Streamlining collateral management through seamless connectivity and automation

30 September 2024

Comyno chief operating officer Frank Becker unpacks areas of collateral management and highlights cost-efficient solutions for automation

Image: Frank Becker

Image: Frank Becker

The development of platforms and networks that enable enhanced connectivity is at the forefront of what we do. By establishing seamless connections across systems and counterparties, institutions can significantly reduce manual labour and automate processes, driving greater efficiency.

This shift towards interconnected, automated platforms not only minimise operational burdens but also leads to the creation of larger liquidity pools. As a result, institutions can optimise their collateral management, ensuring faster access to liquidity while maintaining compliance with regulatory frameworks.

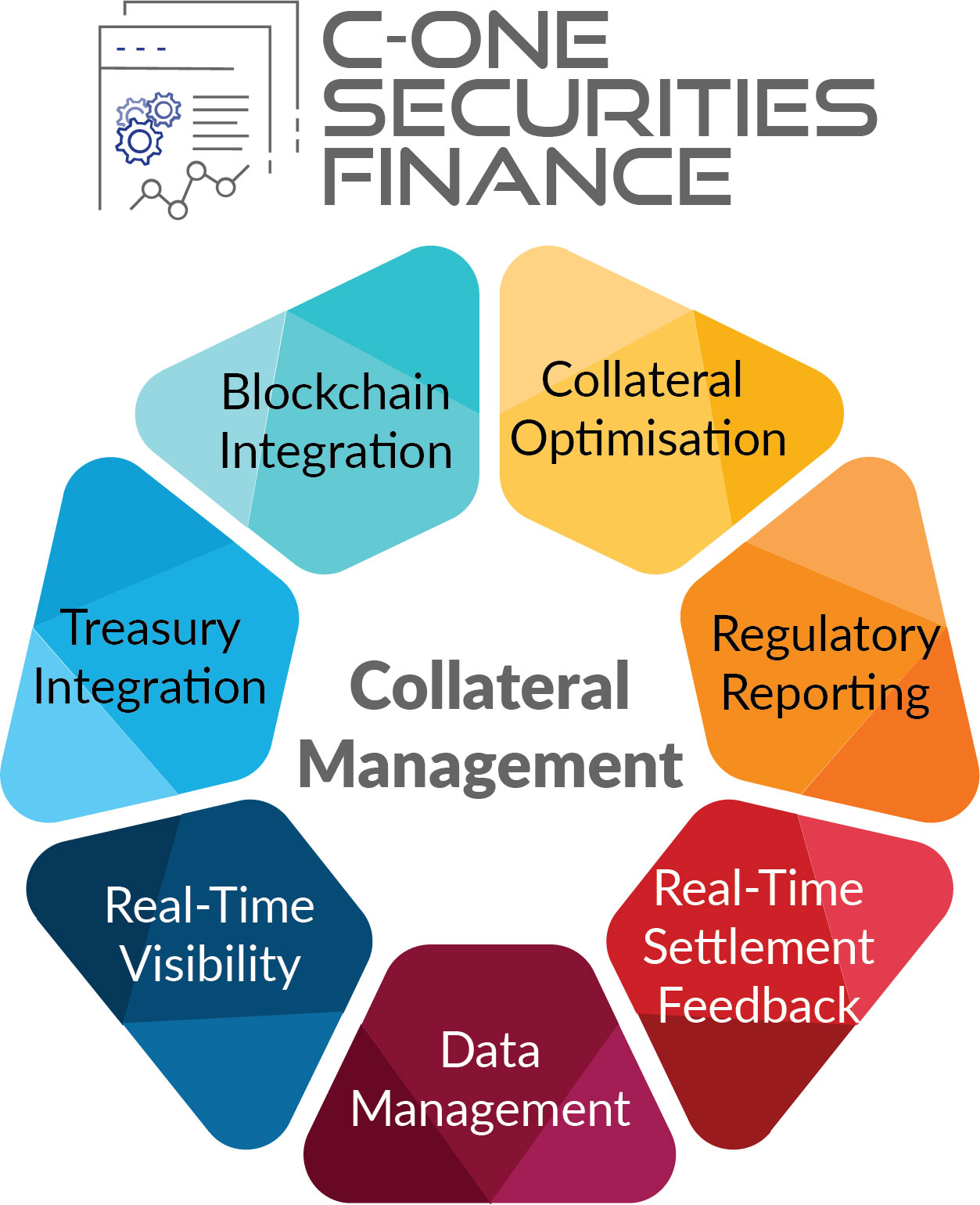

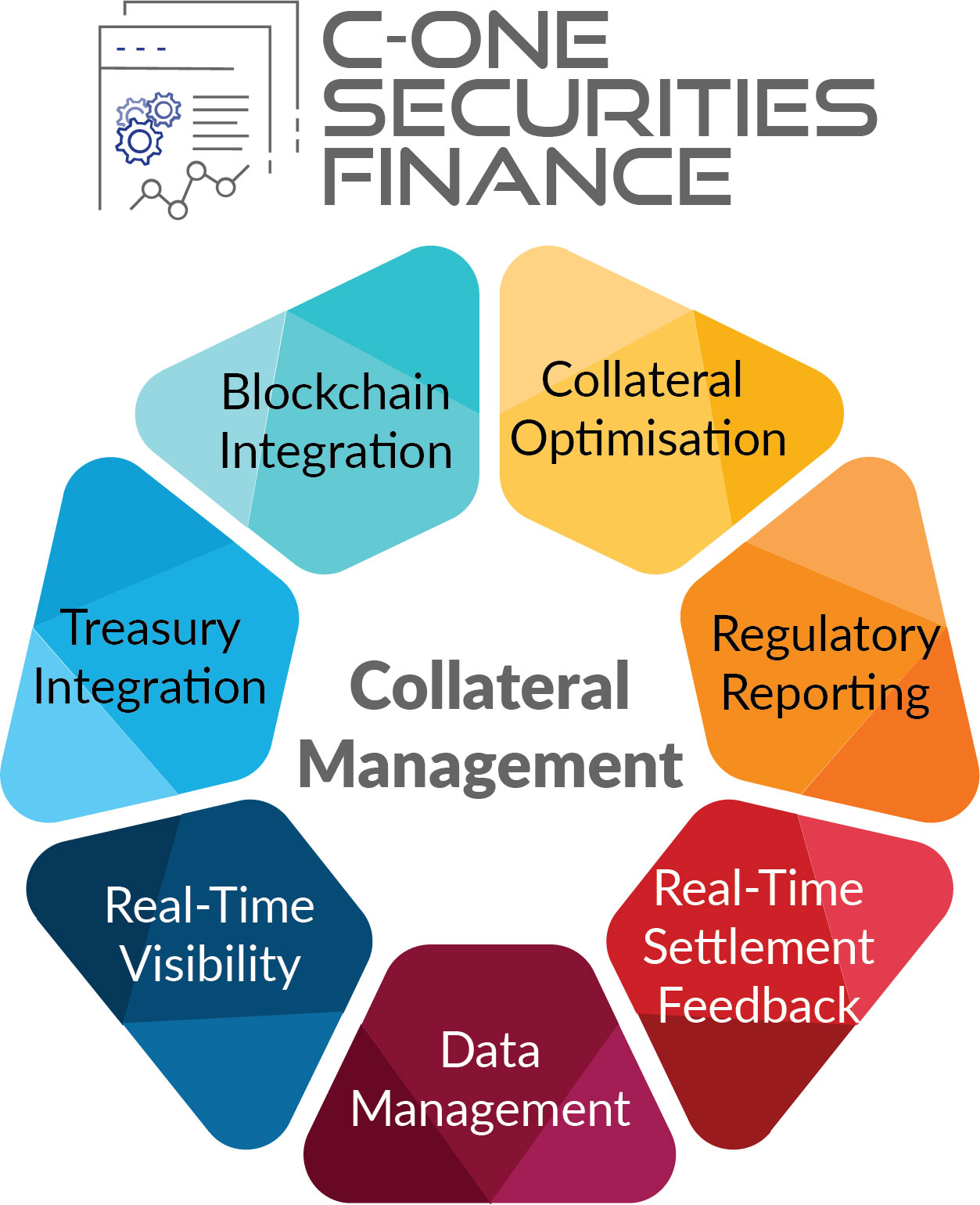

C-ONE Securities Finance includes a collateral management tool that is designed to meet the growing demand for seamless connectivity across systems and sources, driving efficiency in collateral processes. This article explores how C-ONE improves key collateral management functions, such as margin management, collateral optimisation, settlement, automation, real-time data integration, and position monitoring — enabling institutions to operate with increased precision, speed, and reliability.

