EU and UK risk SFTR data blackout post Brexit

12 November 2020 UK

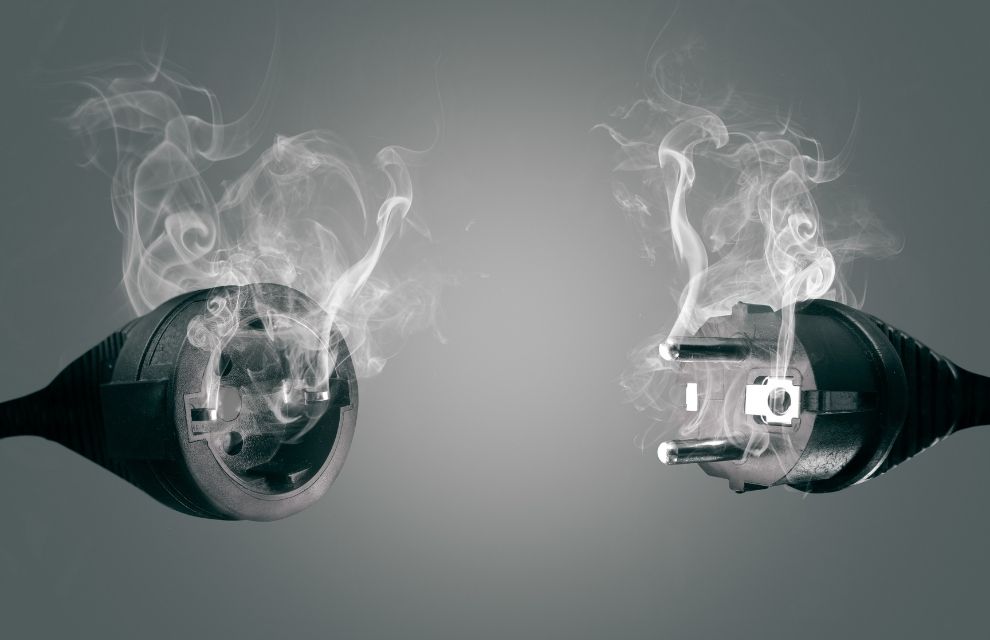

Image: photoschmidt/adobe.stock.com

Image: photoschmidt/adobe.stock.com

Financial market regulators in the UK and Europe will be shut-off from accessing each other's transactions data reported under the Securities Financing Transaction Regulation (SFTR) if a bilateral equivalency decision isn’t reached before the Brexit transition period ends on 31 December.

Negotiations between the European Commission and Her Majesty’s Treasury on post-Brexit equivalency for 40 areas of EU law began in the first half of the year but delays caused by the pandemic and other political and technical issues means a full sweep of bilateral agreements is unlikely to be reached this year.

The lack of continuity on either side of the English Channel will ratchet-up market uncertainty, raise legal barriers between counterparties and reduce regulatory oversight ahead of what could be a crucial bounce-back period for capital markets after Europe grapples with the resurgence of COVID-19 during the winter months.

A spokesperson for the European Securities and Markets Authority (ESMA), which provides technical support to the commission for the negotiations, tells SFT that the regulator expects to make progress, but an agreement under article 19 of SFTR will “probably not [be signed] before 31 December”.

In this instance, both regulators will lose their rights to the other’s treasure trove of SFT data, being reported by buy- and sell-side entities to assess potential systemic risks building in the market.

The blackout would continue until a bilateral equivalency agreement is reached under article 19 or a memorandum of understanding (MoU) is signed under article 20. An MoU application can be instigated by either authority but ESMA says it is “currently not a priority”.

The commission began its equivalence assessments in April by sending more than 2,500 pages of questionnaires to the UK. The documents were returned in July but the analysis and follow-up discussions on these responses are “ongoing”, according to the ESMA spokesperson.

This week, the chancellor of the exchequer Rishi Sunak outlined a bundle of regulatory equivalence decisions that the UK was willing to offer the European Economic Area (EEA) states. The list included the Central Securities Depositories Regulation, minus the settlement discipline regime, the European Market Infrastructure Regulation and the Short Selling Regulation.

