentation. Bloomberg hosts electronic trading, and Euroclear provides post-trade settlement and collateral management.

Guaranteed Repo is designed to enable banks to continue their roles as intermediaries in repo markets without using their balance sheets. Unlike with some other types of repo arrangements, banks are not counterparties in Guaranteed Repo trades — they neither lend to the hedge fund, nor borrow from the money market fund. Instead, those traders deal directly with one another through the functionality. The bank’s role is to serve as a contingent obligor — it promises to step in should there be a default by the party whose performance it is guaranteeing.

Clearing requirements

In December 2023, the SEC adopted a rule that will require clearing of all US Treasury-backed repo transactions in which at least one counterparty is a direct participant in a covered clearing agency (CCA). Direct participants are primarily the banks and broker-dealers that are full members of the CCA. Because most expected users of Guaranteed Repo are not direct participants in the CCA, their transactions are excluded from the clearing requirement.

In the US, the only repo CCA is the Fixed Income Clearing Corporation (FICC). It offers several clearing models, the most widely used of which is called sponsored repo. For banks, sponsored repo is based on a principal model. In it, sponsoring members, such as banks and broker-dealers that are full members of FICC, enter into principal transactions with sponsored members — typically entities such as hedge funds and money market funds that are not full members — and subsequently novate, or reassign, these principal transactions to FICC.

Sponsoring members guarantee the performance of sponsored members to FICC. These guarantees result in risk-weighted assets (RWAs) on both the repo and reverse repo leg transactions, that are identical to equivalent uncleared bilateral repo transactions.

Sponsored repo transactions maintain leverage in the financial system at the same level as uncleared bilateral transactions, as novation transfers leverage from the banking system to FICC, with losses mutualised among members. By contrast, Guaranteed Repo reduces financial system leverage by making banks contingent obligors rather than principals.

Guaranteed Repo complements clearing by offering repo market participants an alternative that achieves similar goals, potentially at a lower cost. As a result, transactions that are unprofitable for banks if cleared could become profitable.

Basel III Endgame

The Basel Committee on Banking Supervision (BCBS) has come to a consensus on the minimum capital standards that they would enforce on banks. The 45 central banks and regulatory agencies that make up the committee membership have begun to formulate the local rules, implementing the final accord in their 28 countries and jurisdictions.

When implemented, the standards are expected to increase capital requirements overall for a number of banks. While changes in the amount of capital required for secured funding transactions — including repo and securities lending transactions — are likely to be quite benign for many, the overall increase in the amount of capital that banks need to hold will make them focus on efficiency across all business lines.

US regulators were the first to release proposed rules. The Federal Reserve, Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) promulgated a notice of proposed rulemaking in July 2023. The proposed rule would have resulted in the US ‘gold plating’ the consensus rules by adopting higher capital requirements for US banks relative to other jurisdictions. Following extensive pushback from market participants, US regulators announced that they are reviewing the proposed rule.

While a revised US proposed rule might dial back some of the impact of the original proposal, the impact of the global consensus rules is nevertheless likely to be quite punitive on secured funding transactions. Chief among the consensus revisions to existing rules is a sharply reduced ability for banks to use internal models to determine counterparty risk weights. This change is likely to substantially increase risk weights — and RWAs — for exposures to unrated and low-rated counterparties.

The Endgame rules could therefore produce a counterintuitive effect: banks’ exposures to low-risk entities could result in substantially higher RWAs than exposures to higher-risk entities. That result derives from a repo desk convention. A substantial portion of banks’ uncleared bilateral repo trades that provide funding to end users, such as hedge funds, are transacted with zero per cent haircuts — meaning that the cash equals the value of the securities. Conversely, banks generally post haircuts — typically two per cent for government bond-backed trades — when they raise funding from end providers such as money market funds.

Guaranteed Repo will result in substantially lower RWAs than other repo trading models, thereby lowering the amount of capital needed. The reason being that banks’ credit exposures are limited to one counterparty in the transaction — the trader they are guaranteeing. By contrast, other repo trading models cause banks to have exposure to two counterparties.

Consider three hypothetical scenarios that show the lower RWAs in Guaranteed Repo (Figure 1). Scenario 1 represents banks’ typical exposure from a two-leg trade — the bank receives a zero per cent haircut from its hedge fund counterparty and posts a two per cent haircut to its money market fund counterparty. Scenario 2 sets both haircuts to zero per cent, and Scenario 3 sets them both to two per cent. The risk weights for the counterparties are 100 per cent for the leg involving the non-investment-grade counterparty, such as the hedge fund, and 65 per cent for the leg with the investment-grade counterparty.

Figure 1

The chart highlights the RWAs under the single transaction exposure formula for Guaranteed Repo trades compared with two-leg structures. Eliminating repo leg exposures causes RWAs for Guaranteed Repo transactions to be substantially lower than the other structure in all three haircut scenarios. In fact, in Scenario 3, RWAs for Guaranteed Repo are zero because the haircut received on the loan to the hedge fund is greater than the standard minimum required market-volatility haircut.

G-SIB surcharge

Financial institutions deemed as global systemically important banks (G-SIBs) are assigned an additional capital surcharge based on a number of metrics such as size and interconnectedness. This additional G-SIB surcharge can substantially increase capital requirements for banks, making them reluctant to expand their intermediation activities when market disruptions occur. The surcharge increases in large increments (50 basis points in the US, for example), making the marginal transaction that tips a bank into the next higher surcharge bucket very costly. As a result, banks are highly resistant to engage in the marginal transaction.

Guaranteed Repo transactions can help banks maintain their critical intermediary roles when the marginal transaction is expensive. Most elements of the calculation do not apply to Guaranteed Repo transactions, particularly the US Method 2 calculation, which reflects a bank’s reliance on short-term wholesale funding. Because banks are contingent obligors in these transactions, they do not incur short-term liabilities. So that element of the G-SIB surcharge calculation does not apply. While making the incremental surcharge step more granular (as US regulators have proposed) can reduce the cost of the marginal transaction, it is nevertheless expensive. Guaranteed Repo is more efficient in helping banks to increase their intermediation in stressed periods than other alternatives.

Regulators have also moved to eliminate ‘window dressing’ for the purpose of managing the G-SIB surcharge, by requiring the stock elements of the surcharge to be calculated based on daily averages. As Guaranteed Repo transactions are not included in most elements of the G-SIB surcharge calculation, banks can use it to maintain their support of repo markets at current intra-reporting period levels.

Other regulatory benefits

Guaranteed Repo transactions are excluded from the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) calculations. Guarantees furnished by banks are neither credit facilities nor liquidity facilities under the LCR. And because banks are not principals to transactions, the NSFR does not apply.

Injecting liquidity

Central banks’ liquidity facilities are generally only available to regulated banks. Regulators rely on banks to deploy the liquidity to sectors and clients in need. The past few years have shown that balance sheet and capital constraints can limit the ability of banks to act as liquidity conduits.

Guaranteed Repo can help address these constraints. From an operational perspective, Guaranteed Repo trades are executed and settled directly by end users, without reliance on intermediate transactions with banks. Central banks can use this direct access method to rapidly direct liquidity toward entities or sectors experiencing stress. Collateral eligibility and haircuts can be predetermined, and eligible counterparties and guarantors can execute standardised documentation in advance.

In summary, Guaranteed Repo can potentially reinforce systemic resilience. It reduces systemwide leverage, thereby lowering contagion risk. It diffuses risk among market participants, reducing concentration. It requires less intraday liquidity systemwide, decreasing the risk of disruptions caused by an inability to settle transactions. And it reduces costs for market participants, as collateral and cash move directly between end users and providers.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times