Comyno’s C-ONE offers collateral inventory overviews, enhanced liquidity access, and improved risk management, underscoring their commitment to building a more interconnected financial ecosystem. Comyno’s platform C-ONE simplifies access to the securities lending business while ensuring compliance with key regulations like the Securities Financing Transaction Regulation (SFTR) and the Uncleared Margin Rules (UMR).

C-ONE streamlines the securities financing lifecycle. By integrating a multi-entity platform, the solution allows institutions to pool assets, create larger liquidity reservoirs, and enable direct trading between counterparties.

The platform’s real-time negotiation and execution of securities lending requests further highlight its efficiency. It not only addresses the growing demand for transparency and regulatory compliance but also aids firms in navigating the complexities of collateralisation and margin requirements.

Collateral management is at the core of the financial system’s stability, and C-ONE addresses this with a wide array of advanced tools and features to optimise collateral allocation, asset selection, and overall efficiency.

The platform’s ability to automatically optimise collateral allows institutions to minimise costs while ensuring compliance with the necessary regulatory frameworks and counterparty requirements. This optimisation process utilises advanced algorithms to assess the best mix of assets for each transaction, balancing cost efficiency with liquidity requirements.

The ability to automate these processes reduces the need for manual intervention, freeing up resources for more strategic tasks and ensuring that collateral pools are used to their full potential.

A standout feature of C-ONE is its integration of machine learning, particularly for reading and interpreting collateral schedules. This automation reduces the time spent on manual data input and minimises the risk of human error. By streamlining the process, institutions can focus on high-value activities, improving operational efficiency. Additionally, machine learning ensures accuracy in interpreting complex collateral requirements, resulting in smoother workflows.

Beyond this, C-ONE offers sophisticated asset selection tools designed to assist institutions in choosing the most suitable collateral assets. These tools take into consideration factors like liquidity, risk profile, and the specific requirements of each transaction. By ensuring that the best assets are used, institutions can enhance the overall efficiency of their collateral management strategies while simultaneously reducing costs and minimising risk.

Settlement processes and real-time feedback

Effective settlement processes are crucial for the smooth functioning of the securities finance market, and C-ONE is built to support real-time settlements with straight-through processing (STP) capabilities. This allows institutions to execute trades and settlements more quickly and efficiently, reducing the likelihood of delays or settlement failures that could result in financial penalties or operational risks.

By incorporating real-time feedback mechanisms, institutions can continuously monitor the status of their trades and collateral movements, adjusting as necessary to ensure everything remains on track.

Real-time feedback also plays an essential role in enhancing transparency throughout the transaction lifecycle. Institutions can immediately identify any discrepancies in their settlements, enabling quicker resolution of potential issues.

This increased level of visibility is particularly important when managing high volumes of transactions or dealing with complex cross-border settlements, where timing and accuracy are critical. With C-ONE’s integrated system, financial institutions are empowered to manage their settlements with greater speed and precision, reducing the risks associated with operational inefficiencies.

Automation is one of the primary drivers of efficiency in modern collateral management, and C-ONE leverages this through a suite of features designed to minimise manual processes and increase operational accuracy. One of the key automated processes is the import of collateral data from various sources, including custodians and third-party agents (TPAs).

By automating these imports, institutions ensure that all relevant collateral data is constantly updated in real-time, enabling them to make more informed decisions about collateral allocation and management. This automation reduces the risk of errors or delays in the processing of collateral data, which can otherwise result in costly disputes or inefficiencies.

Another critical automated process is the reading of exposure reports. C-ONE eliminates the need for manual data entry by automatically reading and interpreting exposure data, ensuring that institutions have immediate access to the information needed for accurate margin calls and other risk management activities. This level of automation significantly reduces the time spent on routine data processing tasks, allowing institutions to focus on more strategic initiatives.

In addition, C-ONE automates the generation and dispatch of margin calls, ensuring that all margin requirements are met in a timely and compliant manner. By automating this process, institutions reduce the risk of errors or delays in margin call processing, which can otherwise result in non-compliance with regulatory requirements or disputes with counterparties.

The ability to automate the entire margin call lifecycle — from calculation to dispatch — ensures that institutions can manage their margin requirements with greater precision and efficiency, while also reducing operational risks.

