The growing potential of green repo

01 October 2024

Speaking with industry experts, Daniel Tison uncovers the rising opportunities of repo in sustainable finance, as well as pressing obstacles on the path to its wider adoption

Image: stock.adobe.com/TensorSpark

Image: stock.adobe.com/TensorSpark

Innovations in sustainable finance remain crucial as companies and governments across the world collaborate to decrease greenhouse gas emissions by 43 per cent by the end of the decade, in line with the Paris Agreement and on the recommendation of the International Panel on Climate Change (IPCC) to limit global warming to 1.5°C.

This includes capital markets, where efforts around environmental, social, and governance (ESG) considerations intensified during the coronavirus pandemic.

“It is imperative that all banks actively engage with clients and their respective ESG desks to develop a framework around green funding in the capital markets,” says Andre Van Hese, international head of securities financing at MUFG.

“The agreed ESG framework would be bilateral at first, but can be standardised over time with ICMA governance. Furthermore, companies can allocate a portion of their repo balance sheets to supporting sustainability projects.”

Although the implementation of repo for sustainable finance has been drawing increasingly more attention, there are also concerns about greenwashing.

Different shades of green

In its report from October 2022, the International Capital Market Association (ICMA) said: “Most of the repo market today does not provide a direct contribution to sustainable finance. However, working within the constraints of the product, the market has come up with pragmatic ways to support sustainable finance in their repo business, such as the use of revolving financing facilities or rollovers.”

Carsten Hiller, vice chair of the Repo and Sustainability Taskforce at ICMA, explains that green repo is based on the traditional repurchase agreement, ie short-term borrowing for dealers in government securities, but there are additional sustainable benefits.

“Structurally, functionally, and legally, it’s the same as a traditional repo,” he says. “And that’s why we are looking, from the ICMA perspective, at these different areas.”

The ICMA report divides green repos into two main categories: repos supporting sustainable financing and repos providing sustainable financing.

The first one includes repo transactions in which the buyer and the seller use sustainable assets as collateral for the trade. It can also be a repo transaction that considers the sustainability credentials of the counterparties to the repo transaction.

Most sustainable collateral refers to green bonds which meet certain requirements such as the EU Green Bond Standard. However, “sustainability-screened” collateral, as marked by ICMA, uses ESG ratings or company in-house metrics with no agreed market standards.

Similarly, there are currently no agreed market standards for the recognition of sustainable counterparties. According to ICMA, “it is difficult to tell whether such transactions can be labelled as truly sustainable”.

Repo providing sustainable financing consists of two options: First, sustainability-linked (SL) repo, where the characteristics of the transaction are linked to the seller’s performance regarding a set of predefined sustainability criteria. Second, sustainable use of proceeds (UoP) repo where the cash is used exclusively to finance eligible sustainable projects or the borrower’s sustainable asset portfolio.

Regarding the second group, ICMA adds: “Most of the UoP repos do not necessarily use sustainable assets as the underlying collateral, as the focus is purely on the cash proceeds, although an integrated approach which combines the UoP with sustainable collateral also started to appear in the market.”

Green initiatives around the globe

Eurex, where Hiller serves as head of fixed income sales for continental Europe, focuses primarily on repos with sustainable collateral.

“It's our main role that we contribute to the development of an efficient and transparent market for sustainable finance by supporting the funding and liquidity of sustainable assets,” says Hiller.

In November 2020, Eurex launched the first green general collateral (GC) basket. However, as Hiller explains, the initial basket was “too broad”, leading to a more conservative approach from clients. Therefore, the company introduced two additional baskets in 2021.

In order to attract more liquidity to green repo, Eurex came up with GC pooling basket in April 2024, which offers more flexibility and convenience for cash takers and collateral providers.

In its report from January 2024, Eurex said: “We are working continuously to address the challenges shaping the securities finance markets and to promote a robust and sustainable repo and collateral market.”

In 2023, green bonds accounted for 57 per cent of the wider sustainable markets, with global issuances “significantly” lower than in prior years, according to the report.

