The importance of data and analytics in today’s complex world of collateral

30 September 2024

The introduction of UMR has irrevocably changed the world of collateral, says Hiroshi Tanase, executive director, product analysis and design, at S&P Global Market Intelligence, who reviews the significance of data quality and the accuracy of models

Image: stock.adobe.com/Ihor

Image: stock.adobe.com/Ihor

More than 1,000 firms were estimated to be subject to the Uncleared Margin Rules (UMR) in the final two years of its implementation. “Requiring so many firms to perform such complex margin calculations daily is suicidal,” a seasoned Tier 1 bank quant told me with a sigh of resignation. Such was the sentiment among some practitioners when the industry was preparing for the last phase of UMR.

In the end, with a concerted effort and good outsourced initial margin (IM) solutions developed by several third-party companies (S&P Global being one of them), the industry marched past the monumental Phase 5 and 6 go-live dates in 2021 and 2022 without a catastrophe some had feared.

However, there is no doubt that the world of collateral after the introduction of UMR bears no resemblance to what it was in the past. It is now a highly analytical world where the quality of data and the accuracy of models have severe consequences on the outcome.

Two years after the last phase of UMR (Phase 6 go-live on 1 September 2022), it is a good time now to reflect on the importance of data and analytics in the context of the International Swaps and Derivatives Association (ISDA) Standard Initial Margin Model (SIMM) calculations. Reviewing and buttressing the analytical and data foundations should be a priority for firms looking to stay ahead.

The margin requirement for non-centrally cleared derivatives was added in 2011 to the Group of Twenty’s (G20) reform programme on OTC derivatives in light of the lesson learned from the great financial crisis that began in 2007. The primary objective of UMR is to reduce systemic risk caused by the trading of uncleared derivatives. To fulfil the systemic objective, an industry-wide unified margin methodology was adopted in the form of ISDA SIMM to ensure consistency across firms. In many ways, the creation and adoption of SIMM was a major success of UMR implementation.

Although SIMM standardises a major part of the margin calculation process, the risk sensitivities of trading portfolios, the key ingredients to SIMM, are left to individual firms to calculate. Therefore, the accuracy and soundness of the initial margin amount depend entirely on the quality of risk sensitivities. The calculation of risk sensitivities — a highly complex process given the complexities of many of the derivatives models — is now fundamental to achieving the goal of adequately mitigating counterparty credit risk with collateral.

Build the foundation

SIMM calculation could go wrong due to inaccurate calculation of risk sensitivities. Here, we show an example that involves a swaption.

Swaptions are a widely used product. It allows financial institutions to express a view on and hedge against interest rate movement. Although pricing swaptions is not generally considered a challenge, accurately pricing them is difficult, especially when the option is deep out-of-the-money (OTM) or in-the-money (ITM) because of the presence of volatility skew. OTM and ITM positions are commonly found in firms’ portfolios as certain strategies call for them (such as a low-strike put as a crash insurance). In addition, initially, at- or near-the-money positions can drift to become ITM or OTM as market levels move.