In today’s fast-paced financial environment, real-time visibility into collateral positions is critical. C-ONE provides institutions with up-to-the-minute updates on their collateral positions, allowing them to monitor their holdings and exposures in real time. This level of transparency enables institutions to make more informed decisions about their collateral management strategies and ensures that they are always prepared to meet regulatory requirements or respond to market changes.

The integration of C-ONE with treasury systems further enhances institutions’ ability to manage their liquidity and cash flows. By providing real-time data on collateral and exposure positions, the platform enables treasury departments to make more informed decisions about cash management, improving overall liquidity planning and risk management.

This integration ensures that treasury operations are closely aligned with collateral management activities, enhancing the institution’s ability to respond to market demands and optimise its cash and collateral positions.

One of the most important aspects of modern collateral management is the ability to import and integrate data from multiple sources in real time. C-ONE supports real-time data imports from custodians, central counterparties (CCPs), and third-party agents (TPAs), ensuring that institutions always have the most up-to-date information available.

This real-time data integration allows institutions to make faster, more informed decisions about their collateral and liquidity positions, enhancing their ability to respond to market fluctuations and regulatory demands.

C-ONE is a comprehensive Securities Finance and collateral management platform that empowers institutions to streamline their collateral processes effectively. From margin management and collateral optimisation to settlement automation and real-time data integration, C-ONE provides a complete solution that enhances efficiency, reduces operational risks, and ensures regulatory compliance. By leveraging the platform’s advanced capabilities, institutions can optimise their collateral management strategies and stay ahead in a rapidly changing financial landscape.

Through our partnership with SWIAT, a blockchain-based financial market infrastructure for digital and traditional assets, we are also able to connect with this blockchain-based platform. This allows us to unlock future potential by integrating both traditional and digital worlds. With this collaboration, Comyno and SWIAT aim to offer solutions that combine the advantages of the conventional securities finance market with cutting-edge digital technology, creating a more robust, flexible, and future-proof financial ecosystem.

This shift towards interconnected, automated platforms not only minimise operational burdens but also leads to the creation of larger liquidity pools. As a result, institutions can optimise their collateral management, ensuring faster access to liquidity while maintaining compliance with regulatory frameworks.

C-ONE Securities Finance includes a collateral management tool that is designed to meet the growing demand for seamless connectivity across systems and sources, driving efficiency in collateral processes. This article explores how C-ONE improves key collateral management functions, such as margin management, collateral optimisation, settlement, automation, real-time data integration, and position monitoring — enabling institutions to operate with increased precision, speed, and reliability.

Comyno’s C-ONE offers collateral inventory overviews, enhanced liquidity access, and improved risk management, underscoring their commitment to building a more interconnected financial ecosystem. Comyno’s platform C-ONE simplifies access to the securities lending business while ensuring compliance with key regulations like the Securities Financing Transaction Regulation (SFTR) and the Uncleared Margin Rules (UMR).

C-ONE streamlines the securities financing lifecycle. By integrating a multi-entity platform, the solution allows institutions to pool assets, create larger liquidity reservoirs, and enable direct trading between counterparties.

The platform’s real-time negotiation and execution of securities lending requests further highlight its efficiency. It not only addresses the growing demand for transparency and regulatory compliance but also aids firms in navigating the complexities of collateralisation and margin requirements.

Collateral management is at the core of the financial system’s stability, and C-ONE addresses this with a wide array of advanced tools and features to optimise collateral allocation, asset selection, and overall efficiency.

The platform’s ability to automatically optimise collateral allows institutions to minimise costs while ensuring compliance with the necessary regulatory frameworks and counterparty requirements. This optimisation process utilises advanced algorithms to assess the best mix of assets for each transaction, balancing cost efficiency with liquidity requirements.

The ability to automate these processes reduces the need for manual intervention, freeing up resources for more strategic tasks and ensuring that collateral pools are used to their full potential.

A standout feature of C-ONE is its integration of machine learning, particularly for reading and interpreting collateral schedules. This automation reduces the time spent on manual data input and minimises the risk of human error. By streamlining the process, institutions can focus on high-value activities, improving operational efficiency. Additionally, machine learning ensures accuracy in interpreting complex collateral requirements, resulting in smoother workflows.