The Commonwealth Bank of Australia (CBA) and Northern Trust conducted Australia’s first green repo in December 2021, totalling AU$50 million (US$36 million). The raised cash was allocated towards CBA’s portfolio of green loans.

Experts from BNP Paribas, which has closed green repo transactions in Asia, America, and Europe, believe that green repo could help developing countries raise funds for sustainability projects as part of the international efforts to reach net-zero emissions by 2050.

The company report from 2023 showed that 38 per cent of the total bonds issued in Latin America (LATAM) that year were SL bonds, in contrast to eight per cent globally.

In Africa, the Conference of the Parties (COP) announced the launch of the Liquidity and Sustainability Facility (LSF) in November 2021 to improve African Sovereign debt sustainability and enhance liquidity in the market.

In June 2024, the LSF announced its plans to join forces with Euroclear to create an inter-bank repo solution for African Sovereign Eurobonds — LSF GC Africa Euroclear. This basket reflects more than 120 African Sovereign Eurobonds that the LSF accepts as collateral in repo transactions.

David Escoffier, CEO of the LSF Secretariat, says: “This new phase for the LSF, thanks to the creation of a global community of African Eurobond holders, and the coordination of a diversified pool of specialised counterparties on the repo market, enables liquidity in this asset class to be concentrated and organised efficiently.”

Most recently, MUFG EMEA and Qatar-based Doha Bank closed the first green repo in the Middle East in September 2024, which marked the first repo scheme for both entities that utilised green bonds as collateral.

Van Hese says: “There has been a significant shift in investment criteria as the financial institutions group (FIG) and funds in the Gulf Cooperation Council (GCC) align themselves to the ambitions of the governments in reference to sustainability. The growing demand for green bonds will be enhanced further with the addition of green leverage facilities to build balances and attract additional issuers to issue green bonds.”

MUFG report on ESG from May 2024 shows that the GCC economies, consisting of Saudi Arabia, the UAE, Qatar, Kuwait, Oman, and Bahrain, have a strong commitment to developing a sustainable framework, with green targets set between 2030 and 2040.

Van Hese adds: “Our first transaction was closed in Qatar, which took the first step in creating a green curve for the state of Qatar bonds. Our client was tasked to convert a percentage of their fixed income portfolio into green assets, and they used their existing green assets to raise repo funding that was ringfenced to be deployed on additional green assets.”

