Solutions for central clearing in the US Treasury repo market

30 September 2024

Nathaniel Wuerffel, head of market structure at BNY, explores the challenges of the upcoming and transformative US Treasury central clearing rule, and its potential impact on the repo market

Image: stock.adobe.com/@foxfotoco

Image: stock.adobe.com/@foxfotoco

The structure of US markets has changed significantly over the past several years, as the industry and regulators have worked to make markets more resilient to the episodes of dysfunction that have been experienced over the past decade.

These structural changes are set to accelerate as the US Treasury market — the largest and most liquid government securities market in the world — transitions to mandatory central clearing for cash and repo transactions in 2025 and 2026 respectively.

The rule will transform the Treasury market by requiring most cash and repo transactions to be submitted by direct participants of a US Treasury covered clearing agency (a central counterparty, or CCP), which then becomes the legal counterparty to each participant in the trade.

In doing so, central clearing is designed to reduce counterparty credit risk and make the Treasury market more resilient in times of stress. However, it could also increase transaction costs and could reduce liquidity somewhat in normal market conditions, at least initially. The rule will have a particularly large impact on Treasury repo markets, where over US$3 trillion in daily trading activity is not centrally cleared.

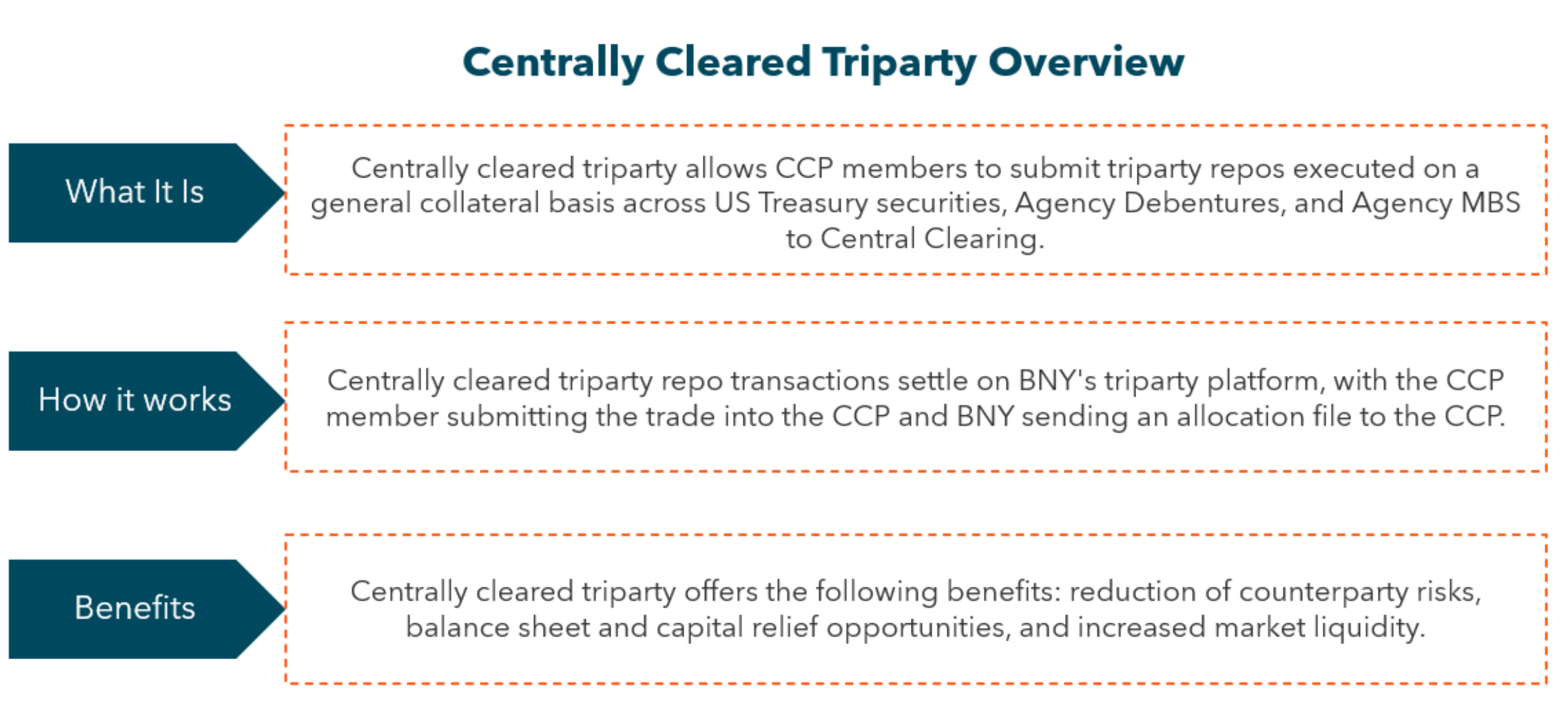

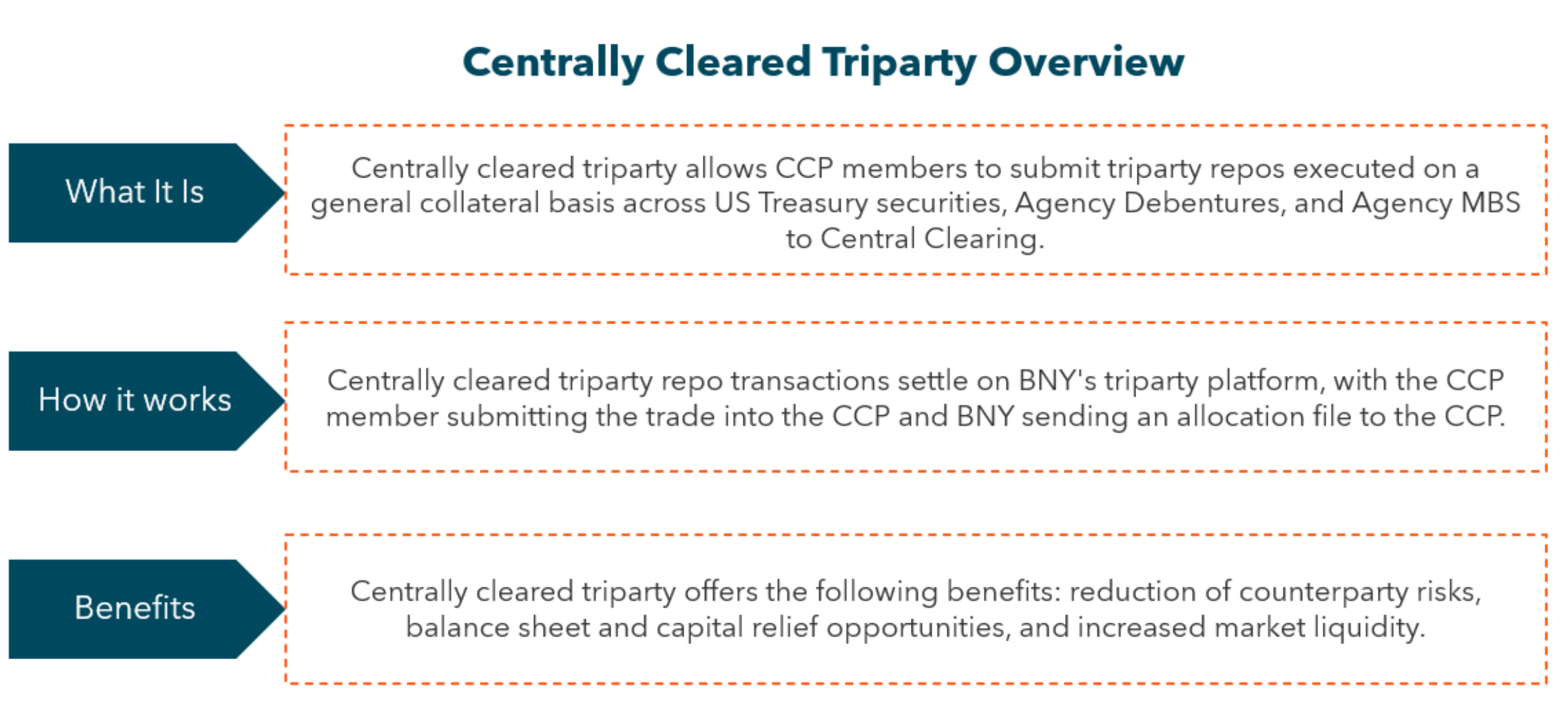

The centrally cleared versions of triparty repo will play a critical role by allowing market participants to centrally clear their repo transactions and optimise their collateral processes to better handle the increased margin levels and transaction costs.

The Treasury market and BNY

The central clearing rule is a top priority at BNY because of the unique role we play in the Treasury market. For more than 235 years, we have supported the markets for US government finance, having provided the first loan to the US Treasury department in 1789.

Today, BNY is the primary settlement provider in the Treasury market, including for Treasuries that are newly issued by the US Treasury department; we safeguard more than US$10 trillion of Treasury securities in custody; we are one of the largest sponsors of centrally cleared repo in money markets; and we have the single largest government securities triparty repo financing platform in the world.

BNY provides settlement and collateral management services to the Federal Reserve for monetary policy implementation, and for the Fixed Income Clearing Corporation (FICC) — currently the only CCP for Treasury securities. As the Treasury market evolves, we believe it is our responsibility to support clients with solutions to help them navigate change.