On the EU side, the only equivalency decision for UK-based firms is a time-limited mutual recognition period for three clearing houses which runs until 30 June 2022.

Currently, the EU and UK are pointing to each other as the reason why, with less than two months to go before the breakaway, a more comprehensive set of bilateral equivalency agreements are not in place.

Speaking in the House of Commons on Monday, the chancellor said: “We’re ready to continue the conversation where we haven’t yet been able to take decisions. But, in the absence of clarity from the EU, we’re acting unilaterally to provide certainty to firms both here and in Europe.”

A separate written statement from Treasury reiterated that it is “awaiting clarity from the EU about their intentions”, without offering further details on what is needed.

Meanwhile, an ESMA spokesperson states that “ultimately, the timing and the outcome of equivalence assessments will depend on UK position and commitments, and the EU’s interests”.

The spokesperson notes that, regardless of what is offered by the UK to EU firms, the commission is under no obligation to grant comparative equivalency.

They further highlight that the talks are framed by concerns in Brussels that the UK has indicated its intentions to diverge from EU standards in certain areas. Although, they highlight: “The nature of this divergence is not clear yet.”

Negotiations between the European Commission and Her Majesty’s Treasury on post-Brexit equivalency for 40 areas of EU law began in the first half of the year but delays caused by the pandemic and other political and technical issues means a full sweep of bilateral agreements is unlikely to be reached this year.

The lack of continuity on either side of the English Channel will ratchet-up market uncertainty, raise legal barriers between counterparties and reduce regulatory oversight ahead of what could be a crucial bounce-back period for capital markets after Europe grapples with the resurgence of COVID-19 during the winter months.

A spokesperson for the European Securities and Markets Authority (ESMA), which provides technical support to the commission for the negotiations, tells SFT that the regulator expects to make progress, but an agreement under article 19 of SFTR will “probably not [be signed] before 31 December”.

In this instance, both regulators will lose their rights to the other’s treasure trove of SFT data, being reported by buy- and sell-side entities to assess potential systemic risks building in the market.

The blackout would continue until a bilateral equivalency agreement is reached under article 19 or a memorandum of understanding (MoU) is signed under article 20. An MoU application can be instigated by either authority but ESMA says it is “currently not a priority”.

The commission began its equivalence assessments in April by sending more than 2,500 pages of questionnaires to the UK. The documents were returned in July but the analysis and follow-up discussions on these responses are “ongoing”, according to the ESMA spokesperson.

This week, the chancellor of the exchequer Rishi Sunak outlined a bundle of regulatory equivalence decisions that the UK was willing to offer the European Economic Area (EEA) states. The list included the Central Securities Depositories Regulation, minus the settlement discipline regime, the European Market Infrastructure Regulation and the Short Selling Regulation.

On the EU side, the only equivalency decision for UK-based firms is a time-limited mutual recognition period for three clearing houses which runs until 30 June 2022.

Currently, the EU and UK are pointing to each other as the reason why, with less than two months to go before the breakaway, a more comprehensive set of bilateral equivalency agreements are not in place.

Speaking in the House of Commons on Monday, the chancellor said: “We’re ready to continue the conversation where we haven’t yet been able to take decisions. But, in the absence of clarity from the EU, we’re acting unilaterally to provide certainty to firms both here and in Europe.”

A separate written statement from Treasury reiterated that it is “awaiting clarity from the EU about their intentions”, without offering further details on what is needed.

Meanwhile, an ESMA spokesperson states that “ultimately, the timing and the outcome of equivalence assessments will depend on UK position and commitments, and the EU’s interests”.

The spokesperson notes that, regardless of what is offered by the UK to EU firms, the commission is under no obligation to grant comparative equivalency.

They further highlight that the talks are framed by concerns in Brussels that the UK has indicated its intentions to diverge from EU standards in certain areas. Although, they highlight: “The nature of this divergence is not clear yet.”

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times