Transforming collateral management with DLT

30 September 2024

Elisa Poutanen, sales lead at HQLAX, discusses the challenges facing banks when executing cross-custodian settlements, and the firm’s recent work on triparty interoperability

Image: stock.adobe.com/blacksalmon

Image: stock.adobe.com/blacksalmon

With the global collateral market topping €25 trillion in 2024, and heightened regulatory focus on counterparty credit risk and collateral management, efficient collateral management has become a strategic competitive advantage for those who do it well.

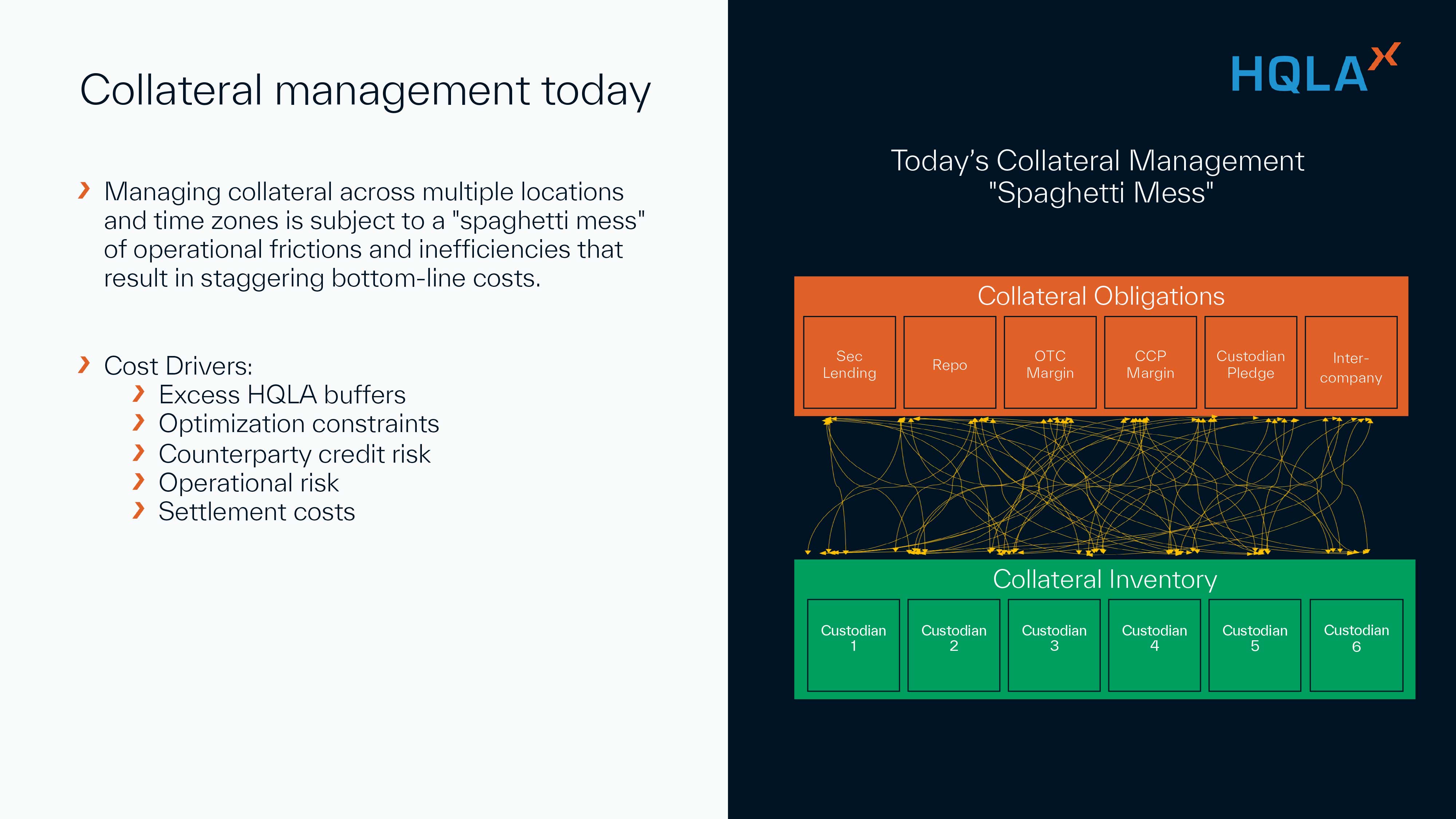

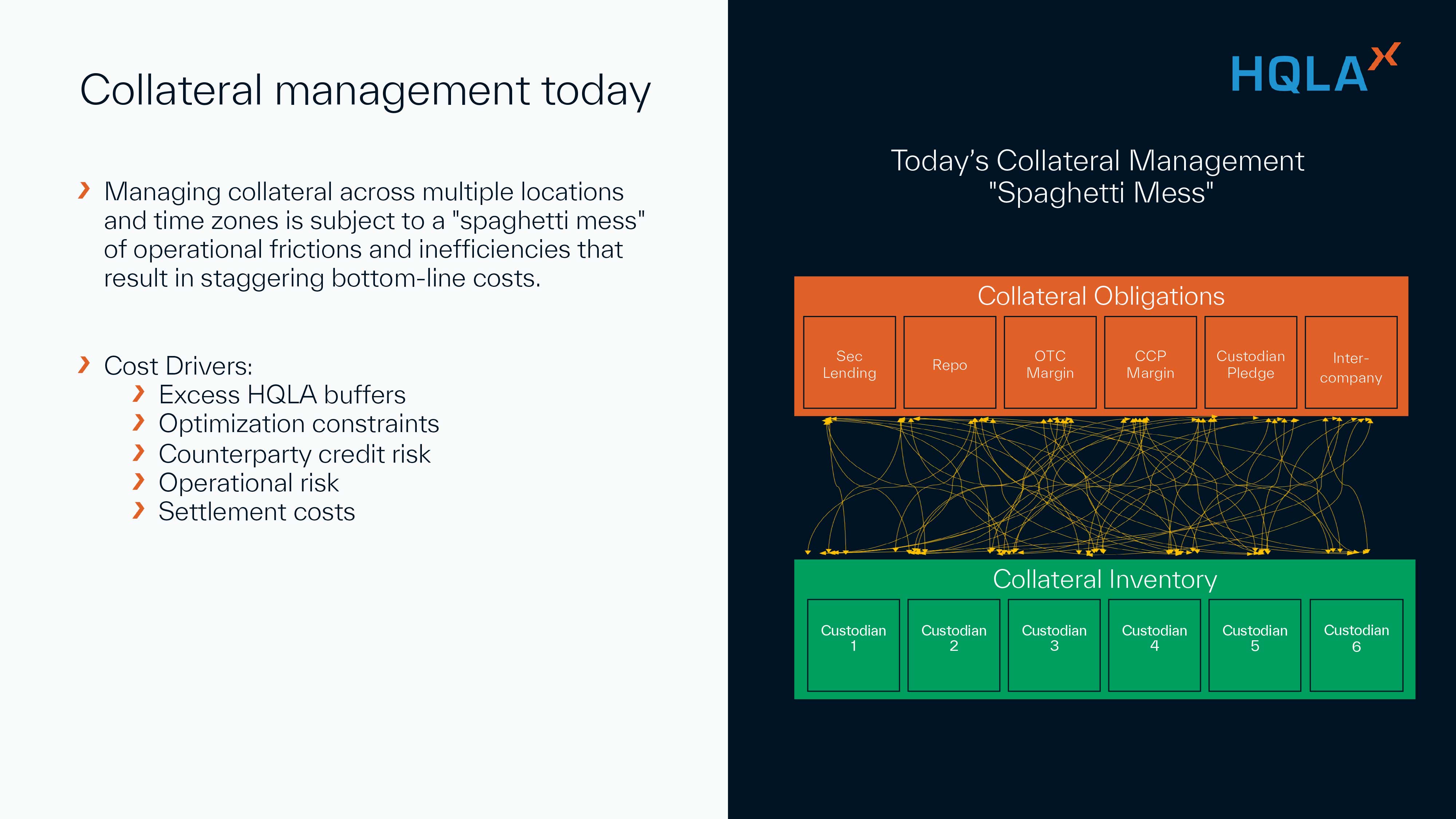

In today’s world, financial institutions often have to navigate a complex network of custodian and counterparty relationships, resulting in costly and inefficient collateral mobility. A solution to address this is becoming a key priority to add to a bank’s toolkit for effective collateral management.

Figure 1: Illustrates the ‘spaghetti mess’ when delivering collateral to meet obligations across the different custody locations and the cost drivers resulting from it

HQLAX offers an innovative platform that eradicates the need for cross-custodian moves required to meet this matrix of collateral obligations, including securities lending, repo, and margin management. HQLAX enhances the efficiency and security of asset transfers and ownership exchanges by using digital ledger technology (DLT).