Prospects and obstacles

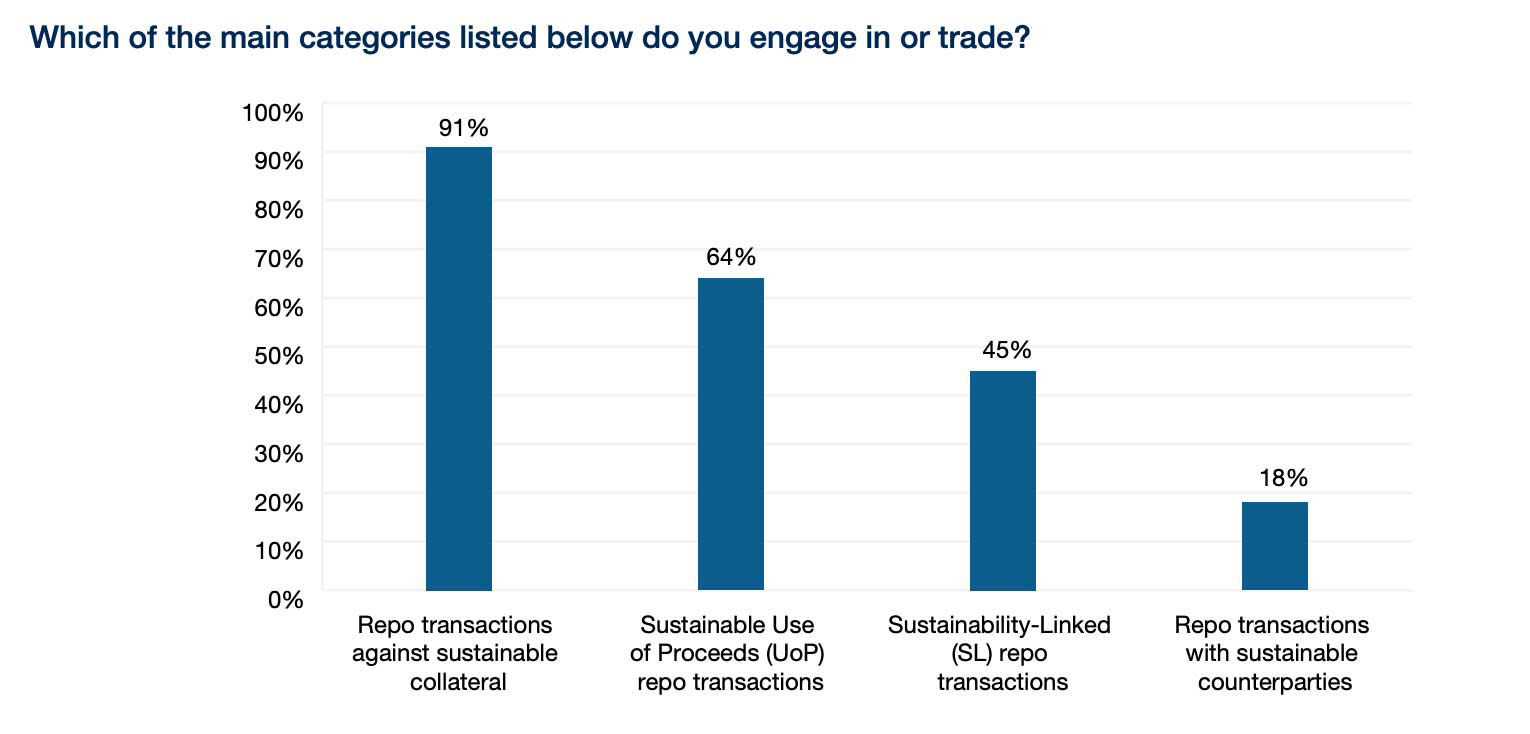

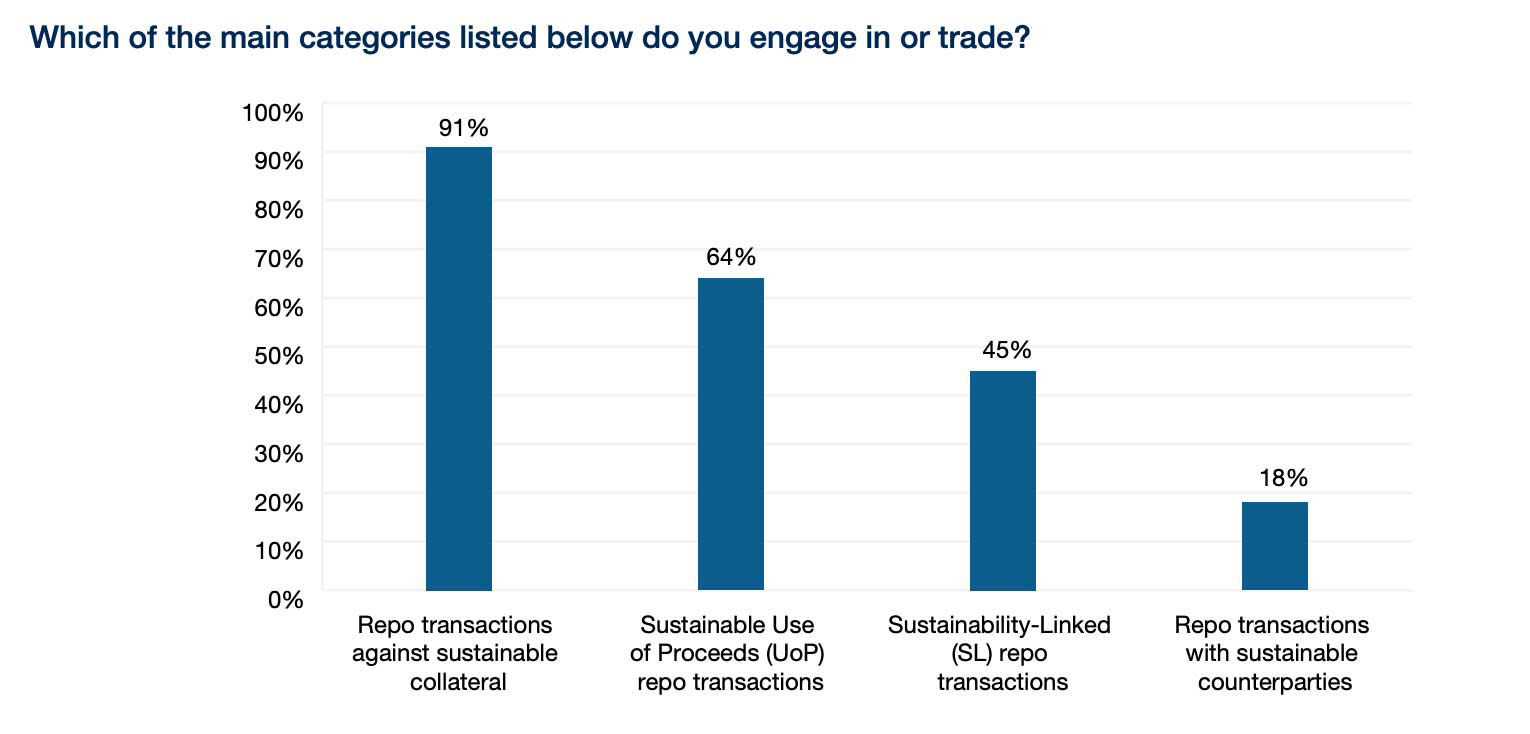

In August 2024, ICMA published a summary report, reflecting feedback received in response to its 2024 Repo & Sustainability Market Survey from Q1 2024. One of the findings was that “the overwhelming majority” (91 per cent) of industry participants specifically focus on repo transactions involving sustainable collateral, and this type of green repo remains their “top priority”.

ICMA adds: “The primary drivers for engaging in sustainability-related repo transactions include a commitment to sustainability as part of the organisation’s broader strategy, responding to investor demand and offering clients additional financing options to support their sustainability objectives.”

Hiller believes that this can impact securities finance in general, but there are still some “constraints and hurdles” that need to be addressed. He adds: “Green repo still plays a small role in sustainable finance, but it has the potential to grow.”