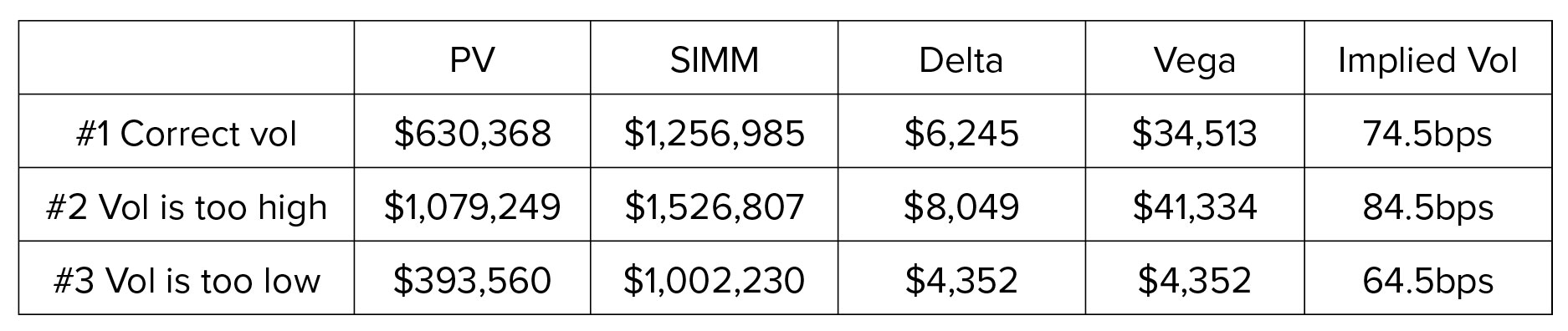

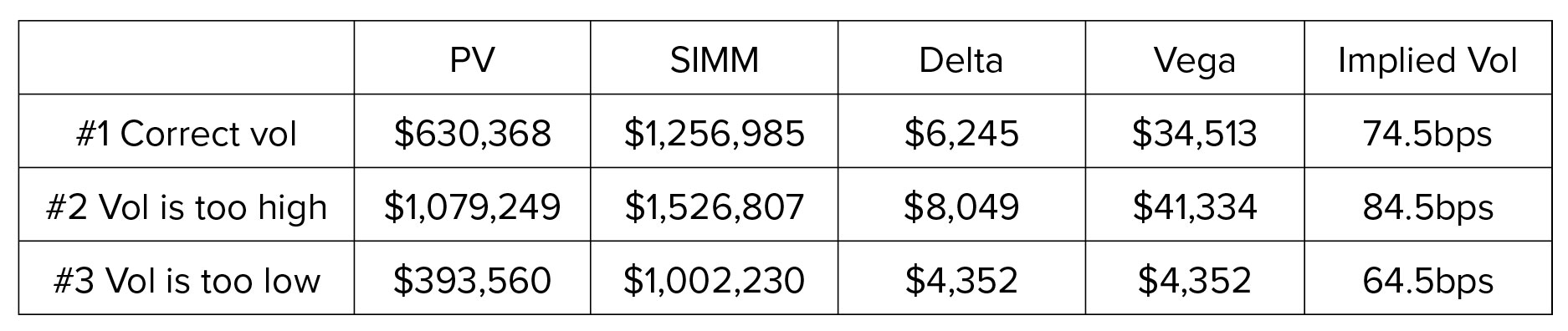

Consider a US$100 million 10Y-into-10Y ATM-300 bps receiver swaption position, where the correct volatility to use is 74.5 bps. What happens if the input volatility is mismarked by around 10 bps? The input volatility level impacts the present value and risk sensitivities, affecting the SIMM amount. Figure 1 shows margin calculations when the input volatility is correct, too high or too low. The SIMM amount swings by circa 20 per cent when the input volatility is off by 10 bps.

Figure 1: Swaption SIMM calculation

This example shows the importance of using high-quality market data to calculate accurate margin amounts. Correct calculation enables a firm to move the right amount of margin and avoid adverse economic consequences.

Defend your position

What is the next step once a solid foundation — a reliable operational workflow that produces accurate IM numbers — is built? Counterparties may call amounts in excess of a firm’s calculation. A firm needs to be able to defend its position by reconciling IM amounts with its counterparties. The firm must have a robust operational process with good quality control (QC). In addition, the following elements are key to reconcile IM effectively:

• Transparency around the risk sensitivity calculation process, especially if calculation is outsourced to a third party.

• The input data is of high quality and defensible.

• The model is sound and in line with the industry’s best practice.

In addition, counterparties can request to increase SIMM margin amounts bilaterally by applying add-on factors if the current margin level is deemed insufficient by their backtesting results. This is not a situation that occurs frequently, but when it does, the additional amount demanded can be very material. The only way to stay in control and be able to validate and challenge the demands of the counterparty is to backtest SIMM on a regular basis, regardless of whether it is required by the regulator.

SIMM backtesting is a complex exercise if it is to be performed in full. A light version of it may only cover testing SIMM against actual P&L as you go. This type of backtesting is often called dynamic backtesting. While dynamic backtesting is useful and critical for detecting changes to the market environment (besides assessing risks-not-in-SIMM), it must be complemented with static backtesting which tests the validity of SIMM against historical market movements.