HQLAX’s Digital Collateral Records (DCR) solution helps market players seeking access to their inventory within client, counterparty, and service provider ecosystems. This includes custodians, central securities depositories (CSDs), triparty agents, banks, and investment firms.

The DCR solution represents the ownership of an underlying ISIN held in an account within an existing inventory location, which can be delivered to other participants on the platform in a frictionless manner, without the need to move the underlying ISIN. This therefore decouples ownership transfers from moves of collateral between physical locations.

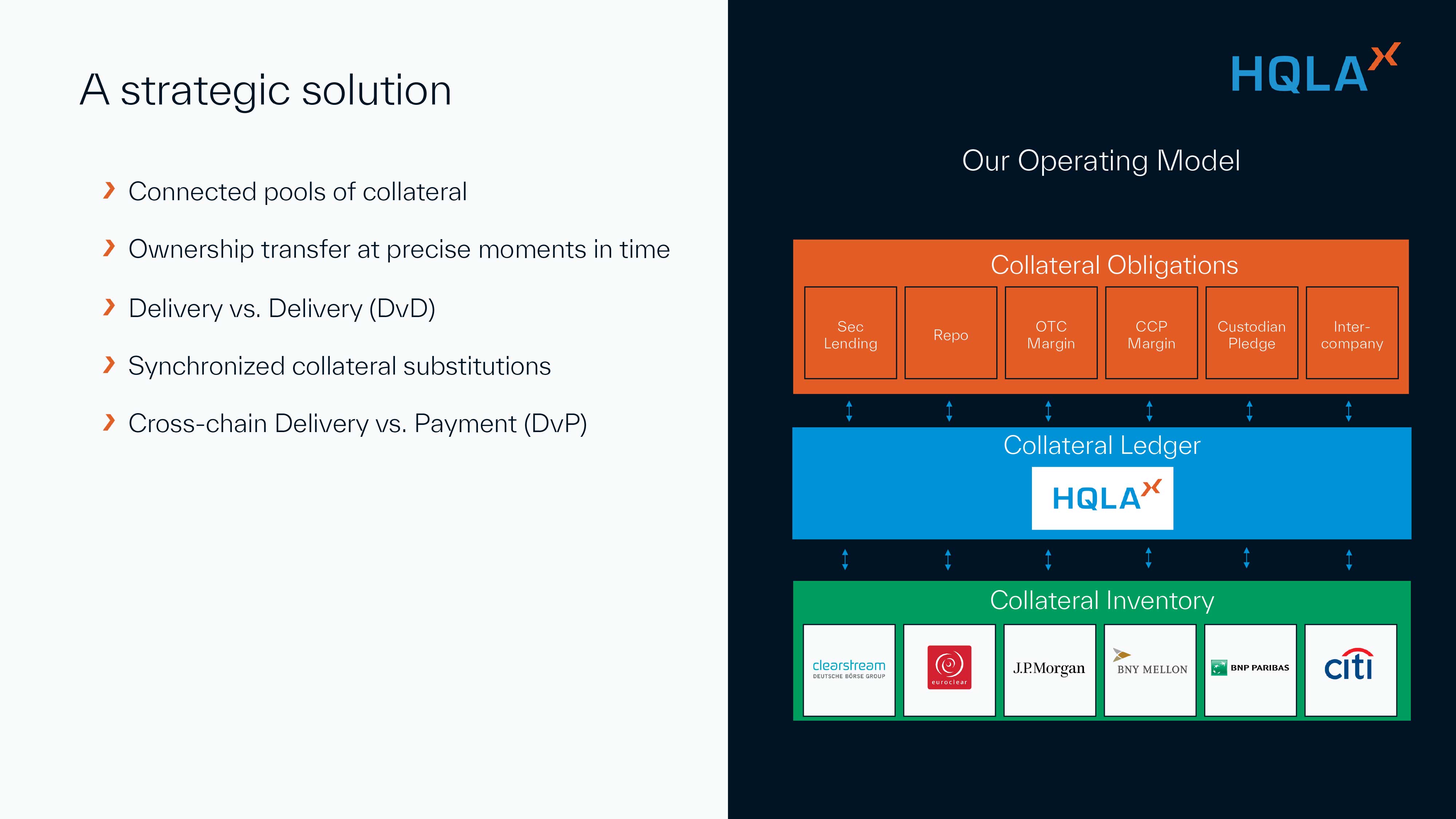

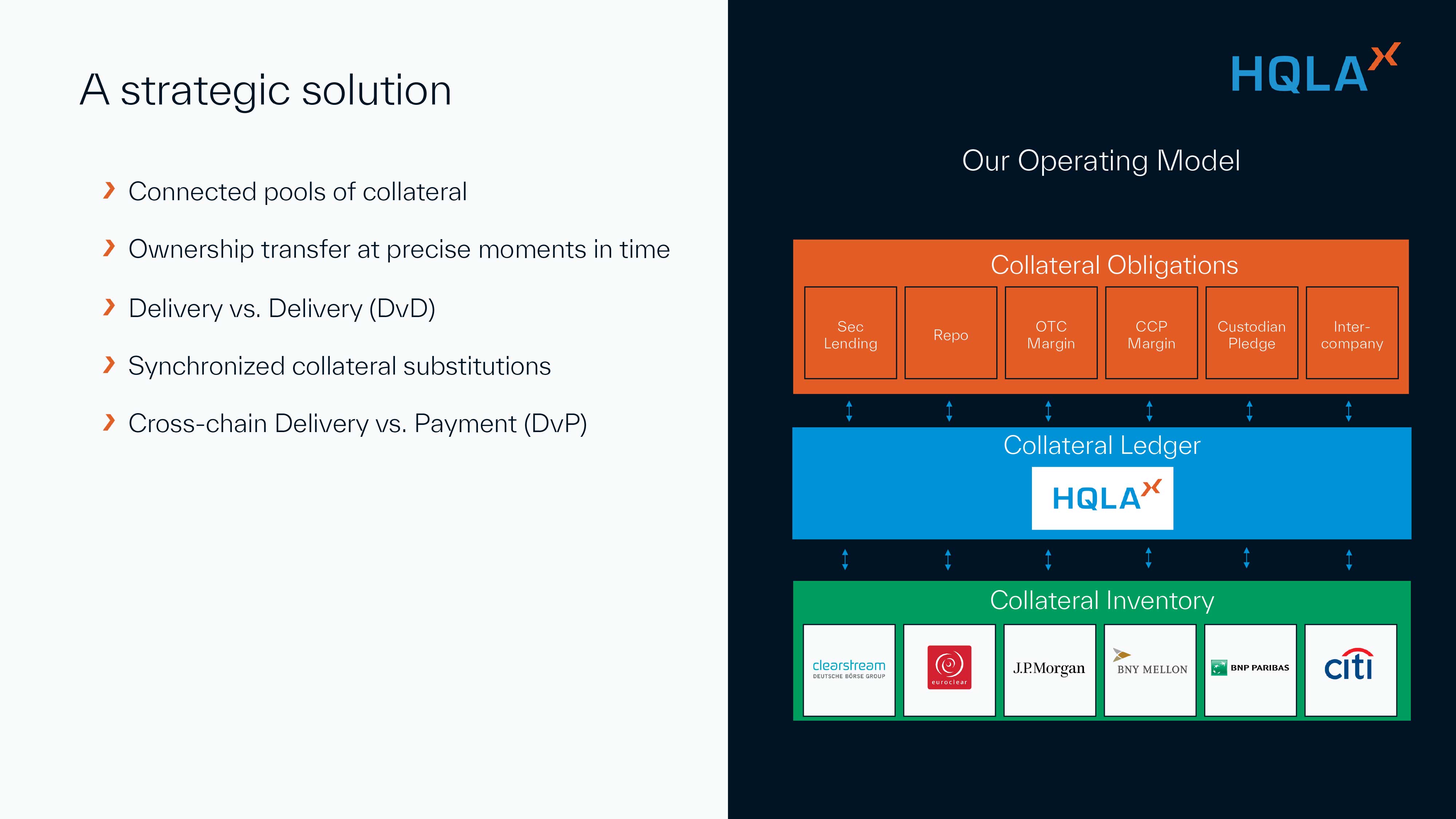

As reflected in Figure 2, HQLAX acts as a digital collateral registry, enabling banks to manage collateral from multiple locations seamlessly within a single digitised platform and to assimilate real-time data. This helps banks to enhance capital efficiency, collateral mobility, to mitigate the risk of fails and to lower operating costs by merging DLT advantages with traditional triparty and custody services.

Figure 2: Operating model

Securities lending DvD

Traditional free-of-payment exchanges in securities lending create significant intraday credit exposures due to the ‘give before you get’ market practice. HQLAX’s delivery-versus-delivery (DvD) solution eliminates this pain point by enabling participants to exchange loan securities for collateral through a simultaneous DvD swap on the digital ledger.