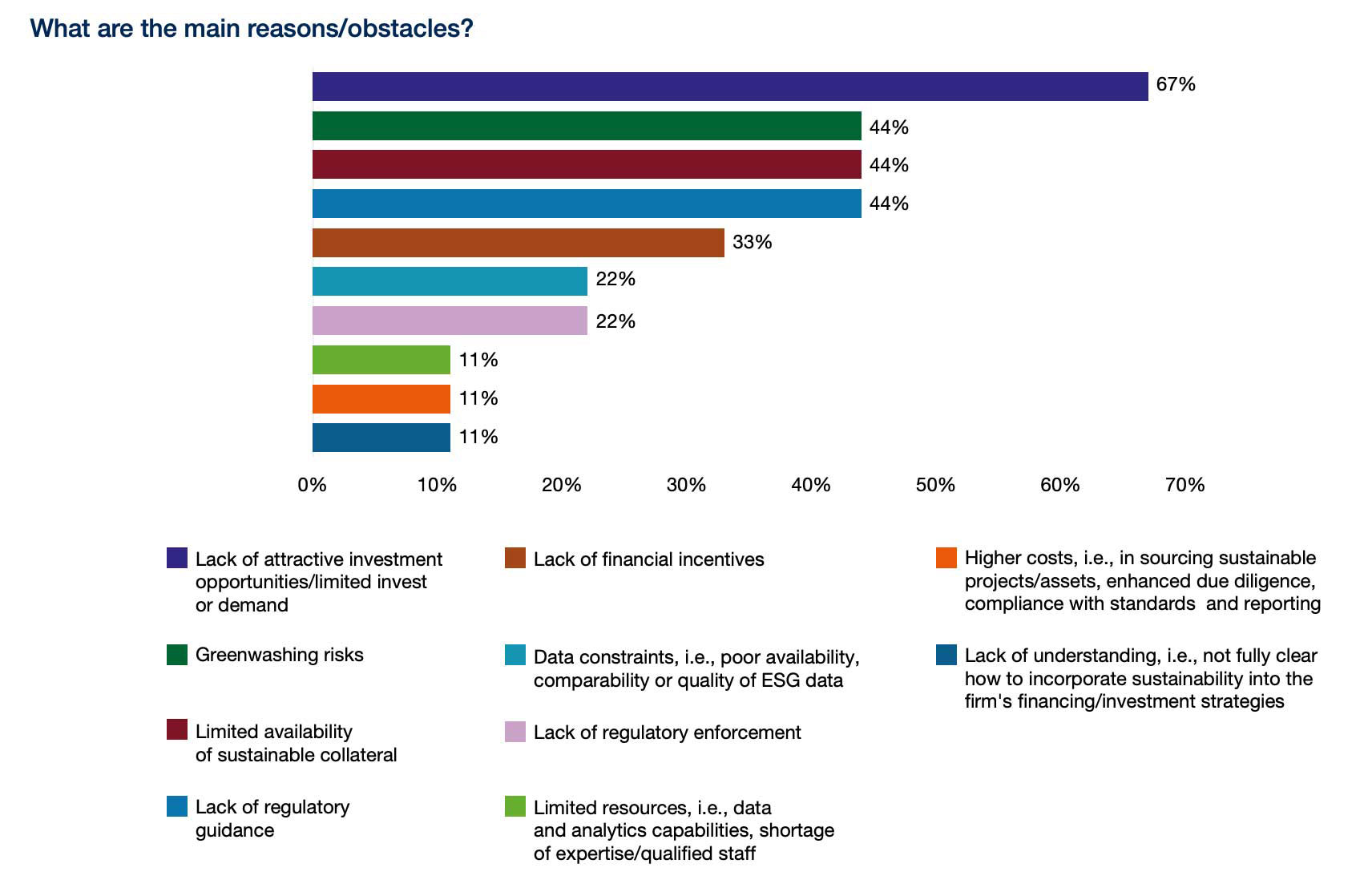

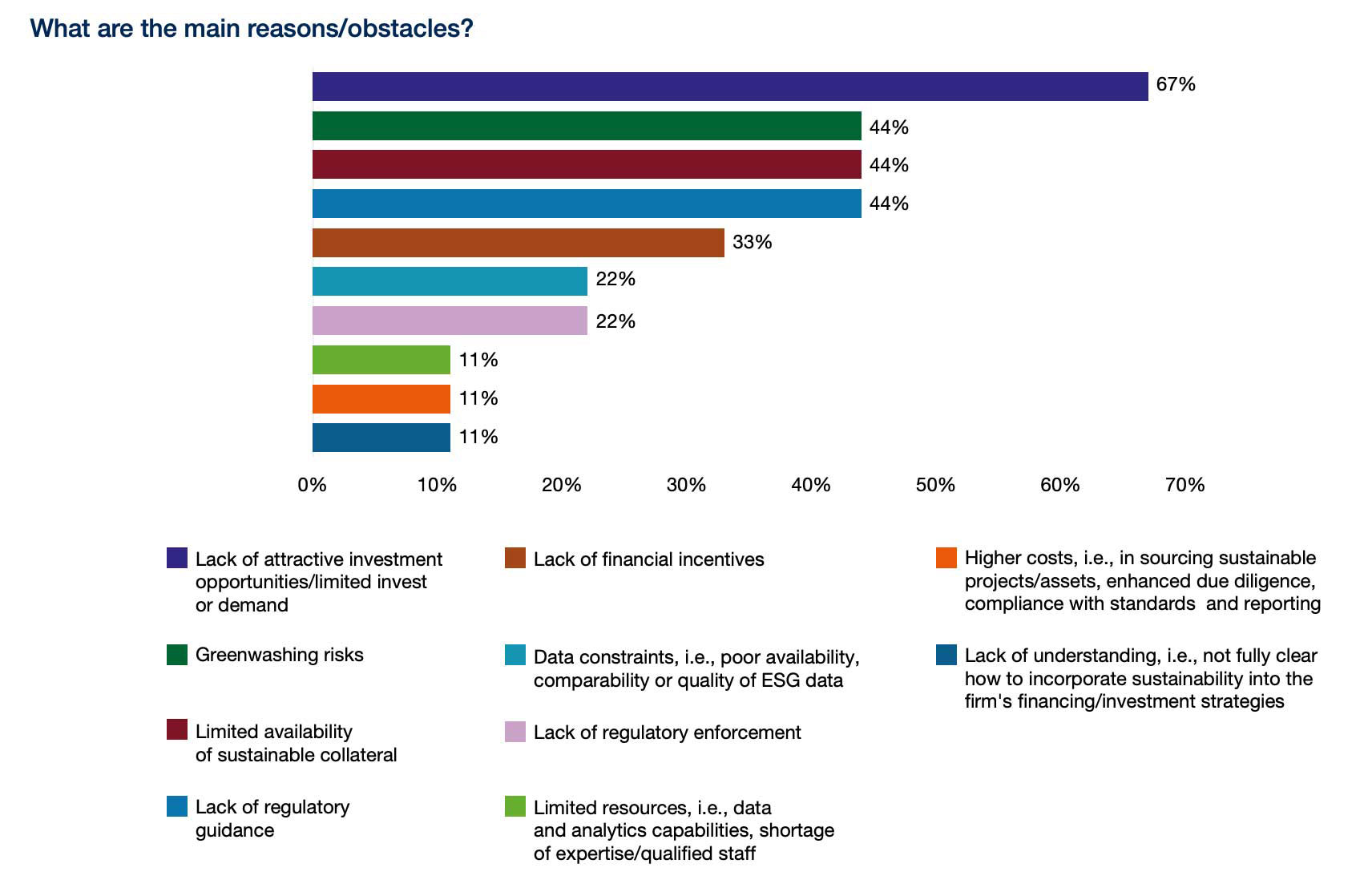

Lack of attractive investment opportunities and limited investor demand were highlighted as the main obstacles in the ICMA 2024 report, followed by concerns about greenwashing risks, insufficient regulatory guidance, and limited availability of sustainable collateral.

A “real gamer changer” for the green repo market, according to Hiller, could be regulatory benefits or incentives from the European Central Bank.

He says: “Lower rates for green collateral or special open market operations like green targeted longer-term refinancing operations (TLTROs) could significantly increase trading activity and volumes in standardised green collateral baskets.”

Green road ahead

While green repo remains a relatively small player in the field of sustainable finance, the potential for growth and growing interest from industry participants are evident. However, addressing challenges such as the lack of standardisation, limited investor demand, and greenwashing concerns seems crucial in scaling up green repo activities.

Looking ahead, Hiller says: “If we want to achieve these very ambitious targets of the green transition and the Paris goal in terms of climate change and reduction of greenhouse emissions, there’s a huge amount of money needed and more green bonds have to be issued.”

Following its recent report, ICMA plans to continue monitoring the market evolution around green repo and to work on expanded guidance as a next step, which is a “clear request“ emerging from the survey outcomes, according to the association.

From the European perspective, the potential for a green repo market to develop in Europe is high due to the mature and active repo market, according to Hiller, but there needs to be more activity.

Hiller adds: “This market is still small and niche, so further education and awareness among repo traders, sales, and structuring teams about the benefits and opportunities of sustainable finance can drive more interest and activity, especially when combined with traditional SL bonds. These teams need to work very closely, hand in hand.”