Beyond this, C-ONE offers sophisticated asset selection tools designed to assist institutions in choosing the most suitable collateral assets. These tools take into consideration factors like liquidity, risk profile, and the specific requirements of each transaction. By ensuring that the best assets are used, institutions can enhance the overall efficiency of their collateral management strategies while simultaneously reducing costs and minimising risk.

Settlement processes and real-time feedback

Effective settlement processes are crucial for the smooth functioning of the securities finance market, and C-ONE is built to support real-time settlements with straight-through processing (STP) capabilities. This allows institutions to execute trades and settlements more quickly and efficiently, reducing the likelihood of delays or settlement failures that could result in financial penalties or operational risks.

By incorporating real-time feedback mechanisms, institutions can continuously monitor the status of their trades and collateral movements, adjusting as necessary to ensure everything remains on track.

Real-time feedback also plays an essential role in enhancing transparency throughout the transaction lifecycle. Institutions can immediately identify any discrepancies in their settlements, enabling quicker resolution of potential issues.

This increased level of visibility is particularly important when managing high volumes of transactions or dealing with complex cross-border settlements, where timing and accuracy are critical. With C-ONE’s integrated system, financial institutions are empowered to manage their settlements with greater speed and precision, reducing the risks associated with operational inefficiencies.

Automation is one of the primary drivers of efficiency in modern collateral management, and C-ONE leverages this through a suite of features designed to minimise manual processes and increase operational accuracy. One of the key automated processes is the import of collateral data from various sources, including custodians and third-party agents (TPAs).

By automating these imports, institutions ensure that all relevant collateral data is constantly updated in real-time, enabling them to make more informed decisions about collateral allocation and management. This automation reduces the risk of errors or delays in the processing of collateral data, which can otherwise result in costly disputes or inefficiencies.

Another critical automated process is the reading of exposure reports. C-ONE eliminates the need for manual data entry by automatically reading and interpreting exposure data, ensuring that institutions have immediate access to the information needed for accurate margin calls and other risk management activities. This level of automation significantly reduces the time spent on routine data processing tasks, allowing institutions to focus on more strategic initiatives.

In addition, C-ONE automates the generation and dispatch of margin calls, ensuring that all margin requirements are met in a timely and compliant manner. By automating this process, institutions reduce the risk of errors or delays in margin call processing, which can otherwise result in non-compliance with regulatory requirements or disputes with counterparties.

The ability to automate the entire margin call lifecycle — from calculation to dispatch — ensures that institutions can manage their margin requirements with greater precision and efficiency, while also reducing operational risks.

In today’s fast-paced financial environment, real-time visibility into collateral positions is critical. C-ONE provides institutions with up-to-the-minute updates on their collateral positions, allowing them to monitor their holdings and exposures in real time. This level of transparency enables institutions to make more informed decisions about their collateral management strategies and ensures that they are always prepared to meet regulatory requirements or respond to market changes.

The integration of C-ONE with treasury systems further enhances institutions’ ability to manage their liquidity and cash flows. By providing real-time data on collateral and exposure positions, the platform enables treasury departments to make more informed decisions about cash management, improving overall liquidity planning and risk management.

This integration ensures that treasury operations are closely aligned with collateral management activities, enhancing the institution’s ability to respond to market demands and optimise its cash and collateral positions.

One of the most important aspects of modern collateral management is the ability to import and integrate data from multiple sources in real time. C-ONE supports real-time data imports from custodians, central counterparties (CCPs), and third-party agents (TPAs), ensuring that institutions always have the most up-to-date information available.

This real-time data integration allows institutions to make faster, more informed decisions about their collateral and liquidity positions, enhancing their ability to respond to market fluctuations and regulatory demands.

C-ONE is a comprehensive Securities Finance and collateral management platform that empowers institutions to streamline their collateral processes effectively. From margin management and collateral optimisation to settlement automation and real-time data integration, C-ONE provides a complete solution that enhances efficiency, reduces operational risks, and ensures regulatory compliance. By leveraging the platform’s advanced capabilities, institutions can optimise their collateral management strategies and stay ahead in a rapidly changing financial landscape.

Through our partnership with SWIAT, a blockchain-based financial market infrastructure for digital and traditional assets, we are also able to connect with this blockchain-based platform. This allows us to unlock future potential by integrating both traditional and digital worlds. With this collaboration, Comyno and SWIAT aim to offer solutions that combine the advantages of the conventional securities finance market with cutting-edge digital technology, creating a more robust, flexible, and future-proof financial ecosystem.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times