This streamlined process reduces intraday liquidity spikes, operational costs, and settlement failures, fostering greater collateral optimisation. Our securities lending DvD offering is catered for both collateral transformation and short-covering trades. Agent lenders and principal lenders are able to connect to the platform using their existing technical channels such as API or SWIFT messaging, therefore avoiding any technical build.

The platform’s DvD functionality ensures lenders only release ownership of loaned securities in exchange for corresponding collateral. This includes releasing a portion of the loan book that matches the delivered collateral value even if the full required value (RQV) has yet to be collateralised.

Borrowers also gain from reduced capital costs and enhanced liquidity management, making HQLAX a flexible tool for both sides of a securities lending transaction. Securities can be freely moved between participants on the platform and to and from the platform to the clients preferred custodian. HQLAX supports collateral posting both under a title transfer and pledge legal structures and our clients are able to use their preferred triparty agent to cover their RQVs, removing the need to move collateral between longboxes to achieve optimised usage.

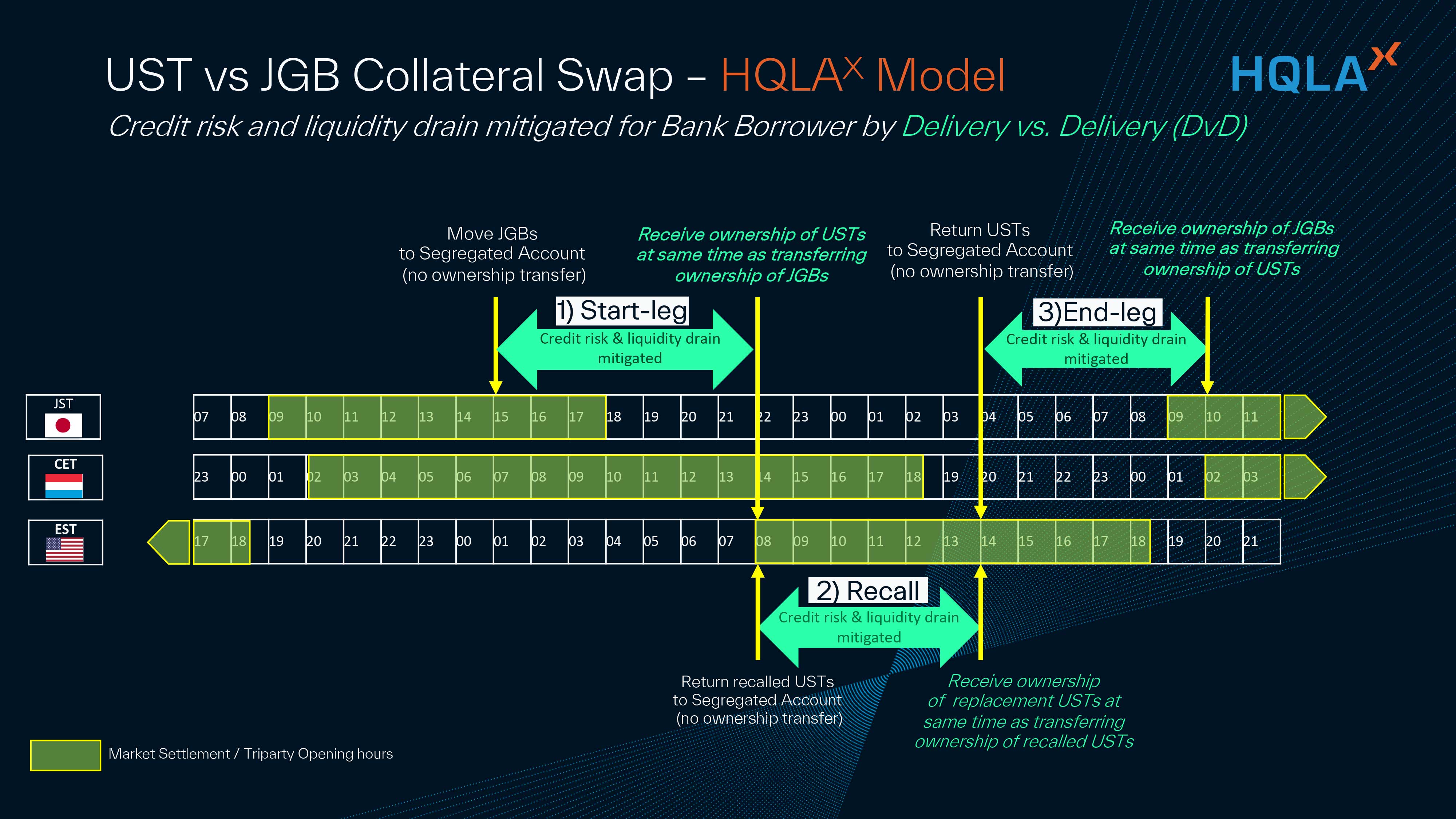

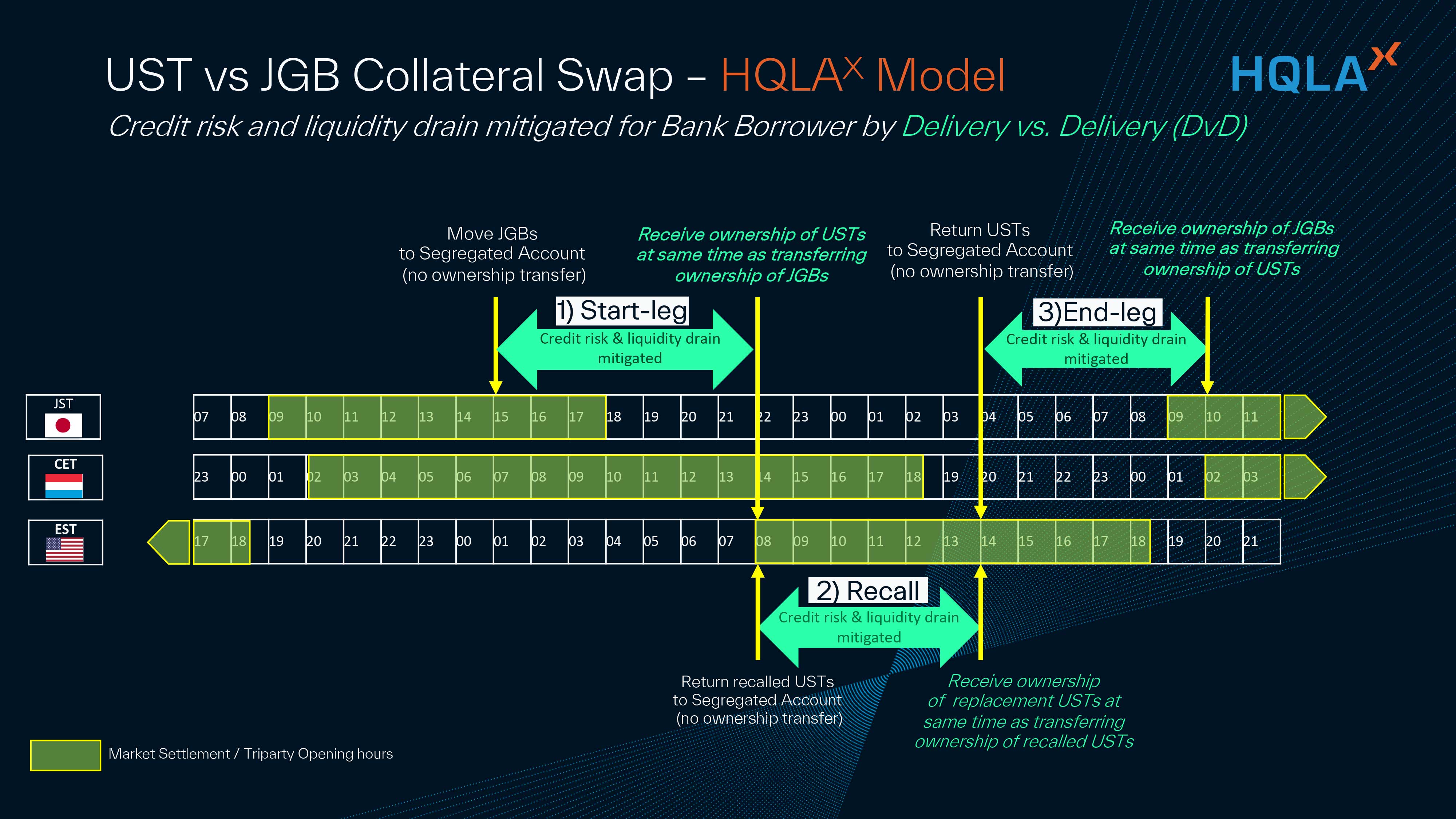

US Treasury borrowing versus Japanese government bonds (JGB) offers a practical example of one of the benefits that DvD settlement can offer. Such securities lending transactions require collateral movement across different time zones, creating settlement delays and credit exposures. Utilising HQLAX’s DvD capability eliminates these issues, as digital ownership transfer allows simultaneous execution as illustrated in Figure 3. This minimises credit risk, enhances liquidity, and streamlines the entire process, crucial in fast-paced trading environments.