This includes capital markets, where efforts around environmental, social, and governance (ESG) considerations intensified during the coronavirus pandemic.

“It is imperative that all banks actively engage with clients and their respective ESG desks to develop a framework around green funding in the capital markets,” says Andre Van Hese, international head of securities financing at MUFG.

“The agreed ESG framework would be bilateral at first, but can be standardised over time with ICMA governance. Furthermore, companies can allocate a portion of their repo balance sheets to supporting sustainability projects.”

Although the implementation of repo for sustainable finance has been drawing increasingly more attention, there are also concerns about greenwashing.

Different shades of green

In its report from October 2022, the International Capital Market Association (ICMA) said: “Most of the repo market today does not provide a direct contribution to sustainable finance. However, working within the constraints of the product, the market has come up with pragmatic ways to support sustainable finance in their repo business, such as the use of revolving financing facilities or rollovers.”

Carsten Hiller, vice chair of the Repo and Sustainability Taskforce at ICMA, explains that green repo is based on the traditional repurchase agreement, ie short-term borrowing for dealers in government securities, but there are additional sustainable benefits.

“Structurally, functionally, and legally, it’s the same as a traditional repo,” he says. “And that’s why we are looking, from the ICMA perspective, at these different areas.”

The ICMA report divides green repos into two main categories: repos supporting sustainable financing and repos providing sustainable financing.

The first one includes repo transactions in which the buyer and the seller use sustainable assets as collateral for the trade. It can also be a repo transaction that considers the sustainability credentials of the counterparties to the repo transaction.

Most sustainable collateral refers to green bonds which meet certain requirements such as the EU Green Bond Standard. However, “sustainability-screened” collateral, as marked by ICMA, uses ESG ratings or company in-house metrics with no agreed market standards.

Similarly, there are currently no agreed market standards for the recognition of sustainable counterparties. According to ICMA, “it is difficult to tell whether such transactions can be labelled as truly sustainable”.

Repo providing sustainable financing consists of two options: First, sustainability-linked (SL) repo, where the characteristics of the transaction are linked to the seller’s performance regarding a set of predefined sustainability criteria. Second, sustainable use of proceeds (UoP) repo where the cash is used exclusively to finance eligible sustainable projects or the borrower’s sustainable asset portfolio.

Regarding the second group, ICMA adds: “Most of the UoP repos do not necessarily use sustainable assets as the underlying collateral, as the focus is purely on the cash proceeds, although an integrated approach which combines the UoP with sustainable collateral also started to appear in the market.”

Green initiatives around the globe

Eurex, where Hiller serves as head of fixed income sales for continental Europe, focuses primarily on repos with sustainable collateral.

“It's our main role that we contribute to the development of an efficient and transparent market for sustainable finance by supporting the funding and liquidity of sustainable assets,” says Hiller.

In November 2020, Eurex launched the first green general collateral (GC) basket. However, as Hiller explains, the initial basket was “too broad”, leading to a more conservative approach from clients. Therefore, the company introduced two additional baskets in 2021.

In order to attract more liquidity to green repo, Eurex came up with GC pooling basket in April 2024, which offers more flexibility and convenience for cash takers and collateral providers.

In its report from January 2024, Eurex said: “We are working continuously to address the challenges shaping the securities finance markets and to promote a robust and sustainable repo and collateral market.”

In 2023, green bonds accounted for 57 per cent of the wider sustainable markets, with global issuances “significantly” lower than in prior years, according to the report.

The Commonwealth Bank of Australia (CBA) and Northern Trust conducted Australia’s first green repo in December 2021, totalling AU$50 million (US$36 million). The raised cash was allocated towards CBA’s portfolio of green loans.

Experts from BNP Paribas, which has closed green repo transactions in Asia, America, and Europe, believe that green repo could help developing countries raise funds for sustainability projects as part of the international efforts to reach net-zero emissions by 2050.

The company report from 2023 showed that 38 per cent of the total bonds issued in Latin America (LATAM) that year were SL bonds, in contrast to eight per cent globally.