Central clearing implementation

US Treasury central clearing will create several significant implementation challenges for participants in the US$4.5 trillion Treasury repo market. Under the new rule, all repo and reverse repo agreements collateralised by US Treasury securities, to which a direct participant is a counterparty, must be submitted for central clearing, with few exceptions.

The rule provides an exemption for a small set of counterparty types, like central banks, and does not require clearing of certain trades that the FICC does not currently clear, such as evergreen, intraday, or open repo. Despite this, FICC surveys suggest that over US$2 trillion in additional repo transactions are likely to be cleared under the mandate.

The requirement to clear repo trades is not geographically bound; eligible transactions must be centrally cleared wherever they are conducted around the globe.

To comply with the rule, market participants will need to:

• Determine which of their trades require clearing.

Choose how to centrally clear those trades using various access models provided by the CCP.

• Manage collateral and margin requirements.

• Launch change management programmes to be ready by the implementation deadlines of 31 December 2025 for cash transactions and 30 June 2026 for repo.

The move to central clearing will raise the cost of transacting in funding markets in the short term, as more trades will require margin to be posted, and liquidity commitments could grow.

While netting should reduce some balance sheet costs, additional margin and the costs of sponsorship are likely to push bid-ask spreads wider initially, increasing the cost of repo funding and leverage.

Repo market impact

The various repo market segments will face different challenges in the move to central clearing. Although over US$1 trillion in daily activity is centrally cleared today, most of the repo market is currently made up of bilateral and triparty repo market segments that are not centrally cleared.

The non-centrally cleared bilateral repo (NCCBR) market makes up over US$2 trillion in daily repo and reverse repo activity that is settled and collateralised on a bilateral basis between dealers and their individual clients.

With over US$1 trillion in daily triparty repo transactions in Treasury securities, BNY’s collateral management platform is the single largest settlement location in triparty repo markets. Though BNY serves as a central settlement agent for these transactions, most trades in the triparty repo market today are not centrally cleared, with only US$250 billion in daily FICC Sponsored GC activity as of September 2024.

Both the NCCBR and triparty repo markets are set to see a dramatic shift toward central clearing. In the NCCBR market, some trades may shift toward use of centrally cleared DvP services, for example FICC DvP.

DVP repos, even if centrally cleared, still require the parties involved to handle many of the collateral management duties that surround the trade, including the calculation of collateral requirements, daily mark-to-market of collateral, and collateral substitutions. Many marketparticipants look to BNY to outsource these functions as a triparty collateral agent.

Centrally cleared triparty transactions

In the triparty repo market, centrally cleared triparty transactions will be crucial in the transition because they will allow market participants to utilise triparty collateral management while still complying with the requirements of the central clearing mandate.

For example, FICC Sponsored GC combines many of the features of the triparty repo market with the broader FICC Sponsored Service. Dealers use BNY’s triparty infrastructure to finance their securities inventory and manage multiple collateral obligations across their enterprise, while investors leverage BNY’s platform as a third party so that their transactions with dealers and other collateral providers remain secured.

Sponsored GC repo transactions are cleared at FICC and will continue to settle on BNY’s triparty platform in a similar fashion to how triparty repo transactions are handled outside of central clearing today. For market participants who are already active in the triparty repo market, the transition to Sponsored GC is simple, as the onboarding process and trade flow is very similar to the standard triparty processes. It is important that firms start working with their clients to migrate activity into centrally cleared repo, as the 2026 implementation deadline will come quickly.

The transition to US Treasury central clearing will be challenging, but it should make the market more resilient in times of stress by reducing counterparty credit risk.

BNY has played a central role in building the safety and liquidity of the Treasury market since its inception, and we look forward to continuing that role and partnering with clients as we navigate through central clearing. We believe centrally cleared triparty repo will be critical in helping market participants manage their transition to central clearing because it can simplify the process of complying with the rule while providing the benefits of efficient collateral management, safety, and increased resiliency.

These structural changes are set to accelerate as the US Treasury market — the largest and most liquid government securities market in the world — transitions to mandatory central clearing for cash and repo transactions in 2025 and 2026 respectively.

The rule will transform the Treasury market by requiring most cash and repo transactions to be submitted by direct participants of a US Treasury covered clearing agency (a central counterparty, or CCP), which then becomes the legal counterparty to each participant in the trade.

In doing so, central clearing is designed to reduce counterparty credit risk and make the Treasury market more resilient in times of stress. However, it could also increase transaction costs and could reduce liquidity somewhat in normal market conditions, at least initially. The rule will have a particularly large impact on Treasury repo markets, where over US$3 trillion in daily trading activity is not centrally cleared.

The centrally cleared versions of triparty repo will play a critical role by allowing market participants to centrally clear their repo transactions and optimise their collateral processes to better handle the increased margin levels and transaction costs.