Figure 3: US Treasury versus JGB collateral swap

Digital DvP

To launch in Q4 2024, HQLAX’s digital delivery-versus-payment (DvP) solutions will complement its existing offerings, enabling the monetisation of mobilised collateral and increased liquidity. The greatest advantage lies in the creation of new intraday repo markets. By allowing precise scheduling of transaction times down to the minute, participants can better manage liquidity, reduce funding costs, and utilise balance sheets more effectively.

Cash lenders can also gain incremental revenue by investing cash traditionally held overnight into intraday markets. This creates a dual advantage, providing new liquidity tools for banks and enhancing financial stability during stress events.

HQLAX’s DvP solutions integrate with both digital cash ledgers and traditional fiat systems. Collaborating with partners like Fnality (digital central bank money) and Onyx by J.P. Morgan (digital commercial bank money), HQLAX stands at the intersection of digital and legacy systems, promoting interoperability as a key driver of market liquidity.

Margin management

Effective collateral re-use is essential for securities finance, ensuring timely mobilisation of eligible collateral. HQLAX addresses settlement delays and credit risks through its advanced DvD capabilities, enabling precise collateral substitutions and real-time margining between market participants. This automated process helps firms meet tight margin call deadlines, particularly in centrally cleared transactions, reducing operational risks and securing financial stability.

By decoupling ownership transfer from asset movement, the platform enhances the efficiency of margin collateralisation, minimises cross-custodian movements, and bolsters operational resilience. Clients can rely on HQLAXX to manage their end-to-end margin processes, ensuring they meet their obligations without the risk of failure.

What next?

HQLAX remains at the forefront of addressing inefficiencies in securities finance post-trade and settlement processes. Together with a group of five global systemically important banks (G-SIBs), three triparty agents, and two software service providers, we have explored DLT-based solutions for triparty interoperability.

As previously alluded to, banks often need to execute cross-custodian settlements to transfer securities between triparty agents. This process is time-consuming, frequently manual, and prone to settlement fails. The economic repercussions are significant, necessitating larger operational buffers and missing out on potential optimisation benefits. Addressing these issues requires a streamlined approach to collateral mobility, ensuring efficient allocation, optimal collateralisation, and cost-effective tenor utilisation.

The HQLAX platform aims to mitigate these pain points by enabling seamless reassignment of securities between different triparty agent accounts on-ledger, eliminating the need for cross-custodian settlements. This innovation translates to lower operational costs for triparty agents and substantial benefits for banks, including increased automation, enhanced optimisation, and improved capital efficiency.

Together with our partners, we are actively working on mobilising the initial stages of a production deployment, promising significant advancements in the efficiency and robustness of securities finance operations.

In today’s world, financial institutions often have to navigate a complex network of custodian and counterparty relationships, resulting in costly and inefficient collateral mobility. A solution to address this is becoming a key priority to add to a bank’s toolkit for effective collateral management.

Figure 1: Illustrates the ‘spaghetti mess’ when delivering collateral to meet obligations across the different custody locations and the cost drivers resulting from it

HQLAX offers an innovative platform that eradicates the need for cross-custodian moves required to meet this matrix of collateral obligations, including securities lending, repo, and margin management. HQLAX enhances the efficiency and security of asset transfers and ownership exchanges by using digital ledger technology (DLT).

HQLAX’s Digital Collateral Records (DCR) solution helps market players seeking access to their inventory within client, counterparty, and service provider ecosystems. This includes custodians, central securities depositories (CSDs), triparty agents, banks, and investment firms.

The DCR solution represents the ownership of an underlying ISIN held in an account within an existing inventory location, which can be delivered to other participants on the platform in a frictionless manner, without the need to move the underlying ISIN. This therefore decouples ownership transfers from moves of collateral between physical locations.

As reflected in Figure 2, HQLAX acts as a digital collateral registry, enabling banks to manage collateral from multiple locations seamlessly within a single digitised platform and to assimilate real-time data. This helps banks to enhance capital efficiency, collateral mobility, to mitigate the risk of fails and to lower operating costs by merging DLT advantages with traditional triparty and custody services.