Static backtesting requires good derivatives models and a full set of historical time-series of all relevant risk factors (eg interest rates, equity spot prices) spanning across periods including the stress period from the great financial crisis in 2008-09.

Since historical data across all risk factors is not widely available, it is important for a firm to review its current backtesting arrangement, especially the historical data used in the exercise (for example, whether actual data is used or is substituted with a proxy). Having an effective backtesting process and running it with at least a quarterly frequency enables the firm to validate and challenge counterparties’ requests to increase margin.

Optimise your margin

There is a tangible economic cost to posting margin. Therefore, the next step is understanding and minimising current and future margin requirements. A pre-trade IM calculator comes in handy to achieve that objective. A firm can investigate how much initial margin is required for a new product it plans to trade next. Before trade execution, it can compare the cost of margin across counterparties to optimise execution.

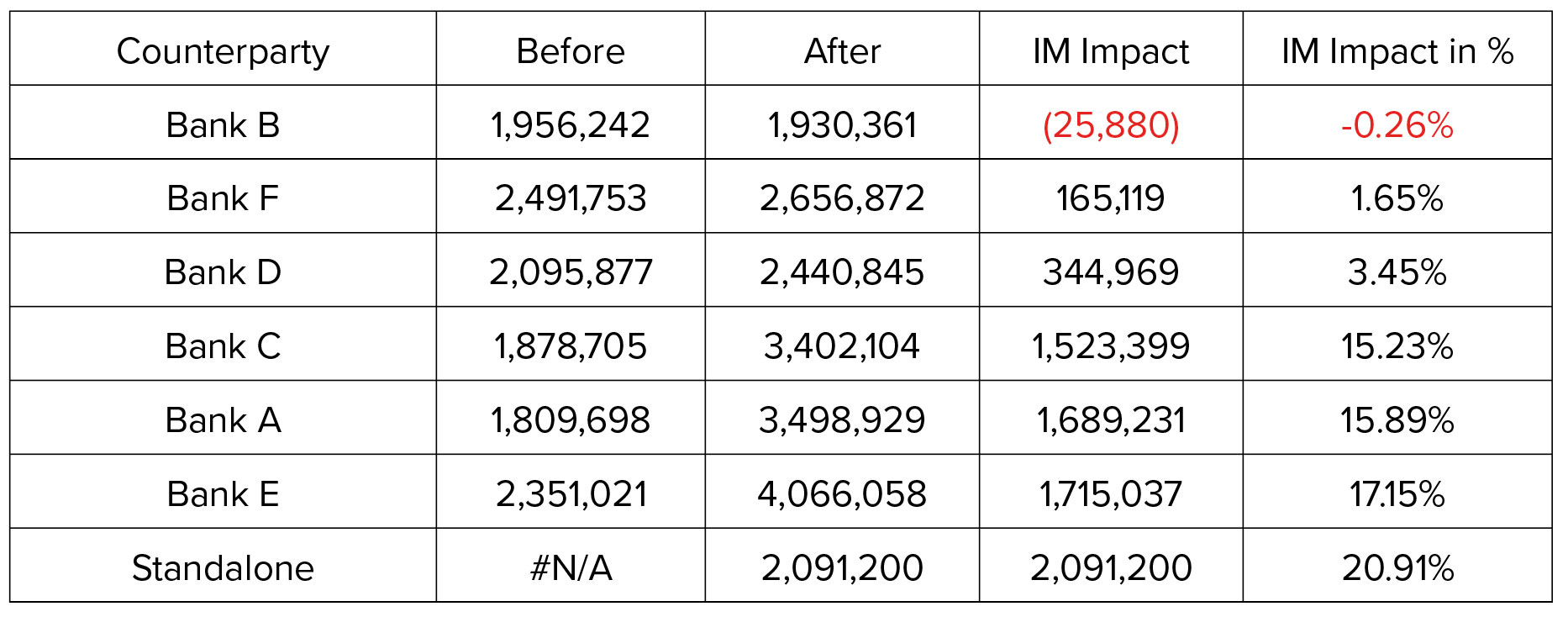

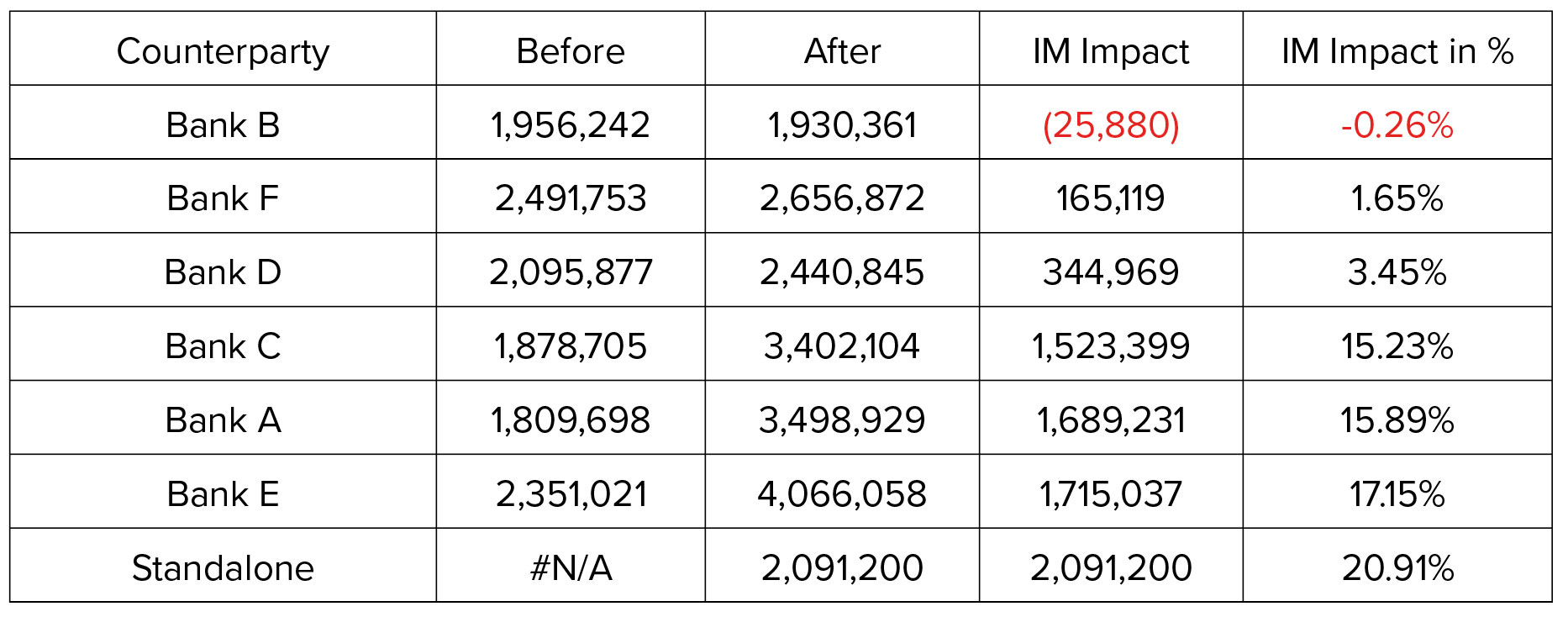

A sample calculation is shown in Figure 2 using an equity auto-callable structure referencing the performance of EURO STOXX 50 and Nikkei 225 with a notional of €10 million. The standalone SIMM amount for this hypothetical trade is €2,091,200, or 20.9 per cent of notional.

Figure 2: Auto-callable IM impact

Since the initial margin is calculated at the portfolio level (ie for each netting set), the cost of incremental IM depends on the risk of the existing portfolio. If there is more offsetting risk in the existing portfolio the incremental margin amount will be smaller. Incremental IM amount may even be negative if the new trade reduces the risk of the portfolio sufficiently.