The Treasury market and BNY

The central clearing rule is a top priority at BNY because of the unique role we play in the Treasury market. For more than 235 years, we have supported the markets for US government finance, having provided the first loan to the US Treasury department in 1789.

Today, BNY is the primary settlement provider in the Treasury market, including for Treasuries that are newly issued by the US Treasury department; we safeguard more than US$10 trillion of Treasury securities in custody; we are one of the largest sponsors of centrally cleared repo in money markets; and we have the single largest government securities triparty repo financing platform in the world.

BNY provides settlement and collateral management services to the Federal Reserve for monetary policy implementation, and for the Fixed Income Clearing Corporation (FICC) — currently the only CCP for Treasury securities. As the Treasury market evolves, we believe it is our responsibility to support clients with solutions to help them navigate change.

Central clearing implementation

US Treasury central clearing will create several significant implementation challenges for participants in the US$4.5 trillion Treasury repo market. Under the new rule, all repo and reverse repo agreements collateralised by US Treasury securities, to which a direct participant is a counterparty, must be submitted for central clearing, with few exceptions.

The rule provides an exemption for a small set of counterparty types, like central banks, and does not require clearing of certain trades that the FICC does not currently clear, such as evergreen, intraday, or open repo. Despite this, FICC surveys suggest that over US$2 trillion in additional repo transactions are likely to be cleared under the mandate.

The requirement to clear repo trades is not geographically bound; eligible transactions must be centrally cleared wherever they are conducted around the globe.

To comply with the rule, market participants will need to:

• Determine which of their trades require clearing.

Choose how to centrally clear those trades using various access models provided by the CCP.

• Manage collateral and margin requirements.

• Launch change management programmes to be ready by the implementation deadlines of 31 December 2025 for cash transactions and 30 June 2026 for repo.

The move to central clearing will raise the cost of transacting in funding markets in the short term, as more trades will require margin to be posted, and liquidity commitments could grow.

While netting should reduce some balance sheet costs, additional margin and the costs of sponsorship are likely to push bid-ask spreads wider initially, increasing the cost of repo funding and leverage.

Repo market impact

The various repo market segments will face different challenges in the move to central clearing. Although over US$1 trillion in daily activity is centrally cleared today, most of the repo market is currently made up of bilateral and triparty repo market segments that are not centrally cleared.

The non-centrally cleared bilateral repo (NCCBR) market makes up over US$2 trillion in daily repo and reverse repo activity that is settled and collateralised on a bilateral basis between dealers and their individual clients.

With over US$1 trillion in daily triparty repo transactions in Treasury securities, BNY’s collateral management platform is the single largest settlement location in triparty repo markets. Though BNY serves as a central settlement agent for these transactions, most trades in the triparty repo market today are not centrally cleared, with only US$250 billion in daily FICC Sponsored GC activity as of September 2024.

Both the NCCBR and triparty repo markets are set to see a dramatic shift toward central clearing. In the NCCBR market, some trades may shift toward use of centrally cleared DvP services, for example FICC DvP.

DVP repos, even if centrally cleared, still require the parties involved to handle many of the collateral management duties that surround the trade, including the calculation of collateral requirements, daily mark-to-market of collateral, and collateral substitutions. Many marketparticipants look to BNY to outsource these functions as a triparty collateral agent.

Centrally cleared triparty transactions

In the triparty repo market, centrally cleared triparty transactions will be crucial in the transition because they will allow market participants to utilise triparty collateral management while still complying with the requirements of the central clearing mandate.

For example, FICC Sponsored GC combines many of the features of the triparty repo market with the broader FICC Sponsored Service. Dealers use BNY’s triparty infrastructure to finance their securities inventory and manage multiple collateral obligations across their enterprise, while investors leverage BNY’s platform as a third party so that their transactions with dealers and other collateral providers remain secured.

Sponsored GC repo transactions are cleared at FICC and will continue to settle on BNY’s triparty platform in a similar fashion to how triparty repo transactions are handled outside of central clearing today. For market participants who are already active in the triparty repo market, the transition to Sponsored GC is simple, as the onboarding process and trade flow is very similar to the standard triparty processes. It is important that firms start working with their clients to migrate activity into centrally cleared repo, as the 2026 implementation deadline will come quickly.

The transition to US Treasury central clearing will be challenging, but it should make the market more resilient in times of stress by reducing counterparty credit risk.

BNY has played a central role in building the safety and liquidity of the Treasury market since its inception, and we look forward to continuing that role and partnering with clients as we navigate through central clearing. We believe centrally cleared triparty repo will be critical in helping market participants manage their transition to central clearing because it can simplify the process of complying with the rule while providing the benefits of efficient collateral management, safety, and increased resiliency.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times