Figure 2: Operating model

Securities lending DvD

Traditional free-of-payment exchanges in securities lending create significant intraday credit exposures due to the ‘give before you get’ market practice. HQLAX’s delivery-versus-delivery (DvD) solution eliminates this pain point by enabling participants to exchange loan securities for collateral through a simultaneous DvD swap on the digital ledger.

This streamlined process reduces intraday liquidity spikes, operational costs, and settlement failures, fostering greater collateral optimisation. Our securities lending DvD offering is catered for both collateral transformation and short-covering trades. Agent lenders and principal lenders are able to connect to the platform using their existing technical channels such as API or SWIFT messaging, therefore avoiding any technical build.

The platform’s DvD functionality ensures lenders only release ownership of loaned securities in exchange for corresponding collateral. This includes releasing a portion of the loan book that matches the delivered collateral value even if the full required value (RQV) has yet to be collateralised.

Borrowers also gain from reduced capital costs and enhanced liquidity management, making HQLAX a flexible tool for both sides of a securities lending transaction. Securities can be freely moved between participants on the platform and to and from the platform to the clients preferred custodian. HQLAX supports collateral posting both under a title transfer and pledge legal structures and our clients are able to use their preferred triparty agent to cover their RQVs, removing the need to move collateral between longboxes to achieve optimised usage.

US Treasury borrowing versus Japanese government bonds (JGB) offers a practical example of one of the benefits that DvD settlement can offer. Such securities lending transactions require collateral movement across different time zones, creating settlement delays and credit exposures. Utilising HQLAX’s DvD capability eliminates these issues, as digital ownership transfer allows simultaneous execution as illustrated in Figure 3. This minimises credit risk, enhances liquidity, and streamlines the entire process, crucial in fast-paced trading environments.

Figure 3: US Treasury versus JGB collateral swap

Digital DvP

To launch in Q4 2024, HQLAX’s digital delivery-versus-payment (DvP) solutions will complement its existing offerings, enabling the monetisation of mobilised collateral and increased liquidity. The greatest advantage lies in the creation of new intraday repo markets. By allowing precise scheduling of transaction times down to the minute, participants can better manage liquidity, reduce funding costs, and utilise balance sheets more effectively.

Cash lenders can also gain incremental revenue by investing cash traditionally held overnight into intraday markets. This creates a dual advantage, providing new liquidity tools for banks and enhancing financial stability during stress events.

HQLAX’s DvP solutions integrate with both digital cash ledgers and traditional fiat systems. Collaborating with partners like Fnality (digital central bank money) and Onyx by J.P. Morgan (digital commercial bank money), HQLAX stands at the intersection of digital and legacy systems, promoting interoperability as a key driver of market liquidity.

Margin management

Effective collateral re-use is essential for securities finance, ensuring timely mobilisation of eligible collateral. HQLAX addresses settlement delays and credit risks through its advanced DvD capabilities, enabling precise collateral substitutions and real-time margining between market participants. This automated process helps firms meet tight margin call deadlines, particularly in centrally cleared transactions, reducing operational risks and securing financial stability.

By decoupling ownership transfer from asset movement, the platform enhances the efficiency of margin collateralisation, minimises cross-custodian movements, and bolsters operational resilience. Clients can rely on HQLAXX to manage their end-to-end margin processes, ensuring they meet their obligations without the risk of failure.

What next?

HQLAX remains at the forefront of addressing inefficiencies in securities finance post-trade and settlement processes. Together with a group of five global systemically important banks (G-SIBs), three triparty agents, and two software service providers, we have explored DLT-based solutions for triparty interoperability.

As previously alluded to, banks often need to execute cross-custodian settlements to transfer securities between triparty agents. This process is time-consuming, frequently manual, and prone to settlement fails. The economic repercussions are significant, necessitating larger operational buffers and missing out on potential optimisation benefits. Addressing these issues requires a streamlined approach to collateral mobility, ensuring efficient allocation, optimal collateralisation, and cost-effective tenor utilisation.

The HQLAX platform aims to mitigate these pain points by enabling seamless reassignment of securities between different triparty agent accounts on-ledger, eliminating the need for cross-custodian settlements. This innovation translates to lower operational costs for triparty agents and substantial benefits for banks, including increased automation, enhanced optimisation, and improved capital efficiency.

Together with our partners, we are actively working on mobilising the initial stages of a production deployment, promising significant advancements in the efficiency and robustness of securities finance operations.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times