Figure 2 illustrates a scenario with six counterparties (each representing a netting set) with varying amounts of incremental IM before and after adding the new auto-callable trade. The incremental IM amount varies widely across counterparties in this example, which endorses the utility of pre-trade IM calculation.

Conclusion

The introduction of UMR has irrevocably changed the world of collateral; trading of uncleared derivatives now comes with an obligation and burden of dealing with initial margin. First, an effective operational solution must be put in place to achieve regulatory compliance. Second, the initial margin amount must be calculated with accuracy and a firm must systematically defend its position when the counterparty calls for a larger-than-expected margin. In addition, the economic cost of funding initial margin should be understood and optimised.

The SIMM calculation process is complex due to the complexity of derivatives pricing models and risk sensitivity calculation. Great care must be taken to ensure that high-quality data and analytics are used. Failing that, a firm may face some or all of the following issues:

An insufficient amount of margin is collected, or an excess amount of margin is posted.

The firm is unable to effectively validate or challenge the counterparty’s margin calls.

The cost of funding margin diminishes the effectiveness of the derivatives the firm uses.

Good solutions are available from third-party providers. It goes a long way to do due diligence on the quality of the services on offer. By having a good solution, a firm can meet regulatory requirements, avoid serious issues, and stay ahead of competition.

In the end, with a concerted effort and good outsourced initial margin (IM) solutions developed by several third-party companies (S&P Global being one of them), the industry marched past the monumental Phase 5 and 6 go-live dates in 2021 and 2022 without a catastrophe some had feared.

However, there is no doubt that the world of collateral after the introduction of UMR bears no resemblance to what it was in the past. It is now a highly analytical world where the quality of data and the accuracy of models have severe consequences on the outcome.

Two years after the last phase of UMR (Phase 6 go-live on 1 September 2022), it is a good time now to reflect on the importance of data and analytics in the context of the International Swaps and Derivatives Association (ISDA) Standard Initial Margin Model (SIMM) calculations. Reviewing and buttressing the analytical and data foundations should be a priority for firms looking to stay ahead.

The margin requirement for non-centrally cleared derivatives was added in 2011 to the Group of Twenty’s (G20) reform programme on OTC derivatives in light of the lesson learned from the great financial crisis that began in 2007. The primary objective of UMR is to reduce systemic risk caused by the trading of uncleared derivatives. To fulfil the systemic objective, an industry-wide unified margin methodology was adopted in the form of ISDA SIMM to ensure consistency across firms. In many ways, the creation and adoption of SIMM was a major success of UMR implementation.

Although SIMM standardises a major part of the margin calculation process, the risk sensitivities of trading portfolios, the key ingredients to SIMM, are left to individual firms to calculate. Therefore, the accuracy and soundness of the initial margin amount depend entirely on the quality of risk sensitivities. The calculation of risk sensitivities — a highly complex process given the complexities of many of the derivatives models — is now fundamental to achieving the goal of adequately mitigating counterparty credit risk with collateral.

Build the foundation

SIMM calculation could go wrong due to inaccurate calculation of risk sensitivities. Here, we show an example that involves a swaption.

Swaptions are a widely used product. It allows financial institutions to express a view on and hedge against interest rate movement. Although pricing swaptions is not generally considered a challenge, accurately pricing them is difficult, especially when the option is deep out-of-the-money (OTM) or in-the-money (ITM) because of the presence of volatility skew. OTM and ITM positions are commonly found in firms’ portfolios as certain strategies call for them (such as a low-strike put as a crash insurance). In addition, initially, at- or near-the-money positions can drift to become ITM or OTM as market levels move.

Consider a US$100 million 10Y-into-10Y ATM-300 bps receiver swaption position, where the correct volatility to use is 74.5 bps. What happens if the input volatility is mismarked by around 10 bps? The input volatility level impacts the present value and risk sensitivities, affecting the SIMM amount. Figure 1 shows margin calculations when the input volatility is correct, too high or too low. The SIMM amount swings by circa 20 per cent when the input volatility is off by 10 bps.

Figure 1: Swaption SIMM calculation

This example shows the importance of using high-quality market data to calculate accurate margin amounts. Correct calculation enables a firm to move the right amount of margin and avoid adverse economic consequences.