In Africa, the Conference of the Parties (COP) announced the launch of the Liquidity and Sustainability Facility (LSF) in November 2021 to improve African Sovereign debt sustainability and enhance liquidity in the market.

In June 2024, the LSF announced its plans to join forces with Euroclear to create an inter-bank repo solution for African Sovereign Eurobonds — LSF GC Africa Euroclear. This basket reflects more than 120 African Sovereign Eurobonds that the LSF accepts as collateral in repo transactions.

David Escoffier, CEO of the LSF Secretariat, says: “This new phase for the LSF, thanks to the creation of a global community of African Eurobond holders, and the coordination of a diversified pool of specialised counterparties on the repo market, enables liquidity in this asset class to be concentrated and organised efficiently.”

Most recently, MUFG EMEA and Qatar-based Doha Bank closed the first green repo in the Middle East in September 2024, which marked the first repo scheme for both entities that utilised green bonds as collateral.

Van Hese says: “There has been a significant shift in investment criteria as the financial institutions group (FIG) and funds in the Gulf Cooperation Council (GCC) align themselves to the ambitions of the governments in reference to sustainability. The growing demand for green bonds will be enhanced further with the addition of green leverage facilities to build balances and attract additional issuers to issue green bonds.”

MUFG report on ESG from May 2024 shows that the GCC economies, consisting of Saudi Arabia, the UAE, Qatar, Kuwait, Oman, and Bahrain, have a strong commitment to developing a sustainable framework, with green targets set between 2030 and 2040.

Van Hese adds: “Our first transaction was closed in Qatar, which took the first step in creating a green curve for the state of Qatar bonds. Our client was tasked to convert a percentage of their fixed income portfolio into green assets, and they used their existing green assets to raise repo funding that was ringfenced to be deployed on additional green assets.”

Prospects and obstacles

In August 2024, ICMA published a summary report, reflecting feedback received in response to its 2024 Repo & Sustainability Market Survey from Q1 2024. One of the findings was that “the overwhelming majority” (91 per cent) of industry participants specifically focus on repo transactions involving sustainable collateral, and this type of green repo remains their “top priority”.

ICMA adds: “The primary drivers for engaging in sustainability-related repo transactions include a commitment to sustainability as part of the organisation’s broader strategy, responding to investor demand and offering clients additional financing options to support their sustainability objectives.”

Hiller believes that this can impact securities finance in general, but there are still some “constraints and hurdles” that need to be addressed. He adds: “Green repo still plays a small role in sustainable finance, but it has the potential to grow.”

Lack of attractive investment opportunities and limited investor demand were highlighted as the main obstacles in the ICMA 2024 report, followed by concerns about greenwashing risks, insufficient regulatory guidance, and limited availability of sustainable collateral.

A “real gamer changer” for the green repo market, according to Hiller, could be regulatory benefits or incentives from the European Central Bank.

He says: “Lower rates for green collateral or special open market operations like green targeted longer-term refinancing operations (TLTROs) could significantly increase trading activity and volumes in standardised green collateral baskets.”

Green road ahead

While green repo remains a relatively small player in the field of sustainable finance, the potential for growth and growing interest from industry participants are evident. However, addressing challenges such as the lack of standardisation, limited investor demand, and greenwashing concerns seems crucial in scaling up green repo activities.

Looking ahead, Hiller says: “If we want to achieve these very ambitious targets of the green transition and the Paris goal in terms of climate change and reduction of greenhouse emissions, there’s a huge amount of money needed and more green bonds have to be issued.”

Following its recent report, ICMA plans to continue monitoring the market evolution around green repo and to work on expanded guidance as a next step, which is a “clear request“ emerging from the survey outcomes, according to the association.

From the European perspective, the potential for a green repo market to develop in Europe is high due to the mature and active repo market, according to Hiller, but there needs to be more activity.

Hiller adds: “This market is still small and niche, so further education and awareness among repo traders, sales, and structuring teams about the benefits and opportunities of sustainable finance can drive more interest and activity, especially when combined with traditional SL bonds. These teams need to work very closely, hand in hand.”

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times