Defend your position

What is the next step once a solid foundation — a reliable operational workflow that produces accurate IM numbers — is built? Counterparties may call amounts in excess of a firm’s calculation. A firm needs to be able to defend its position by reconciling IM amounts with its counterparties. The firm must have a robust operational process with good quality control (QC). In addition, the following elements are key to reconcile IM effectively:

• Transparency around the risk sensitivity calculation process, especially if calculation is outsourced to a third party.

• The input data is of high quality and defensible.

• The model is sound and in line with the industry’s best practice.

In addition, counterparties can request to increase SIMM margin amounts bilaterally by applying add-on factors if the current margin level is deemed insufficient by their backtesting results. This is not a situation that occurs frequently, but when it does, the additional amount demanded can be very material. The only way to stay in control and be able to validate and challenge the demands of the counterparty is to backtest SIMM on a regular basis, regardless of whether it is required by the regulator.

SIMM backtesting is a complex exercise if it is to be performed in full. A light version of it may only cover testing SIMM against actual P&L as you go. This type of backtesting is often called dynamic backtesting. While dynamic backtesting is useful and critical for detecting changes to the market environment (besides assessing risks-not-in-SIMM), it must be complemented with static backtesting which tests the validity of SIMM against historical market movements.

Static backtesting requires good derivatives models and a full set of historical time-series of all relevant risk factors (eg interest rates, equity spot prices) spanning across periods including the stress period from the great financial crisis in 2008-09.

Since historical data across all risk factors is not widely available, it is important for a firm to review its current backtesting arrangement, especially the historical data used in the exercise (for example, whether actual data is used or is substituted with a proxy). Having an effective backtesting process and running it with at least a quarterly frequency enables the firm to validate and challenge counterparties’ requests to increase margin.

Optimise your margin

There is a tangible economic cost to posting margin. Therefore, the next step is understanding and minimising current and future margin requirements. A pre-trade IM calculator comes in handy to achieve that objective. A firm can investigate how much initial margin is required for a new product it plans to trade next. Before trade execution, it can compare the cost of margin across counterparties to optimise execution.

A sample calculation is shown in Figure 2 using an equity auto-callable structure referencing the performance of EURO STOXX 50 and Nikkei 225 with a notional of €10 million. The standalone SIMM amount for this hypothetical trade is €2,091,200, or 20.9 per cent of notional.

Figure 2: Auto-callable IM impact

Since the initial margin is calculated at the portfolio level (ie for each netting set), the cost of incremental IM depends on the risk of the existing portfolio. If there is more offsetting risk in the existing portfolio the incremental margin amount will be smaller. Incremental IM amount may even be negative if the new trade reduces the risk of the portfolio sufficiently.

Figure 2 illustrates a scenario with six counterparties (each representing a netting set) with varying amounts of incremental IM before and after adding the new auto-callable trade. The incremental IM amount varies widely across counterparties in this example, which endorses the utility of pre-trade IM calculation.

Conclusion

The introduction of UMR has irrevocably changed the world of collateral; trading of uncleared derivatives now comes with an obligation and burden of dealing with initial margin. First, an effective operational solution must be put in place to achieve regulatory compliance. Second, the initial margin amount must be calculated with accuracy and a firm must systematically defend its position when the counterparty calls for a larger-than-expected margin. In addition, the economic cost of funding initial margin should be understood and optimised.

The SIMM calculation process is complex due to the complexity of derivatives pricing models and risk sensitivity calculation. Great care must be taken to ensure that high-quality data and analytics are used. Failing that, a firm may face some or all of the following issues:

An insufficient amount of margin is collected, or an excess amount of margin is posted.

The firm is unable to effectively validate or challenge the counterparty’s margin calls.

The cost of funding margin diminishes the effectiveness of the derivatives the firm uses.

Good solutions are available from third-party providers. It goes a long way to do due diligence on the quality of the services on offer. By having a good solution, a firm can meet regulatory requirements, avoid serious issues, and stay ahead of competition.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times